Video: Municipal leaders on public-private partnerships

NCRC Just Economy Conference 2024 — Recorded April 4, 2024 Cincinnati Mayor Aftab Pureval, Houston’s District F City Councilwoman Tiffany Thomas, and Asahi Pompey, Global Head of Corporate Engagement and President of the Goldman Sachs Foundation will share how local policy and elected officials partner with financial and other anchor institutions such as hospitals, higher ed, and

The job market for college graduates remains strong but uncertainties persist

The Bureau of Labor Statistics (BLS) monthly jobs report provides a broad look at the current state of the labor market. It is comprised of two surveys, a household survey sent to people that gauges their labor market experiences of employment and unemployment and an establishment survey sent to businesses to measure their hiring levels, hours and

Video: FDIC Chairman Martin Gruenberg at the 2024 Just Economy Conference

Chairman of the Board of the Federal Deposit Insurance Corporation Martin Gruenberg provided remarks and answered questions from the National Community Reinvestment Coalition’s (NCRC) President and CEO Jesse Van Tol at the 2024 Just Economy Conference.

Video: OCC Acting Comptroller Michael Hsu at the 2024 Just Economy Conference

The Acting Comptroller of the Currency Michael Hsu provides remarks and answers questions from the National Community Reinvestment Coalition’s (NCRC) President and CEO Jesse Van Tol at NCRC’s Just Economy Conference.

Video: Vice Chair of the Federal Reserve Michael Barr Sits Down With Politico Reporter Victoria Guida at the 2024 Just Economy Conference

Vice Chair of the Federal Reserve Board of Governors Michael Barr answers questions from Politico reporter Victoria Guida on April 3, 2024, at NCRC’s Just Economy Conference.

Video: CFPB Director Rohit Chopra at the 2024 Just Economy Conference

Director of the Consumer Financial Protection Bureau Rohit Chopra provides remarks and answers questions from the National Community Reinvestment Coaltion’s President and CEO Jesse Van Tol on April 3, 2024, at NCRC’s Just Economy Conference.

Jesse Van Tol’s Keynote Speech At The 2024 Just Economy Conference

NCRC head Jesse Van Tol provided an update on KeyBank and previewed the upcoming fight with Capital One at the 2024 Just Economy Conference.

Video: 2024 Hill Day Priorities

Online Event Archive Recorded March 21, 2024 During the webinar, NCRC staff review the policy priorities for this year’s Hill Day. This session will help grow your policy knowledge and is the first step in preparing Hill Day participants for their meetings. Speaker: Rion Dennis, Senior Government Affairs Director, NCRC Transcript: NCRC video transcripts

Empowering Voices: Celebrating Women’s Achievements at NCRC for Women’s History Month

As we celebrate Women’s History Month this March, NCRC would like to acknowledge all the amazing work and accomplishments women have achieved. At NCRC, we are proud to have many strong and hardworking women advocating for a Just Economy for all. Each of them plays a crucial role in creating a more inclusive society. And

Messaging Memo: Words That Work to Oppose the Capital One-Discover Merger

Please Sign in to view this page. Not a member? Join Now! Why join? Because we’re stronger together. Our members work together to build communities free of discrimination and full of opportunity. Learn more about membership . Join now.

NCRC Statement: “Huge Step Forward” In New FDIC Merger Review Proposal

The Federal Deposit Insurance Corporation (FDIC) on Thursday proposed changes to its merger review practices. Jesse Van Tol, President and CEO of NCRC, released the following statement: “The FDIC’s proposal is a huge step forward. In particular, it recognizes that the regulators obligation is to assess public benefit in a forward-looking way, not just rely

NCRC Statement: Capital One Merger Filing Is A Polite Way Of Saying ‘Please Let Us Exploit More Desperate Americans’

Capital One’s merger filing is an attempt to expand a business model that intentionally harms the most vulnerable Americans.

Groups Demand Open, Transparent Process for Capital One-Discover Merger Review

Regulators should block Capital One’s merger — and the process by which they evaluate the deal needs to include community voices.

