August 27, 2019

RE: NCRC Comment Letter on Rakuten Charter Application

To Whom it May Concern:

The National Community Reinvestment Coalition (NCRC) maintains that Rakuten’s application for an Industrial Loan Charter (ILC) has not demonstrated a significant commitment to meeting the convenience and needs of the community to be served as required per the Federal Deposit Insurance Act (FDIC Act) and the FDIC statement of policy on applications for deposit insurance.[1] Rakuten has developed an incomplete strategic plan for its Community Reinvestment Act (CRA) evaluation that does not adequately serve the credit and deposit needs of the communities, including low- and moderate-income (LMI) communities. NCRC, our members and allies, oppose Rakuten charter application and urge the FDIC to deny it in its current form.

Receiving a bank charter is a privilege, not a right. Rakuten proposes a CRA strategic plan that focuses on community development although it will be a significant retail lender offering credit card loans, consumer loans, and small business loans. Although Rakuten will be engaged in retail lending nationwide, it states that it does not want to be evaluated regarding whether its retail activity is serving LMI consumers and communities. It is asking the FDIC to leave it off the hook for meeting LMI needs in a significant aspect of its business.

The proposed community development activity is restricted to Salt Lake County, UT although Rakuten states that it will face significant competition in making community development loans and investments. Considering the competitive nature of the Salt Lake market, it would be sensible for Rakuten to propose to serve other areas of Utah. Yet, the plan does not address statewide needs in more distressed rural parts of Utah nor in adjacent states although CRA examination procedure allows a bank to engage in community development outside of its assessment area after it has responded to the needs in its assessment areas.

In order for Rakuten to be adequately evaluated for the nationwide reach of its retail products, NCRC believes that Rakuten must not be allowed to designate only one assessment area (it is proposing Salt Lake County Utah as its assessment area). The designation of one assessment area will not allow for a sufficient evaluation of Rakuten’s retail activities and will also needlessly restrict its community development activities. NCRC proposes below that Rakuten engage in data analysis and dialogue with community-based organizations as a means of designating additional assessment areas that will encompass a significant amount of its lending activity.

The federal bank agencies have touted mobile and on-line banking as a means of serving traditionally underserved populations. The agencies have devoted considerable time amending the Interagency Q&A document on CRA in order to encourage and evaluate on-line banking. Yet, neither the agencies nor Rakuten’s application has provided any data indicating that on-line and mobile banking is effectively serving low- and moderate-income (LMI) populations. If the FDIC does not require a rigorous CRA strategic plan from Rakuten with specific goals for serving consumers and small businesses with deposit accounts, credit card loans or consumer loans, an approval of an inadequate plan will merely exacerbate the digital divide and encourage more fintechs to apply for bank charters without any ironclad plans for serving LMI communities. In addition, the community development service portion of Rakuten’s strategic plan is poorly developed. It does not address how Rakuten, an internet provider of access to shopping and banking services, could provide financial education designed to help LMI people access responsible shopping and banking services.

The FDIC’s statement of policy on applications for deposit insurance states that a factor for consideration of approval of a charter application is the “willingness and ability of the applicant to serve those financial needs (credit and deposit needs).”[2] While Rakuten acknowledges CRA obligations, its CRA strategic plan falls short of demonstrating a commitment to adhere to CRA’s obligations commensurate with Rakuten’s ability.

In addition, NCRC is opposed to ILC charters as problematic from a safety and soundness perspective. ILC charters can include a parent institution that is not a financial institution. Federal agencies cannot comprehensively examine the parent nor other affiliates and subsidiaries for their safety and soundness. The ability of the FDIC to monitor thoroughly the relationship between the ILC and its parent and to monitor risk the parent poses to the ILC has been questioned by the Government Accountability Office and other stakeholders. These concerns are magnified in the case of Rakuten since its application says it owns 43 companies in the United States alone.[3] What is the financial condition of these companies? Should any of them become imperiled financially, what demands will Rakuten’s parent place on the proposed ILC to bail out the troubled companies?

