Community

Reinvestment Act

Keep Up

alerts by email.

The Community Reinvestment Act (CRA) was passed by Congress in 1977 to encourage deposit-taking banks to reinvest in the communities where they operate. The law was passed to combat “redlining” – a practice where banks would not issue loans in neighborhoods with high populations of people of color or low- and moderate-income (LMI) residents.

UPDATE

CRA regulations were overhauled in 2023. Check out NCRC’s guide to the changes in the final CRA rule for more.

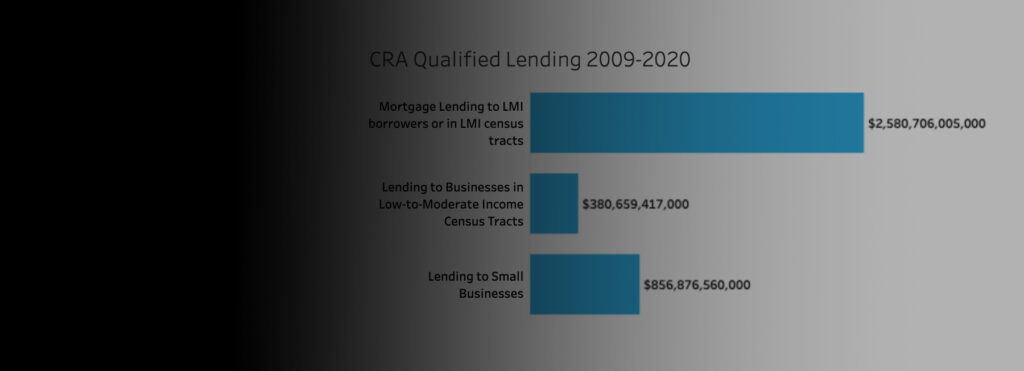

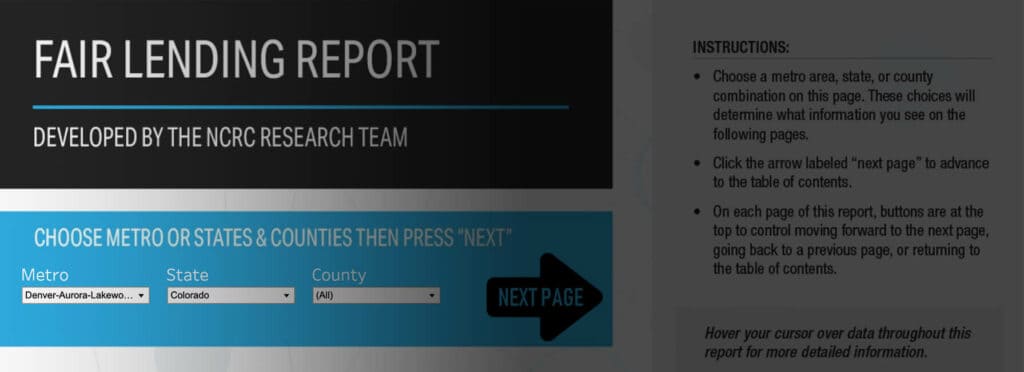

CRA requires banks to meet the credit needs of all communities, including LMI areas, consistent with the safety and soundness of the banks’ operations. The law created a framework wherein community organizations, banking regulatory agencies and financial institutions interact in assessing how well a financial institution is meeting the needs of disadvantaged communities. This framework has proven critical in promoting greater investment and service in areas that banks might otherwise disregard.

NCRC and our members have used the CRA to negotiate community benefits agreements (CBAs) with 21 different banks, totaling over $574 billion in loans and investments for affordable housing, small businesses, economic development and bank branches in low- and moderate-income neighborhoods and communities of color.

Contact Us

For additional information on the Community Reinvestment Act.