September 12, 2019

RE: NCRC Comment Letter on AmeriNat Charter Application

To Whom it May Concern:

The National Community Reinvestment Coalition (NCRC) maintains that AmeriNat’s application for an Industrial Loan Charter (ILC) has not demonstrated a significant commitment to meeting the convenience and needs of the community to be served as required per the Federal Deposit Insurance Act (FDIC Act) and the FDIC statement of policy on applications for deposit insurance.1 AmeriNat has developed an incomplete plan for its Community Reinvestment Act (CRA) evaluation that does not adequately serve the credit and deposit needs of the communities, including low- and moderate-income (LMI) communities. NCRC, our members and allies, oppose AmeriNat’s charter application and urge the FDIC to deny it in its current form.

Receiving a bank charter is a privilege, not a right. AmeriNat proposes to be evaluated as a small bank although it already has a national presence as a servicer of loans and experience working with 300 local jurisdictions. It touts its expertise in the affordable housing and community development field, including its longstanding partnership with Habitat for Humanity and local and state housing finance agencies. Yet, by proposing to be evaluated as a small bank, it will not subject itself to an evaluation that tests whether it is bringing its full range of talent, expertise, and capacity to its community reinvestment program.

The proposed community development activity is restricted Clark County, Nevada although it has loan servicing offices in seven locations across the country in states as diverse as Minnesota, Maryland, Texas, and Florida. AmeriNat says it hopes to eventually use these areas as assessment areas but that the CRA regulations constrain it to request small bank designation and use Clark County, Nevada as its only assessment area in this application. It would add the other assessment areas at a later date. This is an inexcusable and unacceptable proposal for CRA activities regardless of whether the proposal stems from AmeriNat’s interpretation of the CRA regulation or whether the FDIC advised AmeriNat to develop an application proposing a limited evaluation and geographical scope.

The designation of one assessment area will not allow for a sufficient evaluation of AmeriNat’s retail activities and will also needlessly restrict its community development activities. NCRC proposes below that AmeriNat engage in data analysis and dialogue with community-based organizations as a means of designating additional assessment areas that will encompass a significant amount of its business activity.

The FDIC’s statement of policy on applications for deposit insurance states that a factor for consideration of approval of a charter application is the “willingness and ability of the applicant to serve those financial needs (credit and deposit needs).”2While AmeriNat acknowledges CRA obligations, its CRA plan falls short of demonstrating a commitment to adhere to CRA’s obligations commensurate with AmeriNat’s ability.

In addition, NCRC is opposed to ILC charters as problematic from a safety and soundness perspective. ILC charters can include a parent institution that is not a financial institution. Federal agencies cannot comprehensively examine the parent nor other affiliates and subsidiaries for their safety and soundness. The ability of the FDIC to monitor thoroughly the relationship between the ILC and its parent and to monitor risk the parent poses to the ILC has been questioned by the Government Accountability Office and other stakeholders.

During the financial crisis, two ILCs, Security Savings Bank, based in Nevada, and Advanta Bank Corp, based in Utah failed. In addition, a number of parents of ILCs, including Lehman Brothers, General Motors, Flying J Inc., Capmark Financial Group Inc., CIT Group Inc., and Residential Capital, LLC filed for bankruptcy.3

In contrast to AmeriNat’s CRA plan, NCRC believes the FDIC should consider the following as minimal requirements for creating a rigorous CRA plan. Such a plan must be comprehensive, qualities lacking in AmeriNat’s proposed plan:

Assessment Area Cannot be Narrow but Must Include Areas Where a Substantial Amount of Business is Conducted

AmeriNat’s plan establishes Clark County, Nevada as the assessment area for AmeriNat because its headquarters is located in the county.4This narrow assessment area is not truly responding to credit and deposit needs where AmeriNat is doing business and will thus fall short of meeting the convenience and needs requirement for a charter application.