During the financial crisis, two ILCs, Security Savings Bank, based in Nevada, and Advanta Bank Corp, based in Utah failed. In addition, a number of parents of ILCs, including Lehman Brothers, General Motors, Flying J Inc., Capmark Financial Group Inc., CIT Group Inc., and Residential Capital, LLC filed for bankruptcy.[4]

In contrast to Rakuten’s CRA plan, NCRC believes the FDIC should consider the following as minimal requirements for an online lender applicant creating a rigorous CRA plan. Such a plan must be comprehensive, qualities lacking in Rakuten’s proposed plan:

Affiliates and Subsidiaries Must be Included

Rakuten says one affiliate located in San Mateo, California could be included in its CRA strategic plan and serve as a launching pad for community development activities in the San Mateo area. NCRC is pleased that Rakuten is considering this but maintains that all U.S.-based affiliates must be automatically included in the strategic plan. Affiliate locations should be designated assessment areas since Rakuten’s employees of the affiliates could contribute to the development and execution of CRA activities. Excluding affiliates reduces the amount of resources available for CRA activities. Also, Rakuten’s fair lending and consumer compliance reviews, which are conducted concurrently with CRA exams, would not consider affiliate activity nor would sanction Rakuten due to any illegal or abusive practices of the affiliates.

Assessment Area Cannot be Narrow but Must Include Areas Where a Substantial Amount of Business is Conducted

Rakuten’s strategic plan establishes Salt Lake County, Utah as the assessment area for Rakuten because the bank’s headquarters is located in the county.[5] This narrow assessment area is not truly responding to credit and deposit needs where Rakuten is doing business and will thus fall short of meeting the convenience and needs requirement for a charter application.

It is a contradiction in terms for a branchless fintech to establish its assessment area where its headquarters is. In this case, Rakuten is acting as if its headquarters location is a branch and as such, the headquarters location will make loans in its contiguous community. But the headquarters is not a branch and will not be used for making loans. This sleight of hand mocks the intention of CRA to serve credit needs wherever a lender is conducting business.

Rakuten clearly states that it will be a nationwide lender in the following:

Rakuten Bank America will provide the following products and services: consumer loans, consumer credit cards, consumer deposits (NOW, savings, and time), merchant acquiring, commercial loans, and commercial savings accounts. This simple, yet profitable product suite was selected to specifically serve the users of the U.S.-based online marketplace, both consumers and merchants. These offerings will essentially complete the Rakuten U.S. ecosystem, whereby consumers and merchants are served in a common online marketplace that creates loyalty and provides real value to both sets of customers.[6]

The CRA regulations do not prohibit a branchless bank from establishing assessment areas beyond its headquarters. Assessment areas can include areas where substantial amounts of lending activity occur.[7]Again, if Rakuten’s assessment area is restricted to Salt Lake City, Utah, Rakuten is not demonstrating a willingness to serve credit and deposit needs where it does business as required by the FDIC statement of policy.

Using loan data, NCRC believes that the agencies can require non-traditional banks and fintechs to create assessment areas that capture the vast majority of their loans. An example of lending by state for Lending Club during the time period of 2012 and 2013 shows that assessment areas can be meaningfully created for an on-line lender (a two year time period is a typical time period covered by a CRA exam).[8] Lending Club makes data on its lending activity by state and for three digit zip codes publicly available, a practice NCRC recommends for Rakuten.

