Karen Kali, Program Manager, Special Initiatives, NCRC

EXECUTIVE SUMMARY

Older adults aged 55+, a growing population, are moving into retirement and later stages of life with less economic security than their immediate predecessors. Housing affordability and increasing health expenses are two significant barriers to the “golden age” of retirement many reminisce from years past. A barrage of scammers, fraudsters and even close members of social and familial circles threaten the ability of older adults to age in place, in community and with confidence, dignity and security. For low- to moderate-income (LMI) older adults, the prospects are even more stark.

While older adults have long represented the banking and financial services industry’s most loyal and consistent customers, LMI older adults have specific banking needs. All banks and financial institutions have a distinct role in serving all communities and customers, including LMI older adults.

NCRC’s Age-Friendly Banking initiative has long advocated for products, services and protections that will improve the economic security of older adults. This paper addresses the core features and standards of personal Age-Friendly Banking accounts that allow older adults to remain banked, remain secure, weather emergencies and save money as they move into or thrive in later stages of life.

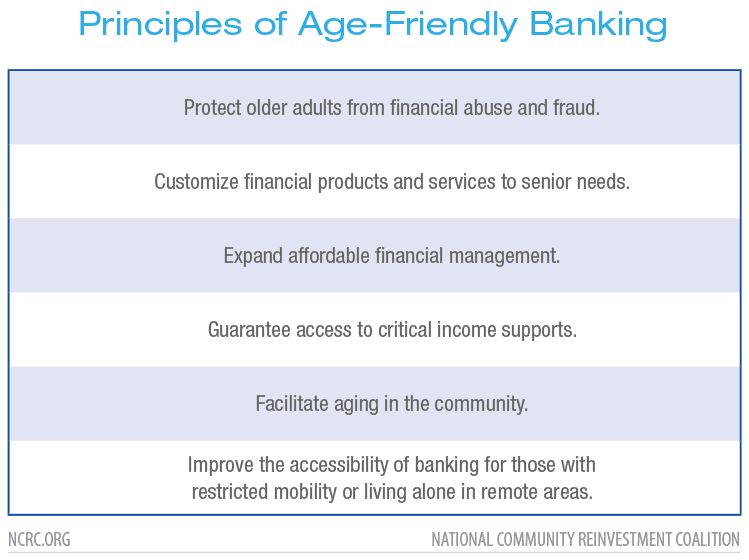

PRINCIPLES OF AGE-FRIENDLY BANKING

- Protect older adults from financial abuse.

- Customize financial products and services to address older adults’ needs.

- Expand affordable financial management.

- Guarantee access to critical income supports.

- Facilitate aging in the community.

- Improve the accessibility of banking for those with restricted mobility or living alone in remote areas.

INTRODUCTION

NCRC works hand-in-hand with passionate, thoughtful and diligent community-based organizational partners who share our mission of building wealth and opportunity in communities across the country. With a convergence of our shared missions, NCRC and select local partners first launched its focus on the aging population in 2011 via NCRC’s National Neighbors Silver special initiative. In 2012, NCRC officially launched its Age-Friendly Banking initiative based on a year-long research and development phase that included collaborations with banks and financial institutions, aging network engagement, building support with regulators and policymakers and establishing awareness. Through NCRC’s National Neighbors Silver, NCRC continues today to partner and work with local organizations focused on economic security and financial well-being of older adults (aged 55+). With a multitude of data, primary research, publications, digital learning products, one documentary film and several convenings and innovation labs over the years, NCRC’s Age-Friendly Banking has emerged as a concept for improving the mental, physical and economic well-being of vulnerable older adults through the financial service system.

BACKGROUND

The United States is experiencing, and will continue to experience in the coming decades, a significant increase in the population of older adults.[1] This aging population faces unique financial challenges that require products and services from financial institutions that are tailored to their needs. Just over 34% of the U.S. population is aged 50 and older, and more than half of the nation’s households are headed by someone 50 years or older. Much of the growth in the older population is due to the baby boomer generation. While there is an indication that this growth will slow over the next two decades, greater longevity means that the population of people in their 70s, 80s and 90s is set to double by 2037.[2] Many older adults may be economically and physically vulnerable due to a heavy reliance on Social Security, cognitive decline, an increased likelihood of falling victim to financial abuse and exploitation and social isolation. These trends will disproportionately impact women who tend to outlive men.

There are as many as 50 million LMI adults age 50 and older living in the United States today. Unlike previous generations, these LMI older adults face unique financial challenges. According to a recent report by the Center for Financial Services Innovation, only 17% of LMI adults 50 and older consider themselves financially healthy, while 83% of LMI older adults struggle with either some or all components of their financial lives. Due to the limited buffer between income and expenses, more than half of LMI older adults do not have an adequate amount of short-term, emergency savings. The lack of savings puts the rapidly aging population at risk if they experience a financial shock, such as a sudden hospital bill or emergency home repair. Additionally, almost 40% of LMI older adults are facing unmanageable debt, making it difficult to plan for their future finances. Because of this financial vulnerability, many LMI older adults are not able to retire fully and end up taking part-time positions in the gig economy.[3]

Older adults are at a great risk for financial fraud and abuse. Research finds that at least 20% of older adults have been victimized by fraud and abuse.[4] From 2013-2017, financial institutions reported $6 billion in actual losses and attempts in Suspicious Activity Reports on Elder Financial Exploitation.[5] On top of that, this is likely an underestimate as recent research regarding elder financial abuse has shown only one in every 44 cases is reported. Thus, the reported amount of losses could ultimately be vastly less than the actual amount.[6] Retaining wealth is fundamentally critical for older adults’ financial health and ultimately their physical and mental health and wellbeing.[7] Older adults’ wealth also affects the health and resiliency of future generations, as evidenced by over 500,000 grandparents age 65 or over in 2014 who had the primary care responsibility for their grandchildren.[8]

PRIMARY COMPONENTS OF AGE-FRIENDLY BANKING

NCRC’s Age-Friendly Banking initiative centers around six primary principles: protecting older people from financial abuse and fraud, customizing financial products and services to senior needs, expanding affordable financial management, guaranteeing access to critical income supports, facilitating aging in the community and improving the accessibility of banking for those with restricted mobility or who are living alone in remote areas.

