March 30th, 2023

Teresa Sabanty

Deputy Regional Director

Federal Deposit Insurance Corporation

300 South Riverside Plaza, Suite 1700,

Chicago, IL 60606-3447

CC: Kentucky Department of Financial Institutions

RE: Community Reinvestment Act exam for Republic Bank & Trust of Kentucky.

Dear Deputy Regional Director Sabanty:

Thank you for the opportunity to submit this comment on the community reinvestment performance of Republic Bank & Trust of Kentucky.

The National Community Reinvestment Coalition, the National Consumer Law Center (on behalf of its low income clients), Accountable.US, Americans for Financial Reform Education Fund, the Center for Economic Integrity, the Center for Responsible Lending, Consumer Action, the Consumer Federation of America, Public Citizen, US PIRG, and the Woodstock Institute believe the practices discussed in this comment compel the FDIC to downgrade Republic Bank & Trust’s community reinvestment exam rating.

Through partnerships with non-bank lenders, Republic Bank & Trust of Kentucky (“Republic”) has used its charter to partner with high-cost non-bank lenders. These predatory credit products have generated numerous complaints from consumers, revealing abusive lending practices and potential violations of consumer protection laws. These activities contradict the spirit of the Community Reinvestment Act that an insured depository should meet the convenience and needs of consumers.

I. Republic’s high-cost lending conducted through partnerships with non-banks are harmful. While branch visitors may never associate these products with the activities of the bank, high-cost lending contributes to a substantial portion of the bank’s revenues and income. States have reached settlements with Republic’s partners to address the impacts of their lending arrangements. The FDIC must include these loans in its CRA exam. The high-cost nature of the lending reveals how these activities do not meet the needs and conveniences of consumers.

- The loans facilitated by Republic through partnerships with non-banks are expensive.

- High-cost partnership lending is a large share of Republic’s profitability.

- Disclosures are opaque and misleading

- States have settled lawsuits against Republic and its partners over their high-cost lending

- An evaluation of Republic’s mortgage lending would also support the conclusion that the bank does not meet the needs and conveniences of consumers. It has a poor track record of originating mortgages for borrowers of color.

- By receiving a charter, Republic has received financial subsidies and legal privileges. Those benefits are not given to high-cost non-bank predatory lenders. Banks should be held to higher standards.

II. These products harm consumers. Many consumers have complained about Republic Bank of Kentucky’s lending partners.

- Through complaints submitted to the CFPB, consumers reveal the harms of NetCredit-branded lines of credit and consumer installment loans.

- Through complaints submitted to independent customer review websites, consumers reveal how of Elastic-branded lines of credit did not meet their needs and conveniences.

III. Tax lending is high-cost and underwritten without a meaningful method for assessing a borrower’s ability-to-repay.

- Tax refund “Easy Advance” loans are costly for consumer borrowers. In most cases, the actual cost of borrowing is in excess of 36 percent.

- Expected Refund Advances (ERAs), branded as Holiday Advances (HAs), are expensive.

- Tax loans are made without a meaningful assessment of a borrower’s ability to repay a loan.

- Issuing Easy Advance loans creates significant risk for the company, including the risk that independent preparers will not file returns correctly. There are challenges to ensuring the integrity of tax filings.

- Agreements to offer tax refund loans through relationships with tax preparers present challenges for internal controls.

DISCUSSION

I. Republic’s high-cost lending conducted through partnerships with non-banks are harmful. While branch visitors may never associate these products with the activities of the bank, high-cost lending contributes to a substantial portion of the bank’s revenues and income. States have reached settlements with Republic’s partners to address the impacts of their lending arrangements. The FDIC must include these loans in its CRA exam. The high-cost nature of the lending reveals how these activities do not meet the needs and conveniences of consumers.

A review of Republic’s business activities:

Republic segments its operations into two categories: Core Banking and Republic Processing Group. In Core, Republic operates a mix of traditional retail and commercial business lines. The RPG segment involves consumer installment, tax advances, and lines of credit and is primarily conducted with non-bank partners. These partnerships are complicated, inherently risky, and pose harms to consumers.

Core Banking consists of traditional banking, warehouse lending, and mortgage banking.

- The Mortgage Banking segment makes single-family loans for owner-occupied home purchases. The bank sells most of its mortgage loans to the government-sponsored entities (GSEs).

- The traditional banking segment consists of banking activities performed inside branches. According to Republic, it earns the majority of fee income from overdraft services. A substantial portion of traditional banking involves financing commercial real estate companies.

- The warehouse division provides liquidity to other mortgage lenders. On average, the bank had $1.3 billion in outstanding warehouse lines in 2022.

Republic Processing Group (RPG) operations consist of Tax Refund Solutions (TRS) and Republic Credit Solutions (RCS). There are two lines in TRS: refund advances and TRS commercial loans.

- TRS has two activities. First, it originated commercial loans for tax preparers. The average loan size is approximately $30,000. Second, it makes advances on future tax refunds, either during December or as a part of a tax filing in late January until the end of February. All refund advances are made through partnerships with tax preparation companies.

- The RCS division facilitates high-cost installment loans and lines of credit through partnerships with two non-bank companies.

Our concerns reside with the RPG segment.

Elastic, a subsidiary of Elevate Decision Sciences, partners with Republic to offer the Elastic Line of Credit (LOC I). Republic sells 90 percent of each advance within three days of funding. The relationship existed throughout the entire examination period.

In January 2021, Republic began to offer a second line of credit (LOC II). Through a partnership with Enova, Republic holds 5 percent of Enova’s NetCredit loans on its books. The remaining loan balances are sold to an affiliate of Enova within three days of funding.

Additionally, Republic facilitates an installment loan product with NetCredit. In 2022, Republic facilitated the origination of $271.4 million in consumer installment loans.[1] Each relies on the same “rent-a-bank” model where a bank makes its charter available to serve the needs and conveniences of a high-cost non-bank lender. Because so few banks are willing to participate in these partnerships, Republic can earn tens of millions of dollars annually.

1. The loans facilitated by Republic through partnerships with non-banks are expensive.

The following table provides details on Republic’s partnership lines of credit and installment loans.

| Row | Elevate Elastic Line of Credit (LOC) | Enova Net Credit LOC | NetCredit Installment | |

| 1 | Duration | n/a | n/a | 12 to 60 months |

| 2 | Participation interest sold to third parties[2] | 90 percent | 95 percent | 100 percent |

| 3 | Duration held before sale[3] | 3 business days | 3 business days | About 16 days |

| 4 | Fees from selling receivables[4] | $6.4 million | $6.7 million | |

| 5 | Average effective interest rate[5] | 94.25 percent[6] | Up to 99.99 percent[7] | |

*These calculations were made by Republic to describe to investors the average rate of interest received from its RPG LOC portfolio.

