April 24, 2023

The Federal Housing Finance Agency

Office of Fair Lending Oversight

400 7th Street SW 9th Floor

Washington, D.C. 20219

RE: Enterprise Single Family Social Bond Policy RFI

The National Community Reinvestment Coalition (NCRC) appreciates the opportunity to submit written comments to the Federal Housing Finance Agency (FHFA) in response to its Request for Input regarding single-family social bonds. We appreciate the FHFA’s willingness to consider single-family social bonds as a designation that can meet the needs of low-income people, people of color, and other underserved communities as a potential supplement to the government-sponsored enterprises’ affordable housing goals. We believe that the social bond designation will fulfill a valuable purpose if it is reserved for loan purchases that are more deeply targeted than the affordable housing goals and the special affordable homeownership programs of the Government Sponsored Enterprises (GSEs)

NCRC and its grassroots member organizations create opportunities for people to build wealth. We work with community leaders, policymakers and financial institutions to promote fairness and end discrimination in lending, housing and business. NCRC was formed in 1990 by national, regional and local organizations to increase the flow of private capital into traditionally underserved communities. NCRC has grown into an association of more than 700 community-based organizations that promote access to basic banking services, affordable housing, entrepreneurship, job creation and vibrant communities for America’s working families. Our members include community reinvestment organizations, community development corporations, local and state government agencies, faith-based institutions, community organizing and civil rights groups, minority and women-owned business associations, and social service providers from across the nation.

NCRC recommends more stringent targeting requirements for social bonds because the private sector must be encouraged to reach populations that are currently underserved. According to the FHFA’s RFI, investors are willing to pay a premium for single family Uniform Mortgage Backed Securities (UMBS) targeted to low- and moderate-income (LMI) households because these households do not “prepay” or refinance their loans as often as affluent borrowers.[1] This means that investors benefit from UMBS payments for a longer period on UMBS financing loans to LMI and other underserved populations. Since the private sector is willing to pay a premium, the premium should be more deeply targeted than currently under the UMBS that consist of loans qualifying for the affordable housing goals and are made under Fannie’s HomeReady or Freddie’s Home Possible programs.

An outcome that would be suboptimal from the perspective of equity is if social bonds end up financing a large portion of the GSE’s UMBS market. This dilutes the private subsidy and does not target it to the most underserved populations. We believe it is most efficient and equitable to employ Social Bond financing for populations that are being underserved to a great extent by the private market.

In order to qualify for the affordable housing goals, a loan must be a home purchase loan for a low-income or very low-income borrower, a home purchase loan in a minority census tract to borrowers with no more than 100% of area median income, home purchase loans in low-income census tracts, and refinance loans for low-income borrowers.[2]

In addition to the affordable housing goals, both GSE’s operate affordable homeownership programs. Freddie Mac operates a Home Possible program targeting low-income and very low-income borrowers that include these features[3]:

- 3% downpayment,

- Mortgage insurance can be cancelled after loan balance drops below 80% of home’s appraised value, and

- Credit fees are capped and less than standard fees for all loans over 80% LTV.

Similarly, Fannie Mae operates a HomeReady program for low-income borrowers with these features:

- 3% downpayment,

- Flexible funding for downpayment or closing costs including gifts or grants, and

- Qualifying income can include rental or boarder income, including income from Accessory Dwelling Units[4]