ASSESSING THE SENIOR MARKET

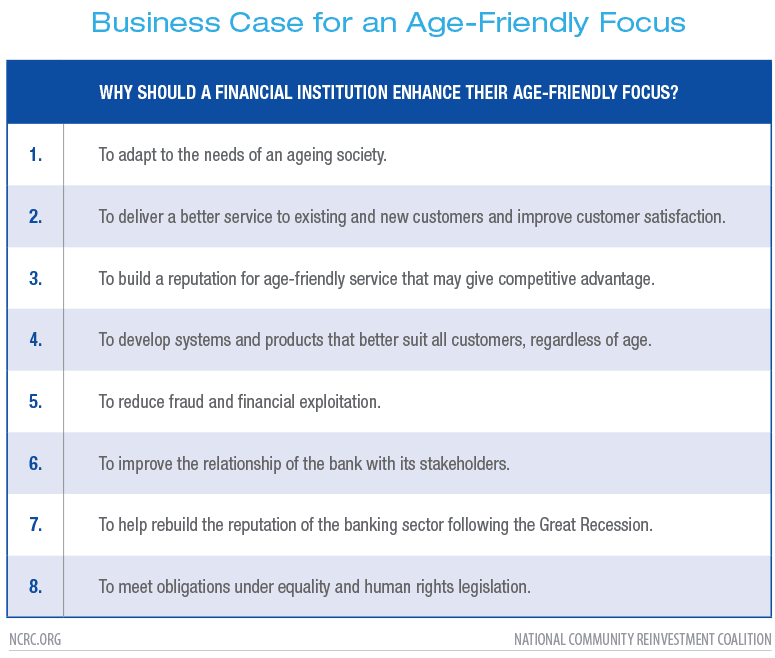

The current banking and financial services market is ripe for Age-Friendly Banking implementation. While some banks and financial institutions have made small steps into the space, older adult customers continue to voice interest for more Age-Friendly Banking products, services and protections. In Age UK’s Age-Friendly Banking report, “What it is and how you do it,” the authors provided several reasons cited by UK and US banks for the move into the age-friendly market.[9] As with general accessibility, banks that expand services, products and protections for the aging population likely do so in benefit to other age groups, thereby expanding customer satisfaction across the age spectrum. Thus, banks that better support seniors will have stronger business models because seniors are the majority of bank customers and hold the majority of bank assets.[10] Those banks and financial institutions profiled in Age UK’s Age-Friendly Banking study, noted that enhancing their age-friendly focus was central to their strategy.

FINANCIAL ABUSE AND FRAUDULENT ACTIVITIES

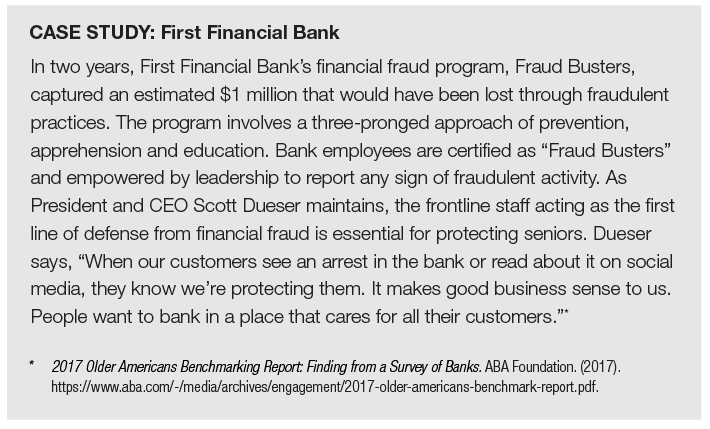

The predominant and most powerful business reasoning for banks to pursue an age-friendly strategy is fraud prevention. Fighting fraud successfully maintains account safety and heightens customer satisfaction.

Two forms of financial victimization that concern older adults is financial exploitation and fraud. Financial exploitation is a type of financial victimization that is committed by trusted persons, such as caregivers, family members and friends. Financial fraud or elder fraud is the type of financial victimization that is committed by strangers.

In 2017, financial institutions lost $2.2 billion to reported cases of financial fraud.10 The vast majority of financial fraud, however, goes unreported due to a myriad of factors. One in 44 instances of elder financial fraud goes unreported.[11] Unfortunately, fraudsters show no sign of slowing criminal attempts. In 2017, the Treasury Department reported a 17% increase from 2016 in the number of senior financial exploitation cases.[12] With advances in technology, including artificial intelligence, financial fraud is becoming more sophisticated.[13]

SENIORS’ VIEWS ON PRODUCT FEATURES

Seniors continue to express a need for financial services that better address their socio-economic circumstances. The California Coalition for Rural Housing (CCRH), an NCRC member, conducted a three-part research project between 2012 and 2014 to determine the potential for Age-Friendly Banking in parts of California. NCRC and CCRH developed a survey in English and Spanish to gain insight into the types of financial services older adults’ use, the types of fraud they encounter and the various income supports they are provided. CCRH surveyed 1,800 residents in 36 low-income, rent-subsidized properties throughout rural and suburban California. They received responses from 410 older adults in 25 different cities. In an effort to contextualize the survey results, CCRH conducted a series of focus groups reaching over 150 participants in Napa, Davis, Sacramento, West Sacramento, Folsom, Red Bluff, Morro Bay, Santa Paula and Salinas. Based on CCRH’s research, they were able to identify overlapping financial needs of many of the low-income older adults in these housing communities. They found that older adults want and need low-cost checking accounts with no minimum deposit requirements, credit cards with small maximum balances and low interest rates for financial emergencies, assistance with public benefits and income supports, protection from exploitation and fraud, in-person customer service at bank branches and early intervention retirement planning. Their study strongly supports the principles of Age-Friendly Banking developed by NCRC.[14]

CHANGING FINANCIAL LANDSCAPE

With bank branch closures increasing nationally as the move to internet and mobile banking intensifies, there will undeniably be a shift in banking among the older adult population, specifically among those who prefer or rely on branch banking. The older adult population is multifaceted in its preferences. In 2017, the American Bankers Association reported that 56% of respondents age 65+ conducted mobile banking, compared with 21% for branch banking.[15] As the senior population ages, the “younger” of the older adult population (aged 50-65) will likely continue to age into online or mobile banking. This shift in banking provides a significant market for banks to build upon by developing and enhancing confidence in mobile and internet banking while maintaining brick and mortar functions as needed.

