2023

IMPACT

Jesse Van Tol

President & CEO

Robert Dickerson, Jr.

NCRC Board Chair & Executive Director of the Birmingham, Alabama, Business Resource Center

Dear NCRC Community,

We’re pleased to share with you these highlights from NCRC’s work and impact in 2023. As you’ll see, what we and our more than 700 member organizations achieved last year helped hundreds of people buy or sustain homeownership, reached and informed millions, and yielded $11.1 billion in commitments from banks for lending, investments and philanthropy that will strengthen entire communities across the nation. The collective force of our research, investigations, publishing and advocacy – shoulder to shoulder with our member organizations in 43 states and DC and Puerto Rico – also influenced critical changes to government policies and private sector practices that have sustained racial wealth inequality in America for far too long.

We celebrated two huge achievements in national policymaking, both of which reflected years of effort. Regulators finalized an update to the rules that banks must follow to comply with the Community Reinvestment Act. NCRC analysis, member comments, media visibility and leadership in public discourse on the enduring legacy of historic redlining all played a pivotal role in the final shape of the new CRA rules.

The Consumer Financial Protection Bureau also finalized its long-delayed rules to enforce Section 1071 small business lending data requirements first spelled out in the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act. CFPB Director Rohit Chopra announced the new rules to a record crowd of more than 1,200 at NCRC’s Just Economy Conference. NCRC research, advocacy and member comments informed and were essential to the final shape of the rule.

In both cases, our work isn’t over. Both sets of rules – and the CFPB itself – face legal challenges from banking trade associations. No matter how those cases are resolved, NCRC and its members will be strong and visible advocates to ensure that lenders live up to their obligations to meet credit needs in the communities they serve – and that regulators fulfill their mandates to set and enforce the rules.

NCRC informed policymakers and the public about the urgent need for these and other financial system changes. We exposed the nearly complete absence of mortgage lending in and around Native lands in New Mexico and Arizona and revealed that it will take 500 years to close the nation’s racial wealth divide if current trends continue. We called out Keybank as the country’s worst major bank for Black borrowers and maintained pressure over those findings in various ways throughout the year. And our “mystery shopper” investigation team proved that small business borrowers get treated worse by bank staff if they aren’t White.

In 2023 we also looked inward. We reflected on what NCRC has achieved since it was founded in 1990 and considered the transformation and impact we aim to achieve in the next five years. The outcome of that effort with our board and staff was a new strategic plan, a clarified vision to solve America’s historic racial and socio-economic wealth, income and opportunity divides – and a mission that is both simple and daunting: Make a Just Economy a national priority and a local reality. That’s also the foundation of NCRC’s Just Economy Pledge.

The challenges are deep. We don’t win every battle. But we made real progress in 2023 and we’re excited for what we can accomplish together in the coming year. We are grateful for your support and commitment to building a just economy. With your continued support, we will keep fighting for a better future so that everyone has the opportunity to build wealth and live well.

Jesse Van Tol

President and CEO

Robert Dickerson, Jr.

Chair, NCRC Board of Directors

Board of

Directors

Board of Directors

Robert Dickerson, Jr., Chair

Birmingham Business Resource Center

Bethany Sanchez, Vice Chair

Metropolitan Milwaukee Fair Housing Council

Irvin Henderson, Vice Chair

National Trust for Historic Preservation

Ernest Hogan, Treasurer

Pittsburgh Community Reinvestment Group

Elisabeth Risch, Secretary

Housing Opportunities Made Equal (HOME)

Aaron Miripol

Urban Land Conservancy

Andreanecia Morris

HousingNola

Arden Shank

South Bend Heritage Foundation

Beverly Watts

NAACP

Cornell Crews

Community Reinvestment Alliance of South Florida

Carol Johnson

City of Austin’s inaugural Civil Rights Office

Charles Harris

Housing Education & Economic Development

Jean Ishmon

Northwest Indiana Reinvestment Alliance

Kevin Stein

California Reinvestment Coalition

Matt Hull

Texas Association of Community Development Corporations

Matthew Lee

Inner City Press

Phyllis Edwards

Bridging Communities

Moises Loza

Formerly, Housing Assistance Council

Peter Hainley

CASA of Oregon

Roberto Barragan

California Community Economic Development Association

Sharon H. Lee

Low Income Housing Institute

Stephen Glaude

Coalition for Non-Profit Housing and Economic Development (CNHED)

Vernice Miller-Travis

WE ACT for Environmental Justice

Will Gonzalez

Ceiba

Some

Numbers

Some Numbers

Community Benefits Agreements

$11.1

billion

We negotiated one community benefits agreement renewal and one extension that together committed $11.1 billion for loans, investments and philanthropy to underserved communities.