Through its partnerships for high-cost lines of credit facilitated through its rent-a-bank CaaS model, Republic reported that it earned average interest rates in its line of credit portfolio of 94.25 percent, 93.6, and 91.7 in 2022, 2021, and 2020, respectively.[8] For the installment loans, Republic sells up to 100% of the receivables, but it was paid $6.7 million in non-interest program fee revenue in 2022 and $14.1 million over the last three years by the entities that purchased those loans.[9]

The partnership products are originated for amounts far greater than a payday loan. The fact that they are still made at rates that approach 100 percent reveals their unusual cost and infers the risks they pose to consumer financial health. In 2021, Elevate originated 37,937 new lines of credit. At the end of the year, customers had an average loan balance of $1,805.[10]

2. High-cost partnership lending is a large share of Republic’s profitability.

Republic acknowledges how a high share of its earnings comes from these novel, high-risk, loophole-permitted businesses. It writes: “For 2022, 2021, and 2020, approximately 31%, 24%, and 23% of total Company net revenues (which it defines as net interest income plus non-interest income) were derived from the RPG operations. Within RPG, the TRS segment accounted for 18%, 13%, and 14%, while the RCS segment accounted for 13%, 11%, and 9% of total Company net revenues.” [11] Traditional banking, by contrast, is a low-margin and capital-intensive activity.[12]

As Line 4 in the preceding table demonstrates, interest and fees from Republic’s RPG division are a very significant contributor to the ongoing profitability of this bank. That point is further demonstrated when reviewing segment-level information. In 2022, non-interest income in RPG made up the majority of the bank’s overall non-interest income. Fees earned from the sale of RCS high-cost lines of credit and installment loans exceeded mortgage-banking income by a factor greater than two. Interest income on high-cost lines of credit and installment loans exceeded mortgage banking income by a factor of more than fifty. Net income from RPG was almost equivalent to that of the traditional banking unit, and on a before-tax basis, RPG earned more than traditional banking Mortgage banking recorded a net loss, but RPG had net income of $43.76 million.

During the last three years, Republic has recorded over $75 million in interest income from loans made in partnership with high-cost non-bank lenders.[13]

| Net Interest Income[14] | Total company after-tax income[15] | Segment NII/ATI | ||||

| 2022 | 2021 | 2022 | 2021 | 2022 | 2021 | |

| Republic Credit Solutions | $29.18 | $23.35 | $91.11 | $87.61 | 32.0% | 26.7% |

| Tax Refund Solutions | $21.71 | $15.83 | 23.8% | 18.1% | ||

Dollars in millions

The extent of its reliance on partnerships for such a substantial source of revenue and income should raise questions about how Republic uses its charter. A charter is a privilege. It should not be a license to exploit consumers.

Past CRA exams have considered the impacts of Core Banking but have ignored RPG. For several important reasons, the FDIC must include RPG in its CRA evaluation. If it does, it must conclude that the harms of RPG are significant.

3. Disclosures are opaque and misleading

The Elastic line of credit is priced using fees instead of periodic interest, enabling Elastic to fail to disclose an APR to consumers and to disclose pricing in a way that is quite opaque. Under the Truth in Lending Act, the required advertising APR disclosure for lines of credit includes only periodic interest. Regulation Z was also amended a number of years ago to eliminate the requirement to disclose on periodic statements the “effective” APR based on the actual charges and credit extended. But the effective APR is still sometimes used in SEC filings and elsewhere to reveal the true cost of lines of credit.

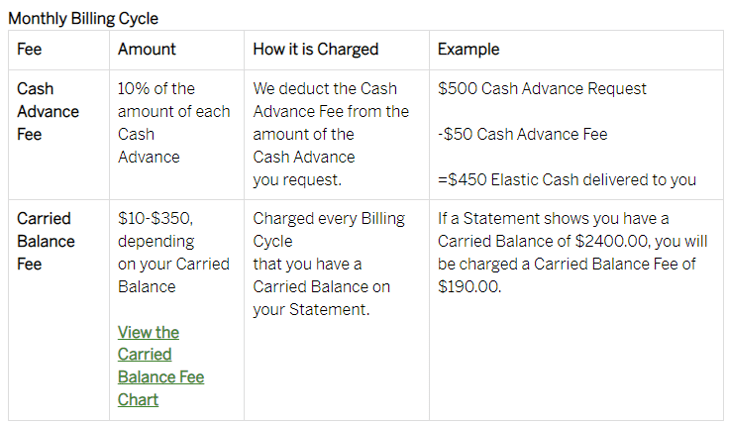

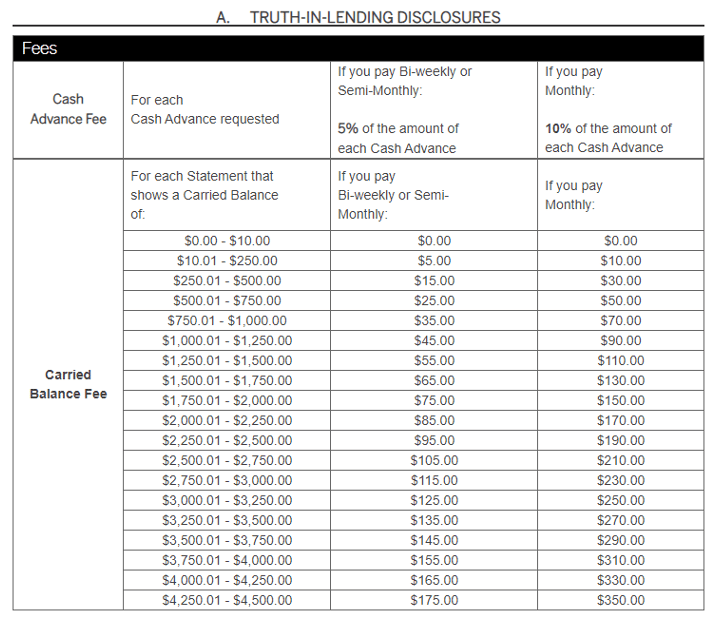

For a consumer who selects a monthly billing cycle, the Elastic website discloses these costs:[16]

Based on this chart, many consumers might understand the APR to be 10%. Even if the consumer clicked on the link to “View the Carried Balance Fee Chart,” that would still yield a complicated chart that does not allow consumers to understand the APR and could lead them to think it is 10%:[17]

NetCredit has similarly opaque cost disclosures based on a 10% cash advance fee along with a statement balance fee.[18]

4. States have settled lawsuits against Republic and its partners over their high-cost lending

Through a banking partnership with Republic, Elevate Credit offered consumers the Elastic Line of Credit. The effective APR for the Elastic lines of credit offered to DC residents ranged between 129 and 251 percent.