The senior market is especially ripe for market innovation because many seniors live far from family, or alone (11.3 million older adults living outside nursing homes or hospitals live alone) and providing them accessible online banking products contributes to their safety and financial wellness.[16] Read or view only banking in particular can be a significant benefit to older adults and their caregivers or care partners because it may act as an extra form of protection from financial fraud. This type of banking feature could be beneficial to adult children or family members who live away from the older adult.

PRODUCT COMPARISON

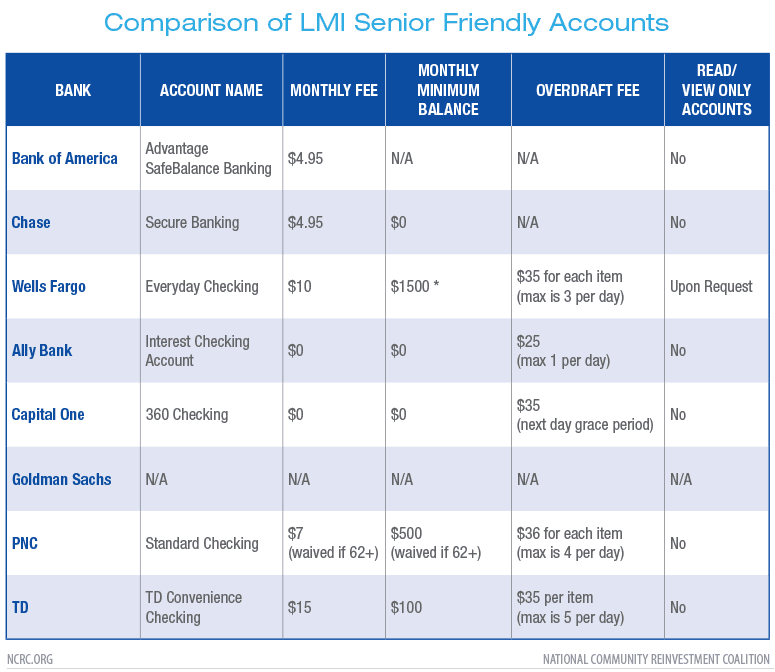

Currently, banks such as JPMorgan Chase, Bank of America, Wells Fargo and others are making strides in providing low-cost products aimed at LMI seniors and others. However, no bank thus far has a comprehensive Age-Friendly Banking account product. The table below examines several well-known banks and the LMI senior-friendly accounts that they currently offer.

Financial institutions have a responsibility as well as a distinct opportunity to better serve the nation’s growing older adult population. Beyond the call from regulators to increase banking products and services for low-income consumers, Age-Friendly Banking products, services and protections provide a business opportunity. A bank that leads the Age-Friendly Banking movement may attract customers, increasing their overall market share, adding to the bank’s deposits. Keeping older adults independent and healthy in their communities benefits everyone and saves federal, state and local governments’ money and resources.[17] Moreover, older adults form banks’ most significant customer base. The rapidly aging population provides a robust market for introducing and growing Age-Friendly Banking initiatives.

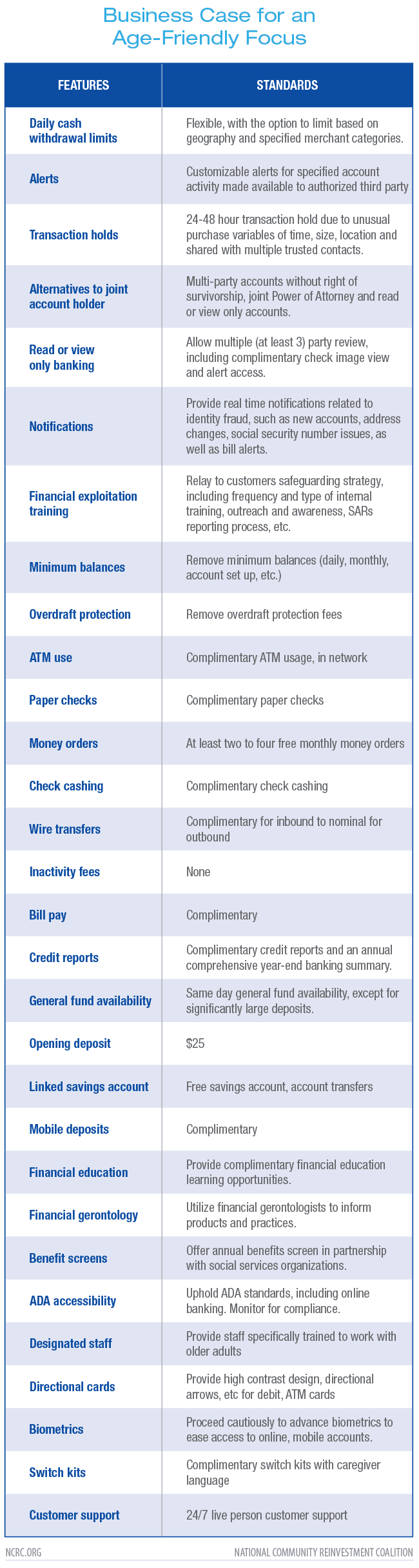

NCRC’S AGE-FRIENDLY BANKING STANDARDS FOR LMI OLDER ADULTS

LMI older adults benefit from banking products, services and protections that are developed in consideration of the unique life stage that the majority of older adults’ experience. These components help LMI older adults avoid financial exploitation and abuse and ultimately allow seniors to retain wealth during later stages of life. Financial institutions and organizations dedicated to Age-Friendly Banking provide a number of products, tools and services for older adults, their caregivers and the general public.