In justifying its choice of Clark County as its assessment area and opting against assessment areas where its other loan servicing offices are located, AmeriNat states the following:

Although under current CRA regulations activities around these locations (loan servicing offices) will not be eligible for the primary CRA businesses outside of the assessment area, evaluation of loans to low- and moderate-income persons and small businesses outside of its assessment area, particularly in a broader statewide or regional area, may be considered after the needs of the primary assessment area have been adequately addressed by AmeriNat….In addition, should the CRA regulations be modified to address activity in LMI communities where substantial business is conducted; it is possible that the office locations (in the other states) could be added to the Bank’s AA (assessment area) at a later date.5

The CRA regulations do not prohibit a branchless bank from establishing assessment areas beyond its headquarters. Assessment areas can include areas where substantial amounts of lending activity occur.6

Again, if AmeriNat’s assessment area is restricted to Clark County, Nevada, AmeriNat is not demonstrating a willingness to serve credit and deposit needs where it does business as required by the FDIC statement of policy.

Using loan data, NCRC believes that the agencies can require non-traditional banks and fintechs to create assessment areas that capture the vast majority of their loans. An example of lending by state for Lending Club during the time period of 2012 and 2013 shows that assessment areas can be meaningfully created for an on-line lender (a two year time period is a typical time period covered by a CRA exam).7 Lending Club makes data on its lending and deposit activity by state and for three digit zip codes publicly available, a practice NCRC recommends for AmeriNat.

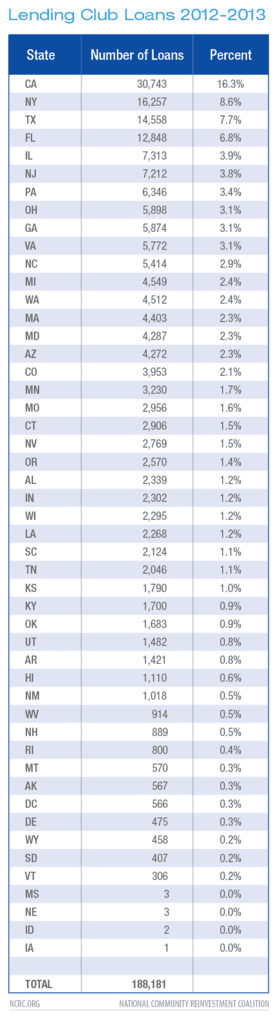

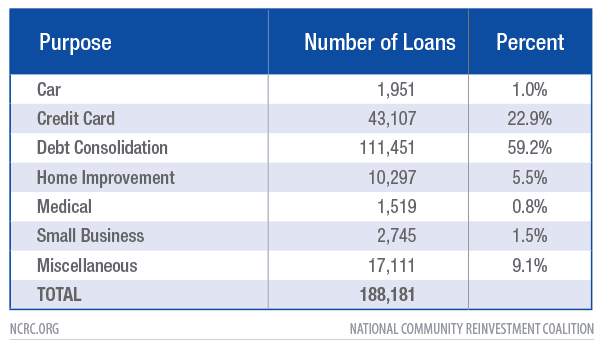

Several states have sizable numbers of Lending Club loans in this time period even before Lending Club’s substantial lending increases of more recent years. During 2012 and 2013, Lending Club made more than 188,000 loans; most of these were consumer-related loans and/or refinancing and consolidation of outstanding debt (see table below). Another table below on lending by state reveals that heavily populated states including California, New York, Texas and Florida had the highest percentage of loans. Ten states each had more than 3 percent of Lending Club’s loans.8 On the other end of the scale, 28 states each had less than 1.5 percent of Lending Club’s loans. In sum, it is quite feasible for at least the top ten or twenty states to constitute assessment areas; these states had high numbers of loans and reasonably high percentages of Lending Club’s loans.