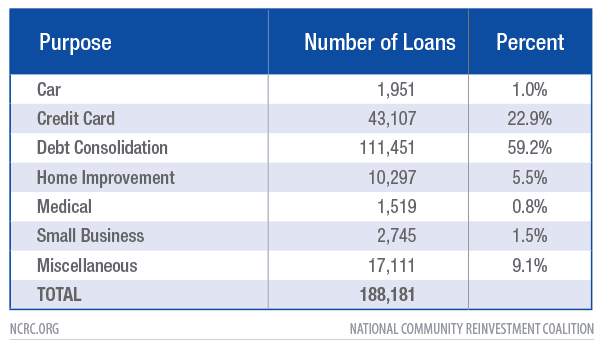

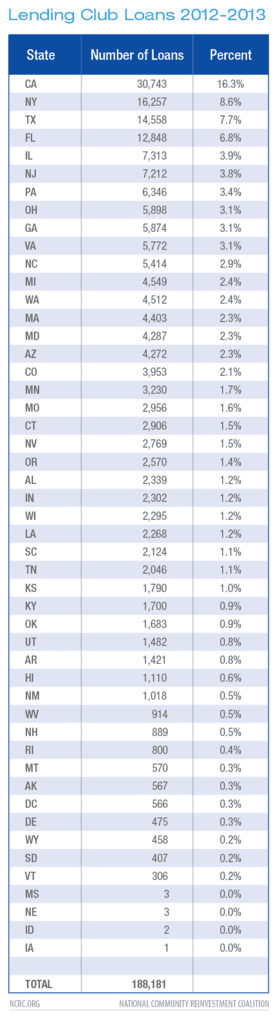

Several states have sizable numbers of Lending Club loans in this time period even before Lending Club’s substantial lending increases of more recent years. During 2012 and 2013, Lending Club made more than 188,000 loans; most of these were consumer-related loans and/or refinancing and consolidation of outstanding debt (see table below). Another table below on lending by state reveals that heavily populated states including California, New York, Texas and Florida had the highest percentage of loans. Ten states each had more than 3 percent of Lending Club’s loans.[9] On the other end of the scale, 28 states each had less than 1.5 percent of Lending Club’s loans. In sum, it is quite feasible for at least the top ten or twenty states to constitute assessment areas; these states had high numbers of loans and reasonably high percentages of Lending Club’s loans.

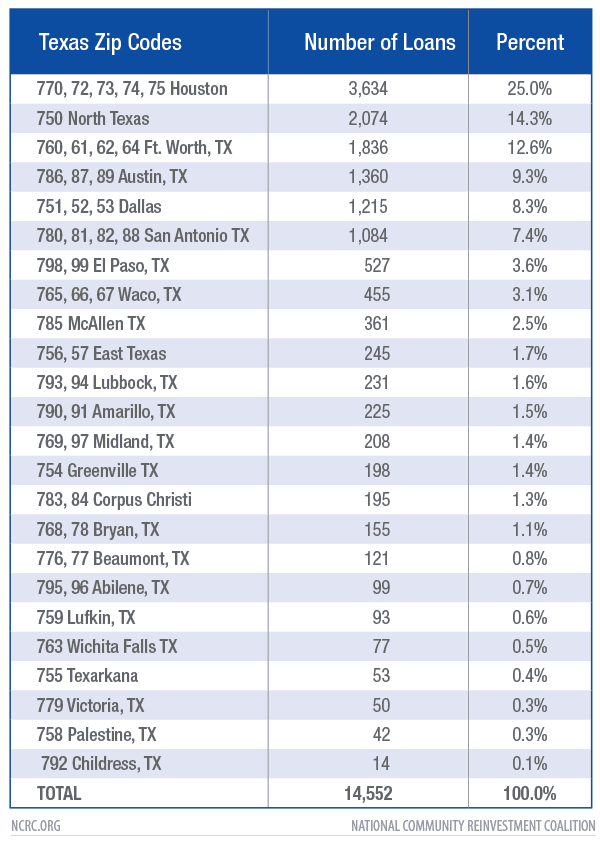

To further investigate how assessment areas would work for a non-traditional bank, NCRC tabulated loans by three digit zip code and metropolitan areas for Texas, one of Lending Club’s high volume states. We found five metropolitan areas with more than 1,000 loans each and one area, North Texas that could possibly be considered a rural area. The five metropolitan areas range in size and location across the state and include Houston, Austin, Ft. Worth, Dallas, and San Antonio. El Paso is the seventh largest area by loan volume with more than 500 loans. Using Lending Club as an example, designating metropolitan areas and counties as assessment areas for non-traditional lenders is feasible and can include a diversity of areas.

Rakuten should make a commitment similar to Lending Club’s of sharing the location of its consumer, small business, and credit card lending by state, metropolitan area, and county. It could also provide geographical data on its deposit taking activity. Rakuten should then confer with community-based organizations and other stakeholders in deciding which geographical areas will constitute assessment areas. Assessment areas should capture the majority of its retail activity and include a healthy mix of states, metropolitan areas, and rural counties. Since Rakuten would be a de novo bank, NCRC would be receptive to a procedure in which Rakuten adds assessment areas during each of its three years of its strategic plans so it can develop infrastructure and partnerships with community-based organizations for helping it achieve goals and targets across its assessment areas.