While various entities define and assess the criteria of Age-Friendly Banking, having multiple standards and core features may be overwhelming for banks and financial institutions and potentially be a cause of confusion for consumers. The Bank On industry standards developed by Cities for Financial Empowerment Fund (CFE Fund) have emerged in recent years as a predominant platform encouraging a wider adoption of low-cost, secure banking and transactional products and services. Recognizing the prevalence of unbanked and underbanked individuals, the CFE Fund collaborates with regional and national banks and financial institutions to expand opportunity and access to low-cost, safe banking products and services. The Bank On standards are widely adopted by municipal partners in nearly every state in the U.S. Utilizing Bank On industry standards and combining promising practices and preferences from older adults served by NCRC members, the following set of products, services and protections are NCRC’s Age-Friendly Banking standards and core features.

1. PROTECT OLDER ADULTS FROM FINANCIAL ABUSE

Account Protections: Cash withdrawal limits create a self-imposed spending limit that have specific hours where transactions can be made both domestically or internationally. Withdrawal limits can prevent older adults from falling victim to financial abuse, because they are unable to take out devastatingly large amounts of money, while still allowing the withdrawal of enough money for their anticipated needs. The daily cash withdrawal limits from major banks range from $100 – $2,500. In addition, geographic transaction limits and transaction restrictions for specified merchants or merchant categories are beneficial because they can prevent older adults from losing a significant amount of money to fraud. Alerts for specified account activity and alerts to authorized third parties are also valuable for preventing financial fraud and abuse by making others aware of suspicious activity and able to stop it in its tracks.[18]

Transaction Holds: Implementing a policy that requires a 24-48 hour transaction hold when an account holder makes an unusual purchase due to customizable variables such as time, size or location is helpful for preventing financial fraud by scammers. Older adults are at a high risk for financial fraud and abuse, and when banks are able to detect and then act on unusual behavior, they can prevent scammers from taking advantage of older customers. These holds allow enough time to identify possible fraud and involve the client’s trusted contact person(s), family member or the authorities who may be able to prevent the permanent loss of the person’s assets. It is distinctly challenging to recover money from financial exploitation. In the majority of cases, law enforcement is unable to recover money once it leaves the account.[19] Rule 2165 from the Financial Industry Regulatory Authority (FINRA), adopted in 2017, tackles this issue for securities (e.g. stocks and bonds). Members of FINRA may receive safe harbor during a hold if there is a reasonable belief of financial exploitation.

Alternatives to Joint Account Holder: Whether it be ensuring older adults are not falling victim to financial exploitation or assisting them with paying bills on time, older adults may need assistance with their finances. While joint bank accounts are helpful in that they allow another person access to an older adults’ finances to monitor for fraud and abuse and pay bills, they may also pose a significant risk to older adults. When older adults open joint accounts, even with someone they trust, that other party has the ability to completely withdraw the funds in the account and open a new one in their own name. Sadly, friends and family are often the ones who perpetrate the financial fraud and abuse, thus giving them access to an older adult’s bank account makes it extremely easy for them to exploit the older adult. Alternatives to traditional joint account holders are multi-party accounts without the right of survivorship, joint power of attorney and read only accounts (see below).

Read or View Only Banking Account: Only a few banks have begun to use view only banking in personal and business accounts, and it has been found beneficial for older adults to designate a trusted person to have access to their finances to help ensure they are not subject to financial fraud and abuse. Read or view only bank accounts with multiple party review and free check image review helps to protect older adults from financial fraud and abuse, by allowing designated people to see their transactions, without giving them the authority over the money. This ensures that someone is able to monitor the customer’s spending and intervene if unusual activity is detected. Read or view only bank accounts should also provide image copies of checks in the transaction history as a free service. This allows older adults to review which checks have posted and see their deposit slips after making a deposit.

Notifications and Alerts: Implementing a system that notifies older adults about suspicious activity is helpful in preventing financial fraud and abuse that can be detrimental to the financial health of so many LMI older adults. These alerts should notify the customer when a bank account is opened in their name, if there is an address change and if their Social Security number is used to create a new identity. In addition, alerts that help older adults keep up with their finances, such as notifications about upcoming bills, is also beneficial for their financial wellness. These alerts could be especially helpful for those with read-only access to an older adult’s account to further help that individual monitor it.

Financial Abuse Prevention Training: According to a report by the U.S. Government Accountability Office (GAO), one of the main challenges in responding to elder financial abuse is the lack of awareness and training for financial institution staff. According to the GAO report, “banks are important partners in combating elder financial exploitation because they are well-positioned to recognize, report, and provide evidence in these cases.” Unfortunately, most cases of financial exploitation are unreported by financial institutions.[20] It is essential to ensure front line employees know the best strategy to safeguard older adults from financial exploitation especially as there are concerns around internet banking. Some important safeguards are defining the type and frequency of internal training, outreach and awareness, reporting process, general promotion of an age-friendly approach and any other strategic elements. In recent years, banks and financial institutions have made significant strides around training of staff to identify and report instances of elder financial exploitation due in part to an increase in educational tools, resources and trainings made available from entities such as the American Banker’s Association. In 2017, the American Banker’s Association released a benchmark study of member banks. Respondents of the survey reported that 71% of all member banks required additional specialized training for front line staff around identifying and reporting fraud. While 71% is considerable, nearly 30% of front line staff lack specialized training around financial fraud and reporting. Relevant safeguards include defining the type and frequency of internal training, outreach and awareness, reporting processes, general promotion of an age-friendly approach and any other strategic elements.