Loans

$5.8

Million

NCRC’s Community Development Fund made $5.8 million in low-interest loans for local capacity-building, small business resilience and construction of affordable housing across dozens of member organizations and communities.

Grants

$3.1

Million

Awarded to 65 grantees in 16 states for affordable housing, small business development, arts & culture, COVID-19 relief, housing counseling and capacity building initiatives.

Housing Counseling Network

18,329

NCRC’s Housing Counseling Network helped more than 18,000 households become homeowners, avoid evictions and foreclosures and understand fair housing, fair lending and accessibility rights.

Research

20 Reports and Briefs

We published ground-breaking research and analysis on disinvestment in Native Lands, the painfully slow progress on closing the racial wealth divide and many other topics.

Just Economy Conference

1,238

A record-breaking 1,238 of our allies and partners from 46 states attended the national event for community, business, foundation, policy and government leaders who want a nation that not only promises but delivers opportunities for all Americans to build wealth and live well.

Advocacy Week

29 State Delegations

129 meetings with the House, Senate and federal regulators with 29 state delegations, including Washington, DC.

Affordable Home Ownership

96 Homes Built or Rehabbed

GROWTH by NCRC built or rehabbed 96 homes, representing an investment of $16 million, and sold 73 homes.

Since 2015, GROWTH has:

- Acquired 1,059 lots or properties

- Sold 643 homes, 85% of which were sold either to LMI buyers and/or within LMI communities

Training

102 Training Programs

with more than 5,000 attendees

Audience

604,884

Web Users

50,663 – Email Subscribers

Media

3,500 Citations

Members

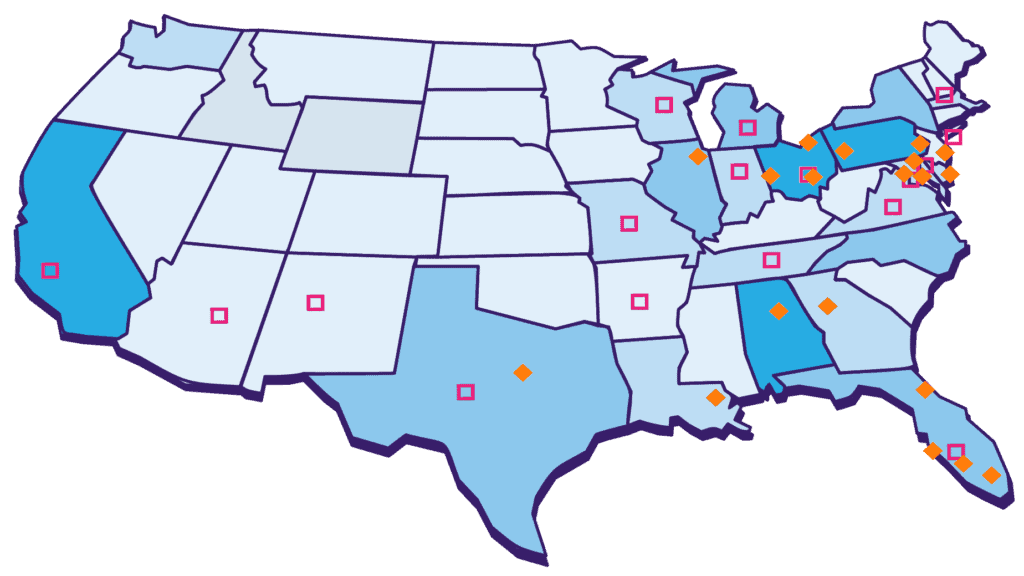

711 organizations in 43 states and DC and Puerto Rico.

