Anneliese Lederer, Director of Fair Lending & Consumer Protection, NCRC

Dedrick Asante-Muhammad, Chief of Race, Wealth and Community,

In cooperation with:

Jerome Williams, Rutgers University; Sterling Bone, Utah State University; Glenn Christensen, Brigham Young University

Executive Summary

The number of businesses owned by women is on the rise,[1] but female entrepreneurs still face more obstacles than men in obtaining small business loans. This study found that Black women business owners face the most difficulty getting loans from banks. The National Community Reinvestment Coalition (NCRC) evaluated 120 matched-pair tests involving a mix of gender and race combinations at 90 bank branches belonging to 54 different financial institutions in the Atlanta, Georgia, and Washington, D.C., metropolitan statistical areas (MSA). NCRC found that while all testers received inadequate treatment from banking personnel, women and people of color reported the worst experiences.

The results add to previous NCRC studies, released in September 2019 and 2017, that found stark differences in the treatment of Black and Hispanic business owners who applied for small business loans compared to White applicants. The earlier matched-pair tests focused on race but did not examine gender differences. This study found that women in general faced a tougher loan application process than men – and Black women faced the toughest of all.

The Equal Credit Opportunity Act (ECOA) requires the financial industry to lend without discrimination on the basis of race or gender (as well as religion, national origin, marital status, age or because you get public assistance). Discouragement in the pre-application process is included under ECOA. Evidence of discrimination by a lender can be grounds for ECOA enforcement actions by federal agencies and private organizations.

NCRC’s matched-pair test findings suggest that financial institutions need better training and internal controls so their employees have a better understanding of borrower expectations and anti-discrimination laws. But training is only as effective as a financial institution’s compliance program. A strong compliance program should include audits and matched-pair mystery shopping. Banks can also limit biases by hiring a more diverse staff.

Financial institutions can’t do this alone. The Consumer Financial Protection Bureau (CFPB) needs to implement section 1071 of the Dodd-Frank Act, which required banks to collect data on their lending practices. This information would help lenders, small business owners, advocates and the government enforce ECOA and better understand growing wealth disparities.

Women and Entrepreneurship

There has been a 6%[2] growth in women-owned businesses from 2017-2018, resulting in 40%[3] of all businesses in the U.S. owned by a woman. As the total number of women entrepreneurs has increased, so too, has the number of women entrepreneurs of color. About 5,824,300[4] businesses in 2018 were owned by minority women, representing about 47%[5] of all women-owned businesses.

Congress has even taken notice. The U.S. House of Representatives passed a bill that doubled the amount that the Small Business Administration Women’s Business Centers[6] could receive to $300,000.[7] These resource centers provide education on promising practices, technical assistance, encouragement and connection to entrepreneurial support systems including financing for free or significantly discounted rates so women can successfully run and expand their small business. This increase in funding is important but is not enough to help even a third of the 12.3 million[8] women-owned businesses across the country that qualify.

An important piece to the entrepreneurial puzzle is access to capital. This foundational piece is too often missing for small business entrepreneurs, particularly women of color. Currently, there does not exist a cohesive, comprehensive, publicly available database that breaks down all the small business lending by type of loan product, amount requested, amount received, type of business, length of time in business and other pertinent information. This type of database would provide the public with a clear understanding of the small business lending arena. A comprehensive database like this would provide insight and understanding into who is making small business loans and who is receiving them. Under section 1071 of the Dodd-Frank Act of 2010, Congress delegated this responsibility to the Consumer Financial Protection Bureau (CFPB). The CFPB has still not fulfilled this Congressionally-mandated directive.

The only publicly available data is Small Business Administration (SBA) loans and Community Reinvestment Act (CRA) accredited loans. However, these loans make up a tiny percentage of total small business lending. SBA loans only make up between 3%-7%[9] of the total $1.4 trillion small business loan market.[10] From this limited publicly available data, we know that about 4%[11] of commercial loans and 18%[12] of SBA loans go to women-owned businesses. The CRA small business lending data does not contain any indications of the gender or racial/ethnic background of borrowers.

Small Business owners who are unable to find funding from traditional sources will turn towards alternative credit providers, such as Fintechs, which are online providers of capital. One Fintech, Fundera, published a report on their small business lending data,The State of Online Small Business Lending: Spotlight on Women Entrepreneurs. They found that there are significant disparities between lending to women and male entrepreneurs. On average, women asked for $35,000 less than men when they made their initial funding request. Women also received smaller loan amounts compared to men in every type of loan product that Fundera offers (e.g., SBA loan, Medium-term loan, line of credit, etc.). Additionally, women took out more expensive loans compared to men, which affects business development, as it shrinks the amount of total capital women have to grow their business. The report noted that about 30% of women took out short-term loans, which have higher interest rates and lower eligibility standards, compared to 20% of men. About 31% of men took out medium-term, more affordable loans, compared to 26% of women.

Wealth and Entrepreneurship

In January 2019, the Institute for Policy Studies released the report, “Dreams Deferred,” that highlighted how racial wealth inequality has increased over the last 33 years. In 2016, White median wealth was $146,984, Latino median wealth was $6,591 and Black wealth was at a low $3,557. Dr. Mariko Chang found in, “Women and Wealth: Insight for Grantmakers,” that single African American women between the ages of 18-64 have a median wealth of $200, for Latina’s it is $100 and White women have $15,640. For single men in the same age bracket, the median wealth for Black men is $300, for Latino’s $950 and for White men $28,900. There is growing recognition that wealth is a central indicator of the economic well-being and stability of households and that such low levels of wealth are a significant indicator of deep economic insecurity.

Professor Edward Wolff’s 2017 paper, “Deconstructing Household Wealth Trends in the United States, 1983-2016,” noted that throughout the last 33 years unincorporated business equity has consistently been the second-largest percent of gross assets only behind principal residence. Business equity is a foundational part of wealth development in this country, making small business development a central aspect of strengthening financial well-being for many Americans. With the aforementioned growth of women-owned businesses, it’s necessary that we learn more about and understand the barriers that women and particularly women of color face as business owners. To properly assist women in the journey to equal wealth and success as entrepreneurs, we must pay close attention to the basic level of treatment among small business owners by financial institutions.

Examining Small Business Lending

“Disinvestment, Discouragement and Inequity in Small Business Lending” examines the racial realities and the practices of bank investing in small businesses. As a follow up to those explorations, this white paper added a gender lens. The purpose of mystery shopping is not only to uncover possible fair lending and compliance violations, but to better understand the barriers that different people experience when trying to gather information from lenders. Mystery shopping helps to reveal “discrimination with a smile.” It uncovers behaviors that an individual may not realize are an issue but, when seen in the totality of the matched-pair setting, reveal the presence of discouragement, discrimination and fundamental marketing failures. Revealing these barriers allows us to work towards solutions to dismantle them.

Throughout 2018 and 2019, NCRC completed racial and gender mystery shopping in the small business pre-application stage in Atlanta’s MSA and in D.C.’s MSA. The shopping focused on the experience that White and/or Black females have when inquiring about a small business loan. NCRC analyzed the differences in treatment that matched-pair testers received throughout the interaction when they inquired about a small business loan.

Methodology

NCRC, in collaboration with our academic partners, conducted and examined 60 matched-pair gender tests (white male v. white female) in the Atlanta MSA and 60 male and female race tests (white male v black male and white female v black female) in the Washington, D.C., MSA for a total of 240 interactions between testers and banks. These tests occurred in 90 bank branches belonging to 54 financial institutions. The purpose of the research was to determine the baseline customer service level that men and women testers received when seeking information about small business loans.

This study, like our previous studies, was designed to answer the following research questions. Are minority and non-minority small business owners with similar economic and business profiles:

- Presented with the same information?

- Required to provide the same information?

- Given the same level of service quality and encouragement?

Matched-pair mystery shoppers had nearly identical business profiles and strong credit histories to inquire about a small business loan product to expand their business. The profiles of all testers were sufficiently strong that, on paper, they would all qualify for a loan. Furthermore, the women and Black male tester profiles were slightly better than their White male counterparts in terms of income, assets and credit scores.

Immediately following the interaction, testers were asked to answer either yes or no about whether specific behaviors, queries and comments were made by bank small business lending specialists. These interactions were categorized into four stages: the initial introduction, information gathering by the bank, information provided to the customer and the close of the discussion.

NCRC and our academic partners applied statistical analysis in evaluating whether differences in the interactions between White testers and Black testers were significant. The chi-square test for independence is a particularly robust way for social scientists to evaluate whether or not there are substantial differences in outcomes between groups. The simple “yes or no” categorization of the interactions between bank personnel and testers and the number of interactions observed ensure high level of validity.

Our relationship with our academic partners has resulted in expanding our analysis of the mystery shopping tests through the additional lense of the customer experience and customer satisfaction. This lense has both fair lending and market profitability implications. The Federal Reserve Small Business Credit Survey 2019 Report on Nonemployer Firmsstates that 13%[13] of all small business owners do not apply for credit because they are discouraged. Discouragement can occur when the customer experience is poor. The ECOA recognizes discouragement in the pre-application sphere as a potential fair lending violation. Furthermore, there is a strong correlation between customer satisfaction and customer loyalty leading to long-term financial success for a company.[14]

One method to measure the customer experience is to plot the experience on a line graph with segmentations at 25%, 50% and 75%. There is a marketing quantitative standard that to demonstrate good marketing practices all marketing measures should be in the 4th quantile or 80% and higher.[15] As a marketing measure, strong customer experience will be plotted on the bar graph in the 4th quantile. Practice measures that fall below the 4th quantile demonstrate a decline in the customer experience and increased dissatisfaction and company disloyalty. If a majority of the different measures don’t enter into the 4th quintile, then all testers received poor customer service regardless of their race or gender.

Results

Our overall analysis reveals the following significant findings:

- All of our testers, regardless of race, received poor service as many of our measures did not fall into the 4th quantile.

- In terms of greeting, information asked and closing we see strongest differences in the D.C. MSA.