Frequent Customer Bank Training: Ensure customers know the strategy employed to safeguard older adults from financial exploitation especially as there are concerns around internet banking and check fraud. Similar to the front line staff training but from a consumers’ perspective, this would include defining the type and frequency of internal training, outreach and awareness, fraud activity reporting process, general promotion of an age-friendly approach and any other strategic elements. Banks can host workshops or other educational outreach events to relay knowledge, tools and resources for older adults and caregivers on combating financial exploitation and financial abuse.

Free Paper Checks: As many older adults prefer to pay bills using checks, supplying complimentary paper checks would likely be a preference for many customers. However, check fraud is significant. According to the American Bankers Association 2017 Deposit Account Fraud Survey report, check fraud accounts for 35% of industry losses.[21] To balance preferences with safety and security, banks may consider providing financial education and outreach around preventing check fraud for seniors.

Money Orders: With ample scams surrounding money orders and cashier’s checks, the safest route is usually to obtain these items from reputable sources. To encourage older adults who may choose to or need to use money orders or cashier’s checks, banks could allow a certain number per month free with an account. The FDIC’s Money Safe Pilot allocated two free money orders per month. Check cashing is also free using the standards of the Money Safe Pilot.[22] According to the Bank On accounts, developed by Cities for Financial Empowerment Fund, money orders cost approximately $1.60.[23] Complimentary money orders or, at most, nominal fees would be in alignment with these two accounts that target LMI customers.

Fraud and Financial Abuse Associated with Wire Transfers: Sending money securely in a timely manner is a necessity for multiple situations, such as buying a home or sending money to family members. Beyond concerns around fraud and exploitation with wire transfers, there is a cost associated with these transfers. According to an analysis of 30 banks and credit unions, the average fees associated run around $6 to $8 for inbound wires (domestic and international) and $23 to $43 for outbound domestic or international.[24] Many banks offer inbound wires at complimentary or very low fees, while outbound fees are significantly higher. Ideally, inbound fees should be minimal as possible, while a nominal fee for outbound wires would be in line with industry standards.

2. CUSTOMIZE FINANCIAL PRODUCTS AND SERVICES TO ADDRESS OLDER ADULTS’ NEEDS

Balances and Fees: Minimum account balances and fees create barriers to financial wellness for many LMI older adults. Removing minimum balance requirements allow these customers to have a secure place to deposit their money. Implementing overdraft protection helps LMI older adults by reducing the burden of unnecessary overdraft fees. Reducing or removing minimum fees on monthly accounts, ATM use and overdrafts are a few other ways to reduce some of the financial hurdles LMI older adults face. In addition, making it easier for LMI older adults to have control over their finances by instituting free checks and bill pay helps support them with financial planning and wellness.

Limited Power of Attorney: Provide limited power of attorney as an alternative to joint signer on an account. Joint accounts are beneficial for older adults because they can enable a family member to assist an older adult with their finances such as helping them pay bills and assist with other transactions.[25] However, it also comes with some risk. Because joint accounts allow another person access to an older adult’s finances, the joint owner can withdraw money for his or her own use or mismanage the older account holder’s money. Limited power of attorney means that a principal (older adult) gives authority to an agent (family member) over a specified set of tasks. This limits the authority of the family member to the specified task, making financial exploitation more difficult.

Credit Reports and Summary: Offer customers free credit reports and an annual comprehensive year-end banking summary that tracks spending, bills and account balances. Free services such as these go a long way in helping older adults with their finances, with little or no cost to financial institutions. Fees for these services create barriers to financial planning for LMI older adults, making it more difficult for them to plan and save for the future.

General Fund Availability: Funds generally should be available within the senior account on the same day (general fund availability) of the transaction, except for significantly large deposits which may require a longer wait period. Large banks have policies to this effect with some variation based on variables such as type and amount of deposit.

Balances: In order to open and maintain a bank account, many banks impose balance requirements. The average account balance individuals and joint account holders may have varies by numerous factors, such as age, income, gender, etc. Typically, once past the middle stages of life, older adults’ checking account balances decrease overall. Regardless, to best support LMI older adults as they age and take on new financial burdens, such as emergency repairs or medical and health-related expenses, banks should consider eliminating all balance requirements. These include minimum balance, minimum daily balance, minimum combined balance and average monthly balance. As Social Security by far comprises the most significant pot of funding sources in retirement for LMI seniors, it is possible that minimum balances imposed on LMI seniors may not align well with Social Security deposits and bill payment cash flows, leaving seniors vulnerable.[26] Eliminating costly fees allows LMI older adults the ability to retain funds in the bank.

3. EXPAND AFFORDABLE FINANCIAL MANAGEMENT

FOR OLDER ADULTS

Financial Education: Providing financial literacy education and financial fraud and exploitation education in an accessible video form online or during in-person sessions is important for supporting older adults with their financial planning and stability. As mentioned earlier, it is important to educate staff regarding the high-risk of financial exploitation that older adults face. However, it is also important to provide information to older adult customers about the risks of financial abuse. In tandem, financial education beyond retirement planning for older adults supports LMI 50+ customers who may have comparable but also unique concerns than that of high-income older adults.

Financial Gerontology: Examining the intersection of finance and wealth and the process of aging is the field of financial gerontology. Financial gerontologists are experts regarding the biological, social and psychological components to aging. In recent years, some banks and financial institutions have utilized financial gerontologists. With greater longevity and societal changes in retirement norms, the field of financial gerontology can offer innovation and insight on the potential of new products, services, protections and strategies to improve customer and caregiver/partner experiences. Financial gerontologists also focus on determining customer cost savings. Internally, financial gerontology may uncover prime training and educational opportunities for banks and financial services to better serve LMI older adults.

Financial Gerontology: Examining the intersection of finance and wealth and the process of aging is the field of financial gerontology. Financial gerontologists are experts regarding the biological, social and psychological components to aging. In recent years, some banks and financial institutions have utilized financial gerontologists. With greater longevity and societal changes in retirement norms, the field of financial gerontology can offer innovation and insight on the potential of new products, services, protections and strategies to improve customer and caregiver/partner experiences. Financial gerontologists also focus on determining customer cost savings. Internally, financial gerontology may uncover prime training and educational opportunities for banks and financial services to better serve LMI older adults.