Up to 9

10-19

20-39

40-70

Housing Counseling Network

26 Member organizations in 16 states and the District of Columbia assisted 18,329 households.

GROWTH by NCRC

Affordable homes in 20 markets in 12 states and the District of Columbia

We Shaped The Future

We Shaped

The Future

Through advocacy, campaigns, research, investigations and media, we built the will to overcome economic inequality and racial inequity.

Section 1071: Celebrating, and Circling the Wagons

CFPB Director Rohit Chopra chose to announce the final Section 1071 small business lending rule on the mainstage at the 2023 Just Economy Conference, a reflection of NCRC’s leading role in shaping that vital policy. Not long after, though, we found ourselves facing renewed attacks on the rule from some powerful actors within the banking industry. We helped push back on the misleading claims those industry holdouts made in the media and through an effort to repeal the rule in Congress that was eventually vetoed by President Biden. With a group of leading fintech companies, NCRC’s Innovation Council for Financial Inclusion expressed support for a stable CFPB, and we exposed the false legal arguments bank trade groups pushed in a federal lawsuit to block the rule and to attack the CFPB’s funding structure. The latter case was argued before the Supreme Court in the fall, with nearly every Justice poking holes in the industry lawyers’ poorly argued case – a promising indication of how the Court may rule in 2024.

CRA: Making Hay While the Sun Shines

Delays to the original timeline for the final interagency rule on CRA afforded NCRC additional time to influence the outcome and educate key audiences. In the first three quarters of 2023, NCRC staff collaborated to develop and implement a clear work plan in anticipation of the rule, which included the development of social media and policy briefing materials to assist members. We met with Senate staff to shape their understanding of some intra-movement tensions around the rule. We made three presentations to stakeholders in mid-October, including another briefing for House of Representatives staff and members, to set the stage for the final rule’s unveiling later that month. After the final rule was released in late October, we helped both lawmakers and the public digest the complex and detailed new material, holding two webinars with agency heads and staff experts, helping key lawmakers prepare for a congressional hearing on the rule and making CRA presentations to allied groups on five separate occasions in the short span between the rule’s release and the holiday break.

KeyBank’s Broken

Promises

In late 2022, NCRC researchers discovered that Cleveland-based KeyBank had broken commitments it made to us and our members in a 2016 Community Benefits Agreement. Our former partner had become the country’s worst major bank for Black borrowers, prompting us to break ties with KeyBank.

Throughout 2023, NCRC kept pressure on the bank and successfully countered the bank’s spin of the story in the press. With 80 members signed on, we urged regulators to downgrade KeyBank’s CRA rating. NCRC findings also informed a shareholder-led effort to demand accountability from the bank, and successfully pressured the bank into announcing in May that it would engage a third party to conduct a racial equity audit. This work is ongoing and will continue as long as necessary to deliver true and tangible accountability for KeyBank’s behavior.

Mystery Shopper Testing

NCRC conducted 433 matched-pair tests in 13 cities to investigate potentially discriminatory practices in mortgage lending, small business lending and other financial industry transactions relevant to family wealth-building. We also processed more than 60 individual fair housing complaints filed with us through our national #FairHousingMatters digital media campaign.

NCRC continued to address enforcement efforts in 2023 by following up on HUD complaints filed in 2022 against realtors, property management companies and lending institutions. The impact of these complaints will be felt at a local level where housing providers are held accountable for discriminatory conduct and required to engage in corrective action that promotes fair housing choice for all Americans.

We Expanded Access To Private Capital In Communities That Need It Most

We Expanded Access To Private Capital In Communities That Need It Most

Through advocacy, campaigns, research, investigations and media, we built the will to overcome economic inequality and racial inequity.

Community Benefits Agreements

Community benefits agreements (CBAs) are a way for banks to spell out, in writing, how they will meet the needs of the communities where they do business. Since 2016, NCRC has facilitated the creation of CBAs with 21 bank groups worth more than $580 billion for mortgage, small business and community development lending, investments and philanthropy in LMI and under-resourced communities.

In 2023 NCRC’s organizing team convened and facilitated 160 NCRC member organizations to negotiate two community benefits agreements – one a renewal and one an extension of a previous agreement.