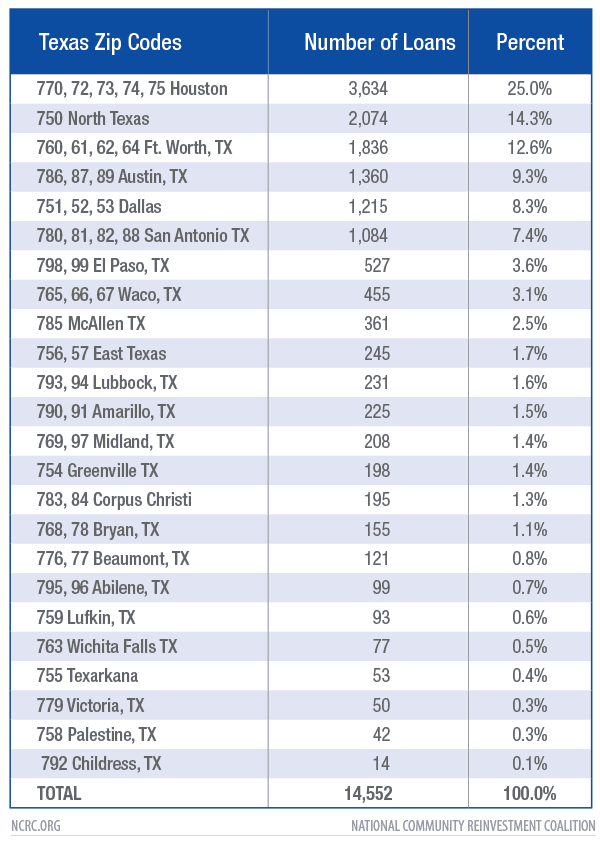

To further investigate how assessment areas would work for a non-traditional bank, NCRC tabulated loans by three digit zip code and metropolitan areas for Texas, one of Lending Club’s high volume states. We found five metropolitan areas with more than 1,000 loans each and one area, North Texas that could possibly be considered a rural area. The five metropolitan areas range in size and location across the state and include Houston, Austin, Ft. Worth, Dallas, and San Antonio. El Paso is the seventh largest area by loan volume with more than 500 loans. Using Lending Club as an example, designating metropolitan areas and counties as assessment areas for non-traditional lenders is feasible and can include a diversity of areas.

AmeriNat should make a commitment similar to Lending Club’s of sharing the location of its small business and home lending by state, metropolitan area, and county. It could also provide geographical data on its deposit taking activity. AmeriNat should then confer with community-based organizations and other stakeholders in deciding which geographical areas will constitute assessment areas. The assessment areas should include the seven locations that contain its administrative and loan servicing offices. Also,assessment areas should capture the majority of its retail activity and include a healthy mix of states, metropolitan areas, and rural counties.

NCRC believes that assessment areas for non-traditional banks and fintechs must include rural areas. Populations in rural areas are less likely to be connected to the internet. While only 4 percent of people living in urban areas lack adequate broadband services, this issue is particularly concentrated in rural areas and tribal lands, with 39 percent and 41 percent respectively, still lacking access.9 If fintechs and non-traditional banks do not make efforts to serve rural areas, the digital divide disadvantaging rural communities will only widen.

Towards a Substantial CRA Plan that Utilizes the Talents and Expertise of the Applying Institution

A non-bank applying for a bank charter must apply its talent and expertise in serving the LMI population. We are pleased that AmeriNat indicates goals for retail lending and goals for serving a significant percentage of LMI and minority borrowers. Even though AmeriNat has established goals for retail lending, it does not establish goals for community development lending and investments although it has considerable expertise in this area. AmeriNat should have opted for the strategic plan option instead of the small bank evaluation so that its talent and expertise could be fully utilized in its CRA program.

Small Business Lending and Home Lending

NCRC appreciates that AmeriNat has established goals in which the majority of its home loans will be for LMI borrowers and the majority of its small business loans will be for businesses with less than $1 million in revenue for its assessment area of Clark County, Nevada.10 However, NCRC notes that this lending will represent a small minority of its overall lending since AmeriNat anticipates it will be receiving deposits from and making loans to locations across the country.11 CRA procedure must no longer accept plans and goals for a small minority of a financial institution’s business activity.

NCRC also appreciates that AmeriNat indicates that a majority of its home lending will be in LMI tracts. In contrast, AmeriNat indicates that less a majority of its small business lending will be in LMI tracts. The disparity in geographical goals for home and small business lending is not explained in the application. NCRC urges AmeriNat to align its small business geographical goal with its home loan goal.

Deposit Accounts and Service Delivery

AmeriNat establishes no goals for its deposit accounts or its service delivery for LMI customers, communities, or small businesses since it is proposing a small bank evaluation that does not include a service test. NCRC reiterates that it is inappropriate for an institution that is nationwide in scope to not offer a comprehensive plan that includes goals for deposits and services.

Also since a significant part of its business will likely be generated from internet operations, AmeriNat should adopt benchmarks based on specific guidance on how CRA examiners evaluate alternative delivery systems in the Interagency Questions and Answers Regarding CRA (Interagency Q&A).12 The Interagency Q&A advises that CRA examiners will scrutinize whether a financial institution’s alternative delivery systems are effectively delivering services to LMI populations by considering a variety of factors including: ease of access; cost to consumers; range of services delivered; ease of use; rate of adoption and use; and reliability of the system.13 AmeriNat should establish specific performance measures and goals for the LMI community for each of these factors. Factors like the rate of adoption and use and the reliability of the system should have separate metrics and goals specifically set for rural as well as urban areas, and for under banked populations.