4. ASSIST OLDER ADULT ACCESS TO CRITICAL INCOME SUPPORTS

Yearly Benefits Screen: Offer the service of a yearly benefit screen, which identifies the income assistance, housing/utilities and tax relief benefits that an individual may be eligible to receive. It also serves as a tool that allows older adults the ability to view all applicable federal, state and private benefit programs in one convenient location. The screen will utilize the user’s personal, medical, geographic and financial information to identify matches between benefits and user qualifications. Once an individual qualifies, they may receive a link to the applications of the appropriate benefits. Partnering with community-based organizations and nonprofit service providers to conduct these assessments can be a distinct benefit to customers. Online tools, such as the National Council on Aging’s (NCOA) Benefits Check Up tool, help consumers quickly and easily identify programs for which they are eligible, and when possible, facilitate enrollment. Many LMI older adults rely on government assistance programs for a variety of services. Being able to provide them an easy way to navigate and manage these benefits helps ensure LMI older adults are not missing out on possible benefits for which they qualify.

5. FACILITATE AGING IN THE COMMUNITY

Small Dollar Loans: Older adults generally want to age in place in their homes for as long as possible, because it is less expensive and they usually have some type of support system from their community. When older adults remain in their homes as they age, many of them have to make modifications to improve accessibility. Most of the time, these modifications are not very costly, but because LMI older adults tend to not have a large disposable income they may need to take out loans. Providing small dollar loans can assist LMI older adults with aging in community, and help them avoid costly retirement communities and assisted living centers. In 2012, the average total monthly costs for housing (rental or homeownership) for adults age 65 and older was $865. In contrast, assisted living costs approximately $3,500 per month, and a nursing home with a higher level of care can be $6,500 to $7,300 a month, based on semi-private or private care needs or preferences.[27]

Line of Credit: Lines of credit for older adults help facilitate aging in community, by providing a source of funds for home modifications to increase accessibility. The average cost of a home modification is about $4,600.[28] In addition to home modifications, older adults often pursue lines of credit to help pay for medical costs due to high-rising health care costs that they are unable to cover out of pocket.

6. IMPROVE ACCESSIBILITY TO BANK BRANCH

LOCATIONS AND SERVICES

ADA Standards: The Americans with Disabilities Act (ADA) works to ensure that public spaces are accessible to those with disabilities. Online banking is also subject to these requirements, making it readily available to people with disabilities. Banks, like other entities, can be cited for not being accessible for people with disabilities. According to a study by Shippensburg University, out of 162 people surveyed with vision disabilities, 60% of them were not able to use a financial website or app because of an accessibility barrier.[29] By making online banking products more accessible, banks are not only avoiding unwanted litigation, but are also making services more attractive to a customer base. There are approximately 61 million people living with a disability in the United States, according to the CDC.[30] People with disabilities make up a fourth of the population and more than one-quarter live in poverty. It is essential that online banking platforms meet the requirements laid out by WCAG 2.0, and it is integral to invest in experts to evaluate the accessibility of digital apps and online platforms to bring them up to the ADA standards and monitor them periodically to ensure continued compliance.

Designated Staff for Service to Older Adults: Designating specific customer service staff members as the point of contact to assist older adult customers with their financial needs improves accessibility for older adults. Banking and financial planning as an older adult can be stressful and overwhelming. Having the same representative for all questions and banking needs as much as possible is important for select older adult customers who require consistency.[31]

Easy-to-Read Debit Cards: Providing debit cards with directional arrows that show which way to put a card into the ATM or card reader along with high contrast colors so that customers can easily read the numbers can make the daily financial lives of older adults more manageable. In addition, providing chip and signature debit cards are beneficial because it ensures that older adults do not have to remember a pin. Older adults may suffer from vision impairment, making easy-to-read ATM cards impactful.

Enhanced Biometrics Services: Designing methods of passing security tests without having to perform complex tasks or remember difficult passwords can be extremely beneficial for some older adults. Older adults may struggle with remembering long passwords, and keeping a physical record of passwords to financial accounts creates opportunity for financial fraud. By implementing enhanced biometrics services, including voice authentication recognition or eye scan technology, instead of password requirements, financial institutions can improve their security against ID theft for older adults. However, with new technology comes limitations. The aging voice may be difficult to authenticate.[32] While several U.S. banks utilize voice biometrics data, caution is integral as the technology continues to improve.[33]

Assisting Vulnerable Customers: It is vital to train customer service staff specifically to interact with and serve older adults, including those living with dementia (including younger age groups), people with disabilities and people with serious mental illness.[34] The majority of people living with dementia, disabilities and serious mental illness have trouble with banking and many of them are at risk of financial exploitation. Being able to adjust speed based on needs, providing a quiet space to talk without distractions and training staff to recognize signs of cognitive decline are important with helping older adults with their financial needs. Some ways to improve the financial lives of those living with dementia, disability and serious mental illness include voice biometrics, implementing algorithms that help detect unusual changes in spending patterns and training staff to better assist customers through patience, quiet dialogue, etc.

Switch Kits: Complementary resources, checklists and tools called a “Switch Kit” facilitate the transition from one bank and financial institution to another, presumably seamlessly. Caregivers or care partners with read or view only access should be able to utilize the switch kit to assist the senior with the transition.

Customer Support: Older adults voice a distinct preference for in-person communications.[35] Being able to communicate with a live person, preferably a dedicated, steady contact that is well-trained in communications with older adults builds trust and eases anxiety around financial issues.