In February 2022, District of Columbia Attorney General Karl A. Racine reached a $4 million settlement with Elevate concerning its high-cost installment loans and Elastic line of credit. According to the complaint, Elevate issued 1,680 Elastic lines of credit in DC at interest rates well above the District’s usury limits.[19] Because the ELOCs were originated in Washington, D.C. as late as April 2020, those activities are within the CRA exam evaluation period.

The FDIC must not ignore how Republic played an essential role in making credit available under these terms. With the power afforded by Republic’s charter, Elevate could originate loans well above the District’s 24 percent interest rate limit. It was only through the auspices of the right of a bank to export its home state interest rate rules that Elevate could construct its abusive line of credit product.

5. An evaluation of Republic’s mortgage lending would also support the conclusion that the bank does not meet the needs and conveniences of all of the members of its communities. It has a poor track record of originating mortgages for borrowers of color.

While Republic matches or slightly exceeds market-wide averages for its mortgage lending to low-and-moderate income borrowers, Republic originates a disturbing low share of loans to borrowers of color.

| 2022 HMDA | Cincinnati | Lexington | Louisville (IN & K.Y.) | Tampa, FL | Tennessee | |||||

| Black | Latino | Black | Latino | Black | Latino | Black | Latino | Black | Latino | |

| Republic | 1 | 0 | 0 | 0 | 34 | 9 | 1 | 8 | 6 | 507 |

| Other Banks | 402 | 126 | 7 | 6 | 7 | 119 | 354 | 934 | 8 | 267 |

| Republic % | 2.08% | 0.0% | 0.0% | 0.0% | 3.33% | 0.88% | 0.83% | 6.61% | 4.62% | 6.15% |

| Other % | 5.33% | 1.67% | 2.04% | 1.60% | 3.27% | 1.84% | 2.61% | 6.88% | 4.69% | 2.47% |

Source: HMDA, 2022 portfolio share of lending on owner-occupied properties.

In Cincinnati and Lexington, Republic made a single loan to purchase or refinance an owner-occupied residential home to a Black person and did not make any mortgage loans to Latino consumers.

6. By receiving a charter, Republic has received financial subsidies and legal privileges. Those benefits are not given to high-cost non-bank predatory lenders. Banks should be held to higher standards.

Republic earns these profits because it is one of the few banks willing to provide its rent-a-bank “Charter as a Service” (CaaS) model. Through regulatory arbitrage, Republic can access capital at low rates, pass off most of the risk to its non-bank partners, increase its margin and earnings, and receive outsize risk-based returns. The only way it can do this is by offering its charter, and the associated benefits that it confers to lenders, to businesses whose models fall well outside of the norms of the practices at traditional insured depositories. Only a handful of rogue insured depositories use their charters for partnerships with non-banks to make loans at rates as high as 100% to 200% annual percentage rate (APR), well above state interest rate maximums.

Whereas Elevate must rely on stock and bond markets to fund its operations, Republic can access funds through channels that are only available to banks and credit unions. It can receive low-cost deposits and provide the benefit of insurance to their depositors. They can facilitate ACH and wire transfers, use cash services, and connect their consumer accounts to network-branded payment cards. These benefits are only available to banks and credit unions. On the other hand, non-banks cannot.

By contrast, non-bank Elevate has borrowed over $500 million from lenders at rates as high as 15.7 percent, whereas Republic has borrowed money for as low as 19/100ths of one percent during the CRA exam period.[20]

The difference in cost of capital provides a concrete data point to show why a chartered financial institution should be held to a higher standard. Despite these differences, Republic and Elevate both participate in shares of the fee and interest income generated by these loans. The rent-a-bank model permits the line between banks and non-banks to blur. It permits a bank to share in the profits with a non-bank, but at the same time, it shields the bank from some of the risks that the non-bank has to accept.

While no level of capital expenses can justify lending money at rates of these magnitudes, the relative difference underscores how a charter is a privilege with immense economic value. That value should compel a bank to do better. Indeed, when a bank seeks to participate in high-cost lending schemes, regulators should hold them accountable. The status quo is unacceptable. RPG loans do not serve the needs and conveniences of communities.

II. Rent-a-bank products harm consumers. Many consumers have complained about the credit received from Republic Bank of Kentucky’s lines of credit and installment loan partners.

1. Through complaints submitted to the CFPB, consumers reveal the harms of NetCredit-branded lines of credit and consumer installment loans.

Consumer complaints reveal some of the difficulties that consumers have with NetCredit loans. Consumers say they did not understand the actual cost of credit, had trouble with loan servicing, and did not understand how their personal information would be used. Several complain that NetCredit did not honor pandemic-era debt protections.

These complaints with narratives in the CFPB’s Complaint Database were filed on NetCredit installment loans. The complaints are recorded in the name of Enova, the corporate parent of CashNetUSA. Republic is the bank partner for NetCredit installment loans.

- From an older American in Kentucky, inside Republic’s assessment area: “Obtain [ed] loan in XXXX of 2020. Loan amount {$3700.00}. Monthly payments of {$200.00} since XXXX of 2020. Like to pay off loan at lesser amount. Loan is now in excess balance of {$4000.00} at 65 % interest. NetCredit will not discuss early payoff until I pay more into the loan.” (November 22, 2022)

- From a military[21] consumer: “Just prior to the pandemic, NetCredit created a loan for me in the amount of {$4000.00} at XXXX percent interest which is illegal in the state of Florida for them to do so. The company has been sued for several issues, and they have damaged my credit report for years because I refuse to pay a percentage which is not legal for them to charge.” (received on June 19, 2022)

- From a military consumer in Massachusetts: “This letter is to dispute the interest fees that are fraudulently and illegally being charge to me under a loan through NetCredit. I have followed up with NetCredit via email and phone and received no adequate response from anyone. This company does not give the option to pay principal payments, you would have to pay their interest fee and then issue a payment on top of that. Their monthly payments are too high for the average consumer to get out of this type of debt and to try and make extra payments. I have called NetCredit on several occasions to refinance this loan. The first time I was told this was not an option that they provided. The last time I spoke with them in the month of XX/XX/2022 I was told that this is an option, but my case had been escalated and I need to wait for a manager to contact me. I have not heard from anyone to date. This loan is a High Interest loan and after investigating it appears that this illegal and fraudulent.” (May 24, 2022)

