Summary

• The US economy added 336,000 jobs in September, far exceeding expectations

• Wage growth slowed, while the overall unemployment rate remained unchanged

• Weakening demand for temporary and construction workers threatens Hispanic job gains

Race, Jobs, and the Economy October 2023 Update

September 15th through October 15th is Hispanic Heritage Month. As noted in our Latino Racial Wealth Snapshot, almost 19% of Americans are Hispanic and while their population has almost doubled in number since 2020 they remain far less wealthy than non-Hispanic White Americans. From college attainment to homeownership to income, Hispanics in the US lag behind the national average. The Bureau of Labor Statistics (BLS) monthly jobs report and the ADP National Employment Report provide a deep look into employment and income. The BLS September monthly report has unemployment at 3.4% for White workers, 5.7% for Black workers, 2.8% for Asian workers and 4.6% for Hispanic workers.

In this edition of our Race, Jobs and the Economy series, we give an overview of the most recent BLS employment situation with an emphasis on key insights related to Hispanic workers.

As the fastest growing demographic in the United States, Hispanics are quite ubiquitous in the labor force yet have distinct employment trends and face unique challenges in the labor market compared to other groups.

Analysis of Topline Figures in September BLS Report

The economy added roughly 336,000 jobs for an average of 267,000 for the past 12 months. September’s job creation nearly doubled the economists’ consensus expectation that just 170,000 jobs would be added nationwide. The news is even brighter, in fact: BLS also revised upward its total job growth for July and August by some 119,000 previously-missed net new jobs. This strong growth is helping to keep all racial/ethnic groups at historically low levels of unemployment. Additionally, The unemployment rate remained unchanged at 3.8%, a historically low figure.

Jobs & Sectoral Trends

The industries with the largest employment gains in September were leisure and hospitality (+96,000), government (+73,000), healthcare (+41,000) and professional and business services (+21,000). The largest sectoral decline in jobs came in trade, transportation, and utilities (-20,000). Notably, BLS’s finding that high-paying business and professional jobs increased in September contradicts a separate ADP report finding that the economy shed 32,000 of t hose jobs over the month. Additionally, BLS’s upward revision of 119,000 jobs for July and August – is another indication that the slowdown reported by ADP may be premature or short lived.

As we noted in our previous article in this series, policymakers should pay close attention in the coming months to sectoral trends in temporary help services, or workers on temporary contracts. When employers begin shedding these workers, it may be an early recession warning indicator.

This alarm bell has been buzzing quietly for a year. The number of temporary workers has declined since October of 2022, a worrisome trend which continued in September. A similar decline occurred before the official start of the 2007 and 2001 recessions. BLS data has also shown that temporary workers are disproportionately people of color, with Hispanic workers making up almost 18% of all temporary workers. In some occupational categories they account for almost 38% of the temporary workforce.

Construction is a major industry to watch for in the coming months as rising mortgage rates chip at housing demand. 1 out of every 5 Hispanic men work in construction occupations whose average non-supervisory industry hourly wages have increased by 5.5% year-over-year compared to 4.1% overall. Construction added 11,000 jobs in September below the average of 17,000 for 2023. In October the average mortgage rate rose to 7.49%. This is the highest point for mortgage rates since 2000 and has cooled the residential housing market across the US. With 20% of Hispanic men working in construction this is an important figure to watch.

The public sector has steadily increased employment throughout 2023 including 73,000 new workers in September alone. The sector has gained 531,000 jobs so far in 2023, accounting for roughly 15% of all job growth so far. This is compared to only 5% of total growth during the equivalent period last year. Because only 9% of the federal workforce is Hispanic/Latino, the robust public sector jobs growth this year has had a smaller impact on their employment than on Black workers, who account for 19% of the federal workforce.

Wages

ADP’s report found that job-stayers -- those who appear both in the current month and the same month last year at the same employer -- experienced a 5.9% year-over-year increase in pay in September. But that net positive annual growth masks a more worrying short-term statistic: The rate of pay rises is shrinking. This is the 12th straight month of declining wage growth rates even for those who stayed in a job they’d had already.

ADP reports the same declining growth for job-changers. Wage growth for those who have changed jobs in the last 12 months shrank to an annualized 9% from 9.7% in August. The BLS found that overall wages increased 4.2% year-over-year, but again showed a steady shrinkage in wage growth rates. The last two months have seen growth decline to half the rate of the previous 10 months.