OLDER ADULTS AND TECHNOLOGY

A continuing conversation among stakeholders is that of the evolution around financial technology. Bank branches are extremely beneficial for LMI older adults as they provide access to banking services and financial expertise they may not be able to access elsewhere. Older adults largely prefer to conduct banking at a brick and mortar bank. However, there has been a rise in mobile banking in recent years and it offers potential benefits to LMI older adults and their caregivers or care partners. Mobile and internet banking allows customers to pay bills and deposit checks without having to leave the comfort of their home, arguably providing more security than utilizing paper checks.[36] Two thirds of older adults have mobility issues, which may make the core features of mobile banking an appealing option.[37]

While some in the banking industry voice concerns about older adults not possessing appropriate technological expertise to navigate mobile banking platforms, older adults are becoming increasingly technologically savvy. From 2013 to 2016, the number of older adults who owned smartphones doubled. Four-in-ten older adults owned a smartphone in 2016. Almost 70% of adults ages 65 and over use the internet. Age, education level and household income still influence this statistic. For example, only 46% of older adults with $30,000 or less in household income use the internet, while 94% of older adults with $75,000 or more use the internet.[38]

In a 2016 study by the Federal Reserve, just 18% of mobile banking customers were seniors. From the long-term data of this study (which began in 2011), usage of mobile banking has generally increased for all age groups from year to year. As the “younger” of the older adults who are already utilizing mobile banking continue to age, it is possible that the senior age groups will continue to increase. Mobile banking use by respondents is highest for checking account status including recent transactions, making account transfers and receiving alerts.[39] Alerts, if paired with view or read only banking, allows trusted caregivers to support older adults in limiting or preventing financial exploitation or fraud.

Innovation in technology and finance, or Fintech, is changing the ways in which customers participate in finance activities. While fintech as an industry is still somewhat new, services for older adults currently exist outside of traditional banking services. Predominant companies, including EverSafe, True Link Financial, Inc., Wealthcare Planning LLC and others, provide a variety of services such as account monitoring with personalized alerts, customized pre-paid debit cards with spending restrictions and financial decision-making and future planning assessments. The fintech industry continues to grow, providing competitive products and services applicable and sometimes developed with seniors in mind.

Any discussion of financial technology today must include artificial intelligence. Governor Lael Brainard of the Federal Reserve commented in 2018 on the insight garnered from early use of artificial intelligence.[40] Implications and consequences for consumers and financial services certainly may exist, but at this point it remains too early to adequately understand. What is clear is that artificial intelligence is becoming more and more common in financial services, as it is in various areas of daily life.

CONCLUSION

While much of the recommendations for core standards and features of Age-Friendly Banking represented in this paper aim to be as comprehensive as possible for personal products, services and protections, realistically, change takes time. Prioritizing standards and features will ultimately depend on individuals, caregiver preferences and other variables in banking. However, clear preferences and preventive measures have emerged in recent years, that if provided widely to older adults and caregivers or care partners, could allow LMI older adults to see savings, decreased fraud and financial abuse and the reverberating effects of those improvements in their lives. While advocates and stakeholders have much to focus on in the effort to instill Age-Friendly Banking principles in all areas of banking and financial services, the following areas may provide some guidance around priorities: read or view only banking with multiple party review, notifications and alerts, no to minimum fees and enhanced staff training around special needs populations, including older adults and others (e.g. people living with dementia, people with serious mental illness, limited English proficiency, etc.)

[1] Mark Mathers et al., Fact Sheet: Aging in the United States. PRB. (July 15, 2019). https://www.prb.org/aging-unitedstates-fact-sheet/,

[2] Whitney Airgood-Obrycki et al., Housing America’s Older Adults. Joint Center for Housing Studies of Harvard University. (2018), https://www.jchs.harvard.edu/sites/default/files/Harvard_JCHS_Housing_Americas_Older_Adults_2019.pdf.

[3] Andrew Dunn et al., Redesigning the Financial Roadmap for the LMI 50+ Segment. Center for Financial Services Innovation. (2018), https://cfsinnovation.org/research/redesigning-the-financial-roadmap-for-the-lmi-50-segment/.

[4] Andrew Dunn et al., Redesigning the Financial Roadmap for the LMI 50+ Segment. Center for Financial Services Innovation. (2018), https://cfsinnovation.org/research/redesigning-the-financial-roadmap-for-the-lmi-50-segment/.

[5] CFPB, Suspicious Activity Reports on Elder Financial Exploitation: Issues and Trends. Consumer Financial Protection Bureau. (Feb., 2019), https://files.consumerfinance.gov/f/documents/cfpb_suspicious-activity-reports-elder-financial-exploitation_report.pdf.

[6] Lifespan of Greater Rochester, Inc., Under the Radar: New York State Elder Abuse Prevalence Study. Self-Reported Prevalence and Documented Case Surveys. (May, 2011), https://ocfs.ny.gov/main/reports/Under%20the%20Radar%2005%2012%2011%20final%20report.pdf.

[7] James Knickman et al., The 2030 Problem: Carry for Aging Baby Boomers. NCBI. (2002), https://www.ncbi.nlm.nih.gov/pmc/articles/PMC1464018/.

[8] Karen Kali. Age-Friendly Banking Toolkit. Age-Friendly Banking Toolkit, National Community Reinvestment Coalition, https://ncrc.org/wp-content/uploads/dlm_uploads/2018/03/NCRC-AFB-Toolkit-FINAL.pdf.

[9] Age-Friendly Banking What It Is and How You Do It. Age UK, https://www.ageuk.org.uk/Documents/EN-GB/For-professionals/Policy/money-matters/report_age_friendly_banking.pdf?dtrk=true.

[10] Evan Sparks. ABA Report: Banks Stopped Nearly $17 Billion in Fraud Attempts in 2016. ABA Banking Journal. (Jan., 2018), bankingjournal.aba.com/2018/01/aba-report-banks-stopped-nearly-17-billion-in-fraud-attempts-in-2016/.

[11] Elder Financial Exploitation. National Adult Protective Services Association, www.napsa-now.org/policy-advocacy/exploitation/.

[12] Yuka Hayashi. Elder Fraud on the Rise. The Wall Street Journal, Dow Jones & Company. (Feb., 2019), www.wsj.com/articles/elder-fraud-on-the-rise-11551309306.

[13] Penny Crosman. Voice Recognitions Surprise Pitfall: Aging Customers. American Banker. (Feb., 2017), www.americanbanker.com/news/voice-recognitions-surprise-shortcoming-aging-customers.