$11.1 Billion in Private Sector Commitments

Highlights:

This $6.5 billion extension of a previous $16 billion agreement – for a combined $22.5 billion value – followed the collapse of Silicon Valley Banks and the acquisition of most of its business by First Citizens. The expansion incorporated commitments to communities in California and Massachusetts previously served by Silicon Valley Bank. The expanded agreement included support for small business, community development and lending, support for residential mortgages to low-and moderate-income borrowers, and $35 million in philanthropic grants.

This was a renewal of a previous agreement. Santander committed to $4.6 billion in community development lending, investments and philanthropy for affordable housing, small business, sustainable finance and supplier diversity. In addition, Santander committed $9 billion in sustainable finance across their footprint.

We Informed & Shaped Public Discourse

We Informed & Shaped Public Discourse

NCRC research and publishing informed local and national leaders and expanded interest in a just economy.

Our publications, advocacy and staff expertise earned hundreds of major media mentions including deep, rich feature pieces in the New York Times, Washington Post, CNBC and NBC Nightly News.

NCRC’s policy, legal and government affairs staff filed 23 comment letters with regulators on bank mergers, fair housing regulations, Section 1071 small business data collection and other topics. We helped lead critical scrutiny of “Buy Now Pay Later” businesses, promoted congressional efforts to close the Industrial Loan Corporation loophole and defended the Consumer Financial Protection Bureau from ongoing attacks and supported cross-team efforts to influence, celebrate and defend the long-awaited update to CRA rules – among many other activities to uphold consumer rights and ensure the safety and soundness of our financial system at both the federal and state levels.

We Championed Affordable Homeownership

We Championed Affordable Homeownership

And Delivered It For More Than 750 Families

Homeownership is a key driver of generational wealth and long-term financial security for families – which is why NCRC works to close the huge and persistent divide in homeownership rates between White, Black, Latino, Native and other minority communities that have historically been targeted for disinvestment and deprivation.

We collaborated with NCRC member Native Community Capital to publish the first-ever financial needs index maps of Tribal Lands in Arizona and New Mexico. The report, “Redlining the Reservation,” found that home loans to Native Americans are not only rare in the study area, but are in half the cases being used to buy manufactured homes that depreciate in value.

We pushed lawmakers and regulators to ensure that sensible increases to bank capital requirements would shelter low-income communities from potential unintended consequences, prioritize public input and community benefit analyses in their overhaul of merger rules. We also supported efforts to implement aggressive state-level CRA measures in Maryland and Illinois.

NCRC’s Housing Counseling Network provided pre-purchase/homebuying counseling that helped 755 families become homeowners. One of our affiliates, GROWTH by NCRC, built or rehabbed 96 affordable homes in 2023, representing an investment of $16 million, and sold 73 homes.

Our Network & Influence

Our Network & Influence

We organized, trained and supported a growing and influential coalition

Membership

As of the end of 2023, NCRC had over 700 members!

70 new members joined the coalition in 2023, bringing our total membership to 711 organizations.

Media Mentions

Our work and views earned 372 unique mentions in major media and approximately 3,500 mentions across all media, for a total potential reach of more than 7.8 billion news consumers. This included NCRC’s work featured in major stories and opinion columns from the New York Times and Washington Post.

New York Times - Washington Post - Bloomberg - American Banker - NBC Nightly News - American Banker - HousingWire - Inside Mortgage Finance -

New York Times - Washington Post - Bloomberg - American Banker - NBC Nightly News - American Banker - HousingWire - Inside Mortgage Finance -

We directly supported new feature-length investigative pieces by both Bloomberg and American Banker, and NCRC President and CEO Jesse Van Tol appeared on NBC Nightly News for a segment on appraisal bias. Those standout examples come on top of a steady drumbeat of day-to-day news coverage in major financial sector trade publications like the American Banker, HousingWire, Inside Mortgage Finance and others.

Audience

Just Economy Conference

Just Economy Conference

The conference drew 1,238 in-person participants

NCRC’s Just Economy Conference has become a must-attend annual event for community, business, foundation, policy and government leaders who want a nation that not only promises but delivers opportunities for all Americans to build wealth and live well, and our 2023 conference was our largest ever, with 1,238 attendees. NCRC members and our closest allies and partners came together in Washington in March to network, share ideas and celebrate the hard work we all do every day.