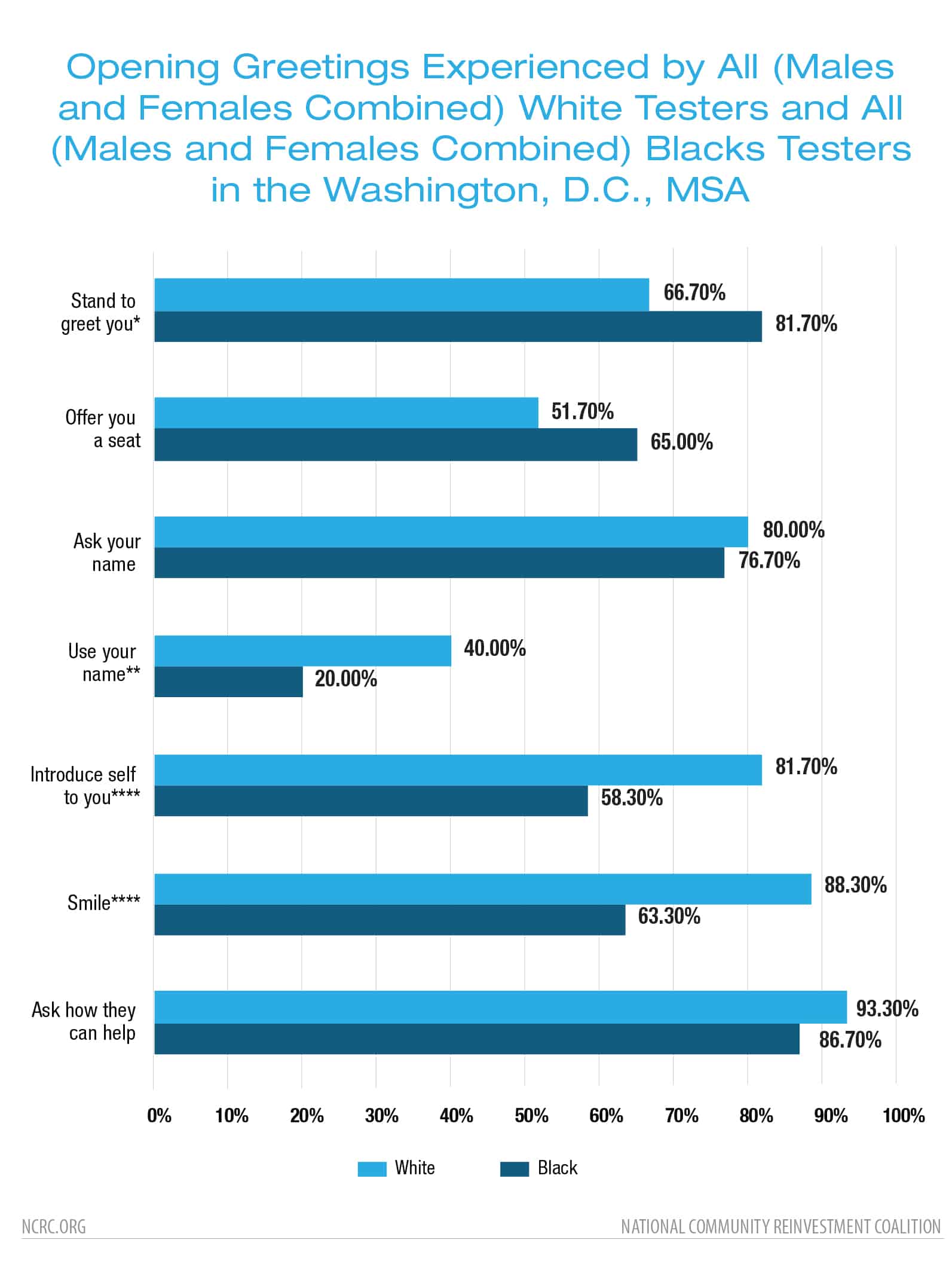

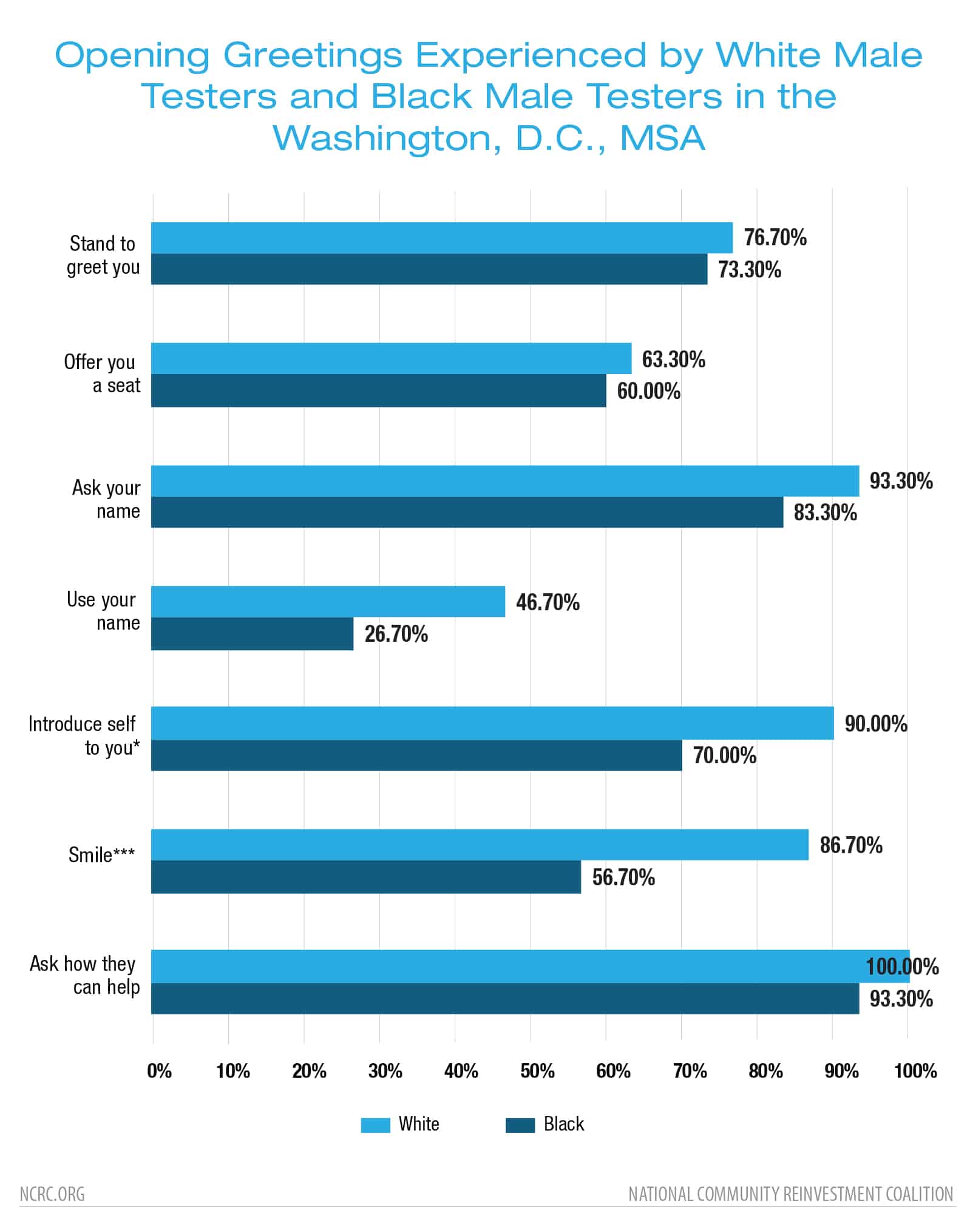

- During the greeting of prospective clients in D.C., none of our six greeting indicators had Black men receive the best treatment and none had White men receiving the worst treatment.

- In terms of information asked, the most numerical and largest percentage differences are found between Black women and White women in D.C., where Black women are much more likely to be asked about the name of their businesses and how the business is registered.

- For closing out interactions, we see that the D.C. MSA had three statistical significant differences by gender all favoring men.