NCRC believes that assessment areas for fintechs must include rural areas. Populations in rural areas are less likely to be connected to the internet. While only 4 percent of people living in urban areas lack adequate broadband services, this issue is particularly concentrated in rural areas and tribal lands, with 39 percent and 41 percent respectively, still lacking access.[10] If fintechs do not make efforts to serve rural areas, the digital divide disadvantaging rural communities will only widen.

Towards a Substantial CRA Plan that Utilizes the Talents and Expertise of the Applying Institution

A non-bank applying for a bank charter must apply its talent and expertise in serving the LMI population. Rakuten’s major line of business is operating as a shopper’s network and offering consumer and credit card loans. Yet, its major commitment in its CRA plan consists of community development lending and investing in Salt Lake County. It will also engage in unspecified amount of financial education in its assessment area in the county. Rakuten is not substantially using its “ability” to meeting credit needs as required by the FDIC Statement of Policy.

NCRC believes that Rakuten’s strategic plan must be re-cast. Rakuten must not be allowed to only engage in community development financing and services. The first part of the strategic plan regulation emphasizes lending and lending-related activities if appropriate considering an institution’s capacity and business model as Rakuten itself acknowledges. Accordingly, the strategic plan must include the following for Rakuten’s retail operations:

Measurable Goals

A CRA plan must have measurable goals so that the public can judge the extent of concrete benefits for the LMI community. Commitments to provide loan or bank deposit products without measurable goals can result in a lending institution declaring that a minimal number of products for LMI populations over the CRA plan time period meets the requirements of the CRA plan. Measurable goals prevent “gaming” and declaring fulfillment of CRA obligations with minimal efforts. In addition, measurable goals provide a substantive opportunity for the public to comment on the adequacy of the CRA plan.

Since Rakuten will likely have sizable retail operations, NCRC believes that goals for retail lending are needed and realistic. Celtic Bank, one of the peers Rakuten lists in its application, has a strategic plan that includes measurable goals such as percent of loans to small business in LMI tracts and to small businesses with revenues under $1 million.[11]

Consumer and Credit Card Lending

Rakuten does not provide information on the volume of its credit card or consumer installment lending but its global internet presence suggests that it is likely a high volume retail service provider. It has the resources, expertise, and capacity to develop responsible credit card and consumer loan products for LMI consumers and communities. Recently, Robinhood, a fintech brokerage company, applied to the OCC for a bank charter and committed to providing a secured credit card to LMI customers. NCRC commented that Robinhood’s plans were inadequate because an expensive secured credit card was the only product it was proposing to offer LMI customers. However, Rakuten’s plans are even worse because it will not commit to using its retail operations to serving LMI customers.

NCRC believes that Rakuten should develop a suite of retail products for LMI customers and communities. A secured credit card to help LMI borrowers build credit can be part of the suite but only if Rakuten provides a clear ladder for helping LMI borrowers graduate from secured credit cards and then use lower cost credit cards after they have demonstrated a good payment record. In addition, the consumer lending can include a product that helps consumers afford sudden expenses. This would address a glaring need since Federal Reserve surveys indicate that most consumers in the United States cannot afford an emergency expense of $400 or more.[12] Rakuten could also help LMI customers find stores on its shoppers network such as appliance providers that offer affordable deals to replace broken items.

Rakuten should develop goals such as percent of credit card and consumer loans to LMI borrowers as part of its strategic plan. It should collect data on the number and percent of its borrowers that are LMI. The GAO recently reported that about a quarter of CRA exams include evaluations of consumer lending.[13] The exams include comparisons of the percent of consumer loans to the percent of assessment area populations that are LMI. Rakuten should consult with these exams to further develop their goals for credit card and consumer lending.