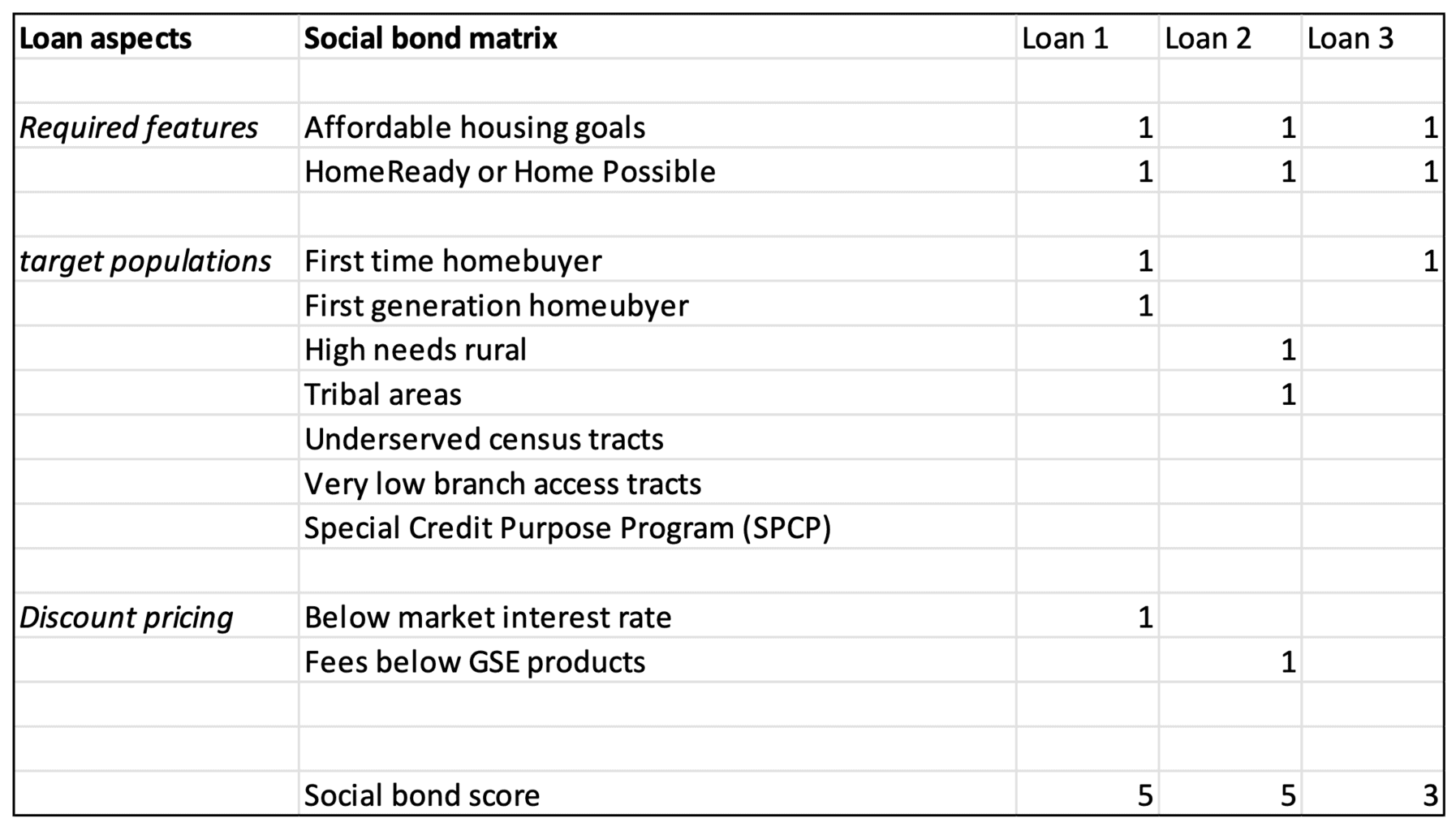

Loans qualifying under the affordable housing (AFH) goals and the GSE special affordable programs target underserved populations, but additional private subsidies are not necessarily needed since the goals and the special affordable programs have been operating for several years. Thus, social bond designations should be more deeply targeted than the AFH and the special affordable programs. In the matrix below, the first two rows indicate if a loan has the targeting requirements of AFH goals and the all the loan terms and features of either HomeReady for Fannie Mae or Home Choice for Freddie Mac. The additional rows then indicate if the loans target geographical areas or have loan terms or pricing discounts beyond AFH and the GSE HomeReady and Home Choice programs.

The table below illustrates how to establish deeper targeting for Social Bond designation. A minimum score could be established for Social Bond designation, such as a score of 5. The table below has three loans: Loan 1 and Loan 2 would qualify for a UMBS receiving social bond designation while Loan 3 would not qualify. All three loans qualify for AFH goals and have features that qualify for the GSE special affordable programs of Home Choice and HomeReady. In addition, Loan 1 was made to a first-time homebuyer and a first-generation homebuyer (in addition to the first time buying a home, the borrower comes from a family that did not own a home). These are demographic characteristics that are not the focus of the AFH goals, but which are demographic characteristics of other underserved populations. In addition, Loan 1 has a below market interest rate (lower than the interest rates in the GSE special affordable programs). Loan 1 would have a Social Bond score of 5 and would thus qualify as a Social Bond loan.

Likewise, Loan 2 has a score of 5 because in addition to qualifying under the AFH goals and the GSE special affordable programs, it was made in a high needs rural area and in a tribal area; it also reduces fees to a greater extent than the GSE special affordable programs. The matrix and scoring system in this comment letter are for illustrative purposes; the FHFA could further refine and expand the matrix and scoring system along the lines of our proposal.