Greeting

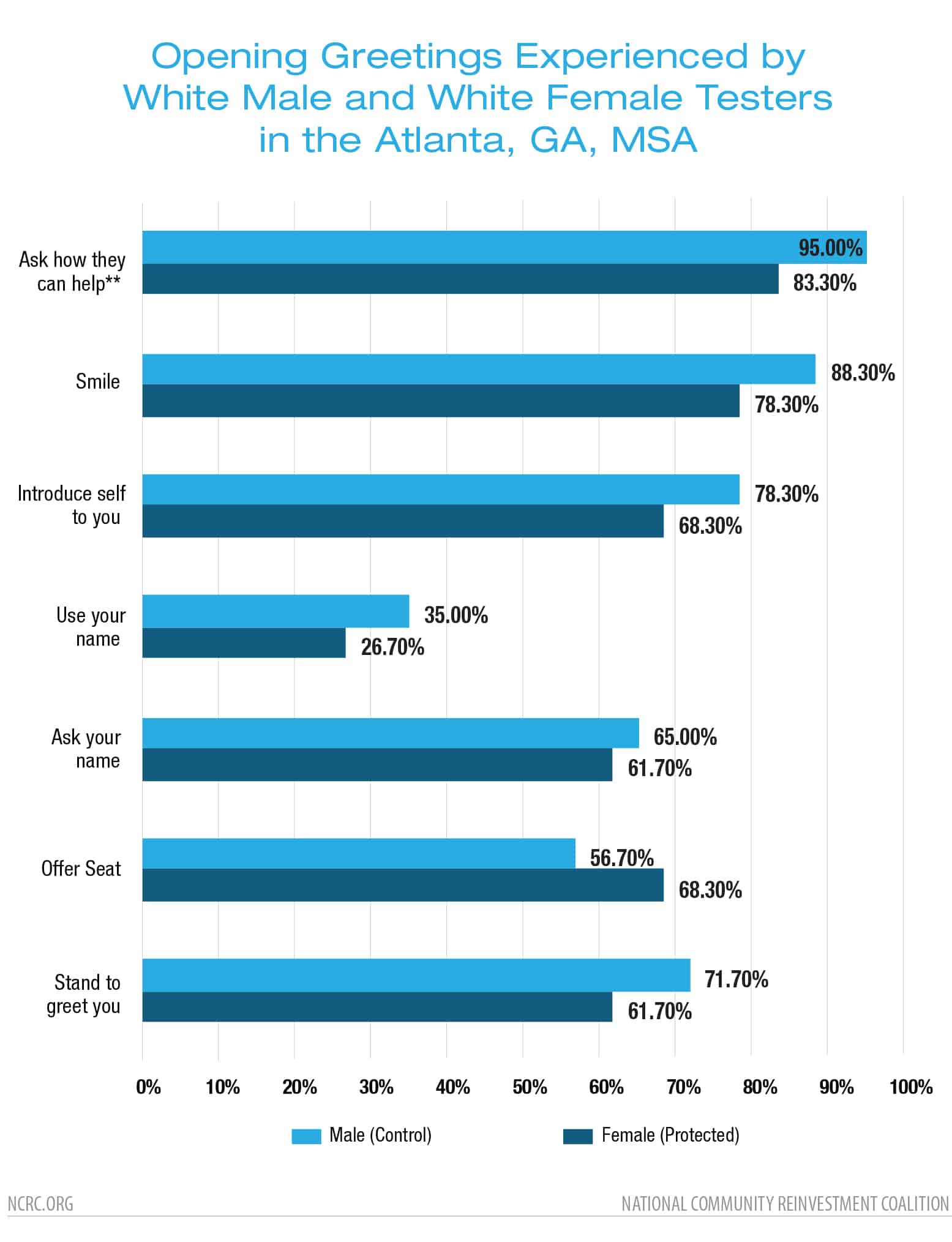

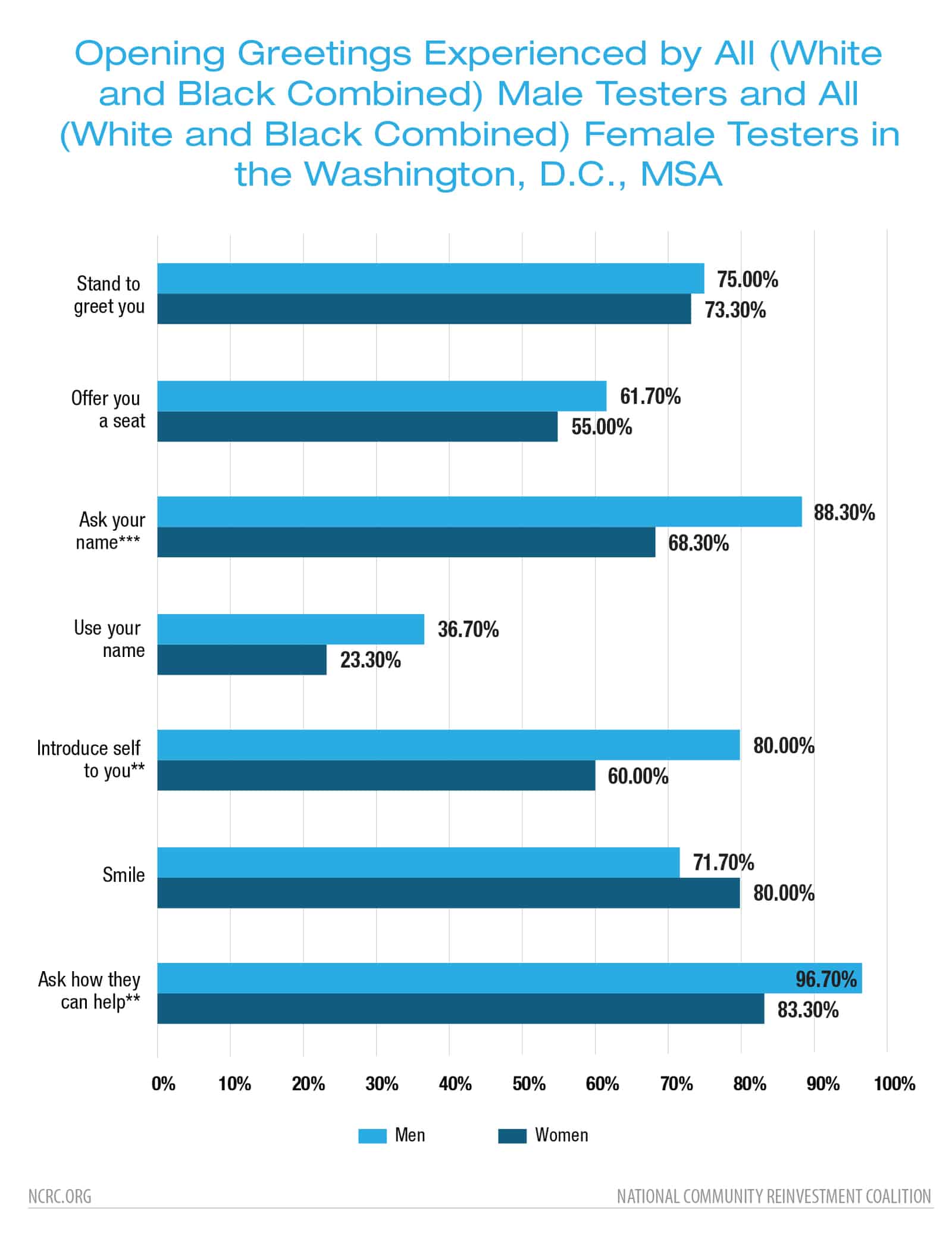

The initial contact between the lending staff and the prospective client was measured through five indicators: standing to greet you; offering a seat; asking of name; using name; introduction to prospective client; smiling and asking if prospective client can be helped. Greeting a prospective client is the first opportunity a company has to impress its values and corporate culture upon a potential customer. It is the beginning of the client relationship and helps to shape the whole interaction. Introductions inform people about who they are speaking with and provide context to determine if the information they are receiving is valid and correct.

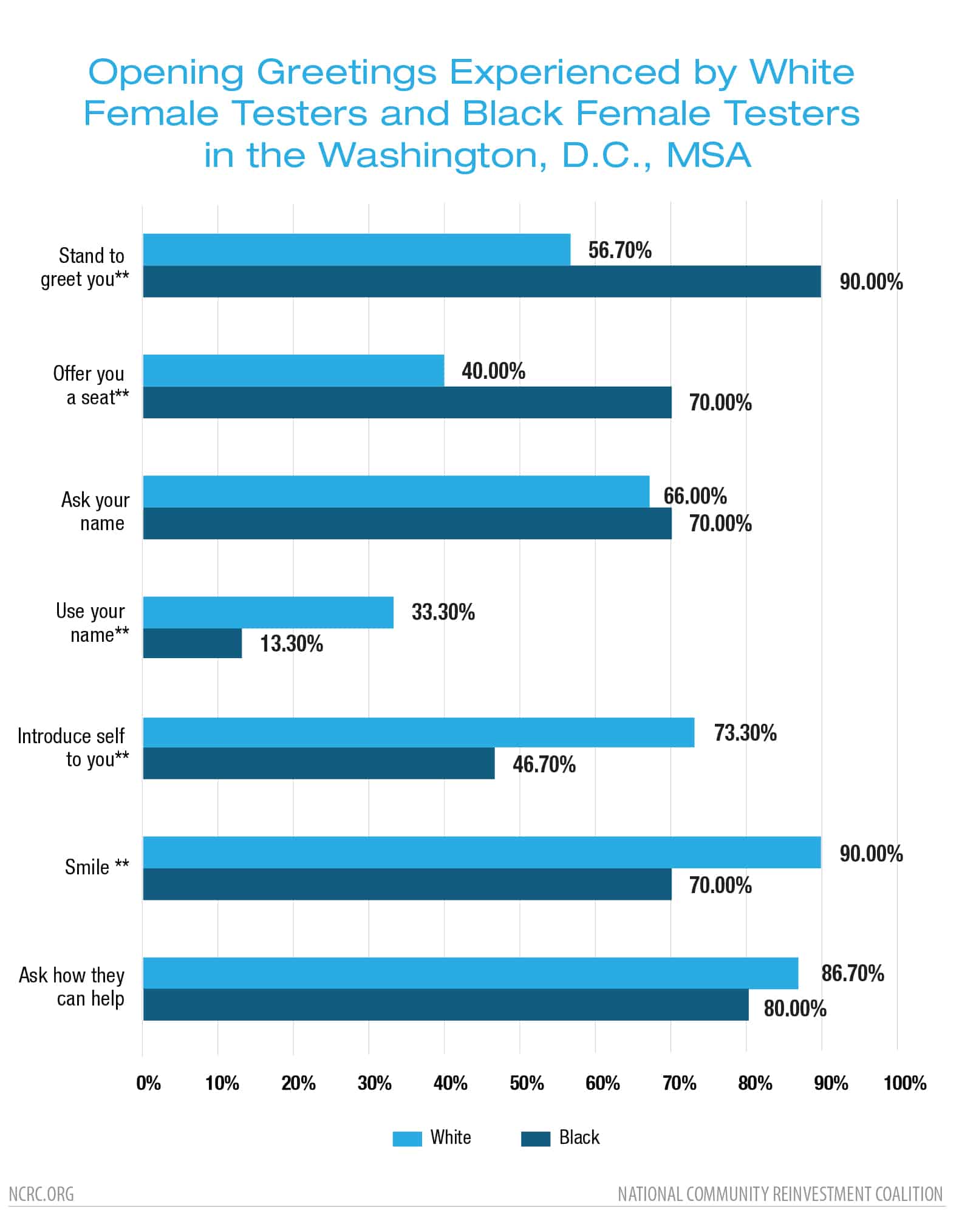

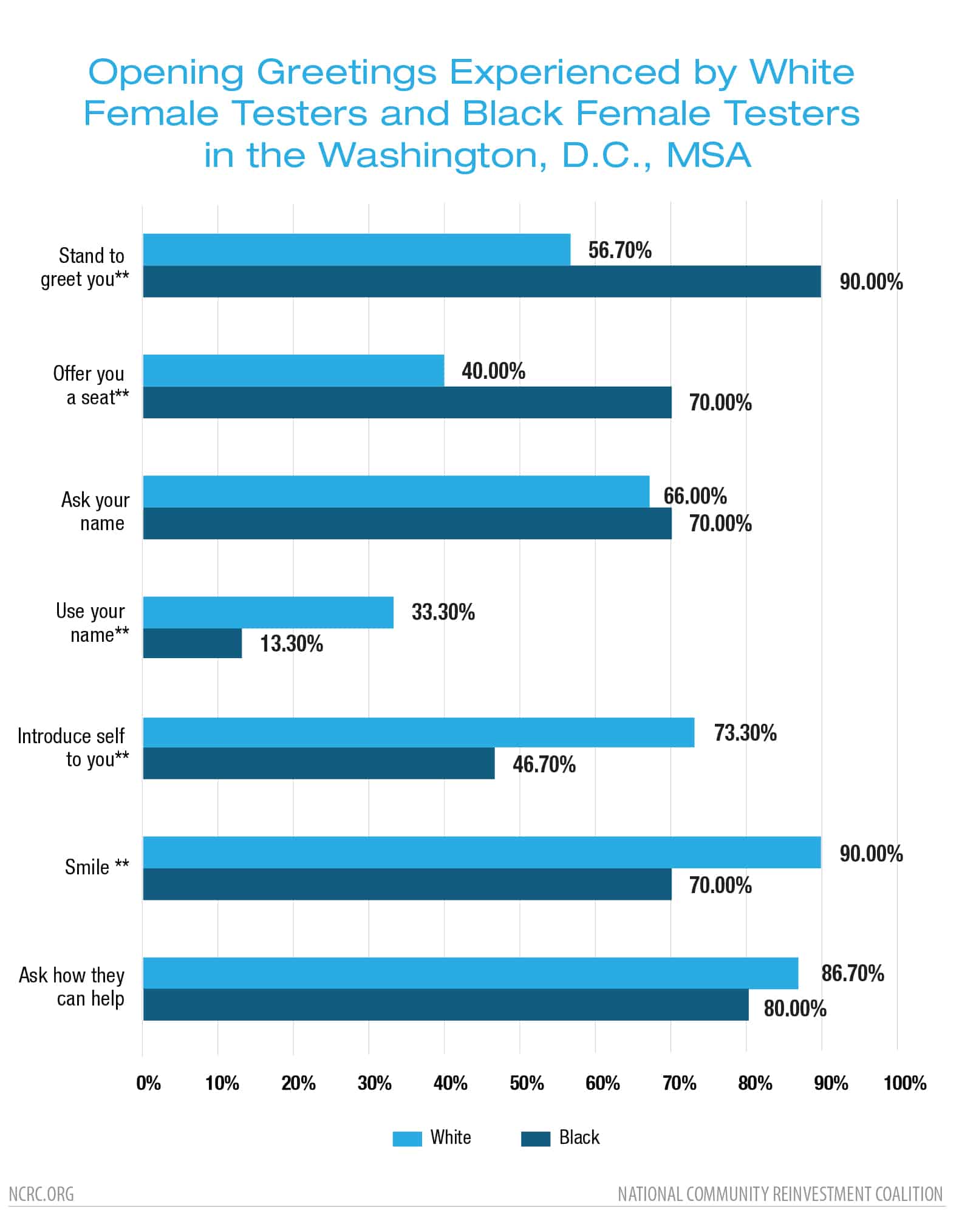

In Figure E below, we see there are widespread disparities in treatment between Black women and White women in terms of greetings. Remarkably, five out of six areas in Figure E show statistically significant disparities in treatment.

