2023 Ends With A Strong Labor Market For Black Workers: Race, Jobs And The Economy Update For December 2023

How is the labor market for Black workers? The December jobs report reveals significant gains for Black workers.

Give A Warm Welcome To NCRC’s Newest Members: January 2024 Update

NCRC’s membership spans more than 700 local, state and regional nonprofits, educational and faith-based institutions and government entities across the nation. Welcome to our new organizational members in December 2023: Tooley Community Development Group, Inc. Titusville, FL Urban Impact Birmingham Birmingham, AL New Jersey Environmental Justice Alliance Trenton, NJ View a map of all our

Vote For Your Favorite 2024 Just Economy Conference Sessions

What would YOU like to see at the 2024 Just Economy Conference? We opened up a selection of conference session ideas for public voting! We want to know what is most important to you in realizing our mission to make a Just Economy a national priority and local reality. Voting will take place over 10

NCRC Statement On President Biden’s Veto Of Section 1071 Repeal

WASHINGTON, DC — After President Biden vetoed a Congressional Review Act measure repealing recently adopted small business lending data rules known as Section 1071, National Community Reinvestment Coalition (NCRC) President and CEO Jesse Van Tol released the following statement: “This is how a doomed and dishonest attack on small businesses ends: not with a bang,

Case Study: How Black Businesses Can Build Competitive Advantage For Anchor Procurement With The Atlanta Wealth Building Initiative

Black-owned small businesses often struggle to reach major-funder “anchor institutions” in their communities that contribute significant resources to support other entrepreneurs. But that is a solveable problem.

Case Study: How The El Paso Hispanic Chamber Of Commerce Is Ensuring Capital Readiness For Rural Hispanic Entrepreneurs

All rural business owners face special challenges, but none more so than those from social groups that have long been fenced out of key financial services. We’re solving that problem.

Case Study: How Catapult Greater Pittsburgh’s Storefront Incubation Programs Are Supporting Women Entrepreneurs Of Color

How can distressed commercial areas regain economic vibrancy? Catapult Greater Pittsburgh is providing creative solutions built to last.

Video: CRA Final Rule Deep Dive

Online Event Archive Recorded December 6, 2023 Breaking down the rule and digging into how it will impact the fight for economic justice and racial equity is an ongoing process and you can expect to see more content and conversations from NCRC as we analyze the rule and gather feedback from our members and allies.

Race, Jobs, and the Economy November 2023 Update: Strong Economic Indicators For African Americans Yet Pessimism In Alleviating Racial Inequality

What can the November jobs report tell us about the future of racial economic inequality?

NCRC’s Guide To The 2023 Community Reinvestment Act Final Rule

A user’s guide to the new Community Reinvestment Act final rule: What’s new, what’s the same, and how will it affect you?

Unprecedented Analysis Of Financial Needs In Indian Country Demands Change From Banks In Native American Community Development Investments

A new report maps severe financial neglect across Indian Country in the American southwest — and offers solutions.

Redlining The Reservation: The Brutal Cost Of Financial Services Inaccessibility In Native Communities

An unprecedented analysis maps the shape and depth of economic despair in the Native American southwest.

Give A Warm Welcome To NCRC’s Newest Members

NCRC’s membership spans more than 700 local, state and regional nonprofits, educational and faith-based institutions and government entities across the nation. Welcome to our new organizational members in November 2023: View a map of all our members. If your organization isn’t yet a member, check out the options here. And if your organization is ineligible, you

NCRC Statement: House Majority’s Doomed Vote Against Section 1071 Rules Is An Attack On Small Business

House Republicans’ doomed attempt to repeal section 1071 small business lending data rules is a pointless performance for their bank industry donors.

Video: Fintech Innovations for Entrepreneurs

Online Event Archive Recorded November 14, 2023 Can smart applications of financial technology give small businesses a competitive edge? Check out innovative products that allow small businesses to more efficiently manage capital flow and to provide valuable benefits to their employees with minimal cost. Hear from the entrepreneurs behind these products directly, and consider how

2024 Just Economy Conference: Registration Now Open

Registration for the 2024 Just Economy Conference is now open! We are so excited to invite you to join us in person from April 2-4 in Washington, DC! The Just Economy Conference is the leading national conference for economic and social justice. Don’t miss your chance to join activists, elected officials, policymakers, community leaders, civil

Contradictions in the fair housing movement

Seen in the The Journal of Urban History: an article about contradictory ideologies in the fair housing movement, by NCRC senior policy advisor Nichole Nelson. “While the National Committee Against Discrimination in Housing (NCDH) supported ending racial discrimination in the housing market by lobbying for state and local fair housing laws and the federal Fair

Comment on SBA Proposed Rule on Criminal Justice Reviews for the SBA Business Loan Programs

