NCRC Condemns HUD’s Disparate Impact Rule

The Trump Administration has attacked one of the most vital pieces of civil rights legislation, the Fair Housing Act, on multiple fronts in the last several weeks. They gutted the Affirmatively Furthering Fair Housing rule that enforces fairness in housing. Now, they are effectively eliminating the disparate impact standard in fair housing cases.

The OCC “True Lender” rule will allow lenders to evade state consumer protections

September 3rd, 2020 National Community Reinvestment Coalition 740 15th St. NW Washington, DC 20005 Brian Brooks Acting Comptroller of the Currency 400 7th St SW Washington, DC 20219 Re: Comments on Proposal “National Banks and Federal Savings Associations as Lenders” Docket ID: OCC-2020-0026 RIN 1557-AE97 Honorable Acting Comptroller Brooks: The undersigned respectfully submit this comment

NCRC Opposes National Banks and Federal Savings Associations as Lenders

September 3rd, 2020 The National Community Reinvestment Coalition 740 15th St. NW Washington, DC 20005 Brian Brooks Acting Comptroller of the Currency 400 7th St SW Washington, DC 20219 Re: Comments on Proposal “National Banks and Federal Savings Associations as Lenders” Docket ID: OCC-2020-0026 RIN 1557-AE97 Dear Mr. Brooks: We strongly oppose the Office of

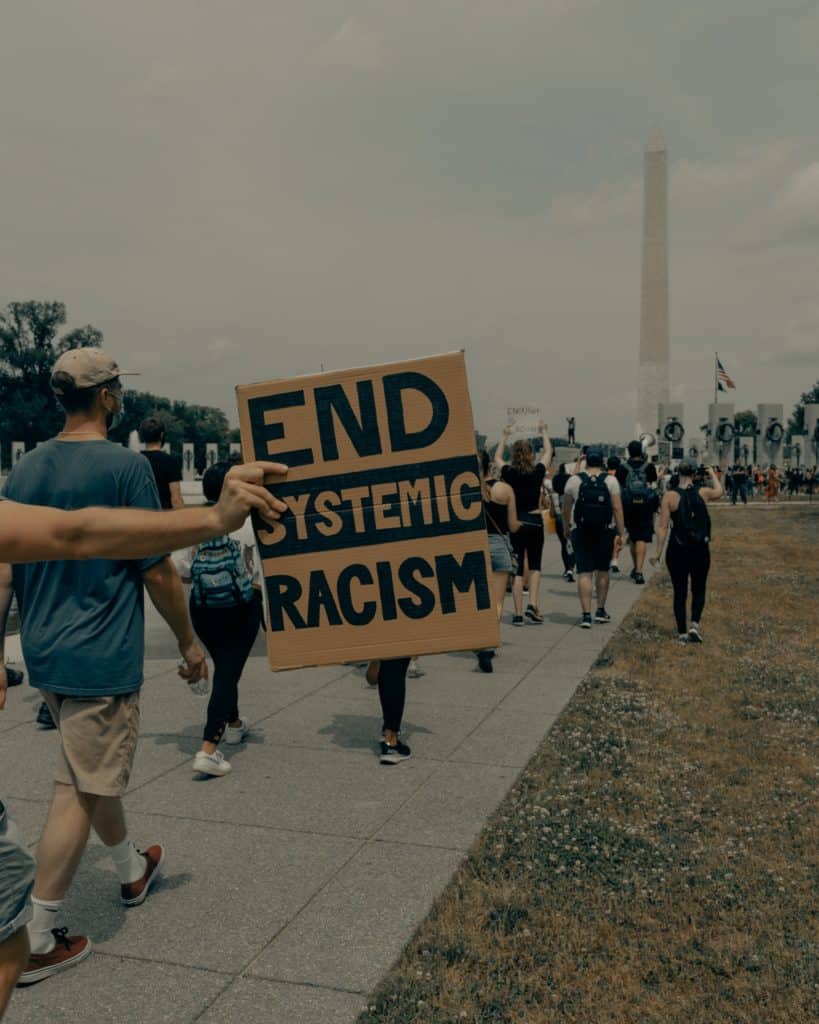

Will local resolutions against racism make a difference?

As COVID-19 disproportionately affects BIPOC and police violence perpetuates devastation to families and communities of color, local governments across the country are acknowledging racism as a public health crisis through public declarations.

CRA for the Securities Industry: A Tool for Combating Wealth Inequality and for Increasing Accountability

If it remains confined to banks, CRA will miss opportunities to make sure that securities services are offered equitably to low- and moderate-income communities.

GSE Capital Rule Comment Sign-on Letter

Comment to the Federal Housing Finance Agency on Enterprise Regulatory Capital Framework Thank you for the opportunity to comment on the Federal Housing Finance Agency’s (FHFA’s) re-proposed rule on capital requirements for Fannie Mae and Freddie Mac (the governmentsponsored enterprises, or GSEs). In our view, the proposed rule erroneously treats the GSEs as banks and

Just Economy Session – Richard Rothstein

“Redlining” is still seen and felt in lower-income communities today. How did that happen? How did lending discrimination in the past contribute to the racial wealth divide that centered the Black Lives Matter protests of 2020?

