NCRC analysis of OCC & FDIC proposal indicates credit card lenders may have reduced incentive to make community development investments.

The Office of the Comptroller of the Currency (OCC) and the Federal Deposit Insurance Corporation (FDIC) recently proposed a rulemaking (NPRM) that would radically change the manner in which retail lending, consumer lending and community development (CD) activities of banks to low- and moderate-income (LMI) borrowers and census tracts are assessed during examinations under the Community Reinvestment Act (CRA). In order to gain a better understanding of the impact of the proposed guidelines on CD lending and investment, the National Community Reinvestment Coalition (NCRC) examined three banks with limited branch footprints that specialize in credit card lending: American Express, Discover and Synchrony. American Express and Synchrony are headquartered in Salt Lake City, Utah, and Discover is headquartered in Wilmington, Delaware. Many of the community development lending and investment activities of all three banks are closely aligned with their headquarter locations. Their total deposits and outstanding loans are comparable (within 14% of each other), while the ratio of CD lending and investment activities to total deposits are quite low for two of the banks (American Express and Discover). Consumer lending is the major portion of their business, largely shaping their capability for retail lending to LMI borrowers and neighborhoods. This makes the expansion of CRA credit to consumer lending especially impactful for these three lenders.

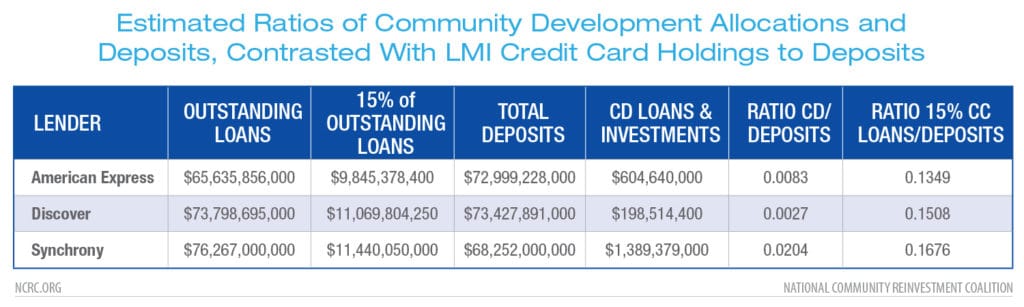

In order to model the proportion of their consumer lending that might be eligible for CRA credit, NCRC utilized data on total outstanding credit card loans taken from the latest Call Reports (section RC-C, part 1, line 6), the retail domestic deposits (schedule RC-E, part 1, line 1)[1] and the most recent CRA examinations for annualized CD lending[2] and investments completed by FDIC or OCC examiners. To model the potential amount of outstanding loans held by LMI borrowers we needed to interpolate a reasonable estimate from other sources. The Consumer Financial Protection Bureau (CFPB) estimates that 23% of the credit scored U.S. population are in the subprime and deep subprime category, however, we do not know the proportion of LMI cardholders[3] . In the mortgage market, LMI borrowers made up a 20.9% share of the loan count and 11.6% of the dollar volume[4] . For purposes of our analysis, we estimated that LMI borrowers could hold 15% of the outstanding credit card loans.