- “I received a loan with the company NetCredit in XXXX of 2020. I must admit at the time I was beyond desperate, my XXXX XXXX was a XXXX months out of XXXX XXXX and medical bills was killing me. A couple weeks after I lost my main source of employment. However with my children child support I managed to scrape by and make payment to avoid credit reporting. The original loan was {$3000.00}. I have been making payments since XXXX, however the company is saying that i have a balance of {$2500.00}. How is that possible? On XX/XX/XXXX, I lost my dad, had to take emergency leave to go to the XXXX, I sent an email to the company to let them know that I will not be able to make a payment, however they tried to withdrew payment, sending my account in negative. I tried having loan refinanced as I have never missed a payment and was unsuccessful. Please help in anyway dealing with high interest company. I am struggling to get by, honestly can’t afford XXXX XXXX monthly.” (December 14, 2021)

- From a person in Oregon: “NetCredit knowing and willingly broke the law in an attempt to get me trapped in to a loan with an interest rate so high that it is also illegal in my state under ORS 725.340. In addition to all other unlawful acts there is also nowhere in my contract an APR % listed. The harassment over this unlawful loan was unbearable to say the least. Calling me repeatedly and interrupting me at my place of work, at my church, during dinner, and every other minute of the day. Then the threatening emails flooding my inbox just added to a level of stress I already couldn’t cope with was pure insanity, but that wasn’t even the worst of it. I have made multiple attempts to contact the company directly, but have been unsuccessful in actually talking to a real person thus far other than an email reply (attached) stating that they are allowed to charge any interest rate they want and are licensed to operate in the state of Oregon which they are not.” (December 14, 2021)

- From a person in Florida, inside Republic’s assessment area: “NetCredit obtained my information and entered me into a consumer transaction without my consent or knowledge NetCredit is in violation of 18 U.S. Code 1028A -Aggravated Identity theft and 15 USC 1691 ( d ) ( 6 ) NetCredit does not have the right to the credit pull that 15 USC 1681b ( a ) ( 3 ) ( A ) grants a credit reporting agency I never applied for a loan and I have the capacity to contract since I am a natural person so you denying me my own credit is discrimination pursuant to 15 usc 1691 ( a ) ( 1 ).” (October 14, 2021)

- From a person in Florida (inside Republic’s assessment area) suggesting that the company is not fulfilling know-your-customer rules: “XX/XX/2021 I got a hard inquiry on my XXXX credit report From a company named NETCREDIT/XXXX Never heard of this company Never applied for a loan I was at work all day from XXXX to XXXX Tried calling this company Cannot get through to anyone Tried looking it up Looks like its a high interest personal loan company Would never be interested in a company like that Also called XXXX The said there is nothing they can do Cannot take my word for it I’ve tried so hard to get my credit up and stay in good standing Had identity theft about 5/6 years ago with the IRS this makes me very nervous Please help.” (June 26, 2021)

- A complaint made by a person living in Ohio (inside their assessment area) suggesting that adverse-action notice requirements were not observed: “XX/XX/XXXX – used preapproval offer to make credit application- Net credit does hard inquiry XX/XX/XXXX – received email saying work verification documents required XX/XX/XXXX – sent all required documents XX/XX/XXXX – NetCredit withdrew my application because I didn’t send documents on time. XX/XX/XXXX – started another application on advice of NetCredit customer rep. XX/XX/XXXX – sent required documents XX/XX/XXXX – NetCredit withdrew application because didn’t have documents in time. Please stop NetCredit from providing credit services. They are wrongfully using my credit information without giving me an approval or disapproval letter.” (May 13, 2021)

- “I secured a loan with NetCredit with of my credit rating and potential high interest rates. I’ve been making monthly payments in full and on time expecting some part it would be applied to the principal. To my complete shock, after at least 2 years, balance had significantly increased beyond the initial principal (negative amortization). In speaking with a representative, I was informed that nothing had been applied to the principal and random fees been attached. As no billing statement or account record is neither mailed or emailed to me and nor did any representative disclose that to me. I’m a XXXX and XXXX struggling to make these payments only to get further in debt.” (February 2nd, 2021)

- From a military consumer in California: “I borrowed {$2600.00} with a {$160.00} bi-weekly payment. Over the last year, I have paid back over {$4200.00} and still have over a {$2000.00} balance due. I have proven that I can pay back the loan, and I shouldn’t have to pay back another {$4200.00} over the next year to pay this off. I hope NetCredit can see their way that this is a predatory loan and I have more than paid back my loan amount with interest.” (December 28, 2020)

- From a servicemember in Georgia: “I applied for this loan-I don’t recall the dates specifically, XXXX or XXXX to pay up my car insurance, after an injury, and being off work. I believe I asked for {$3200.00} or {$3500.00} for the loan amount. I received the interest rate information, but I was in desperate need, so I agreed to it. In XXXX of XXXX, I was XXXX XXXX from my XXXX job, as a result of my V.A. doctor’s information to the Office of Personnel Mgmt , and lived for a while on a monthly annuity. Well, the year is up and my annuity amount has changed DRASTICALLY. I’m now trying to get Social Security XXXX Insurance, and have to wait. In the meantime, I can’t continue to pay for this NETCREDIT loan TWICE per month. I’ve written, them, I’ve called them, I’ve complained on their site, I’ve even submitted an email to their subsidiary XXXX, and kept getting error messages. I KNOW the loan is mine, I’ve been paying it off, AND the exorbitant interest rates. It’s terrible that company’s like this can do this to the working poor. I waited for a long time before actually accepting the money, and they ” hunted ” and quickly agreed to send it, but I knew THEN, I was in trouble. I’m NEVER gon na be able to pay this loan off! And it’s ridiculous and unfair. I’ve worked 43 years of my life, and never needed one of these loans, and now I know I was right in my feeling of acceptance. PLEASE, TELL THESE PEOPLE TO JUST TAKE ONE PAYMENT PER MONTH. It’s gon na prolong the loan, but at least I won’t be afraid my necessary bills won’t suffer as a result of this loan. NOW I pay my mortgage, car insurance, and bills. This is SURVIVAL MODE. I’m just asking for some assistance. And PLEASE, ask them to send me the TIME when the loan WILL BE PAID OFF! When I have been able to speak to a LIVE person, they’ve been very elusive about this information. PLEASE HELP ME.” (July 3, 2020)

The complaints suggest that NetCredit does not adequately assess a borrower’s ability to repay a loan, may not follow adverse-action notice requirements, offer repayment plans to borrowers who are struggling to repay their loans, provide helpful customer service, and lends at rates that are above interest rate maximums in some states.