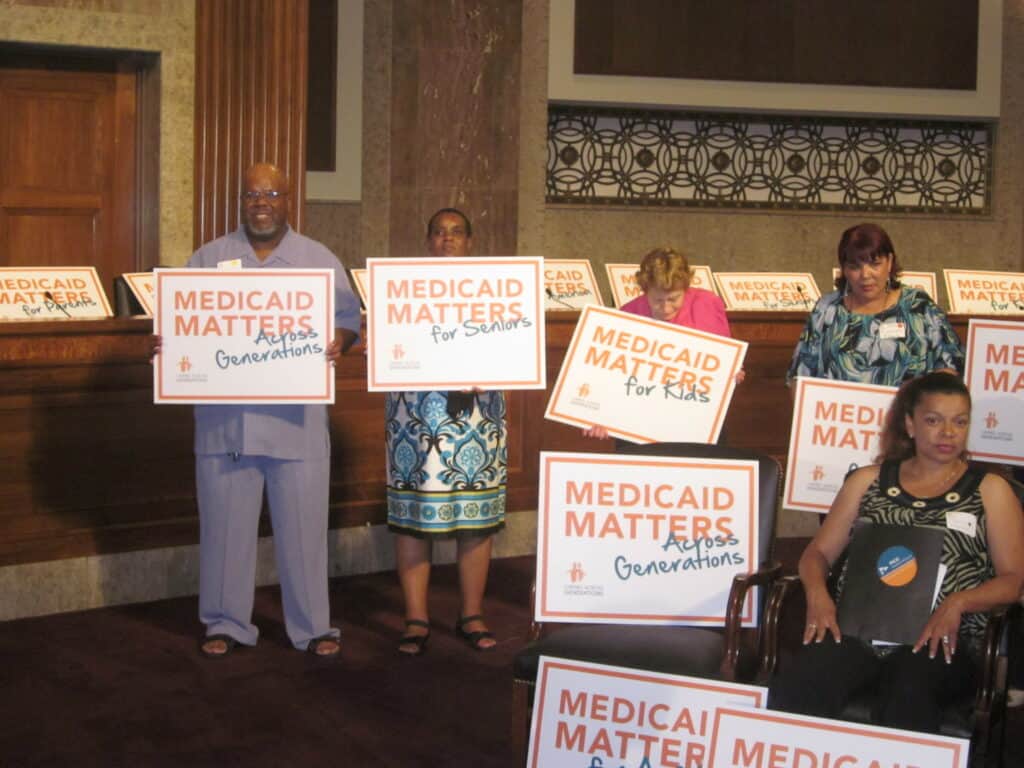

Loss Of Medicaid Coverage Disproportionately Impacted People Of Color

A process known as “Medicaid unwinding” is dumping tens of millions of low-income households off a key anti-poverty program, usually without solid evidence.

NCRC Awarded Largest HUD Housing Counseling Training And Services Grant

NCRC was awarded $578,416.92.

Joint Statement in Support of CFPB 1033 Rulemaking

Consumers’ ability to share their data held at their banks has become necessary to access many financial services. NCRC’s Just Economy Pledge includes a commitment to ensure that individuals own their personal data, control who has access to it, and are treated fairly by anyone who does.[1] The scope of consumers’ rights regarding the sharing of

Gender Differences In Unemployment Trends: Race, Jobs And The Economy Update For February 2024

Better understand the February jobs report with this special Women’s History Month edition of NCRC’s Race, Jobs and the Economy series.

Next Generation Of Community Development Leaders: Join NCRC For The Emerging Leaders Reception At The 2024 Just Economy Conference

NCRC’s Emerging Leaders Reception* is a networking event for young professionals from across the country pursuing a career in the community development field.

Regulators Should Block Capital One-Discover Merger, Advocacy Groups Write In Joint Letter

Here’s why regulators should block the Capital One-Discover merger.

NCRC’s Letter to The Appraisal Subcommittee About Potential Solutions to Appraisal Bias in Response to February 13, 2024 Hearing

(Download) March 4, 2024 Jim Park Executive Director Appraisal Subcommittee 1325 G Street Suite 500, NW Washington, DC 20005 appraisalbiashearing@asc.gov Dear Executive Director Park: The National Community Reinvestment Coalition appreciates the opportunity to submit written comments to the Federal Financial Institutions Examination Council’s Appraisal Subcommittee. We thank The Appraisal Subcommittee of the Federal Financial Institutions Examination