Qualifying Loans for Social Bond Designation

In addition to deeper targeting, NCRC recommends that the FHFA make data on social bond UMBS publicly available, preferably on a loan level but at least on an aggregate basis by census tract and county. If the FHFA decides to release the data on aggregated level by tract or county, the data should nevertheless contain summary borrower demographic data such as the number of first-time homebuyers out of all loans in the geographical area.

With publicly available data, stakeholders can then determine if Social Bond loans are targeting underserved areas or if improvements to geographical targeting can be made. If Social Bond loans are not concentrated in areas with low levels of loans on a per capital basis, the social bond matrix can be revised to include census tracts or counties with the lowest level of loans on a per capital basis (census tracts or counties in the lowest quartile or quintile could qualify as underserved). In a series of white papers, NCRC has developed a concept of underserved tracts or counties that FHFA can adopt or adapt for a scoring system.[5] In addition, the federal bank agencies have developed a methodology for determining tracts with very low access to bank branches that could be used for a social bond matrix as indicated in the table above.[6]

The social bond matrix should also contain an option for Special Purpose Credit Programs (SPCP). Sanctioned by the Department of Housing and Urban Development and the Consumer Financial Protection Bureau, lending institutions develop SPCP programs to target underserved populations or areas, using data analysis to identify populations or areas that are underserved and experience difficulties in accessing credit.[7] SPCP programs are innovative in that they are tailored to local economic and demographic conditions and are likely to identify various groups of underserved borrowers and communities across the country. Lenders will have data identifying which of their loans are SPCP loans, facilitating their bundling into UMBS. We also hope that the federal bank agencies provide CRA points for SPCP programs in their revisions to the CRA regulations.

Banks could earn CRA credit by purchasing UMBS consisting of Social Bonds if the Social Bond program is designed as NCRC recommends. Bank purchases of loans have been controversial in the CRA context. NCRC and others have suggested that CRA exams should prioritize loan originations as opposed to loan purchases since making loans is often the more difficult task and is more directly responsive to local community needs. However, if loan purchases target truly underserved populations and acceptable documentation of this targeting is provided to CRA examiners via publicly available data, then loan purchases like Social Bond UMBS would serve a more meaningful role than the usual bank purchases of MBS in meeting community credit needs.

The concept of Social Bond designation would be most useful if it is used to push the private market even further to underserved populations than the current legal mandates and GSE programs. On the other hand, if targeting requirements are too loose, social bond designation could amount to public relations endeavor with little meaning. We thank you for this opportunity to comment on this important manner.

If you have any questions, feel free to contact myself at jvantol@ncrc.org or Josh Silver, Senior Fellow, at jsilver97@gmail.com.

Sincerely,

Jesse Van Tol

President and CEO

[1] Federal Housing Finance Agency, Enterprise Single-Family Social Bond Policy Request for Input,

[2] Federal Housing Finance Agency, 12 CFR Part 1282 RIN 2590-AB12, 2022-2024 Single-Family and 2022 Multifamily Enterprise Housing Goals, https://www.fhfa.gov/SupervisionRegulation/Rules/Pages/2022-2024-Enterprise-Housing-Goals-Final-Rule.aspx

[3] Freddie Mac, Home Possible, https://sf.freddiemac.com/working-with-us/origination-underwriting/mortgage-products/home-possible

[4] Fannie Mae, HomeReady Mortgage, https://singlefamily.fanniemae.com/originating-underwriting/mortgage-products/homeready-mortgage

[5] Bruce Mitchell, PhD. and Josh Silver, Adding Underserved Census Tracts As Criterion On CRA Exams, January 2020, NCRC, https://ncrc.org/adding-underserved-census-tracts-as-criterion-on-cra-exams/ Josh Silver and Bruce Mitchell, PhD., How To Consider Community Development Financing Outside Of Assessment Areas By Designating Underserved Counties, NCRC, January 2020, https://ncrc.org/how-to-consider-community-development-financing-outside-of-assessment-areas-by-designating-underserved-counties/

[6] Office of the Comptroller of the Currency, Federal Reserve Board, Federal Deposit Insurance Corporation, Notice of Proposed Rulemaking (NPR) to amend the CRA regulations, May 5, 2022, issued version, pp. 267-269, https://www.federalreserve.gov/consumerscommunities/files/cra-npr-fr-notice-20220505.pdf

[7] For a Department of Housing and Urban Development Memorandum on these programs, see https://www.hud.gov/sites/dfiles/FHEO/documents/FHEO_Statement_on_Fair_Housing_and_Special_Purpose_Programs_FINAL.pdf