NCRC applauds DOJ, OCC, CFPB for holding Trustmark accountable for fair lending violations

Justice (DOJ), the Office of the Comptroller of the Currency (OCC) and the Consumer Financial Protection Bureau (CFPB) for alleged discrimination against Black and Hispanic communities and residents in Memphis, Tennessee.

SLEHCRA, The Woodstock Institute and NCRC Oppose First Mid and Jefferson Banks’ Merger Application

On Monday, St. Louis Equal Housing and Community Reinvestment Alliance (SLEHCRA), Woodstock Institute and the National Community Reinvestment Coalition (NCRC) submitted comment letters opposing the proposed merger between First Mid Bank & Trust and Jefferson Bank & Trust to the Federal Reserve.

Joint Comment on Application of First Mid Bancshares to acquire Delta Bancshares Company and Jefferson Bank and Trust

October 18, 2021 Colette A. FriedAssistant Vice PresidentFederal Reserve Bank of Chicago230 South LaSalle StreetChicago, IL 60604 Via comments.applications@chi.frb.org RE: Comment on Application of First Mid Bancshares to acquire Delta Bancshares Company and Jefferson Bank and Trust Dear Ms. Fried: The St. Louis Equal Housing and Community Reinvestment Alliance (SLEHCRA) and the National Community Reinvestment

NCRC Submits Comment on Interagency Proposal for the Regulation of Partnerships between Banks and Fintechs

October 18, 2021 Ann E. Misback Secretary Board of Governors of the Federal Reserve System 20th Street and Constitution Avenue, NW Washington, DC 20551. Federal Reserve Docket OP-1752 James P. Sheesley, Assistant Executive Secretary Attention: Comments-RIN 3064-ZA26, Legal ESS Federal Deposit Insurance Corporation 550 17th Street NW Washington, DC 20429. Chief Counsel’s Office Attention: Comment

Latino housing trends during COVID-19

As the population of young Latinos, aged 18 to 35, continues to grow, protecting and expanding their economic progress during a national pandemic-induced crisis will be critical to their wealth-building trajectory.

New for NCRC members: Quarterly meetings on fair housing

NCRC is launching a quarterly fair housing online meeting with NCRC members as a new benefit of membership. The first meeting will take place October 27, 2021, from 11 am to Noon ET via Zoom.

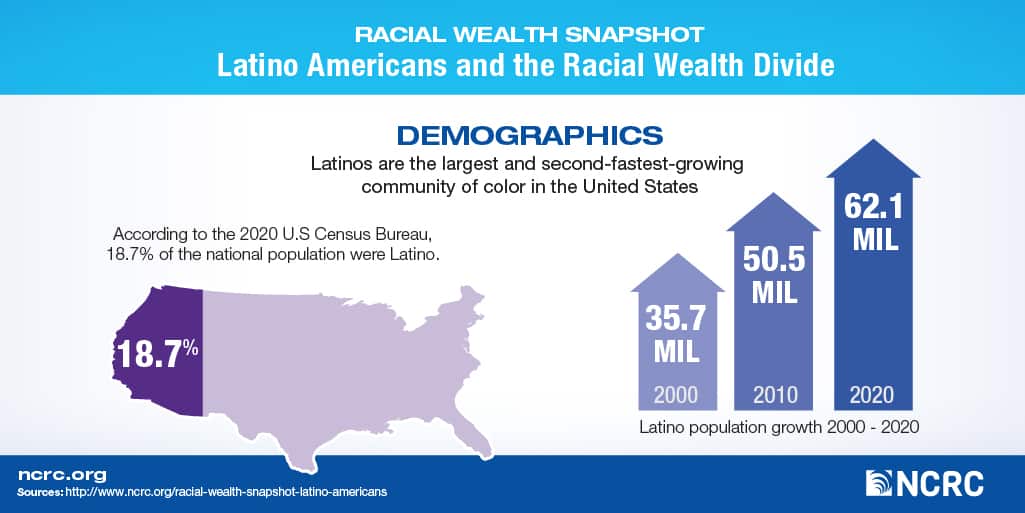

To Preserve Pre-COVID Economic Growth For Latino Americans, Eliminating Racial Economic Inequality Must Be A Priority Of Post-COVID Recovery