Rakuten touts its rewards program for consumers in the form of discounts and cash back in return for purchasing consumer items via its website.[14] If Rakuten wants to make a concerted effort to serve LMI customers, it could tailor some of its discount offerings to this population. Perhaps it could offer larger discounts for basic necessities such as appliances or perhaps it could develop a progressive discount structure that offers larger discounts for LMI consumers. A discount system structured in this manner could attract LMI customers. Rakuten could then ask them if they would be interested in any of Rakuten credit or deposit products.

Rakuten says that most of its customers are not in its assessment area or are LMI, so that’s why it will not develop a retail portion of its strategic plan.[15] This seems to be just too convenient and an excuse to evade CRA responsibilities. Above, NCRC offers sensible suggestions for developing additional assessment areas and serving LMI customers.

Small Business Lending

Rakuten mentions it offers commercial loans, savings accounts, and merchant lines of credit but then later in its application states that it has limited retail operations.[16] NCRC wonders whether Rakuten, as a global service providers, “protests” too much regarding the limited nature of its retail operations. Presumably, Rakuten has established several business relationships with a number of merchants of all sizes. It would follow logically that this is how it generates its commercial banking business. How many of these merchants are small businesses and how many of them are located in LMI census tracts? A strategic plan that fails to discuss how an aspect of its retail operations could be tailored to help underserved businesses must not be approved.

If the retail operations are limited, the public has a right to review verifiable data regarding low volume lending and offer its opinions as to whether programs could still nevertheless be developed to help the smallest businesses in Rakuten’s network obtain access to credit and capital. On the other hand, if the commercial lending and savings operations are at higher volumes, goals in terms of the number and percent of loans to small businesses and in LMI tracts are feasible and should be developed.

Deposit Accounts and Service Delivery

For its mobile banking, Rakuten should adopt benchmarks based on specific guidance on how CRA examiners evaluate alternative delivery systems in the Interagency Questions and Answers Regarding CRA (Interagency Q&A).[17] The Interagency Q&A advises that CRA examiners will scrutinize whether a financial institution’s alternative delivery systems are effectively delivering services to LMI populations by considering a variety of factors including: ease of access; cost to consumers; range of services delivered; ease of use; rate of adoption and use; and reliability of the system.[18] Rakuten should establish specific performance measures and goals for the LMI community for each of these factors. Factors like the rate of adoption and use and the reliability of the system should have separate metrics and goals specifically set for rural as well as urban areas, and for under banked populations. The federal bank agencies have an opportunity to use its recent Q&A guidance and insist that Rakuten’s CRA plan incorporate these metrics so that the public can discern whether Rakuten’s charter application would specifically meet the convenience and needs of LMI communities.

Financial Education

NCRC finds the community development service portion of the strategic plan to be sorely wanting and not responsive to community needs. It only offers vague indications of what activities Rakuten will provide where. The application states, “The Bank’s CEO and other officers have taught financial literacy classes in schools and other programs in the past and will actively seek out ways to provide such services in the AA through the schools, and nonprofit programs.”[19] “Once the Bank has adequately addressed the needs within its AA, community development service hours outside the AA will be considered.”[20] It is hard for the public to judge the quality of the planned community development services when the public does not have either basic or detailed descriptions of what they are. Moreover, the public does not know if they will be targeted to particularly underserved places or people.

An internet-based bank that specializes in on-line provision of financial products should tailor a community development service program that focuses on increasing access to responsible mobile bank products and services. Instead, Rakuten’s draft strategic plan merely lists the number of community development service hours that will be performed annually during each of the three years. Each employee will commit up to six hours. In year one, a goal of 300 hours implies that Rakuten’s bank will have 50 U.S.-based employees. By year three, the goal of 400 hours implies that the number of employees will grow to about 66.[21] The goals in terms of hours does not indicate any comprehensive or strategic approach to delivering financial education in terms of helping the un- or under-banked access mobile banking. Instead, the goals in terms of hours suggests an ad hoc and helter-skelter approach in which each employee will engage in activities, some of which will only be vaguely associated with the regulatory definition of community development.