2. Through complaints submitted to independent customer review websites, consumers reveal how of Elastic-branded lines of credit did not meet their needs and conveniences.

The following comments were found on the Better Business Bureau’s website. All of the complaints were filed from 2021 to 2023.[22]

After making a request to borrow money from Elastic real republic bank, I see you’re not alone in the fight against this company this company made them out to be yeah I’ll be able to pay back in 12 to 18 months it’s not true I found out the hard way. After paying them $250 just to transfer the money from their account to my account which did not go towards paying back the loan and that my first month is going to be $250 , And then after that my monthly bill was going to be $420. And this is a company that knew how much money I made and what the money was for, they still let me borrow money knowing that the amount of money that I make I would never be able to sustain it, what to do. So buyer beware of this Elestric Republic bank company whatever it is it sure reminds me of the program on ******* called dirty money these loan companies are getting away with murder only it’s your pocketbook. It was about this bad guy that started cash call USA and it was also sponsored by ****** ********, so that gave people a sense of comfort only to find out that the terms and conditions were available that only could be made out by attorneys, this man had to pay billions of dollars in return went to jail for 15 years and I think it’s just coming with a different mask on.

Elastic is a complete scam and has no ethics. I paid them faithfully for 2 years, every pay check anytime I received an advance. I lost my job due to the pandemic and they sold me to collections within 2 months. No time to get on my feet. When I called about it, they didnt care at all. Basically shrugged me off and told me late payments are not their problem anymore. Steer clear! Life happens and they dont care!

Total scam! I have borrowed $3,500 since 11/12/21 and paid back $1,195 since then. They are requiring over $800 a month to pay back or they will report you to the credit bureaus. Totally unprofessional and wont work with you! 100% dont recommend

VERY UPSET! I received several mail offers from this company and I would just ignore and throw away, Well I needed little funds but not at a high interest rate and then I received a mail offer for $3500 please apply. When online per the advertisement with a Special code starting an application I stopped and decided to call and ask questions because I did not want in an High interest loan. So I called and with a Representative and ask what was interest rate or fees for this Line of Credit. The Individual stated “there is no interest rate only a cash advance fee of 5% to 10% depending on what you withdrew” , I ask again are you sure there are no hidden fees and he stated “no ma’am only fee are per transaction of credit line you request” “example if you only want cash advance of $100 then we will deposit $90 minus the 10%”, okay so I ask I will only pay back what ever I cash advance? He stated yes no other fees only the cash advance fee or 5% – 10%. This is not the case they have a “carry balance fee” that they do NOT specify exactly that amount until after they start drafting! THIS COMPANY IS NOT TRUSTWORTHY AND REPRESENTING A BANK?

When I attempted to pay off my loan in full, their online system would not allow me to do so. The NEXT DAY, when I was able to pay that amount online, I was billed AN ADDITIONAL $100 for carrying a balance, even though I had tried to pay the loan off two times BEFORE that due date. But their online system would not allow me to make that payment until AFTER that additional amount could be charged. When I contacted them by phone, they were unable to even discuss eliminating that fee.

The following comments were found on the Supermoney website.[23] They were filed from 2020 to 2023.

I am an existing customer and frustrated that you cannot easily increase your monthly payment to accelerate paying down your balance. this is the way the bank can keep fees if you carry a balance over 10 months although your payments are made timely with no issues. Cannot file a complaint with corporate office. This is a bank taking advantage of consumers.

If you borrow $1000 and do not pay back $990 before your next bill cycle you can expect a $130 monthly payment. They will charge you a carried balance fee of $55 plus your regular monthly payment. You’ll find every month the majority of your payment going toward carried balance fees and your hope to pay off the actual loan near to nonexistent unless you can make a large lump payment. Their motto is to keep you in debt. If your balance owed exceeds $10 every month depending how much you owe you’ll be charged a minimum carried balance fee of $55. If you owe $2300 expect to be charged a $105 carried balance fee. You can easily be stuck paying $230 a month. Long story short it’s not worth it. This company is part of the problem and not the solution. Please read all the better business bureau complaints agaisnt this company. I opened my account March 29th 2020 and paying it in full April 30th signed lesson learned. I can’t wait to get this account closed. Horrible customer service, horrible lending practices. You’ll regret taking $1 from this shameful company.

I settled my account in March and now they have no record of my settlement payment and now they’ve sent my account to a collection agency.

Is horrible is killing people life’s i makes big mistake didn’t talked you ha much you pay interest I pay every month I barrow 3.500 I payed back 6 .500 for one year.

Hidden figures at the end very expensive it’s supposed to help no to dig you into more debf

Don’t ever use this company no matter how bad your situation. Borrow from family or a friend! You will end up worse off. They don’t explain it well in the writing but you basically end up paying them double the amount back if you don’t pay it all back at once. They are crooks. They over charge you by charging a carried balance fee that’s added every time you make a payment. Unless you know you can pay the full balance back AVOID THEM AT ALL COST

Horrible fees and call them by a different name to avoid following state mandated interest rate laws.

Horrible high interest. You will never be able to payback and as a clause even DEATH wont release you from this one. Don’t do it!!! As much as they say its so EASY, its a DEATHTRAP.

III. Tax lending is high-cost and underwritten without a meaningful method for assessing a borrower’s ability-to-repay.

In any given year, Republic earns tens of millions of dollars on tax refund loans. Most of those refunds will be at least partially due to refundable EITC credits. Although Congress did not have this intention when it passed the EITC, the ability to earn fee income from tax advances must be addressed. As it is, the delay in receiving tax refunds has led to a condition where some consumers choose to forfeit a portion of their much-needed refund. In this way, Republic has become a beneficiary of a federal tax credit intended to reduce poverty. In 2022, the company recorded $13.2 million in interest on $311.2 million in tax refund advances.[24]

1. Tax refund “Easy Advance” loans are costly for consumer borrowers. In most cases, the actual cost of borrowing is in excess of 36 percent.

During this tax year, Liberty Tax customers who used an Easy Advance (EA) paid a fee equivalent to 3.1 percent of the amount advanced. Disclosures to consumers indicate that the interest rate for an Easy Advance is 35.9 percent. However, this is a questionable claim. The calculation assumes that Republic will be repaid in thirty days. However, that is an estimate, because repayment occurs when the filer receives their refund.