Download November 14, 2023 Dianna Seaborn, Director Office of Financial Assistance U.S. Small Business Administration 409 3rd Street SW Washington, DC 20416 RE: RIN 3245-AI03, 2023-19183, Criminal Justice Reviews for the U.S. Small Business Administration’s Business Loan Programs and Surety Bond Guaranty Program, Dear Director Seaborn: The undersigned organizations appreciate the opportunity to comment on the

NCRC And First Citizens Announce $6.5 Billion Expansion Of Community Commitments In California And Massachusetts

The National Community Reinvestment Coalition (NCRC) and First Citizens Bank today announced an amendment to their previous community benefits agreement, extending the bank’s longstanding community support to Northern California and Massachusetts following its March acquisition of Silicon Valley Bank (SVB). The additional commitment, which recognizes pre-existing Silicon Valley Bank relationships, establishes a new $6.5 billion

The Racial Wealth Divide and Black Billionaires Across the Globe

As conversations regarding the rapid concentration of wealth dominate economic and political discourse, it’s worth analyzing the details of wealth within the billionaire class. However, little attention has been paid to billionaires of African descent. Twenty-four people of African descent have appeared in the Forbes billionaires list. People of African descent have historically been locked

KeyBank’s Betrayal Of Black And Low-Income Homebuyers Continued In 2022

KeyBank continued its years-long retreat from promoting Black and low-income homeownership in 2022, an analysis of the most recent federal data on mortgage lending reveals. Black borrowers made up just 2.6% of the Cleveland-based bank’s home purchase mortgage lending in 2022, down from 3% the year prior. KeyBank has been pulling back from supporting Black

The Racial Wealth Divide and US Black Billionaires

When the first Black billionaires emerged, most stemmed from the entertainment industry. In 2001, Black Entertainment Television cofounder Bob Johnson was the world’s wealthiest Black person with an estimated net worth of $1.6 billion. By 2021, Johnson’s estimated fortune had fallen by more than half – meaning he no longer appeared on annual magazine lists

New Report On Federal Home Loan Banks Can Be Springboard To Much-Needed Reforms

A rich new federal report assessing the Federal Home Loan Bank (FHLB) system will help the public and policymakers achieve effective reforms to improve the FHLBs’ future performance, community advocates said Wednesday. “Government support is crucial in closing the racial homeownership divide, but the dollars deployed through the FHLB system are too often captured on

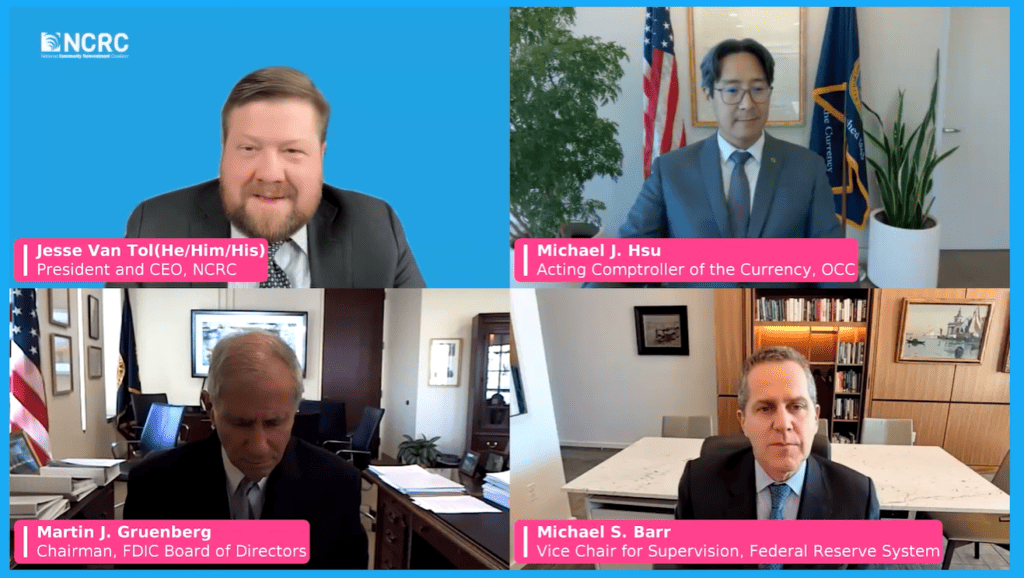

Video: The New Community Reinvestment Act Rule: What’s In It And What Will It Mean

Online Event Archive Recorded November 3, 2023 Acting Comptroller of the Currency Michael Hsu, Chairman of the FDIC’s Board of Directors Martin Gruenberg and Federal Reserve Vice Chair for Supervision Michael Barr joined NCRC President and CEO Jesse Van Tol to discuss the new Community Reinvestment Act (CRA) rules. Speakers: Michael Hsu, Acting Comptroller

Low Unemployment and Labor Victories Unlikely to Bridge Racial Wealth Inequality

Was the October jobs report good, bad, or just plain complicated?