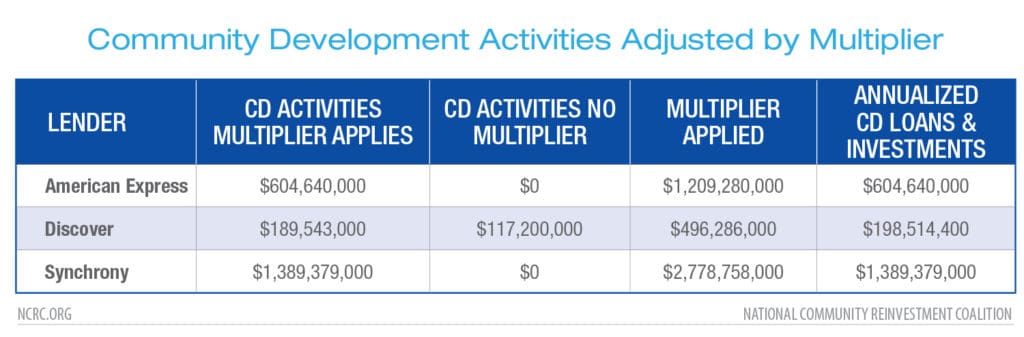

The OCC and FDIC NPRM introduces a multiplier for qualifying CD lending activities. On page 36 , it specifies “…CD investments (not including MBS mortgage-backed securities and municipal bonds) would be adjusted upward by a multiple of two to provide incentive for banks to engage in those activities.” Most CD lending also would be multiplied by two. In our example we calculated CD lending and investments for the most recent CRA exams of the three lenders (Table 1). American Express and Synchrony were both fully qualifying in their lending and investing activities, substantially elevating their adjusted CD amount. On the other hand, Discover had $117.2 million in MBS during the exam period, which is not multiplied by two. Consequently, once Discover’s CD activities are annualized over their two and a half year CRA examination period, their examination credit for total CD investment and lending is only one-third that of American Express, and one-seventh of Synchrony.

This ranking changes when consumer credit enters the picture as a factor of CRA compliance. We calculated the ratio of CD activities to the amount of deposits held, and found that this varied from a low of .0027 for Discover to .0204 for Synchrony, indicating its substantially larger qualified CD lending and investment activity (Table 2). If we calculate a ratio of the proportion of credit card loans divided by deposits held, Synchrony is still ranked first, with a ratio exceeding 0.167, but Discover is a close second with 0.151. In this example, the position of Synchrony remains ahead, while American Express drops from second to third in LMI credit card lending to deposits ratio. The beneficiary of a valuation utilizing consumer credit lending is Discover, whose position improves when credit card lending to LMI borrowers becomes a compliance factor. It is evident from the example that inclusion of consumer lending alters the calculation of examination scores of lenders. The effect could encourage more lucrative activities, such as high-interest, subprime credit card lending, while lessening the incentive for some lenders to engage in CD activities.

Overall, the three lenders’ credit card to deposit ratio exceeds the .11 threshold for Outstanding in the agency proposal. When they hit their CD minimum of .02, they will have little incentive to increase their CD financing. In fact, Synchrony is already above .02 and American Express is close to .01. The long-term impact of this proposal could be stagnant CD financing levels unless the agencies adjust the ratios upward. In cases where current CD lending and investment levels exceed the minimum threshold for qualified CD activity, inclusion of consumer lending criteria could act as a disincentive to maintain current levels of CD lending and investment.

[1] For financial information on banks, see https://www7.fdic.gov/idasp/advSearchLanding.asp

[2] The CRA search engine for finding ratings and exams: https://www.ffiec.gov/cra/ratings.htm. The most recent exam for American Express was 2015, for Discover was 2017, and Synchrony was 2018. The CD loan and investment were annualized to arrive at a yearly average. This accounted for the differences in the CRA examination period of the banks: two years for American Express and Synchrony, and two and a half 1-years for Discover.

[3] Consumer Financial Protection Bureau, The Consumer Credit Card Market, August 2019, ttps://files.consumerfinance.gov/f/documents/cfpb_consumer-credit-card-market-report_2019.pdf

[4]Laurie Goodman, John Walsh, Jun Zhu, Most CRA qualifying loans in low- and moderate-income areas go to middle- and upper-income borrowers, in Uban Wire: Housing and Housing Finance, the blog of the Urban Institute, March, 2019, https://www.urban.org/urban-wire/most-cra-qualifying-loans-low-and-moderate-income-areas-go-middle-and-upper-income-borrowers

Bruce Mitchell, PhD, Senior Analyst, Research & Evaluation, NCRC

Josh Silver, Senior Advisor, NCRC