About NCRC

The National Community Reinvestment Coalition is a network of organizations and individuals dedicated to creating a nation that not only promises but delivers opportunities for all Americans to build wealth and live well. We work with community leaders, policymakers and institutions to advance solutions and build the will to solve America’s persistent racial and socio-economic wealth, income and opportunity divides, and to make a Just Economy a national priority and a local reality. This vision is the foundation of the Just Economy Pledge.

NCRC’s unique mix of research, investigations, investments, media, grant-making, training, advocacy, litigation, lending, convening and facilitation strengthens communities of historic disinvestment, expands economic mobility, holds public and private institutions accountable for their impacts, and informs local and national leaders, policymakers and the private sector.

Who we are

NCRC was formed in 1990 by national, regional and local organizations to increase the flow of private capital into traditionally underserved communities. Today our members include more than 700 nonprofit community development and finance organizations; community organizing and civil rights groups; minority and women-owned business associations; national, state and local housing, economic development, education, media, arts, healthcare and investment organizations; state and local government agencies; faith-based institutions; and committed, hopeful individuals from across the nation.

What we do

Wealth isn’t distributed evenly. But the opportunity to earn and accumulate it should be. We push back against centuries of inequality. We push forward toward a world of inclusive, livable and sustainable communities grounded in practices, policies and standards that advance opportunities for everyone. We produce agenda-setting research, media and events; advocate on behalf of members; renovate and build affordable homes for low- and moderate-income families; provide grants, loans, technical support and training to entrepreneurs, community development and community finance organizations and professionals; investigate and litigate to root out discrimination in financial services and housing; and we inform, organize and facilitate dialog between local anchor institutions and community members to increase lending, investments, philanthropy, health, information and other services and wealth building opportunities in neighborhoods that need it. We testify before Congress and meet with the leadership of regulatory agencies and financial services corporations. Our analysis, tools and experts are routinely cited by journalists, economists, policy makers and scholars focused on consumer finance, fair lending, fair housing, urban renewal, rural development, social determinants of health, the legacy of historic redlining, the racial wealth divide, socio-economic inequity, consumer protection and civil and human rights.

Social Impact Ventures and Funds

NCRC invests and manages a network of affiliated social enterprises and investment funds to expand access to affordable home ownership, living wage jobs and careers and capital for small businesses. The NCRC Community Development Fund is a US Department of Treasury-certified Community Development Financial Institution that makes loans to support economic mobility, bridge the nation’s racial wealth gap, expand access to affordable homeownership and provide loan capital that helps Black-, Brown-, and woman-owned businesses thrive. The NCRC Housing Rehab Fund, known as GROWTH by NCRC, renovates and builds affordable homes in cities across the nation.

Learn more about our vision and values.

Our Impact Last Year

Community Benefits Agreements

$11.1

billion

We negotiated one community benefits agreement renewal and one extension that together committed $11.1 billion for loans, investments and philanthropy to underserved communities.

Loans

$5.8

Million

NCRC’s Community Development Fund made $5.8 million in low-interest loans for local capacity-building, small business resilience and construction of affordable housing across dozens of member organizations and communities.

Grants

$3.1

Million

Awarded to 65 grantees in 16 states for affordable housing, small business development, arts & culture, COVID-19 relief, housing counseling and capacity building initiatives.

Housing Counseling Network

18,329

NCRC’s Housing Counseling Network helped more than 18,000 households become homeowners, avoid evictions and foreclosures and understand fair housing, fair lending and accessibility rights.

Research

20 Reports and Briefs

We published ground-breaking research and analysis on disinvestment in Native Lands, the painfully slow progress on closing the racial wealth divide and many other topics.

Just Economy Conference

1,238

A record-breaking 1,238 of our allies and partners from 46 states attended the national event for community, business, foundation, policy and government leaders who want a nation that not only promises but delivers opportunities for all Americans to build wealth and live well.

Advocacy Week

29 State Delegations

129 meetings with the House, Senate and federal regulators with 29 state delegations, including Washington, DC.

Affordable Home Ownership

96 Homes Built or Rehabbed

GROWTH by NCRC built or rehabbed 96 homes, representing an investment of $16 million, and sold 73 homes.

Since 2015, GROWTH has:

- Acquired 1,059 lots or properties

- Sold 643 homes, 85% of which were sold either to LMI buyers and/or within LMI communities

Training

102 Training Programs

with more than 9,000 attendees

Audience

604,884

Web Users

50,663 – Email Subscribers

Media

3,500 Citations

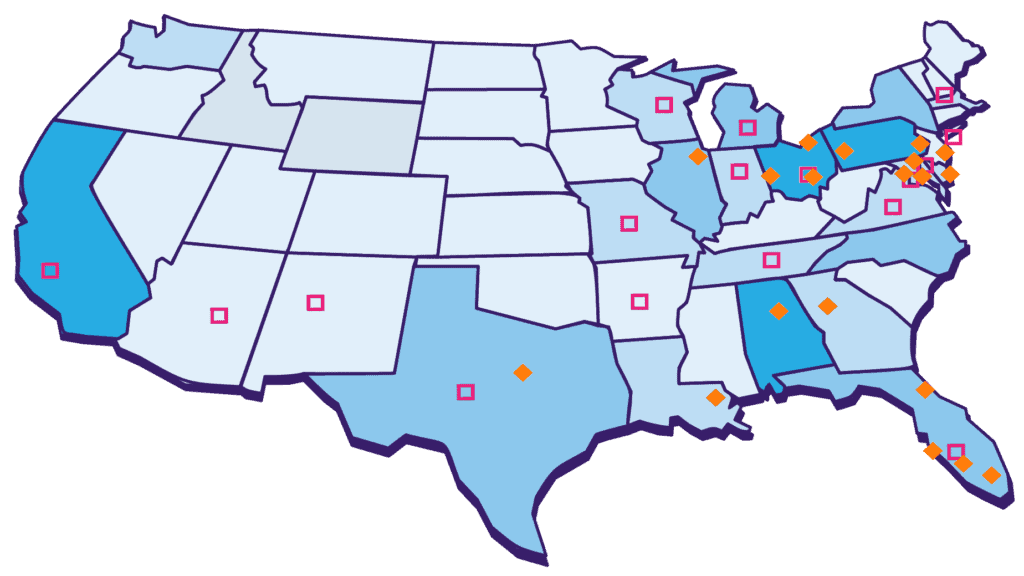

Members

711 organizations in 43 states and DC and Puerto Rico.

Up to 9

10-19

20-39

40-70

Housing Counseling Network

26 Member organizations in 16 states and the District of Columbia assisted 18,329 households.

GROWTH by NCRC

Affordable homes in 20 markets in 12 states and the District of Columbia