NCRC President and CEO Jesse Van Tol testified Friday, July 19, at a public hearing on the proposed Capital One-Discover merger. Here are his prepared remarks:

Good Morning, I’m Jesse Van Tol, President and CEO of NCRC.

This merger is a terrible, horrible, no good, very bad idea. And I could just end my testimony there.

And not just because it would create another too-big-to-fail bank…

…And not just because it would undermine competition and raise prices. It’s also a bad idea because Capital One is a bad actor.

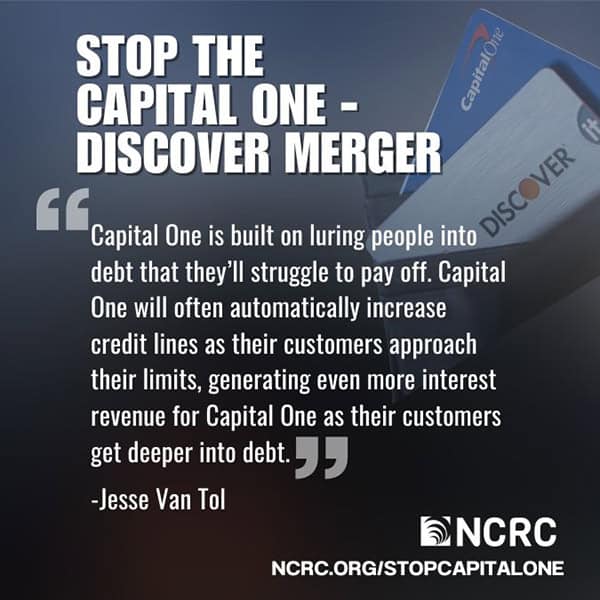

Capital One is built on luring people into debt that they’ll struggle to pay off. Capital One will often automatically increase credit lines as their customers approach their limits, generating even more interest revenue for Capital One as their customers get deeper into debt.

As regulators, your duties with respect to mergers are clear. While the agencies have evolved their merger guidelines over the years, a review of the underlying statutes makes it very clear that you have an obligation to ensure that the public benefits when a merger is approved. This is most clear with respect to antitrust, where unless the public benefits clearly outweigh the adverse effects of a merger, you’re required to deny the merger.

One common way bank’s demonstrate that a marger will benefit the public, is through a community benefits plan.

When Capital One bought ING Direct in 2012. It made a commitment that wasn’t worth the paper it was printed on. It was a commitment to do more of the same, mostly subprime credit card and auto lending. The one part that was good – a $28.5 billion

LMI mortgage commitment – turned out to be a false promise, as Capital One abandoned the mortgage business just a few years later and lent less than half of that.

Capital One is at it again. On Wednesday, they announced a $265 billion community benefit plan. It ought to be called a Corporate Phony Baloney plan.

That’s because of the $265 billion commitment, as little as $4.5 billion of it is new money, according to our analysis. While we are still comparing it to other plans, that amount of new money appears to be an ORDER of MAGNITUDE SMALLER than any other recently announced plan, such as US Bank, TD or BMO.

- For example, it includes $200 billion of consumer credit card and auto lending, something no other community plan includes in the plan total. Capital One makes no claim that this is an increase.

- Take that away and it’s just a $65 billion plan. But it’s not even a $65 billion plan, because most of that is not an expansion over current performance. The plan includes $44 billion in community development, which it claims to be an increase based on what the bank was supposedly planning to do before the merger. But, in fact, it’s not an increase at all, as the bank’s past performance suggests a run rate of almost exactly $44 billion over five years.

- There are numerous other shortcomings with this plan. The plan does not create sufficient public benefit, and it does not address the biggest problems with this merger. To fix that, Capital One should make the new money in the plan an order of magnitude bigger, and consider taking Discover’s innovative housing and small business finance programs nationwide at scale, along with many other changes.

And we know the harms and adverse effects the merger will cause: higher interest rates, branch closures, and customer harm.

In closing, NCRC and over 140 organizations that have signed on to our comment letter, ask the OCC and the Federal Reserve to deny this merger.

Our country deserves a regulatory system that says no to bad actors, and one that recognizes the difference between a legitimate community commitment and a cynical one made just to get merger approval, and then torn up afterwards.

When Capital One bought ING Direct, regulators trusted the commitments they made. They shouldn’t have. You can make a different choice: deny this merger.

Thank you for the opportunity to testify.