Unemployment and Labor Force Participation

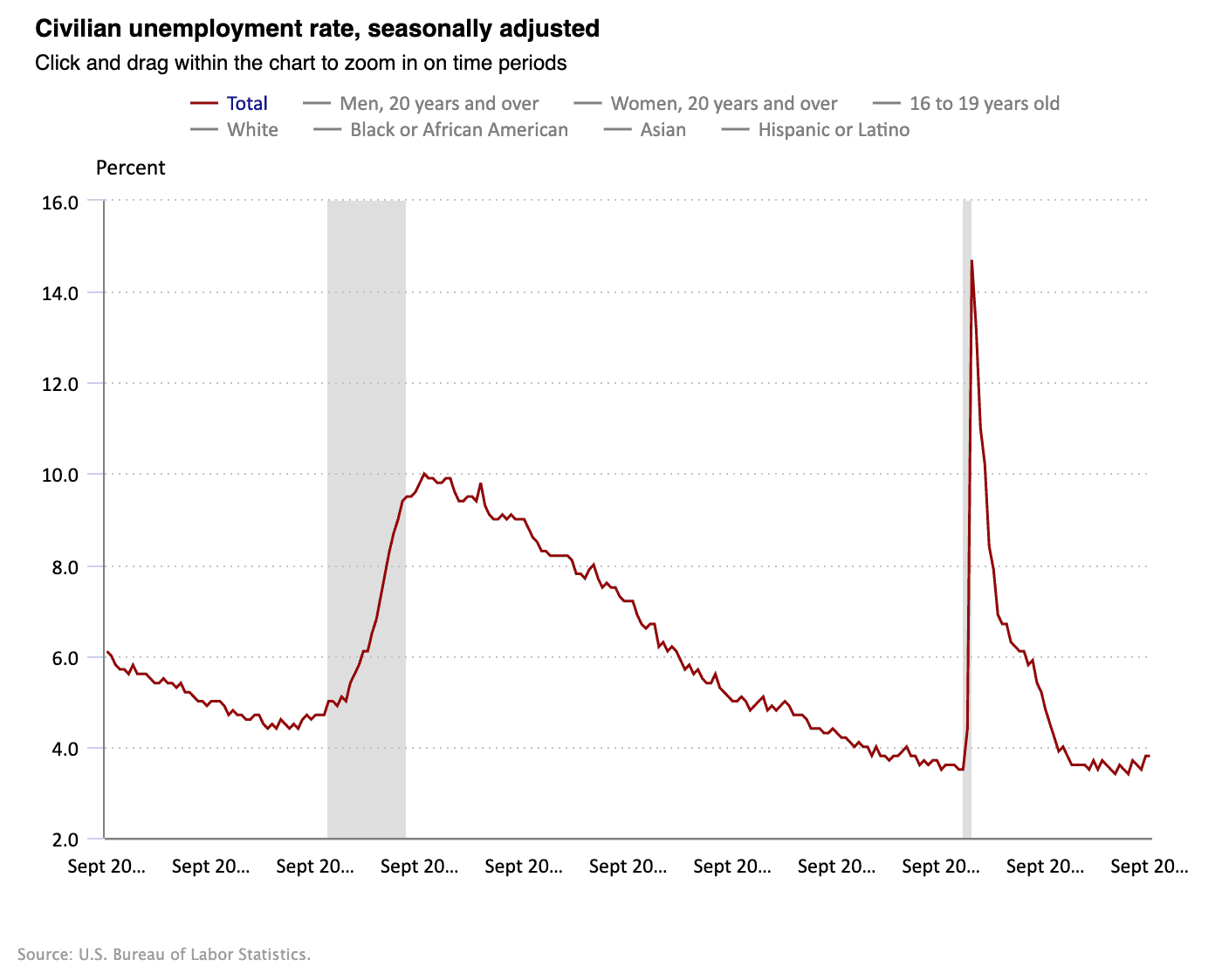

Click to view interactive chart.

Because month to month changes are fairly unremarkable, it is helpful to look at unemployment trends over time. Since February 2022 the overall rate has stayed below 4%. But it has still ticked upward in that time by enough for economists to take note: Though numerically small, the 0.28% increase in the unemployment rate in the last 12 months is considered statistically significant.

That statistically significant overall rise in unemployment reflects a far larger jump for Hispanic and Latino workers. Their overall unemployment rate has risen almost a whole percentage point from a pre-pandemic low of 4% in May to 4.9% in August. In September this trend reversed: The overall Hispanic unemployment rate declined to 4.6%. Hispanic men and women enjoyed an unchanged rate of unemployment and a decline of .1%, respectively.

The labor force participation rate (LFPR) remains unchanged at 62.8% in September and has increased a statistically significant 0.4% over 2023. Zooming out from that near-term stasis, the labor force participation rate is down from its pre-pandemic level of 63.3% and even further away from its peak of 67.3% in 2000. The long term decline has been attributed to an aging workforce and retirement among baby boomers, especially since the pandemic started.

These explanations of declining labor force participation have additional support in the September jobs report: Among prime-age workers (aged 25-54 years old), LFPR reached a nearly 20-year high in August and remained strong in September at 83.5%.

LFPR among Hispanic workers only recently returned to its pre-pandemic high. For reference, among Black workers this occurred back in May of 2022 while for White workers the rate has stagnated since the start of the pandemic.

Conclusion

The core components of the September jobs report were positive, including larger than expected jobs gains, increases in high paying sectors like healthcare and professional services, and low unemployment. While ADP found a slowdown in private sector employment, BLS data suggest this may be premature.

While the overall picture looks good, there are concerning areas particularly for certain racial groups. The trade, transportation, and utilities sector – a major employer of both Black and Hispanic men – reported a non-trivial loss of 20,000 jobs in September.

Hispanic workers have been further affected by the declining numbers of temporary workers and the smaller than average construction job gains. Additionally, Black workers experienced an increase in their unemployment rate from 5.3% to 5.7%, though this increase does not reach the threshold considered to be statistically significant.

All in all the report shows that while the economy remains strong overall, headwinds may remain for certain groups. Over the coming months, we will continue to watch key recession-indicator industries such as construction and temporary services, which are major employers of the Hispanic workers upon whom we focussed this month’s analysis.

Joseph Dean is the Racial Economic Junior Research Specialist

Dedrick Asante-Muhammad is the Chief of Organizing, Policy, and Equity

Image: ImageFlow@adobestock.com