NCRC expects a well-thought out plan of how Rakuten will be delivering financial education across its business footprint in additional assessment areas in urban and rural areas (chosen in a manner suggested above) and not just in Salt Lake County, Utah. Rakuten could use the FDIC’s study of the under- and un-banked (which it cities in its application) for identifying areas in its footprint that would be targeted for community development services because they have high percentages of these populations. The plan would either identify nonprofit or public sector partners for financial education activities. The strategic plan identifies schools as a possibility, which would be a valuable partner. The partners could offer Rakuten webinars and/or deliver the financial education in person, using both their own and Rakuten staff. NCRC would rather have fewer Rakuten staff devoting a greater percentage of time to a well thought out plan than all staff pursuing ad hoc activities, which will likely not have significant impact.

In addition to hours of financial education counseling, NCRC wants to see outcome measurements. How many classes will the hours commitments produce? How many LMI clients will be served? How many of the clients will have improvements in their accounting, credit scores, ability to secure loans, and other objective measures of achievement. How many accounts were opened? How much did participants save? How much did participants pay down debts? It is not enough to simply list staffing hours. There must be a commitment to a thoughtful program of financial education and coaching that produces measurable improvements for the clients. Either Rakuten can develop these outcomes measurements based on its own experience delivering counseling or based on the experience of its nonprofit partners.

Community Development Lending and Investments Priorities for Salt Lake County

Rakuten describes community and credit needs for Salt Lake County in detail over several pages of its strategic plan but then offers vague plans for addressing them. Rakuten also seeks to establish low expectations of its community development activities in the Salt Lake City area, citing vigorous competition from the 42 banks located there for community development.[22]

Over a number of pages, Rakuten describes an affordable housing shortage and vigorous job growth but also wages that have not kept up with housing costs. Prices are high for prospective homeowners while renters, particularly lower income renters, also confront high housing costs.[23] From Rakuten’s analysis, it seems for lower income people, there is a mismatch in terms of jobs with livable wages and the jobs they hold. Rakuten further mentions expansion of the airport, which would offer the prospect of a number of new jobs.[24] Rakuten also mentions that about 18% of the population of Salt Lake County areHispanic.[25] Finally, Rakuten mentions an interagency forum in 2015 in which affordable housing, job training, and small business financing where identified as pressing needs.[26]

The application describes innovative housing and small business programs. For example, it mentions a venture capital program for small businesses operated by the University of Utah.[27] It also mentions the needs of Native American populations.

Despite the description of all these needs and programs to address them, Rakuten seems to then offer modest responses, noting the competition of established banks for community development financing. For example, for affordable housing, Rakuten mentions it will purchase Ginnie Mae Securities.[28] This a secondary market activity that is generally considered only modestly responsive to needs and not particularly innovative by CRA examiners. Although Salt Lake County has a high number of banks, it would seem that the housing developers listed in the application would still have needs such as lines of credit or public sector programs such as low downpayment programs would need additional sources of financing. Moreover, Rakuten should explore job development and small business creation activities associated with the airport expansion and with institutions such as the University of Utah. Finally, how are the needs of the sizable Hispanic population being met in terms of job creation, housing, and financial education?

Rakuten mentions lines of credit and Low Income Housing Tax Credits in terms of affordable housing finance. It is not clear whether this housing finance will be only for the homeless population or will also include other underserved populations?[29] It also mentions partnering with Community Development Financial Institutions (CDFIs) to meet small business financing needs.[30] However, this seems like a laundry list instead of a well-developed plan with dollar allocations for each activity as well as identified partners.

Lastly, as an internet-based company, Rakuten should offer its expertise in financing and expanding broadband to undersevered and distressed areas. Recent changes to the interagency Q&A document encourage banks to invest in broadband.[31] An internet-based company has a special obligation to help bridge the digital divide.

Level of Community Development Lending and Investment

Rakuten’s proposed level of community development lending and investment is modest compared to the peers it lists in its application. Rakuten suggests a level of new community development (CD) financing of .5% of assets for a Satisfactory rating and .65% of assets for an Outstanding rating. NCRC analyzed the levels of comparable CD financing for four of its peers listed in its application (Enerbank, Medallion, Celtic Bank, and Pitney Bowes Bank). The average CD financing per assets for these banks over their strategic plan time period was .64% of assets. Two of the banks with above average performance had ratios of .89% and 1.14%.