The actual time to receive a refund can vary greatly. As a result, disclosures are made with a false sense of precision, and for the most part, the error falls in Republic’s favor.

The IRS says it issues more than 9 out of 10 refunds in less than 21 days, and it suggests that filers who use direct deposit will receive refunds sooner.[25] These conditions infer that for more than nine of every ten filers, the actual cost of an EA is at least 53 percent.

| Easy Advance Loans | |||

| 2020 | 2021 | 2022 | |

| Total volume by amount ($ millions)[26] | $387.8 | $250.0 | $311.2 |

| Interest Income (millions)[27] | $19.67 | $13.20 | $14.48 |

| Interest rate (average interest rate) [28] | 50.6% | 50.2% | 51.6% |

Using data from investor reports, the real cost of an EA has not been 35.9 percent during the prior 3 years. Instead, it has been above 50 percent.

It is also worth acknowledging that these interest rates are applied to larger-size loans. An EA can be for a sum well above the typical loan amounts for a payday loan. During this filing year, consumers could borrow up to $6,250. Often, states place greater restrictions on interest rates charged for larger loans than on small loans.

2. Expected Refund Advances (ERAs), branded as Holiday Advances (HAs), are expensive.

In December 2022, Republic originated $97.5 million in ERAs. ERAs are sometimes known as “paystub loans” because advances rely on the income and withholding information on a December paystub. As a condition of receiving an ERA, the borrower must agree to use the bank-partner tax preparation partner where they receive the ERA. There is a fee to obtain an ERA. On Republic’s investor filings, the fee income for both products is booked as interest income.

A tax review website says the APR for an Early Refund Advance at Jackson Hewitt (JH) is 34.22 percent.[29] (Jackson Hewitt uses Republic for its EA and ERA, but JH does not apply a fee for the EA) Liberty’s ERA is branded as the Holiday Advance (HA). The HA is available from December 12th to January 14th. Loan amounts are between $200 and $500, but most are for less than $500.[30]

The structure of the HA. obligates a consumer to assume additional costs. As a condition of receiving a H.A., the applicant must consent to receiving the funds on a Republic-issued debit card and returning to a Liberty tax preparation service to complete their tax return. The card has a $5 monthly fee.

3. Tax loans are made without a meaningful assessment of a borrower’s ability to repay a loan.

Republic approves its EAs and ERAs based on prior year tax refunds. ERAs are underwritten with a December paystub. EAs rely on estimates of the likelihood of receiving a refund. The underwriting criteria do not consider a borrower’s monthly income or expenses but the probability that the return will be rejected or reduced due to fraud, unpaid taxes, or other factors related to an ability to collect.

Republic, in its annual report, states that “Related to the overall credit losses on refund advances, including ERAs, the Bank’s ability to control losses is highly dependent upon its ability to predict the taxpayer’s likelihood to receive the tax refund as claimed on the taxpayer’s tax return. Each year, the Bank’s EA approval model is based primarily on the prior-year’s tax refund payment patterns.”[31]

4. Issuing Easy Advance loans creates significant risk for the company, including the risk that independent preparers will not file returns correctly. There are challenges to ensuring the integrity of tax filings.

Easy Advance loans carry significant credit risk because they are non-recourse loans. When Republic makes an EA, it bears the risk that a preparer has not correctly filed the return. If the EA payment exceeds the actual refund due to a preparer error, Republic will bear the loss. If the IRS cancels or reduces a refund because of an outstanding tax debt that was unknown to Republic at the time of filing, then Republic bears any losses. Republic will have financial risk if a preparer commits fraud.

As well, both the EA and refund transfer (RT) products carry risks associated with the integrity and skill of their relationships with the tax preparation firms where their products are offered. Liberty Tax targets its preparation services at lower-wealth consumers likely to expect a tax refund. The Easy Advance is one of its primary points of differentiation from free Voluntary Income Tax Assistance centers and independent “mom and pop” preparers.[32] To a great extent, competition among preparers is factored by their ability to file a return with the highest refund. Liberty’s website promises to bring the highest refund possible. The availability of the Easy Advance appears at the top of its web page, followed by the company’s stated value proposition: “Get your largest possible refund. MAXIMUM REFUND GUARANTEE. If you file with us, but get a bigger refund for the same return with a competitor, we’ll refund your preparation fees.”[33]

Because of the financial health of their target consumer, the bank is unlikely to recover its capital when an E.A. refund is rejected or if the approved refund amount is less than the advance. These loans are made without recourse.

Moreover, the bank cannot adjust its underwriting criteria because of conditions placed on returns that receive the Earned Income Tax Credit (EITC). The Protecting Americans from Tax Hikes Act of 2015 (the PATH Act) prevents any return with an EITC from receiving a refund until February 15th. New E.A.s are originated after Feb. 28th. (page 25, 2022 10-k)

As the company notes in its most recent annual report:

The federal government, specifically as a result of the PATH Act, mandates that tax refunds for tax returns with certain characteristics cannot receive their corresponding refunds before February 15th each year. Substantially all the tax returns driving TRS’s product volume meet the criteria of those subject to this later funding under the PATH Act. These funding delays effectively restrict the Bank’s ability to make in-season modifications to its R.A. underwriting model based on then-current year tax refund funding patterns, because the substantial majority of all R.A.s are issued prior to February 15. As a result, the underwriting criteria that TRS establishes for the R.A. product at the beginning of the tax season could have a material negative impact on the performance of the R.A. before mitigating revisions can be made.”[34]

In 2022, Republic charged off $6.67 million in EAs and has charged off a total (after recoveries) of $26.4 million in the last three years.[35]

5. Agreements to offer tax refund loans through relationships with tax preparers present challenges for internal controls.

There are 2,762 Liberty Tax locations, of which ninety-four percent of Liberty Tax offices are independently-owned franchises.[36] To fully convey compliance rules, Republic has to rely on its tax preparation store owners to do the work to train all of their employees.

Due to the nature of the tax preparation business, implementing controls presents fundamental operational challenges. Most tax preparation offices rely on seasonal labor. Republic’s partners generally file most of their returns before March 1st. Four regulate tax preparers and three others require preparers to register. The only federal requirement is to have a personal tax identification number.[37] A high share of tax preparers may only work for a single year before moving to a new firm or leaving the tax preparation field altogether.

In that environment, Republic has to rely on third parties with whom it has no contact to fulfill its obligations to explain procedures for offering credit. It also needs to make sure that credit is not being extended based on false promises that the consumer is entitled to a refund based on fraud committed by tax preparers.