Community Development Lending and Investments

Throughout its application, AmeriNat boasts of its prowess as a national lender and investor in affordable housing, green energy, and social impact. On the first page of its application, AmeriNat describes its relationships with 300 state and local public agencies and nonprofit organizations, receiving deposits and providing loan servicing for its clients. AmeriNat further describes its relationship with 100 Habitat for Humanity affiliates.14It describes its impact lending and investing for affordable housing, green energy, and job creation, boasting that traditional banks do not have the same level of expertise in this area as it does.15 AmeriNat says it will focus on commercial Property Assessed Clean Energy (PACE) financing and in lending and investing that will create 182 jobs for every $10 million in financing.16

This breathless description of its skill and expertise in community development financing is accompanied by vague and modest plans. AmeriNat suggests that the small bank evaluation for which it asks ties its hands and will only allow for community development financing activity after its responsibilities for retail lending is met in its one assessment area of Clark County, Nevada. Accordingly, it is possible it will seek consideration for activities beyond Clark County in a statewide and regional area. Thus, it is unable or unwilling to provide dollar goals for community development financing in areas where it has offices and nationwide or goals expressed as a ratio of its assets or Tier 1 capital.

The FDIC must not allow this type of application in which a financial company lauds its expertise in community development financing and then hides behind existing examination procedure to propose a modest and under-utilization of its capacity and expertise. This falls short of the statutory requirements of meeting convenience and needs of communities.

Community Development Services: Foreclosure Prevention

AmeriNat is a major servicer of loans but it does not propose to use its capacity in servicing to provide the important community development service of foreclosure prevention and loan medication. The Interagency Q&A states that foreclosure prevention is considered a community development activity since it revitalizes and stabilizes low- and moderate-income neighborhoods.17 It logically follows that AmeriNat would want to apply its capacity as a servicer to make sure that neighborhoods that its partner, Habitat for Humanity, serves were stabilized and not experiencing a surge of foreclosures. AmeriNat has likely developed early warning systems indicating when borrowers are in distress; it could apply these warning systems for LMI neighborhoods, particularly those served by Habitat for Humanity. Yet, a lack of creativity in thinking through how to apply its talent and expertise is readily apparent since AmeriNat does not even mention foreclosure prevention and loan modifications in its charter application.

Responsible Lending

A charter application for an industrial bank must have rigorous responsible lending protections. It is unclear from AmeriNat’s application how much retail lending will be conducted via offices and how much of it will be on-line. Serious concerns regarding on-line lending have arisen due to possible fair lending disparities caused by unorthodox underwriting using algorithms employed by many fintechs. Also, AmeriNat will engage in commercial and small business finance but has not indicated whether it will adhere to the Small Business Borrower’s Bill of Rights, a check-list of compliance including transparent disclosures of loan terms and conditions that have been endorsed by many lenders.18

AmeriNat states that it will be involved in Property Assessed Clean Energy (PACE) programs that provide financing for clean energy upgrades or home improvements. AmeriNat says it will favor commercial over residential PACE programs. NCRC believes that AmeriNat must describe in its application fair lending and consumer protection compliance it will follow in the case of PACE lending programs. Residential PACE lending programs have been subject to abuse. Although PACE programs are authorized by state or local governments, PACE programs operate with little government oversight. The National Consumer Law Center (NCLC) documents rampant abuses associated with PACE residential lending programs including lending beyond a borrower’s ability to repay, elder financial abuse, minimal energy savings, and aggressive sales tactics by home improvement contractors of unnecessary home improvements. PACE programs have facilitated the victimization of Habitat for Humanity clients and other vulnerable populations.19

A federal regulatory agency simply cannot approve an application for a bank charter that lacks a comprehensive section about compliance with fair lending and consumer protection law.