In the greeting section, there is one measure that is statistically significant among all the figures. This is the measure of bank representatives “introduction of self to you.” Black women received this measure the least. Thus, when a Black woman tester walked into a financial institution, she was less likely to receive an introduction from a bank employee. This was juxtaposed by the experience of White male testers where employees almost always introduced themselves (90.0% v. 46.70%).

Bank employees who do not introduce themselves to prospective clients are not being transparent. This lack of transparency makes the application process more difficult for Black women entrepreneurs which is a challenge often reported by minority entrepreneurs when applying for credit.[16]

To see more of our results as it relates to Greetings, see Figures A-E at the end of the paper.

Information Asked

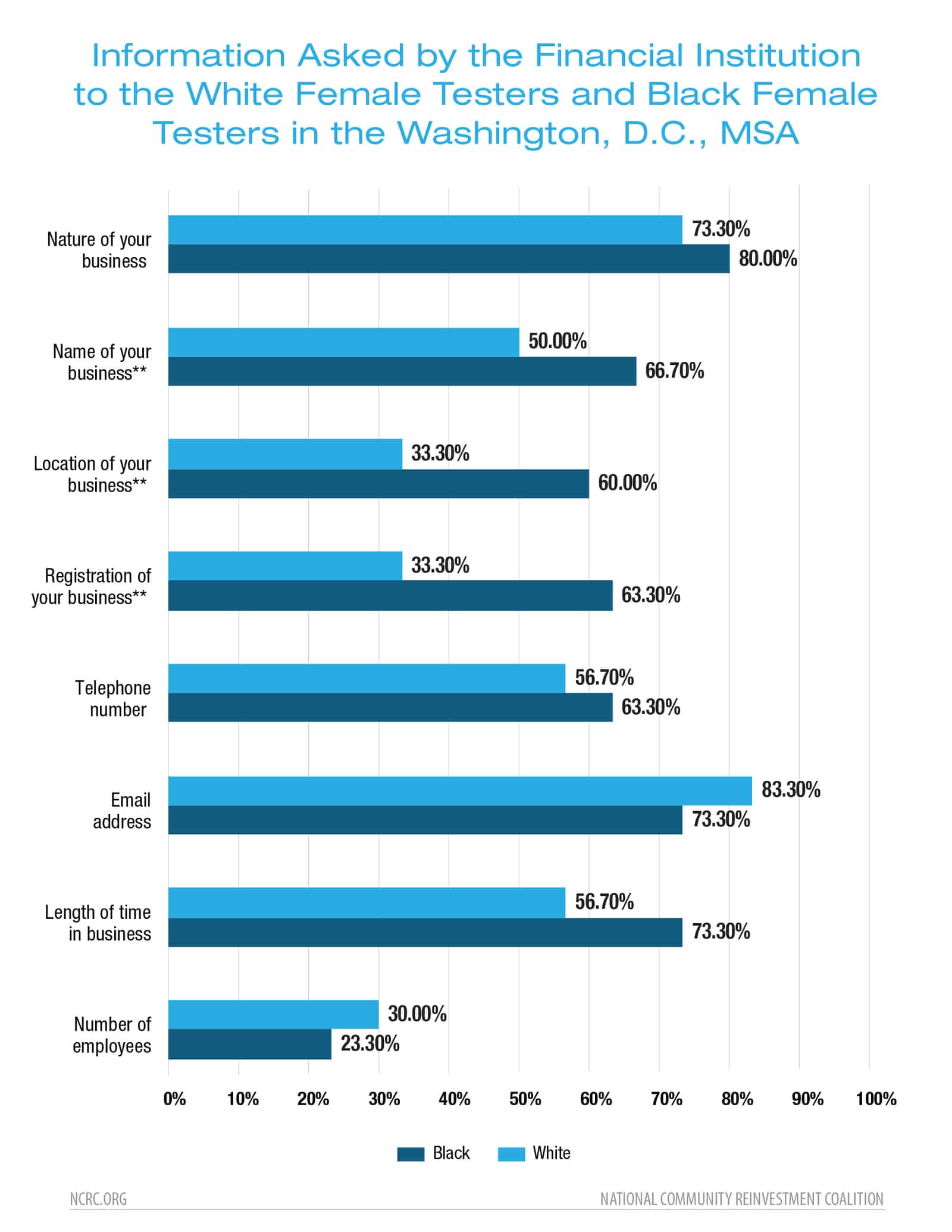

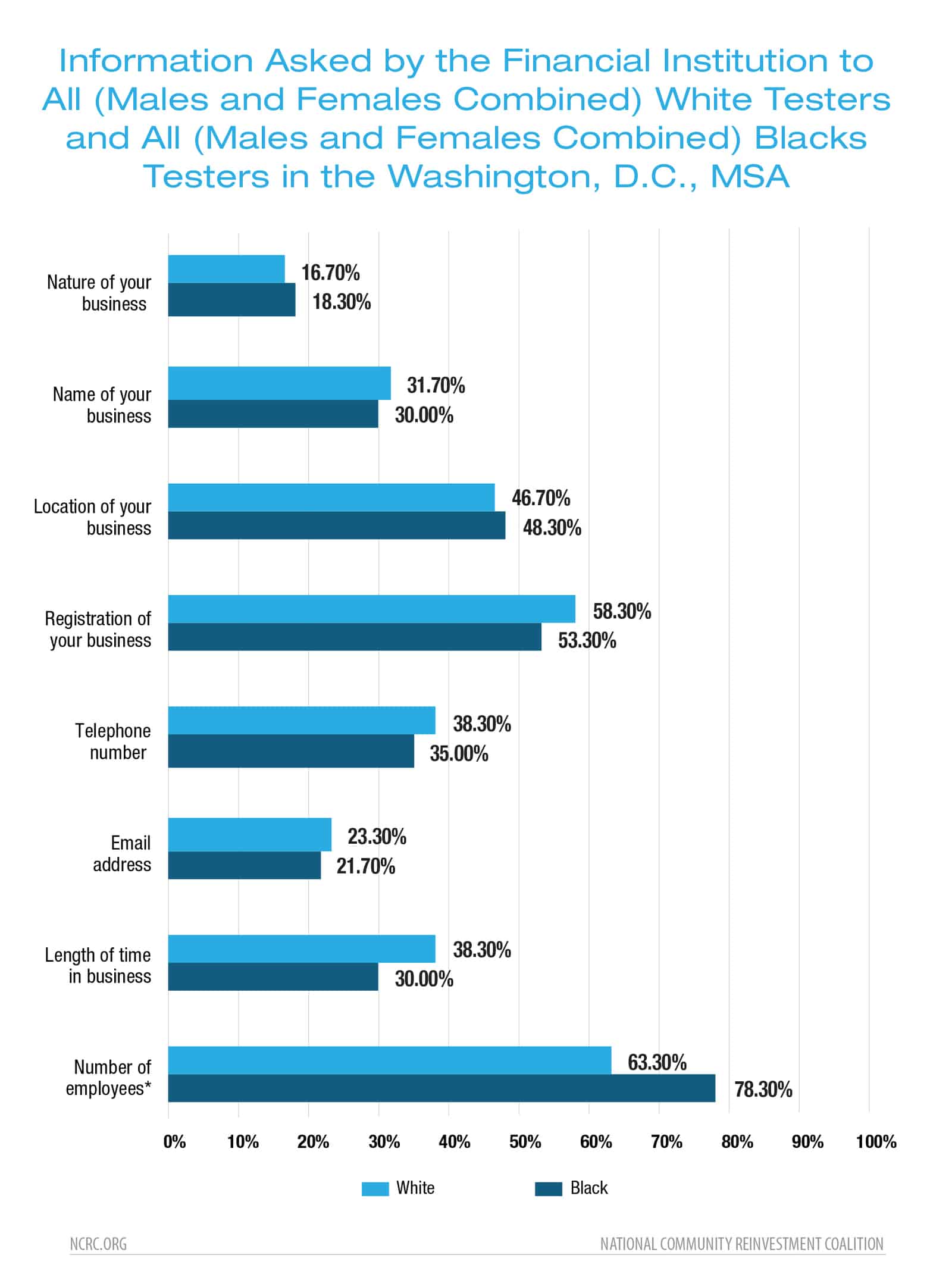

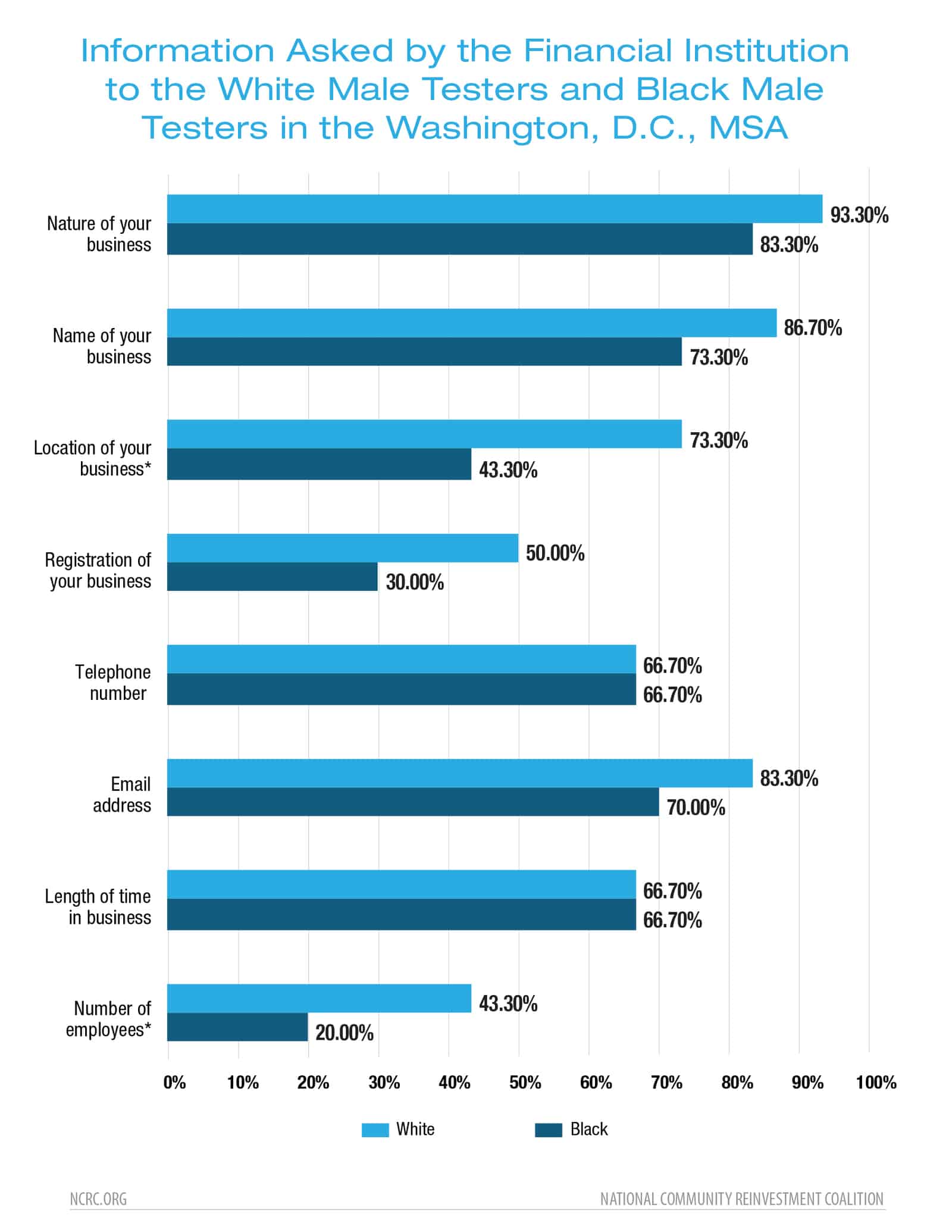

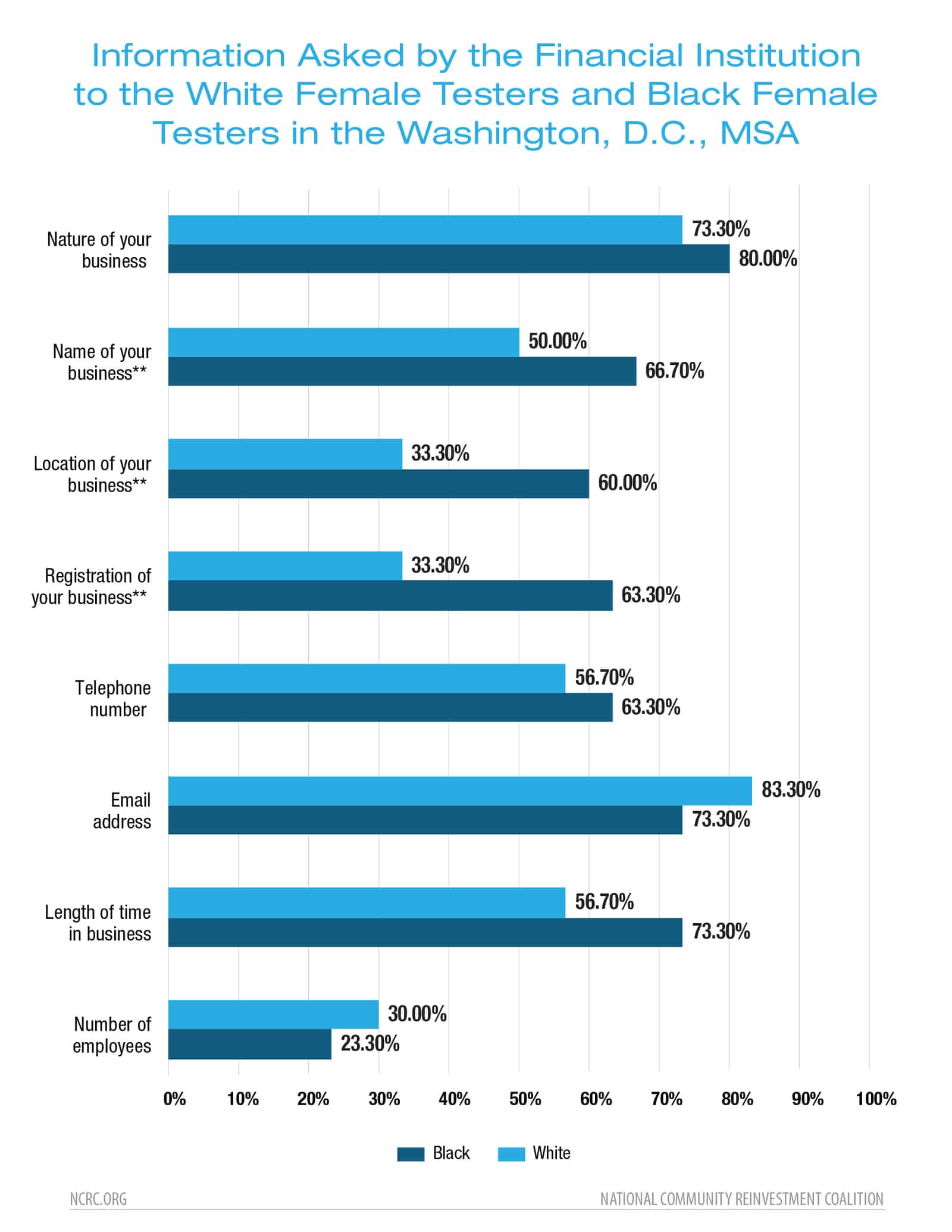

What information a bank representative asks will determine what a potential client may receive from the financial institution. The type of questions not only reveal to the loan officer the business’s needs and possible solutions, but also the hidden biases of employees and institutional policies. In terms of information asked, the most numerical and largest percentage differences are found between Black women and White women in D.C., where Black women were much more likely to be asked about the name of their business and it’s registration.