Moreover, stores relying on tax refund loans to differentiate their services from competitors may not remain open after Republic ends refund loans. This year, Liberty did not offer EAs after February 28th. A new law prevents the issuance of any tax refund for a return that claims an EITC until mid-February.[38] Accordingly, a high share of Republic’s refund advances will not have been collected until after the store has closed its doors for the year.

Some of Republic’s primary tax preparation partners have been the subject of legal action because of their lack of compliance controls. At least two settlements occurred during the CRA exam period:

- In 2019, the U.S. Department of Justice (DOJ) announced a settlement with Liberty Tax Service.[39] The order required a national franchise of Liberty preparers to enhance their compliance controls. Specifically, the order called for enhancements to detect when returns had been filed under false pretenses.

- In 2020, the U.S. Department of Justice barred two owners of Liberty Tax franchises from operating a tax preparation business in the future.[40] DOJ determined that the franchise had filed federal returns that claimed improper tax refunds. Preparers at Liberty stores owned by the defendants overstated refunds by making more than 500 false claims for education credits, among other practices.

6. Consumers complaints filed with the Better Business Bureau[41]show that consumers are confused and are potentially being misled about Republic’s tax products.

From a complaint filed in 2023 on an Early Refund Advance: Republic Bank received my tax refund for the 2021 year on December 12, 2022. I was told that I would receive the check in a number of days after it was sent. After sufficient time passed, I called back and was told that the check had been returned because the address, that had been verified by myself, was incorrect. I completed a form and had the check resent to the same (correct) address. I was told today that the check had been sent back again because of the address. Republic Bank states that they can only send checks from the previous year via USPS, but I find their lack of creativity or care after the second failed attempt appalling. Given that they are a bank and keep failing to ensure I receive my funds, I feel that they should find a different way to deliver my check. I need help from them, more than their internal tracking of the “check” and telling me that there’s nothing more that they can do.

From a complaint filed in 2020 from a consumer when his RAL was sent to an invalid account. When a check was mailed instead, the preparer misplaced it. Ultimately, the filer did not receive a refund until almost two months after their taxes were filed. I went to ******* ****** Tax Services to do my Income tax February 6,2020. On February 26, 2020 Republican banked Trust Company assisted Refund was supposed to Direct Deposit my Federal and State reimbursement. Today is March 27th. Nothing. I have called ******* ****** Tax Service….Nothing…every day is an excuse. Nothing…. I need my money… I just finish complaining to ******* ****** today and they throw the ball back to Republic…. I need help….

Conclusion

Unless the FDIC intervenes, Republic will continue to partner with non-banks to offer high-cost, high-risk credit. Most banks stay away from this space – even though it is profitable – because they see it threatening their reputation.

Republic uses its charter to create financial products that do not meet the conveniences and needs of the public. Instead, it offers loans whose fundamental value proposition serves the interests of non-bank lenders that wish to benefit from the bank’s ability to export the lenient regulations of its home state to other markets. Even if this activity was justifiable in an abstract sense, it is another question if it is the rightful place for damaging loans to be offered by an insured depository. We believe that high-cost lending is fundamentally unsafe. Under the CRA, banks must meet the conveniences and needs of their communities; these practices are directionally opposite to that obligation.

The reliance on high-cost CaaS rent-a-bank activities underscores why these activities must be considered in Republic’s CRA exam. With a complete picture of Republic’s impact on underserved consumers, the FDIC will conclude that this bank is not serving the needs and conveniences of the public. Instead, it is undermining them.

Downgrading Republic Bank on its CRA exam is a first step. The FDIC should give Republic a “needs-to-improve” rating. A downgrade will signal to the bank that the FDIC is prepared to hold Republic accountable for how it uses its charter. Subsequently, the FDIC should consider further actions to ensure that Republic steps away from rent-a-bank lending programs.

Sincerely,

The National Community Reinvestment Coalition

The National Consumer Law Center (on behalf of its low income clients)

Accountable.US

Americans for Financial Reform Education Fund

The Center for Economic Integrity

The Center for Responsible Lending

Consumer Action

The Consumer Federation of America

Public Citizen

US PIRG

The Woodstock Institute

[1] Republic Bank & Trust. (2023). Annual Report for the Fiscal Year Ending December 31, 2022 (No. 10-K). https://www.sec.gov/ix?doc=/Archives/edgar/data/921557/000155837023002793/rbcaa-20221231x10k.htm

[2] Republic Bank & Trust. (2023). Annual Report for the Fiscal Year Ending December 31, 2022 (No. 10-K), 28.

https://www.sec.gov/ix?doc=/Archives/edgar/data/921557/000155837023002793/rbcaa-20221231x10k.htm

[3] Republic Bank & Trust. (2023). Annual Report for the Fiscal Year Ending December 31, 2022 (No. 10-K), 13. https://www.sec.gov/ix?doc=/Archives/edgar/data/921557/000155837023002793/rbcaa-20221231x10k.htm

[4] Republic Bank & Trust. (2023). Annual Report for the Fiscal Year Ending December 31, 2022 (No. 10-K). Table 9 – RCS Program Fees by Product. https://www.sec.gov/ix?doc=/Archives/edgar/data/921557/000155837023002793/rbcaa-20221231x10k.htm

[5] The lines of credit are priced entirely with fees, not a periodic interest rate, but the effective interest rate (including the fees) is shown in the 10-K as the average rate the bank receives.

[6] Republic Bank & Trust. (2023). Filings—Documents—Document Details [10-K]. Table 4, Total Company Average Balance Sheets and Interest Rates. https://republicbank.q4ir.com/filings/documents/sec-filings-details/default.aspx?FilingId=100117312225

[7] https://www.netcredit.com/rates-and-terms.

[8] Republic Bank & Trust. (2023). Filings—Documents—Document Details [10-K]. Table: balance sheet https://republicbank.q4ir.com/filings/documents/sec-filings-details/default.aspx?FilingId=100117312225

[9] Republic Bank & Trust. (2023). Annual Report for the Fiscal Year Ending December 31, 2022 (No. 10-K). Table 9 – RCS Program Fees by Product. https://www.sec.gov/ix?doc=/Archives/edgar/data/921557/000155837023002793/rbcaa-20221231x10k.htm

[10] Elevate Credit, Inc. (2022). Annual Report for the Year Ending December 31, 2021 [10-K]. https://www.sec.gov/ix?doc=/Archives/edgar/data/1651094/000165109422000021/elvt-20211231.htm

[11]Republic Bank & Trust. (2023). Annual Report for the Fiscal Year Ending December 31, 2022, 101, https://www.sec.gov/ix?doc=/Archives/edgar/data/921557/000155837023002793/rbcaa-20221231x10k.htm

[12] Republic Bank & Trust. (2023). Annual Report for the Fiscal Year Ending December 31, 2022 (No. 10-K), 51. https://www.sec.gov/ix?doc=/Archives/edgar/data/921557/000155837023002793/rbcaa-20221231x10k.htm

[13]Republic Bank & Trust. (2023). Filings—Documents—Document Details [10-K]. https://republicbank.q4ir.com/filings/documents/sec-filings-details/default.aspx?FilingId=100117312225 Interest income, Item 24: contracts with customers. Tables 144, 145, and 146.