Execution of Plan

AmeriNat’s application lacks a description of how it plans to engage the community in assessments of whether it is meeting community needs, which of course, is the central aim of the Community Reinvestment Act (CRA). NCRC urges any applicant to provide a thoughtful and rigorous description of community engagement. In particular, NCRC urges applicants for charters to commit to establishing CRA committees composed of representatives of community organizations and other community stakeholders. These committees will meet on a periodic basis to consider a bank’s CRA plan, progress in meeting goals under the plan, and how to improve CRA performance.

Conclusion

AmeriNat’s charter application cannot be approved by the FDIC. The current CRA plan does not illustrate a willingness to meet credit and deposit needs in all areas in which AmeriNat does business as required by the convenience and needs factor for charter approval. In addition to a lack of a robust CRA plan, AmeriNat does not offer an explicit and ironclad commitment to responsible and fair lending in its charter application. We ask the FDIC to reject this application and implement a high standard for any non-bank seeking the privilege of a bank charter.

Thank you for the opportunity to comment on this important matter. This letter represents the perspective of NCRC and the undersigned organizations. If you have any questions, you can reach me or Josh Silver, Senior Advisor, on 202-628-8866.

Sincerely,

Jesse Van Tol CEO

Undersigned Organizations

California

Access Plus Capital

Ephesians Community Development Center

Mutual Housing California

Peoples Self Help Housing Corp

STAND

Vermont Slauson EDC

Florida

Affordable Homeownership Foundation, Inc.

Community Reinvestment Alliance of South Florida

Florida Housing Counselor Network

Goldenrule Housing & Community Development Corp. Inc.

Housing and Community Development Division, City of Tampa

Metro North Community Development Corp.

Real Estate Education and Community Housing Inc.

Solita’s House, Inc.

St. Petersburg Neighborhood Housing Services, Inc. dba Neighborhood Home Solutions

Maryland

Maryland Consumer Rights Coalition

People for Change Coalition

Minnesota

Bii Gii Wiin CDLF

Mid-Minnesota Legal Aid

Village Financial Cooperative

Texas

Los Robles Development Company

Texas Low Income Housing Information Service

- FDIC Statement of Policy on Applications for Deposit Insurance, https://www.fdic.gov/regulations/laws/rules/5000-3000.html

- FDIC Statement of Policy.

- Statement of Martin J. Gruenberg, Chairman, Federal Deposit Insurance Corporation on De Novo Banks and Industrial Loan Companies before the Committee on Oversight and Government Reform; U.S. House of Representatives; 2157 Rayburn House Office Building, https://www.fdic.gov/news/news/speeches/spjul1316.html

- AmeriNat application, p. 77.

- Amerinat application, p. 85.

- See § 345.41 (c) (2), Assessment area delineation, of the FDIC CRA regulation via https://www.fdic.gov/regulations/laws/rules/2000-6500.html#fdic2000part345.41

- See https://www.lendingclub.com/info/statistics.action for summary data tables and to download data.

- These states are CA, NY, TX, FL, IL, NJ, PA, OH, GA,VA.

- 2016 Broadband Progress Report, Federal Communications Commission, Jan. 29, 2016, retrieved at https://www.fcc.gov/reports-research/reports/broadband-progress-reports/2016-broadband-progress-report

- Amerinat application, p. 99.

- Amerinat application, p. 98.

- Community Reinvestment Act; Interagency Questions and Answers Regarding Community Reinvestment Act Guidance, OCC, Board of Governors of the Federal Reserve System, FDIC, Fed. Reg. 81, 142 at 48506, https://www.gpo.gov/fdsys/pkg/FR-2016-07-25/pdf/2016-16693.pdf

- Interagency Q&A at 48542.

- Amerinat application, p. 90.

- Amerinat application, p. 97.

- Amerinat application, p. 97.

- Federal Register /Vol. 81, No. 142 /Monday, July 25, 2016 /Rules and Regulations, see Q&A §_.12(g)(4)(i) Activities That Revitalize or Stabilize Low- or Moderate-Income Geographies on page 48527.

- http://www.responsiblebusinesslending.org/

- National Consumer Law Center, Residential Property Assessed Clean Energy (PACE) Loans: The Perils of Easy Money for Clean Energy Improvements September 2017, https://www.nclc.org/images/pdf/energy_utility_telecom/pace/ib-pace-stories.pdf and Comments to the Consumer Financial Protection Bureau, May 2019, https://www.nclc.org/images/pdf/energy_utility_telecom/pace/nclc-nhlp-pace-comments-%20may2019.pdf