An Outstanding goal of .65% places Rakuten at around average performance compared to its peers. Given the size of Rakuten’s parent and that a one or more of its affiliates might be involved in its CRA activities, NCRC believes that .5% to .65% goals are too modest. We would suggest .65% for Satisfactory and .80 for Outstanding. It is hard to determine whether the bank should stretch even further because the strategic plan does not indicate an estimated asset level. If the bank is estimated to have more than $1 billion in assets, it should aim for at least .89% since this is the ratio achieved by one of its peers that has about $1 billion in assets.

Community Development Outside of its Assessment Area

Rakuten’s commitment to serving its business footprint is lacking as discussed above. It should not have merely one assessment area since it will be conducting business across the country. If it had proposed additional assessment areas, it would solve the problem of competing against many other industrial loan banks for community development finacing as it complains about in its application.

It states that “To the extent the Bank cannot reach its CRA program goals within the AA, once the Bank has done all it can to support the programs described above, it will search for similar opportunities to make community development loans and investments in areas adjacent to the AA and in other communities where the Bank or its affiliates have a presence and knowledge of the needs in those areas.”[32] Instead of this vague statement, NCRC expects that the bank will identify additional assessment areas where it conducts significant business activity and where it has affiliates. The application only mentions possibly serving the area of San Mateo, CA where one of its affiliates is located. In addition, the application is not thoughtful about underserved areas elsewhere in Utah although it mentions underserved Native American areas but then does not indicate any concrete plans to serve this area.

Responsible Lending

A charter application for an industrial bank submitted by an on-line lender must have rigorous responsible lending protections. Serious concerns have arisen due to possible fair lending disparities caused by unorthodox underwriting using algorithms employed by many fintechs. Also, Rakuten will engage in commercial and small business finance but has not indicated whether it will adhere to the Small Business Borrower’s Bill of Rights, a check-list of compliance including transparent disclosures of loan terms and conditions that have been endorsed by many lenders.[33]

A federal regulatory agency simply cannot approve an application for a bank charter that lacks a comprehensive section about compliance with fair lending and consumer protection law.

Execution of Plan and Rakuten’s CRA committee

NCRC appreciates that “Periodically, representatives of non-profit entities and government agencies serving LMI individuals will be invited to attend” meetings of Rakuten’s bank CRA committee.[34] However, NCRC suggests that Rakuten institute a more regular and formal process for receiving and considering community input. In particular, NCRC has negotiated community benefit agreements with banks that establish community advisory committees that meet with bank representatives on a regular basis throughout the year. In a regular as opposed to ad hoc engagement, issues associated with a bank’s ability to meet community needs are addressed in a more consistent and systematic basis.

Conclusion

Rakuten’s charter application cannot be approved by the FDIC. The current CRA plan does not illustrate a willingness to meet credit and deposit needs in all areas in which Rakuten does business and makes loans as required by the convenience and needs factor for charter approval. In addition to a lack of a robust CRA plan, Rakuten does not offer an explicit and ironclad commitment to responsible and fair lending in its charter application. We ask the FDIC to reject this application and implement a high standard for any non-bank seeking the privilege of a bank charter.

Thank you for the opportunity to comment on this important matter. This letter represents the perspective of NCRC and the undersigned organizations. If you have any questions, you can reach me or Josh Silver, Senior Advisor, on 202-628-8866.

Sincerely,

Jesse Van Tol

CEO, NCRC

Undersigned Organizations

Alabama

Alabama Association of Community Development Corporation

Alabama Small Business Development Initiative

Birmingham Business Resource Center

Birmingham City Wide

Building Alabama Reinvestment

Commune Action Association of Alabama

California

Bankers Small Business CDC of California

cashcommunitydevelopment.org

CDC Small Business Finance

Fair Housing Council of the San Fernando Valley

Delaware

Delaware Community Reinvestment Action Council, Inc.

Edgemoor Revitalization Cooperative, Inc.

District of Columbia

Africa Diaspora Directorate

SONS AND DAUGHTERS OF AFRICA (SADA) (Africanization Society)

Florida

Affordable Homeownership Foundation, Inc.