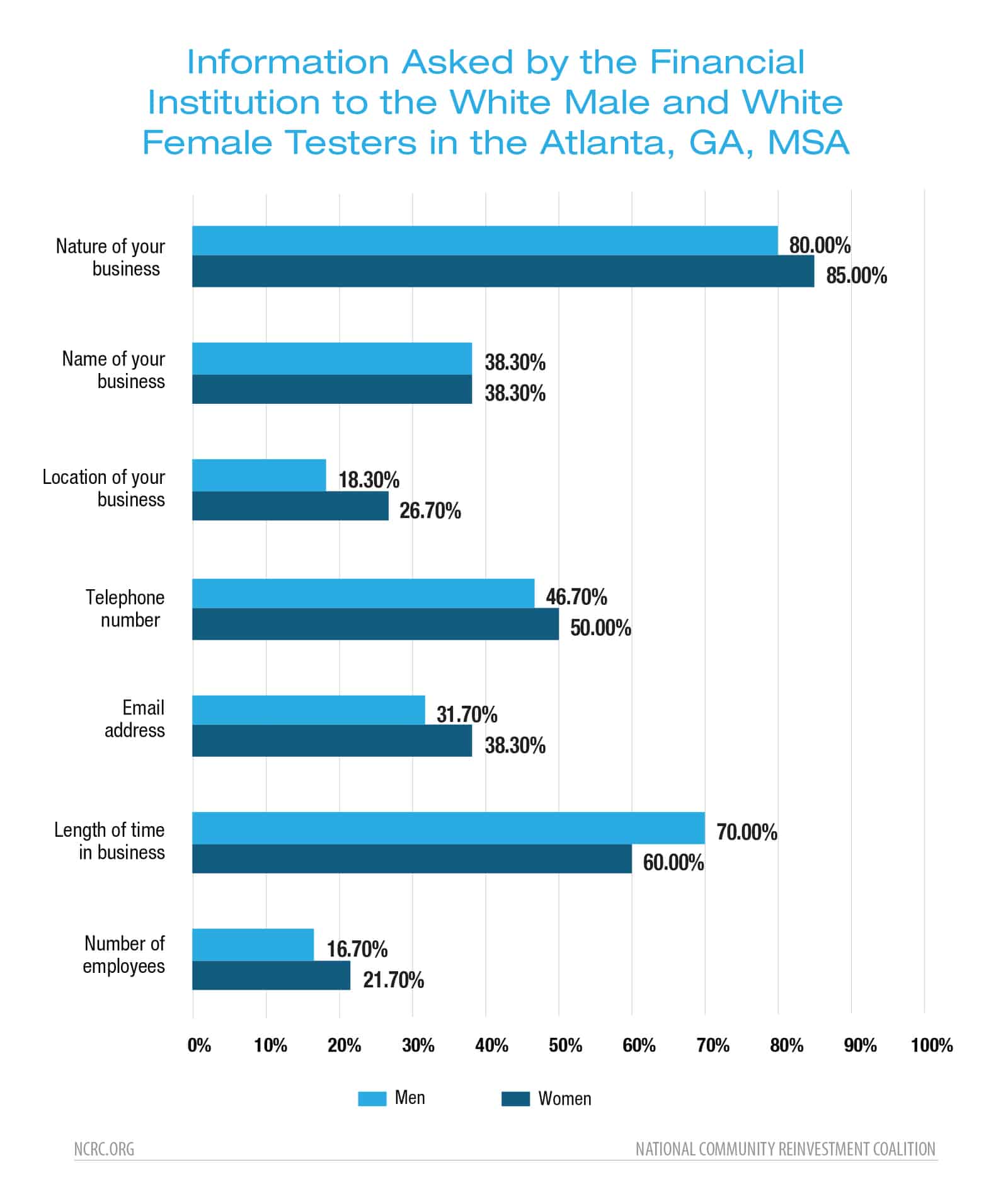

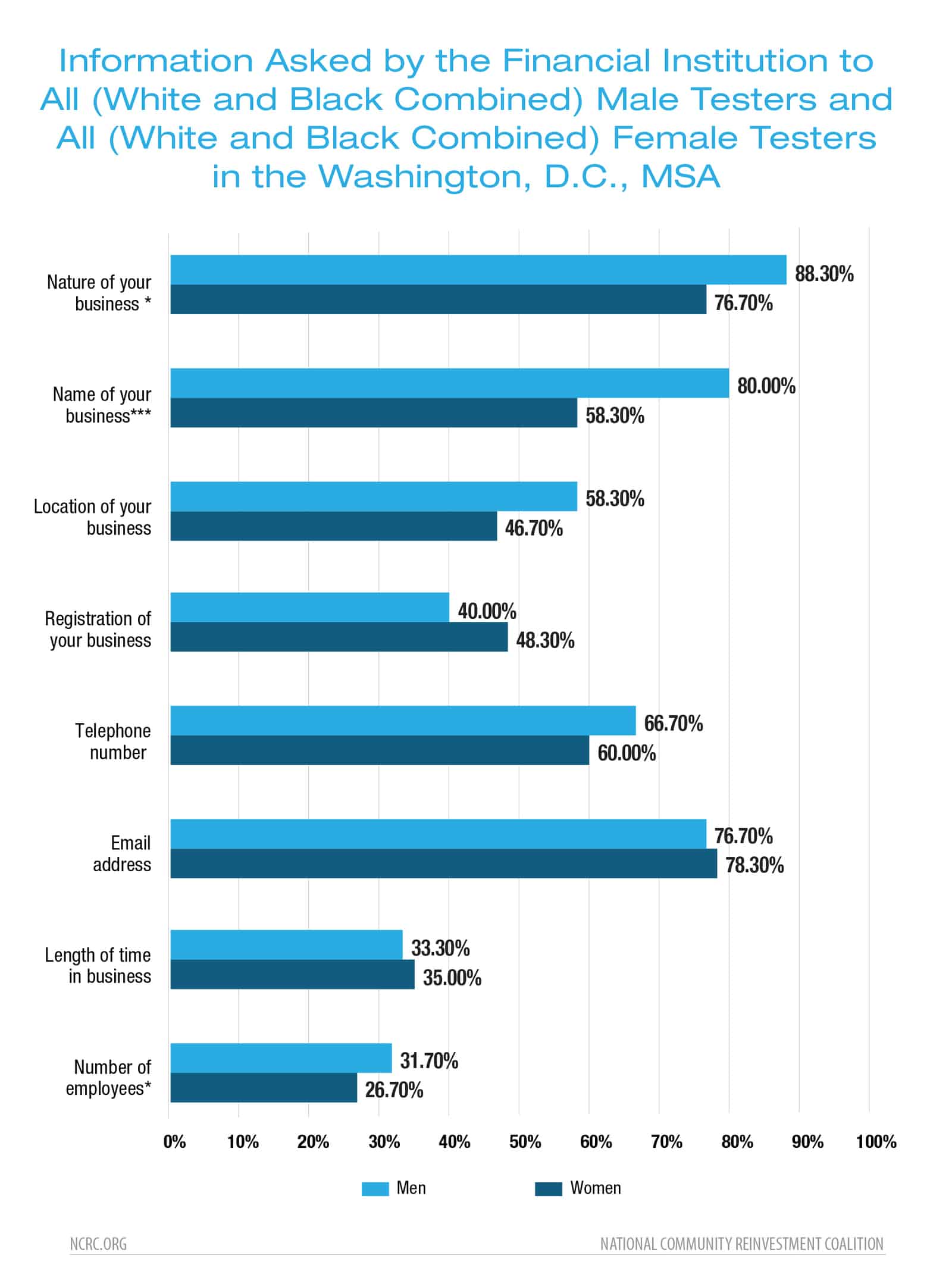

In the Washington, D.C., MSA only two male measures were in the 4th quantile, nature of your business and name of your business. These two measures are also the only measures in this data set to be statistically significant with men being asked these questions more often than women.

When this data was separated for race within the female results, we found that there exists statistical significance for three measures: name of your business, location of your business and registration of your business. For all of these measures, Black women were asked these questions more often than White women.

We observed inquiry questions that tried to determine the legitimacy of a business directed more often to Black women than White women or men. This was highlighted by the statistical significance of the measure, registration of your business, being asked more often to Black women. Testers documented that during the interaction, loan officers accessed the state’s Secretary of State website to look up the business to confirm that it was registered. Loan officers completed this confirmation action rarely with a White male tester. Recognizing this action helps to highlight the barriers that people can face when accessing credit, as well as the actions that can create an environment and belief in discouragement of credit.

To see more of our results as it relates to Information asked, please see Figures F-J at the end of the paper.

Closing Interaction

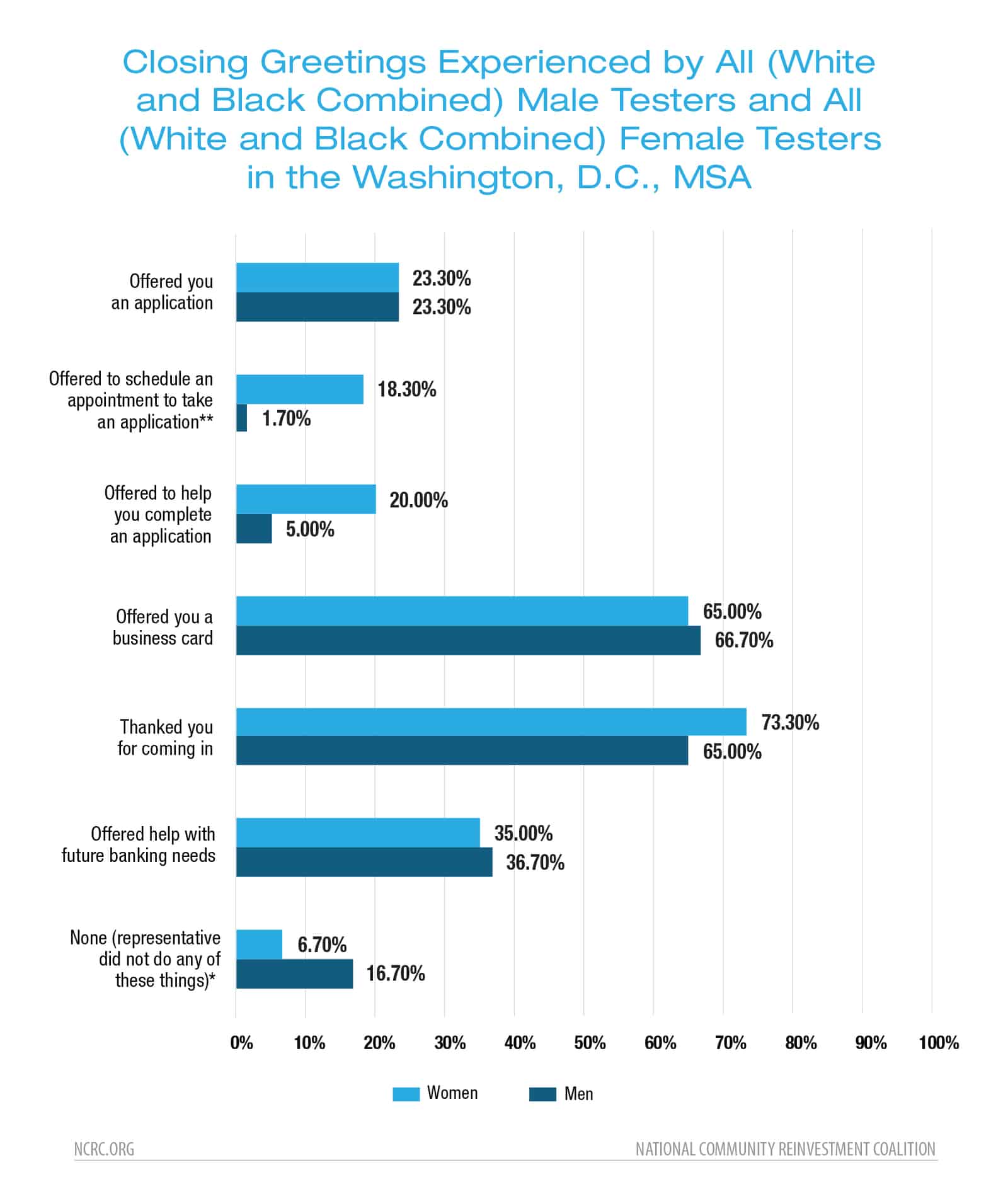

The closing is the final interaction with and lasting impression of the potential customer. Even if the whole interaction before the closing went well, a poor closing can sour the financial institution in the mind of the prospective customer.