Marcia L. Fudge

Secretary of the U.S. Department of Housing and Urban Development

Michael Hsu

Acting Comptroller of the Currency

Jelani Cobb

Dean and Henry Luce Professor of Journalism, Columbia Journalism School

Randall L. Woodfin

Mayor of Birmingham, Alabama

Aaron Dorfman

President and CEO, National Committee for Responsive Philanthropy (NCRP)

Allan Golston

President of the U.S. Program, Bill & Melinda Gates Foundation

Maxine Waters

Congresswoman U.S. House of Representatives, California

Pramila Jayapal

Congresswoman U.S. House of Representatives, Washington

Asahi Pompey

Global Head of Corporate Engagement and President of the Goldman Sachs Foundation

Rohit Chopra

Director of the Consumer Financial Protection Bureau

Karen Attiah

Columnist, Washington

Post

Michael Barr

Vice Chair for Supervision of the Board of Governors, Federal Reserve System

Martin Gruenberg

Chairman, Federal Deposit Insurance Corporation

Virtual Advocacy Week

NCRC’s 2023 Advocacy Week brought 195 NCRC members from 29 state delegations, including DC, to Capitol Hill with more than 129 virtual meetings with members of Congress and federal regulators. Leading up to Advocacy Week, we held dozens of meetings with state leads and their delegations and two Advocacy Week prep calls with participants. During those prep meetings, NCRC trained participants on how to conduct themselves in Capitol Hill meetings and answered questions about NCRC’s 2023 Policy Agenda.

Just Economy Regional: Mountain West Summit

Our Denver summit convened 184 leaders from a four-state region. Speakers included Denver Mayor Mike Johnston, Denver International Airport CEO Phillip A. Washington and members from the Arizona & Colorado Water Conservation Boards. Breakout sessions focused on the affordable housing crisis, the power of community land trusts, environmental justice, CRA, community development on tribal lands and more. The summit concluded with a tour of the Mosaic Community Campus, a 22-acre mixed-use community land trust project developed by the Urban Land Conservancy, an NCRC member organization. After the summit the co-convening organizations continue to meet regularly to build out ongoing collaboration across the region and to recruit new NCRC members.

Training & Mentoring

Training & Mentoring

102 Webinars and Online Training Courses and 6 in-person Events

Our online events covered important just economy topics including a discussion of the critical Community Reinvestment Act update, fintech innovations for entrepreneurs, Section 1071, and more. Together, these events served 5,864 participants.

NCRC’s National Training Academy trained 1,820 practitioners, managers and executives through 20 webinars, 13 virtual sessions, six in-person events, and three eLearning courses. Courses offered included HUD Exam preparation, Disaster Management, Safety First: Counseling through Difficult Situations, Power of Digital Marketing, and more.

The Academy thought of everything needed to make our training experience phenomenal. The topic was relevant and gave us everything needed to start using what we learned instantly. The location and atmosphere was great. Everyone was ready to learn and eager to participate. NCRC did an outstanding job creating a safe space to learn, grow and share.

— Carla Scott, DreamKey PartnersEbony McMillian, owner of Bermuda Triangle Vintage Clothes

NCRC CDF Launch and Growth Academies were business accelerator programs that provided technical assistance to entrepreneurs. The courses consisted of nine-week cohort-style sessions that provided new tools and resources, one-on-one mentoring, and the opportunity to connect with fellow participants to cultivate relationships with like-minded business owners. In 2023, 55 entrepreneurs from 18 states participated – and 78% of them identified as female, reflecting the fund’s commitment to gender equality in entrepreneurship.

NCRC’s Fellowship for Equitable Development program supported 17 fellows who helped a dozen of our member organizations expand their capacity and pursue their local mission – while also helping build skills and knowledge among the next generation of economic justice activists. They were embedded in 12 NCRC member organizations in Alabama, Cincinnati, DC-metro region, Florida, Georgia and New York.

NCRC also forged a partnership with the Goldman School of Public Policy at the University of California Berkeley. Graduate students collaborated with NCRC members to fulfill the students’ capstone project requirements while actively contributing to equitable development initiatives. The inaugural phase yielded four successful fellows/host matches, laying the foundation for an expanding and enduring collaboration in the years to come. The NCRC Fellowship for Equitable Development is not just growing in numbers but evolving into a powerful force for positive change and inclusion.