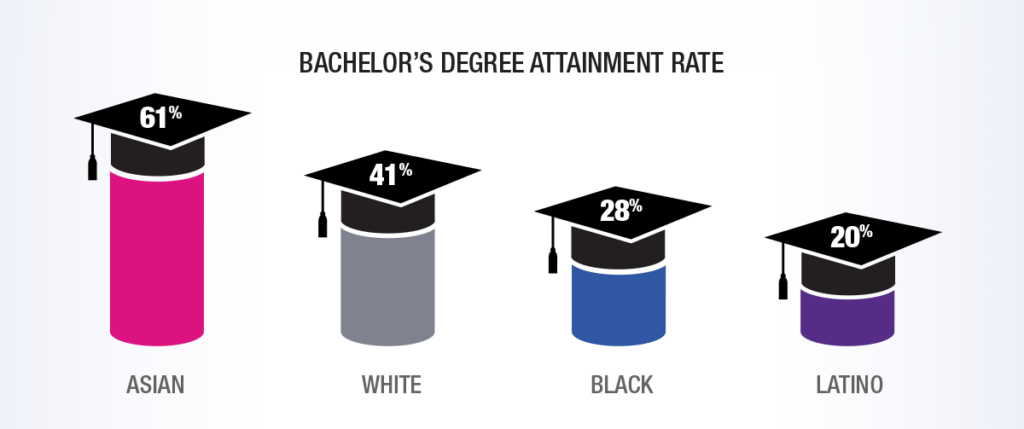

In honor of Latino Heritage Month, this is one in a series of NCRC snapshots and infographics exploring racial economic and wealth disparities and the economic conditions of various Latino nationalities. The Latino population has experienced record population growth, accounting for about half of total population growth from 2010 to 2019. This growth corresponds with

NCRC White Paper: The case for expanding the Community Reinvestment Act and its “duty to serve” to the entire financial sector

be strengthened to cover the entire financial sector and ensure lower-income borrowers and communities of color have access to credit and capital.

Making CRA Relevant for a Changing Financial Services Industry

This paper examines shifts in the market share of banks and nonbank financial institutions in important product markets. Banks are covered by the Community Reinvestment Act (CRA) which requires them to serve all communities, including low- and moderate-income (LMI) ones. Nonbanks, in contrast, do not have this obligation.

On National Coming Out Day, Let’s Come Out Against LGBTQ+ Poverty

October 11 is National Coming Out Day. Each year on this day, we show support for our friends, colleagues and family members who have had the courage to come out and live openly as LGBTQ+. It’s a celebratory day, but also a day to recognize the disparities and struggles faced by members of the LGBTQ+ community when living openly in society.

GROWTH by NCRC and Cleveland Custom Homes Break Ground on Twelve New Builds in Parma Heights, Ohio

The NCRC Housing Rehab Fund, LLC (NCRC HRF), known as GROWTH by NCRC, broke ground on 12 lots dedicated to new construction in Parma Heights, Ohio. GROWTH is partnering with Cleveland Custom Homes (CCH) to build the project.

DC Women’s Business Center director Heidi Sheppard named to board of the Association of Women’s Business Centers

The Association of Women’s Business Centers (AWBC) has named Heidi Sheppard, Project Director, DC Women’s Business Center (DCWBC) as the new board member of the AWBC board of directors.

Monzo USA withdraws national bank charter application opposed by NCRC

In May 2019, the National Community Reinvestment Coalition (NCRC) filed a comment opposing the application and noted then that the company had not provided a complete plan to meet its community reinvestment obligations.

NCRC applauds confirmation of Rohit Chopra to lead CFPB

Rohit Chopra’s prior experience as an Associate Director and Student Loan Ombudsman at the CFPB and most recently as a Federal Trade Commissioner demonstrates his strong commitment to the CFPB’s core mission to protect American consumers from unfair, abusive or deceptive financial practices and products.