[14] Republic Bank & Trust. (2023). Filings—Documents—Document Details [10-K]. https://republicbank.q4ir.com/filings/documents/sec-filings-details/default.aspx?FilingId=100117312225 Table 144k

[15] Republic Bank & Trust. (2023). Filings—Documents—Document Details [10-K]. https://republicbank.q4ir.com/filings/documents/sec-filings-details/default.aspx?FilingId=100117312225 Table 10

[16] Elastic. (2023). What an Elastic Line of Credit Costs. https://www.elastic.com/what-it-costs/

[17] Elastic. (2023). What an Elastic Line of Credit Costs. https://www.elastic.com/what-it-costs/

[18] See, e.g., NetCredit. (n.d.). Kentucky Personal Loans & Lines of Credit Rates and Terms. Retrieved March 22, 2023, from https://www.netcredit.com/rates-and-terms/kentucky

[19] Office of the Attorney General for the District of Columbia. (2020). District of Columbia v. Elevate Credit, Inc. Complaint for Violation of the Consumer Protection Procedures Act. https://oag.dc.gov/sites/default/files/2020-06/Elevate-Complaint.pdf

[20] Republic Bank & Trust. (2023). Filings—Documents—Document Details [10-K]. https://republicbank.q4ir.com/filings/documents/sec-filings-details/default.aspx?FilingId=100117312225 Table 42, Republic 2022 10-k Republic Bank & Trust. (2023). Annual Report for the Fiscal Year Ending December 31, 2022 (No. 10-K). https://www.sec.gov/ix?doc=/Archives/edgar/data/921557/000155837023002793/rbcaa-20221231x10k.htm

[21] The CFPB uses the “servicemember” tag to include active duty servicemembers, veterans, and their dependents.

[22] Better Business Bureau® Profile. (n.d.). Elastic Reviews. Retrieved March 23, 2023, from https://www.bbb.org/us/oh/cincinnati/profile/consumer-finance-companies/elastic-0292-90017369/customer-reviews

[23] Supermoney. (n.d.). Elastic Reviews. Elastic Community Reviews. Retrieved March 23, 2023, from https://www.supermoney.com/reviews/personal-lines-of-credit/elastic-line-of-credit

[24] Republic Bank & Trust. (2023). Filings—Documents—Document Details [10-K]. Table 82. https://republicbank.q4ir.com/filings/documents/sec-filings-details/default.aspx?FilingId=100117312225

[25] Internal Revenue Service. (n.d.). What to Expect for Refunds This Year. Retrieved March 1, 2023, from https://www.irs.gov/refunds/what-to-expect-for-refunds-this-year

[26] Republic Bancorp, Inc. Form 10-K for the year ending Dec. 31, 2022, Table 82, https://s26.q4cdn.com/821943881/files/doc_financials/2023/ar/2022-Annual-Report.pdf Table 62.

[27] Republic 2022 10-k, Table: Balance Sheet table 4, total company average balance sheets and interest rates.

[28] Republic 2022 10-k, Table: Balance Sheet table 4, total company average balance sheets and interest rates.

[29] Tax Refund Loans: Get an Advance in 2023. (2022, December 7). NerdWallet. https://www.nerdwallet.com/article/loans/personal-loans/tax-refund-loans-give-cash-now-to-early-filers

[30] Liberty Tax Service®. (2022, November 10). Tax Preparation, File Taxes, Income Tax Filing. https://www.libertytax.com/holiday-advance-loan

[31] Republic Bank & Trust. (2021). Annual Report for the Fiscal Year Ending December 31, 2021 (Annual Report No. 10-K). Securities and Exchange Commission. https://www.sec.gov/Archives/edgar/data/921557/000155837022002537/rbcaa-20211231x10k.htm#Item1Business_858359

[32] Liberty Tax, Inc. (2018). Liberty Tax, Inc. Investor Presentation. https://ir.libertytax.com/static-files/a8a74082-d9d4-498c-8d22-61192c899aa4

[33] Liberty Tax Service®. (n.d.). Tax Preparation, File Taxes, Income Tax Filing. Retrieved March 1, 2023, from https://www.libertytax.com/easy-advance_expired

[34] Republic Bank & Trust. (2023). Annual Report for the Fiscal Year Ending December 31, 2022 (No. 10-K). https://www.sec.gov/ix?doc=/Archives/edgar/data/921557/000155837023002793/rbcaa-20221231x10k.htm#Item1ARiskFactors_211552

[35] Republic Bank & Trust. (2023). Filings—Documents—Document Details [10-K]. Table 82 https://republicbank.q4ir.com/filings/documents/sec-filings-details/default.aspx?FilingId=100117312225

[36] Franchise Group Inc. (2021, April). Franchise Group Inc. Investor Presentation. https://ir.libertytax.com/static-files/280bb1fe-4343-4cec-b213-85e9ae01c70c

[37] Mark Castro (2022, January 1). Tax Preparer License—CrossLink. CrossLink Professional Tax Solutions. https://www.crosslinktax.com/customer-resources/tax-resource-center/tax-preparer-license/

[38] Internal Revenue Service. (2016, November 9). PATH Act Tax Related Provisions. https://www.irs.gov/newsroom/path-act-tax-related-provisions

[39] United States Department of Justice. (2019, December 3). Justice Department Announces Settlement With Liberty Tax Service. Justice News. https://www.justice.gov/opa/pr/justice-department-announces-settlement-liberty-tax-service

[40] United States Department of Justice. (2020, March 16). Federal Court Permanently Bars Former Liberty Tax Service Owners from Tax Preparation Business. Justice News. https://www.justice.gov/opa/pr/federal-court-permanently-bars-former-liberty-tax-service-owners-tax-preparation-business

[41] Better Business Bureau® Profile. (n.d.). Republic Bank Complaints. Retrieved March 23, 2023, from https://www.bbb.org/us/ky/louisville/profile/bank/republic-bank-0402-5384/complaints