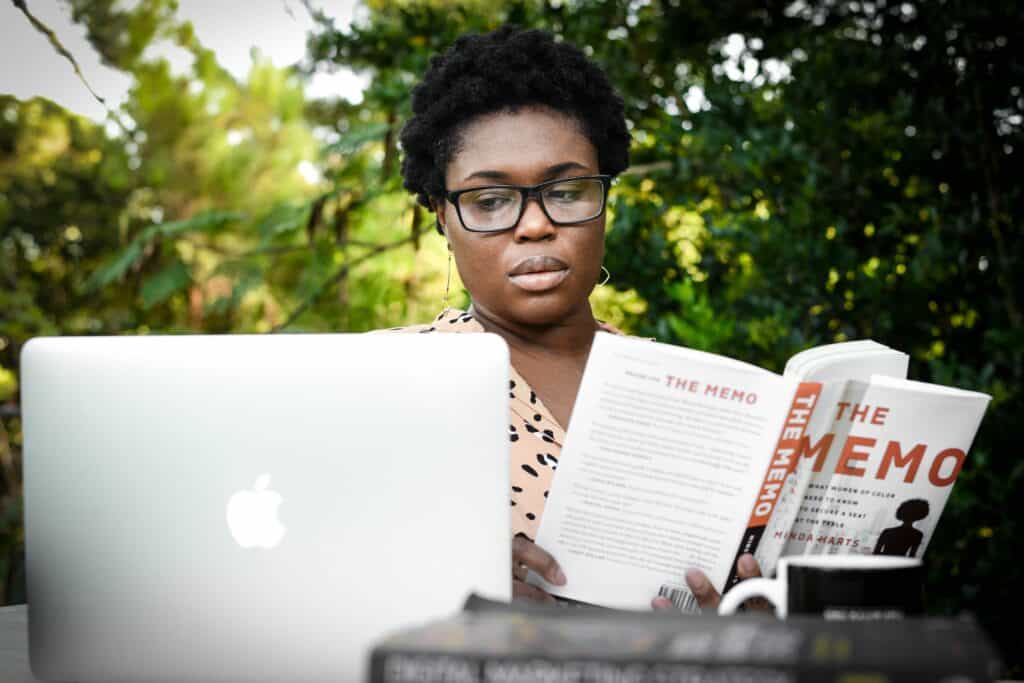

Women entrepreneurs have always faced many challenges, including access to capital, technical training, work-life balance and discrimination in pay. Black entrepreneurs face an even greater disparity.

The COVID-19 public health emergency has brought in new hurdles, especially for women-owned small businesses. Safety measures have put a strain on child care while remote instruction and other social distancing efforts have defined a “new norm.” An unintended consequence of the pandemic for many small businesses is a decrease in revenue, as customers juggle transitioning and are opting to stay home.

As the pandemic continues, the challenges small businesses and entrepreneurs face are heightened. Adjusting to a new normal proves to be most challenging for minority-owned businesses. Female, Black, Latinx and immigrant business owners were hit the hardest by early-stage losses.

In a 2017 report by the U.S. Committee on Small Business and Entrepreneurship, access to mentors and capital were among the top three institutional barriers that women face in efforts to sustain and grow their small businesses.

To understand the institutional barriers that still limit business growth for minority entrepreneurs, we can look at a more recent report published by the National Community Reinvestment Coalition (NCRC). Female and Black testers that had better income, credit scores and assets were discouraged from applying for bank loans at a higher rate than White testers despite having slightly better credentials. Additional research showed that Black businesses received only 2% of the billions of dollars in coronavirus relief aid.

So, what do women entrepreneurs need to engage, sustain and become successful with their small businesses?

In addition to public policy efforts to encourage and incentivize minority small business investments, training, mentorship, technical assistance and finance can have substantial impact on bridging the gender gap and promoting entrepreneurship.

The DC Women’s Business Center (DCWBC), supported by the U.S. Small Business Administration and NCRC, delivers those services. The center provides one on one counseling and online training webinars to assist in the growth of women-owned businesses, particularly those in underserved communities. The DCWBC also provides technical assistance to entrepreneurs interested in federal and local government procurement opportunities. Connect with us today to see how we can work to support women-owned businesses develop and grow. DCWBC.org.

Monti Taylor is a resource coordinator for the DC Women’s Business Center.

Photo by Kelly Fournier on Unsplash.