A Just Economy requires a new Civil Rights movement

Richard Rothstein outlines what’s necessary to reproach residential segregation in NCRC’s Just Economy Series.

Expanding CRA to Non-Bank Lenders and Insurance Companies

if the Community Reinvestment Act (CRA) remains confined to banks, our nation’s underserved neighborhoods will have a harder time revitalizing. Banks are one part of the total financial industry and a shrinking part at that.

Lending Discrimination Faced by Same-Sex Couples in the Mortgage Arena

LGBTQ+ Americans are less likely to own their homes when compared to their straight, cisgender counterparts, and they are more likely to experience financial hardship.

Nassau and Suffolk – Fair Lending Report

Instructions for use: This is an interactive report. Please use the tiles at the top to page forward. Questions: Jason Richardson Director, Research & Evaluationjrichardson@ncrc.org 202-464-2722

Why the Community Reinvestment Act should be expanded broadly across the financial industry

An antidote to discrimination, the Community Reinvestment Act says banks have an affirmative obligation to serve all communities. It’s time to extend that obligation to all of the financial sector, including insurance, securities and non-bank mortgage lenders.

19 community organizations urge FHFA to release data and analysis for proposed capital rule on the GSEs

This week, 19 national community organizations called on the Federal Housing Finance Agency (FHFA) to provide more clarity and transparency around the impacts of the agency’s proposed capital requirements for Fannie Mae and Freddie Mac (the Enterprises) before the end of a public comment period on August 31st.

Phil York

Development Manager pyork@ncrc.org 202.383.7716 Phil York is NCRC’s Development Manager. Phil graduated cum laude from Marietta College in Marietta, Ohio, in 2010 with a B.A. in Political Science and a Business Leadership Certificate where he earned distinctions as a member of three national honor societies – history, political science and leadership. After Marietta, he pursued

The Spirit and Color of CRA: Greater Emphasis on Communities of Color in the Community Reinvestment Act

NCRC continues to advocate for the inclusion of people and communities of color on CRA exams to address continued racial discrepancies in lending.

NCRC Comment on SoFi’s Charter Application

August 12, 2020 RE: NCRC Comment Letter on SoFi Charter Application To Whom it May Concern: The National Community Reinvestment Coalition (NCRC) and 41 community organizations co-signing this letter maintain that Social Finance, Inc.’s (SoFi’s) application for a bank charter has not demonstrated a significant commitment to meeting the convenience and needs of the community

FHFA Re-Proposed Capital Rule for the Enterprises Sign-on Letter

August 10, 2020 The Honorable Mark Calabria Director Federal Housing Finance Agency 400 7th Street, SW Washington, D.C. 20219 Hugh Frater CEO Fannie Mae Midtown Center 1100 15th Street, NW Washington, DC 20005 David Brickman CEO Freddie Mac 1551 Park Run Drive Mclean, VA 22102 Dear Director Calabria, Executives Frater and Brickman: We are writing

New Member Profile: Horizons, a Family Service Alliance

For 60 years Horizons, A Family Service Alliance has been dedicated to providing opportunities to improve the lives of individuals and families.

Limiting Contraceptive Coverage Threatens Women’s Economic Gains

On July 8, the Supreme Court ruled 7-2 in favor of the Trump Administration’s rule to allow employers and universities to opt out based on religious and moral grounds of the Affordable Care Act’s (ACA) mandate to provide contraceptive care.

2020 Policy Agenda for the 116th session of Congress

2020 Policy Agenda For The 116th Session Of Congress Download the full Policy Agenda (PDF) Investing in a Just Economy For nearly 30 years, NCRC has worked to create a just economy. We believe private capital of various forms must be engaged in building an equitable and fair economy. Coronavirus Recovery: Requires a broad and

Mortgage data reveals disparities in Asian American and Pacific Islander lending

The research, from the National Community Reinvestment Coalition (NCRC), sheds new light on the experience of several groups within the AAPI community that have long accused lenders of predatory practices and discrimination.

Mortgage Lending in the Asian American and Pacific Islander Community

Key Findings Over 652,000 loan applications were reported in 2018 where the applicant identified as AAPI. Home purchase loans varied greatly within the AAPI community, with Asian Indians purchasing homes in 70% of cases, compared with Japanese borrowers that purchased a home just 45% of the time. There are substantial variations in the share of

NCRC supports pandemic-related housing needs in 15 States, funded by Wells Fargo Foundation

Nonprofit housing counseling organizations responding to the COVID-19 pandemic in 15 states will receive unrestricted grants and resources from the National Community Reinvestment Coalition (NCRC), thanks to funding from the Wells Fargo Foundation.

NCRC, Two Other Advocacy Groups, File Joint Amicus Brief in Lacewell v. OCC

Last week, the National Community Reinvestment Coalition (NCRC) joined with the Center for Responsible Lending (CRL) and the National Consumer Law Center (NCLC) to file an amicus brief in the Office of Comptroller of the Currency (OCC)’s appeal in Lacewell v. OCC in the federal Second Circuit Court of Appeals.

HUD’s Proposed Rule Enables Discrimination Against Transgender People

The Department of Housing and Urban Development (HUD) recently issued a proposal to change the Equal Access Rule in ways that could encourage discrimination against individuals who are transgender and/or nonbinary.