Closing the Racial Wealth Divide: A Plan to Boost Black Homeownership

This article was co-produced and co-published with the Nonprofit Quarterly. The United States is a country built on the genocide and taking of land of Indigenous peoples, as well as turning enslaved Africans into the private wealth of White citizens. This has created a nation whose riches are highly concentrated among White Americans. Even after landmark

Civil Rights, Consumer Protection, and Housing Policy Organizations Applaud Senator Raphael Warnock’s Introduction of the $100 Billion Downpayment Toward Equity Act, Call for Its Immediate Passage

(Washington, D.C.) — Following Senator Raphael Warnock’s (D-GA) introduction of the Senate companion to the Downpayment Toward Equity Act, which would allocate $100 billion in funding for first-time homebuyers, the National Fair Housing Alliance, the National Coalition for Asian Pacific American Community Development, the National Urban League, the National Community Reinvestment Coalition, the Center for Responsible Lending, UnidosUS, and the Leadership Conference on Civil and Human

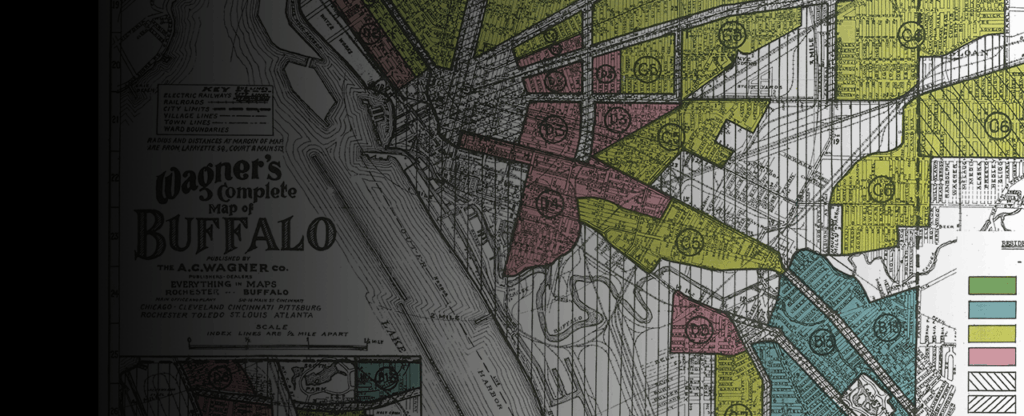

The Injustice of Redlining

The Injustice of Redlining For decades, starting at least in the 1930’s, low-income and minority communities were intentionally cut off from lending and investment through a system known today as redlining. Today, those same neighborhoods suffer not only from reduced wealth and greater poverty, but from lower life expectancy and higher incidence of chronic diseases.

NCRC Files Complaints Against Real Estate Agents For Anti-Asian Business Practices

The National Community Reinvestment Coalition (NCRC) has filed fair housing complaints against three real estate providers for discriminating against prospective Asian American clients.

NCRC Director Ibijoke Akinbowale Appointed to HUD Advisory Committee

The US Department of Housing and Urban Development (HUD) has appointed six new members to its Housing Counseling Federal Advisory Committee, including Ibijoke Akinbowale, director of the National Community Reinvestment Coalition’s (NCRC) Housing Counseling Network (HCN).

NCRC statement on nomination of Saule Omarova as Comptroller of the Currency

Yesterday, President Biden announced the nomination of Cornell Law School Professor Saule Omarova to be the next Comptroller of the Currency.

COVID Creative Placemaking

of this national health crisis will take longer than initially expected. Utilizing art to process loss, explore themes of inequity in health and advocate for a more just society has a much-needed place in the creativity and function of community.

Social Determinants of Health Caucus – Request for Information Letter

(Download) Attn SDOH Caucus Co-Chairs: Congresswoman Cheri Bustos Congressman G.K. Butterfield Congressman Tom Cole Congressman Markwayne Mullin RE: Social Determinants of Health Caucus – Request for Information Dear Members of Congress: Please accept this response to the Request for Information from the Congressional Caucus on Social Determinants of Health, on behalf of the National Community

In Memorium: Remembering Alan Fisher, founding executive director of the California Reinvestment Coalition

Alan Fisher, founding director of the California Reinvestment Coalition, died Thursday, September 16, 2021, surrounded by family, following a hard-fought battle with cancer. In the world of housing and economic justice, Alan was a titan who advocated for working-class families, communities of color, and small-business owners. “The world seems a little sadder today than it

Racial Wealth Snapshot: Latino Americans

Latinos are the largest community of color and fastest-growing native born demographic in the United States.

Adding Robust Consideration of Race to Community Reinvestment Act Regulations: An Essential and Constitutional Proposal

It is time for regulators to incorporate an explicit focus on race in core CRA regulations and examination procedures. This should and can be done in a manner that complements, and does not in any way supplant, the longstanding focus on LMI.