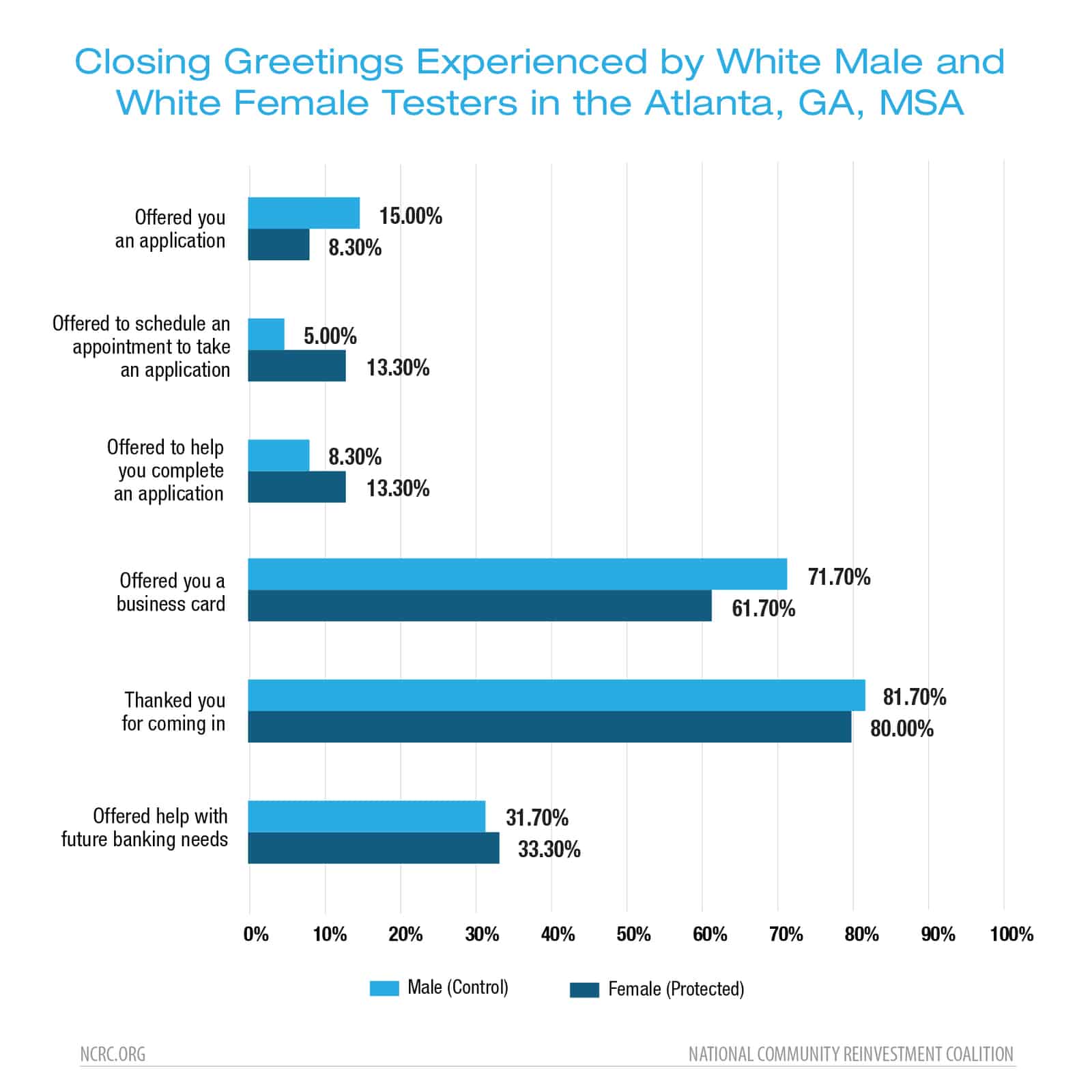

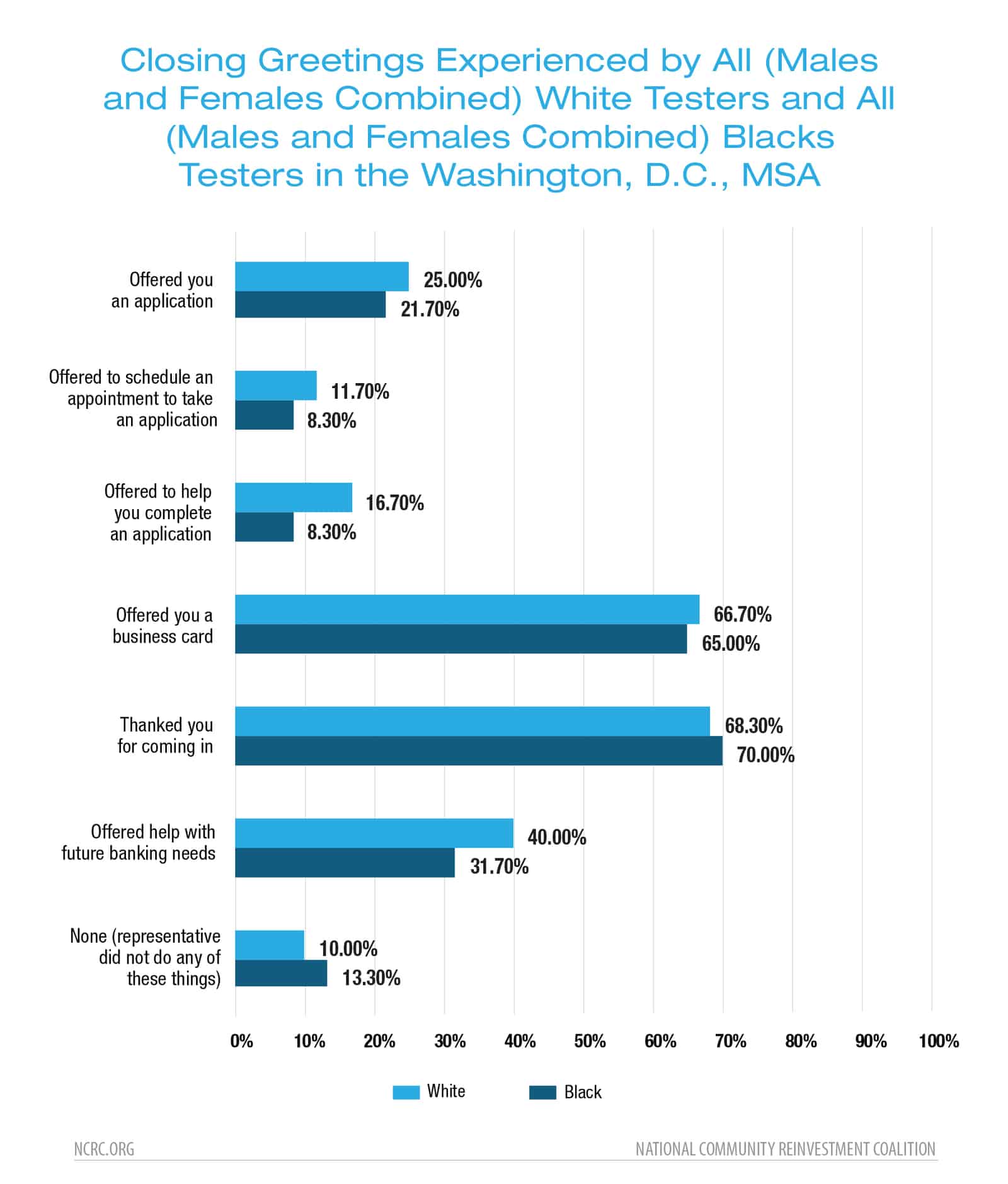

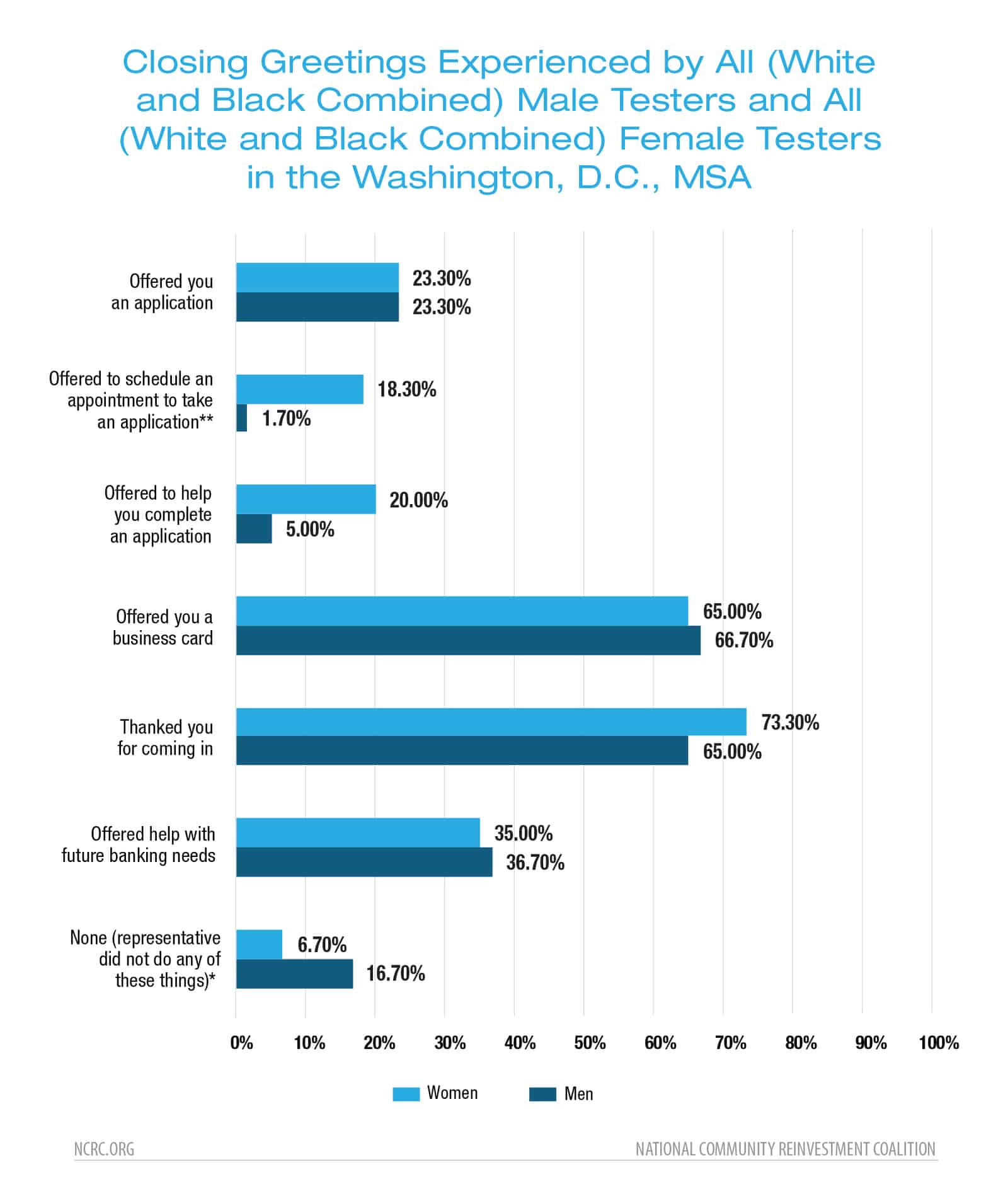

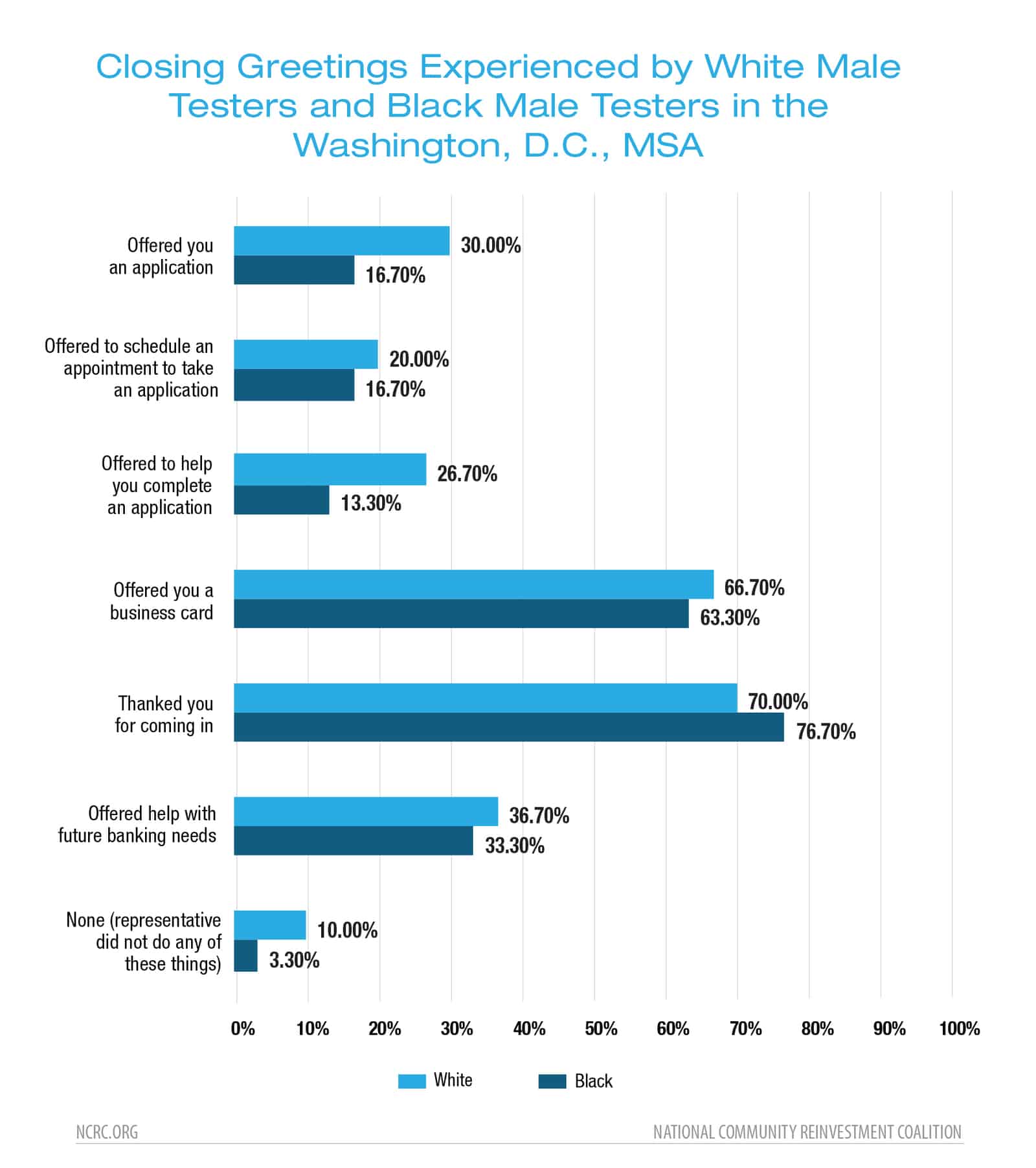

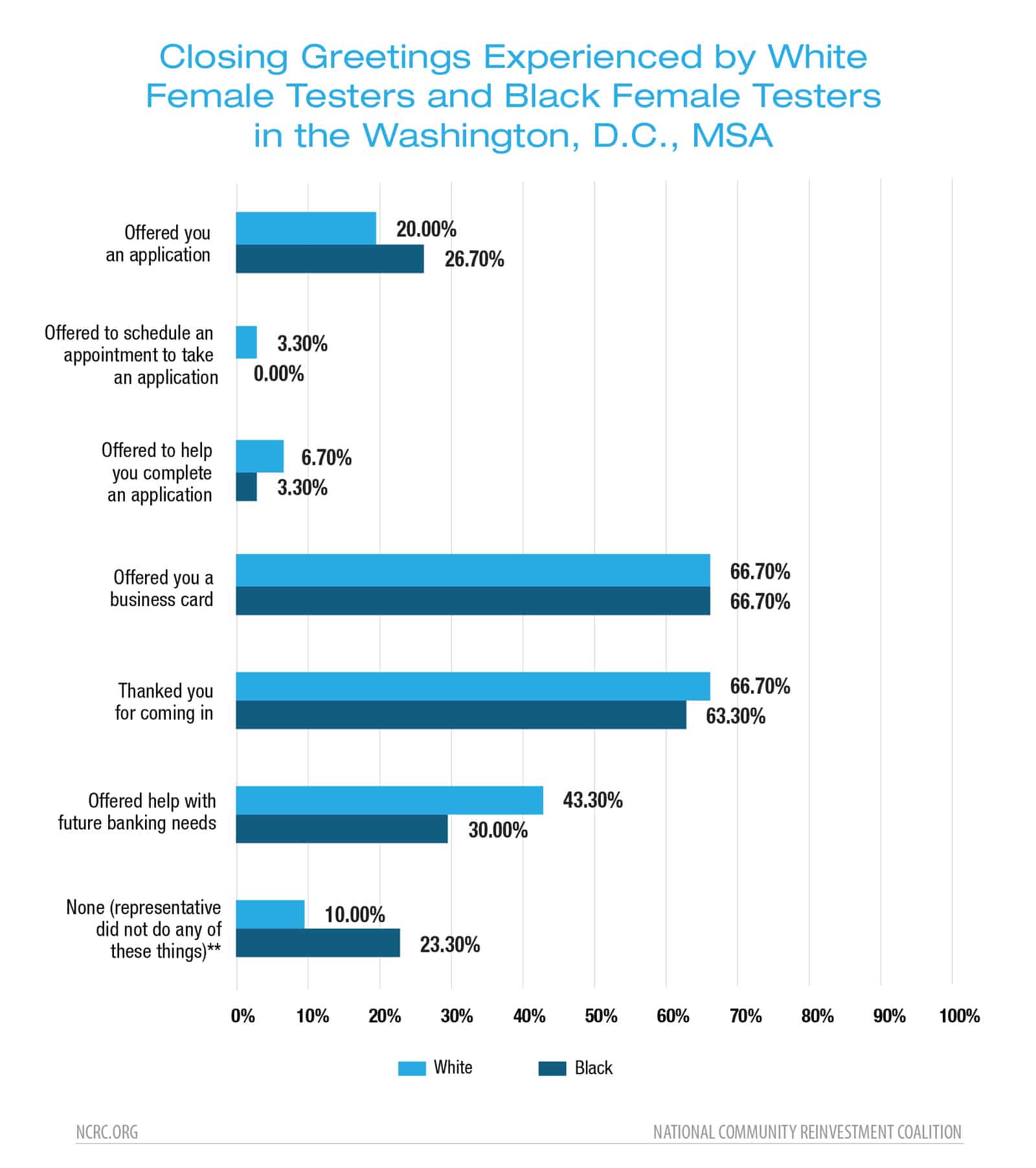

Closing is where we see the poorest performance for everyone. Only in one aspect of closing in Atlanta did the approach move beyond poor service. We saw the most statistically significant differences in the closing process in D.C. when comparing gender regardless of race. We found that men are more likely to be offered the opportunity to schedule an appointment and offered help to complete an application, and we found that women are more likely to not be offered any of our six indicators. Helping a customer fill out an application is important because one of the main reasons for rejection of small business applications is incomplete or incorrectly filled out applications.

To see more of our results as it relates to information asked, please see Figures K-O at the end of the paper.

Qualitative Example of Difference in Treatment

Qualitative examples reveal aspects of the interaction that is not captured in the statistical survey which can include micro-aggressions that analyzed in the totality of the matched-pair tests uncover differences in treatment.

Example 1:

The White female tester received about 22 minutes of facetime with a banker who introduced herself by name, asked her about her needs and took down the general information about her business. She was also guided through the introduction of the phone call with the business direct center and given a private room to speak with the representative over the phone. In contrast, the Black female tester, was told that the specific branch did not house a business specialist, recommended to visit another branch that could assist her needs and never informed about a business direct center that she could reach over the phone.

The different level of service and information received between the two testers highlights the level of discouragement that Black women entrepreneurs receive when trying to access credit.

Example #2:

Both testers spoke with the same loan officer. The loan officer was told the same amount requested by the two testers. Both testers were told that they would not qualify for the original amount requested. The loan officer asked the white male tester if “45k was doable.” The white female tester was offered 40k instead.

Although both testers were not offered the original loan amount by the loan officer, the male tester was offered more capital from the financial intuition compared to the female tester who had the stronger financial profile.

Conclusions

Our results continue to show that all business owners regardless of race or gender are receiving subpar customer service and experience as most of the measures did not cross over into the 4th quantile. Financial institutions need to pay attention to this behavior as it results in lower customer loyalty and negative brand association. While not an overt fair lending violation, this behavior can become a fair lending violation if there exists a pattern or practice of a specific protected class receiving a greater degree of subpar service.

Furthermore, the testing highlighted that within this subpar customer experience that Black females experienced the worst treatment which resulted in a significant difference in information that they receive. This different level of inquiry during pre-application towards Black female entrepreneurs is potentially a violation of the ECOA. Without equal access to information among all potential customers, financial institutions are denying entrepreneurs the ability to make informed decisions. This action by financial institutions has a significant impact on all businesses and is a factor in the ever growing racial wealth divide.

Recommendations

The testing reveals how barriers manifest themselves in the pre-application phase. To counter some of these barriers, we provide the following recommendations:

Immediate Recommendations

Training

Financial institutions need to train their employees better. Training is a valuable tool that provides employees with an understanding of protocol, expectations and laws. There are a few different training avenues that financial institutions should pursue:

- Fair Lending and Implicit Basis Training. Financial institutions need to ensure that their fair lending trainings cover small business lending. They also need to implement biases training so that employees understand both their internal biases and how to make sure that these biases do not lead to actions that discourage applicants in violation of the Equal Credit Opportunity Act.

- Product Training. Financial institutions need to make sure that all of their employees have a basic understanding of all of the small business products that their company offers, so that all employees can talk to potential customers even if the small business specialist is not available.

- Basic Marketing Procedures. Financial institutions need to train their employees on basic marketing procedures, like smiling at potential clients and asking people how they can be helped. Employee failure in this area prevents banks from making loans, which is a bank’s purpose.

Compliance Program

Training is only as effective as its compliance program. Financial institutions need to implement a vigorous compliance program for their small business lending and this program needs to include self-testing, so that they can ensure that there are no fair lending violations.

Hiring more diverse staff

Hiring a more diverse staff is essential, because it helps to limit biases. Additionally, potential clients may feel more comfortable engaging with the financial institution if they see employees who look like them.

LongTerm Recommendation

Implementation of 1071

The CFPB needs to implement section 1071. This data collection vehicle will lead to better understanding of the current lending. It will help lenders, small business owners, advocates and the government to better comprehend the growing wealth disparities and provide insight into ways to stop it.

Continue to Perform Mystery Shopping

A number of our measures did not rise to the level of statistically significant. Additional testing will allow us to observe if these trending, non-statistically significant measures become statistically significant over time. Thus, providing us with more information of specific types of barriers minority and women business owners face when trying to access credit.

Enforcement Actions

Both federal agencies and private organizations should bring forth enforcement actions for discrimination in small business lending under the Equal Credit Opportunity Act. Our mystery shopping reveals that there is a significant difference of treatment based upon the protected status of race, national origin and gender. In certain situations, the only way to produce significant change in the market place is to bring forth enforcement action against bad actors.

All Figures from Testing

[1]STATE OF WOMEN-OWNED BUSINESSES REPORT .American Express, 2018.

[2]STATE OF WOMEN-OWNED BUSINESSES REPORT .American Express, 2018.

[3] Id.

[4] STATE OF WOMEN-OWNED BUSINESSES REPORT .American Express, 2018.

[5] Id.

[6] Disclosure: NCRC operates the DC Women Business Center.

[7] Viek, Claudia, and Corinne Hodges. “Senators Have Chance to Double Funding for Women Entrepreneurs-They Should Take It.” The Hill, 22 Oct. 2019. The bill is H.R. 4405 https://www.congress.gov/bill/116th-congress/house-bill/4405

[8] STATE OF WOMEN-OWNED BUSINESSES REPORT .American Express, 2018.

[9]Disinvestment, Discouragement and Inequity in Small Business Lending.National Community Reinvestment Coalition, 2018.

[10] Id.

[11]What do Women Want in Growth Capital? Survey of Financing Needs of Women Business Enterprises. Invest in Women Entrepreneurs Initiative in Partnership with WBEC-Pacific and WBEC-West, 2019.

[12] Id.

[13]Small Business Credit Survey Report on Nonemployer Firms. Federal Reserve Banks of New York, Cleveland, Richmond, 2018.

[14] Jones, Thomas O., and W. Earl Sasser. “Why Satisfied Customers Defect.” Harvard Business Review,Vol. 12, No. 6, 1995. and Garver, Michael. “Best Practices in Identifying Customer-Driven Improvement Opportunities.” Industrial Marketing Management, 2003.

[15] Id.

[16] Small Business Credit Survey: 2019 Report on Minority-Owned Firms.Federal Reserve Bank of Atlanta, 2019.