[14] Maya Abood et al. What Can We Do To Help? Adopting Age-Friendly Banking to Improve Financial Well-Being for Older Adults. San Francisco, CA: Federal Reserve Bank of San Francisco, Community Development Investment Center. (2015).

[15] Preferred Banking Methods Infographic. American Bankers Association. (2018). www.aba.com/Tools/Infographics/Pages/Infographic-Preferred-Banking-Methods.aspx.

[16] Information on Senior Citizens Living in America. Institute on Aging. (2018). www.ioaging.org/aging-in-america.

[17] Siddiqi, Sehar, et al. A New Dawn: Age-Friendly Banking. National Community Reinvestment Coalition. (2013). ncrc.org/wp-content/uploads/dlm_uploads/2018/02/a-new-dawn-age-friendly-banking.pdf.

[18] CFPB, “Recommendations and Report for Financial Institutions on Preventing and Responding to Elder Financial Exploitation”. Consumer Financial Protection Bureau. (2016). Retrieved from https://files.consumerfinance.gov/f/201603_cfpb_recommendations-and-report-for-financial-institutions-on-preventing-and-responding-to-elder-financial-exploitation.pdf.

[19] David Certner. Received by Marcia E. Asquith. FINRA Regulatory Notice 15-37. FINRA Office of the Corporate Secretary. (2015). Washington, DC.

[20] ELDER JUSTICE: National Strategy Needed to Effectively Combat Elder Financial Exploitation. Government Accountability Office. (2012). ELDER JUSTICE: National Strategy Needed to Effectively Combat Elder Financial Exploitation, www.gao.gov/assets/660/650074.pdf.

[21] Deposit Account Fraud. American Bankers Association. (Jan., 2018). https://www.aba.com/news-research/research-analysis/deposit-account-fraud-survey-report

[22] FDIC Model Safe Accounts Template. Federal Deposit Insurance Corporation. (2012, Apr.). www.fdic.gov/consumers/template/template.pdf.

[23] Bank On National Account Standards (2017–2018). Bank On, Cities for Financial Empowerment Fund. (2018). joinbankon.org/wp-content/uploads/2017/05/Bank-On-National-Account-Standards-2017-2018-final.pdf.

[24] Thompson, Chris. Wire Transfer Fees: Everything You Need to Know. SmartAsset. (2018, Nov). smartasset.com/checking-account/average-wire-transfer-fee.

[25] CFPB. Recommendations and Report for Financial Institutions on Preventing and Responding to Elder Financial Exploitation. Consumer Financial Protection Bureau. (2016). https://files.consumerfinance.gov/f/201603_cfpb_recommendations-and-report-for-financial-institutions-on-preventing-and-responding-to-elder-financial-exploitation.pdf.

[26] Social Security Administration. “Social Security.” Fact Sheet. Congress. Washington, D.C. n.d. Web.

[27] Karen Kali and Robert Zdenek. Staying at Home: The Role of Financial Services in Promoting Aging in Community. (2016).www.frbsf.org/community-development/files/role-of-financial-services-in-promoting-aging-in-place.pdf.

[28] 2019 Cost To Remodel a Home for Disability Accommodation. Home Advisor. www.homeadvisor.com/cost/environmental-safety/remodel-for-disability-accommodation/.

[29] The ADA: 4 Basic Web Accessibility Facts That Financial Institutions May Not Know. Essential Accessibility. (Feb., 2019). www.essentialaccessibility.com/blog/ada-financial-institutions/.

[30] CDC: 1 in 4 US Adults Live with A Disability. Centers for Disease Control and Prevention. (Aug., 2018). https://www.cdc.gov/media/releases/2018/p0816-disability.html.

[31] Maya Abood et al. What Can We Do To Help? Adopting Age-Friendly Banking to Improve Financial Well-Being for Older Adults. San Francisco, CA: Federal Reserve Bank of San Francisco, Community Development Investment Center. (2015).

[32] Khoury, Ellie. The Problem of Voice Aging in Biometric Security. Lecture, RSA Conference, San Francisco, February 2017.

[33] Penny Crosman. Voice Recognitions Surprise Pitfall: Aging Customers. American Banker. (Feb., 2017), www.americanbanker.com/news/voice-recognitions-surprise-shortcoming-aging-customers.

[34] Fidelity. Fidelity Clearing and Custody Launches Program to Help Advisors Protect Aging Clients from Financial Abuse. (Nov. 2015). https://www.fidelity.com/about-fidelity/institutional-investment-management/clearing-and-custody-launches-program-to-help-advisors-protect

[35] Maya Abood et al. What Can We Do To Help? Adopting Age-Friendly Banking to Improve Financial Well-Being for Older Adults. San Francisco, CA: Federal Reserve Bank of San Francisco, Community Development Investment Center. (2015).

[36] Liz Pulliam Weston. Paying by Check Isn’t Any Safer than an Electronic Transaction. Los Angeles Times, Los Angeles Times. (Nov., 2010). www.latimes.com/archives/la-xpm-2010-nov-21-la-fi-montalk-20101121-story.html.

[37] Mobility Is Most Common Disability Among Older Americans, Census Bureau Reports. United States Census Bureau. (Dec., 2014). www.census.gov/newsroom/press-releases/2014/cb14-218.html.

[38] Monica Anderson and Andrew Perrin. “Technology Use among Seniors”. Pew Research Center: Internet, Science & Tech, Pew Research Center: Internet, Science & Tech. (May 2017). www.pewinternet.org/2017/05/17/technology-use-among-seniors/.

[39] Consumers and Mobile Financial Services 2016. Board of Governors of The Federal Reserve System. (Mar., 2016). https://www.federalreserve.gov/econresdata/consumers-and-mobile-financial-services-report-201603.pdf

[40] Brainard, Lael. What Are We Learning About Artifical Intelligence in Financial Services? Board of Governors of the Federal Reserve System. (Nov., 2018). https://www.federalreserve.gov/newsevents/speech/brainard20181113a.htm