Impact Ventures & Funds

Impact Ventures & Funds

We Built Communities – Literally

We don’t just work to move minds — we build homes and communities that are dignified, affordable and accessible to all. NCRC manages a network of subsidiaries, investment funds and mission-driven impact ventures to expand access to affordable homeownership, small business capital and living-wage jobs.

One of them, GROWTH by NCRC, built or rehabbed 96 homes in 2023, representing an investment of $16 million, and sold 73 homes. GROWTH also launched a second fund, the Affordable Homeownership Innovation Fund (AHIF). This larger fund is expected to produce more than 5,000 affordable homes over 10 years, helping in the creation of generational wealth for low- and moderate-income people and people of color.

GROWTH is using the template established in 2022 through its relationships with the cities of Birmingham and Atlanta, and building similar relationships in Dallas/Fort Worth, Texas and Columbus, Ohio, with more to come in other cities and regions.

Since 2015, GROWTH has:

We Mentored & Financed the Next Generation of Small Business & Community Leaders

Another NCRC impact venture, The NCRC Community Development Fund (NCRC CDF), is a US Treasury-certified Community Development Financial Institution. It’s a mission-based lender, focused on ensuring Black, Latino and other underserved borrowers and LMI individuals have the tools, knowledge and expertise to move toward economic mobility.

In 2023, NCRC CDF made $5.8 million in low-interest loans for local capacity-building, small business resilience and construction of affordable housing across dozens of member organizations and communities. The fund also managed the $175 million Back to Business (B2B) grant program for Illinois Department of Commerce and Economic Opportunity. The program provided grants to more than 4,000 Illinois businesses impacted by COVID-19 in the arts, restaurant and hotel sectors.

Community Impact: Grants, Loans and Counseling

Community Impact:

Grants, Loans and Counseling

We directly distributed $3.1 million in grants to more than 65 grantees in 19 states to support affordable housing, small business, arts & culture, COVID-19 relief, housing counseling and capacity building initiatives. The NCRC Community Development Fund made $5.8 million in low-interest loans for local capacity-building, small business resilience and construction of affordable housing across dozens of member organizations and communities.

NCRC’s Housing Counseling Network served 18,329 families in 2023, a remarkable 35% increase from 2022’s record year. The network's services and impact included:

- Eviction Prevention: Housing counseling services led to 205 households receiving rental counseling, successfully averting eviction.

- Homeownership Achievements: 755 households, after receiving pre-purchase/homebuying counseling, successfully transitioned into homeownership, realizing their dreams of owning a home.

- Foreclosure Prevention: The Housing Counseling network played a crucial role in preventing foreclosure for 540 households, safeguarding their homes and financial stability.

- Empowering Through Information: A total of 2,886 households received vital information on fair housing, fair lending, and accessibility rights, empowering them with knowledge and ensuring equitable access to housing opportunities.

With support from Morgan Stanley, NCRC’s Field Empowerment Fund (FEF) provided unrestricted grants to 24 NCRC member community organizations to help them respond to economic challenges created by the COVID-19 pandemic. Together with a prior round of grants in 2022, a total of 54 community groups have benefited from the Morgan Stanley-supported $5 million Field Empowerment Fund.

Support

Support

These Major Funders Provided $100,000 Or More To NCRC In 2023:

- Bank of America

- Bank of the West

- BMO

- CitiBank

- Fifth Third

- First Citizens

- First Horizon

- Goldman Sachs

- Department of Housing & Urban Development

- Ewing Marion Kauffman Foundation

- Huntington National Bank

- JP Morgan Chase

- M&T Bank

- Morgan Stanley

- National Institutes of Health

- NY Community Bancorp

- Ocwen Financial

- Old National Bank

- PNC Bank

- Regions Bank

- Robert Wood Johnson Foundation

- Rocket Mortgage

- Santander Bank

- Share our Strength

- TD Bank

- Truist Financial

- Umpqua Bank

- U.S. Bank

- Valley National Bank

- W.K. Kellogg Foundation

- Webster Bank

- Wells Fargo

Copyright © NCRC. Some Rights Reserved.

Terms / Privacy / Code of Conduct / DMCA