NCRC Announces 3 Winners in #JustEconomy Spirit Contest

Winners receive a ticket to the 2024 Just Economy Conference in Washington, DC, April 3-4, as well as a two-night stay at the Washington HIlton. Congratulations to Carmen Velez, a Housing Counselor at Neighborhood Housing Services of South Florida in Miami; Joseph Williams, Managing Director at The Community Foundation for Greater New Haven in Connecticut; and

NCRC’s Comment on Second Illinois CRA Notice of Proposed Rulemaking

(Download) March 4, 2024 VIA ELECTRONIC FILING Mr. Craig Cellini Rules Coordinator Illinois Department of Financial and Professional Regulation (IDFPR) 329 West Washington, 3rd Floor Springfield, IL 62789 Via Email: Craig.Cellini@Illinois.gov RE: Comment on the Notice of Proposed Rules (NPR) regarding the Banking Community Reinvestment Rule (38 IAC 345), Mortgage Lenders Community Reinvestment Rule (38 IAC

National Community Reinvestment Coalition’s Community Development Fund A Finalist in Truist Foundation’s 2024 Inspire Awards

The National Community Reinvestment Coalition’s Community Development Fund (NCRC CDF) was chosen as one of seven finalist’s in Truist Foundation’s 2024 Inspire Awards. The Inspire Awards, founded in 2022 in response to the impact of COVID-19 on small businesses, look to celebrate technological solutions that improve small business sustainability. NCRC CDF submitted its new technology,

The Racial Wealth Divide And Black Homeownership: New Data Show Small Gains, Deep Fragility

Black homeowners are making significant wealth gains — but the racial wealth divide isn’t narrowing, and data suggest the limited progress is fragile.

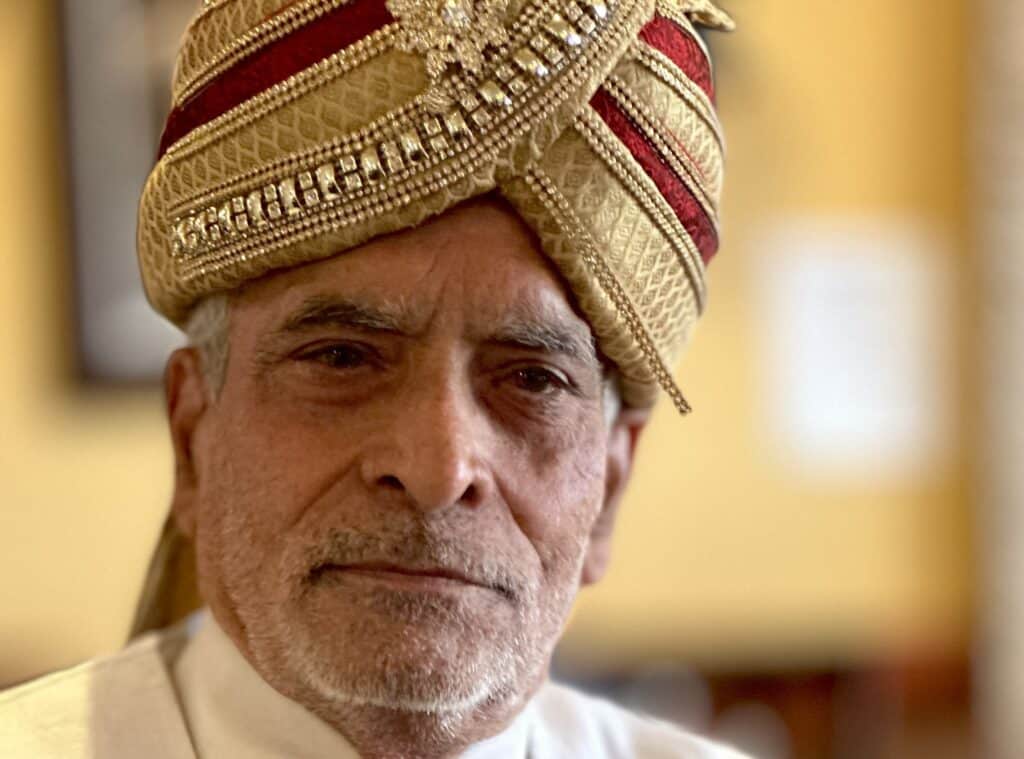

Cash, Culture And Care: Navigating Dementia In An Indian American Family

Igniting conversations about issues surrounding dementia care – from cultural sensitivities and the caregiver’s burden to unsustainable financial costs and systemic inadequacies in elder care.