Georgia

Georgia Advancing Communities Together, Inc.

Illinois

Universal Housing Solutions CDC

Woodstock Institute

Indiana

Continuum of Care Network NWI, Inc.

Maryland

Maryland Consumer Rights Coalition

Massachusetts

Community Service Network Inc.

Minnesota

Jewish Community Action

Missouri

Justine PETERSEN Housing & Reinvestment Corp

New York

Fair Finance Watch

PathStone Enterprise Center

North Carolina

Reinvestment Partners

S J Adams Consulting

The Durham Committee on the Affairs of Black People

Ohio

Friends of the African Union Chamber of Commerce

Hamilton County Community Reinvestment Group

Miami Valley Fair Housing Center, Inc.

Texas

Harlingen CDC

Wisconsin

Metropolitan Milwaukee Fair Housing Council

[1] FDIC Statement of Policy on Applications for Deposit Insurance, https://www.fdic.gov/regulations/laws/rules/5000-3000.html

[2] FDIC Statement of Policy.

[3] Rakuten’s application, p. 2.

[4] Statement of Martin J. Gruenberg, Chairman, Federal Deposit Insurance Corporation on De Novo Banks and Industrial Loan Companies before the Committee on Oversight and Government Reform; U.S. House of Representatives; 2157 Rayburn House Office Building, https://www.fdic.gov/news/news/speeches/spjul1316.html

[5] Rakuten application, p. 6.

[6] Rakuten application, p. 3.

[7] See § 345.41 (c) (2), Assessment area delineation, of the FDIC CRA regulation via https://www.fdic.gov/regulations/laws/rules/2000-6500.html#fdic2000part345.41

[8] See https://www.lendingclub.com/info/statistics.action for summary data tables and to download data.

[9] These states are CA, NY, TX, FL, IL, NJ, PA, OH, GA,VA.

[10] 2016 Broadband Progress Report, Federal Communications Commission, Jan. 29, 2016, retrieved at https://www.fcc.gov/reports-research/reports/broadband-progress-reports/2016-broadband-progress-report

[11] CRA exam of Celtic Bank, https://www5.fdic.gov/CRAPES/2017/57056_171106.PDF

[12] Board of Governors of the Federal Reserve System, Report on the Economic Well Being of U.S. Households in 2017, May 2018, p. 21, https://www.federalreserve.gov/publications/files/2017-report-economic-well-being-us-households-201805.pdf

[13] Government Accountability Office: Community Reinvestment Act: Options for Treasury to Consider to Encourage Services and Small-Dollar Loans When Reviewing Framework, March 16, 2018, https://www.gao.gov/products/GAO-18-244

[14] Rakuten application, p. 13.

[15] Rakuten application, p. 60.

[16] Rakuten application, p. 3 and 60 for discussion of its commercial products, and p. 41; its strategic plan states it has limited retail operations.

[17] Community Reinvestment Act; Interagency Questions and Answers Regarding Community Reinvestment Act Guidance, OCC, Board of Governors of the Federal Reserve System, FDIC, Fed. Reg. 81, 142 at 48506, https://www.gpo.gov/fdsys/pkg/FR-2016-07-25/pdf/2016-16693.pdf

[18] Interagency Q&A at 48542.

[19] Rakuten application, p. 66.

[20] Rakuten application, p. 69.

[21] Rakuten application, p. 69.

[22] Rakuten application, p. 55 and page 61.

[23] Rakuten application, p. 45 for high price of homes, page 46 for high rental costs and low vacancies.

[24] Rakuten application, p. 49

[25] Rakuten application, p. 50

[26] Rakuten application, p. 53.

[27] Rakuten application, p. 57.

[28] Rakuten application, p. 58.

[29] Rakuten application, p. 59.

[30] Rakuten application, p. 59.

[31] Closing the Digital: A Framework for Meeting CRA Obligations, Federal Reserve Bank of Dallas, July 2016, retrieved at https://www.dallasfed.org/assets/documents/cd/pubs/digitaldivide.pdf

[32] Rakuten application, p. 66.

[33] http://www.responsiblebusinesslending.org/

[34] Rakuten application, p. 41.