NCRC 2020

Impact

Overview

NCRC is well known among policy makers and in the private sector for our work as an advocacy organization, including our efforts to preserve, enforce and strengthen the Community Reinvestment Act. That work continues and remains a high priority for our policy team.

But NCRC is also much more than that. From our founding in 1990, NCRC has grown into an association of more than 600 community-based organizations, and into a social enterprise that produces agenda-setting research, investigations, publishing, training, insight and a variety of services.

Today, NCRC is deeply engaged in the deployment of capital for community impact. We renovate and build affordable homes for low- and moderate-income families; we provide counseling to home buyers and owners and business-building expertise and financing to small businesses; we train and support housing counselors, nonprofit leaders and entrepreneurs, we monitor, investigate and challenge discrimination in lending and housing; and we convene and facilitate dialog between financial institutions and community networks to increase lending, investments and philanthropy in neighborhoods that need it.

Read on for a look at the scope and impact of our work in 2020.

Catastrophe, Resilience

2020 altered the way the world operates and challenged the values we chose to uphold. This was true for everyone, NCRC and its network included. The coronavirus pandemic, the Black Lives Matter movement, and the 2020 presidential election pushed NCRC to become more responsive, innovative, transparent and communicative about the principles that guide our work.

The COVID-19 pandemic hit hardest communities burdened by historical and ongoing disparities – many of which are communities of color and low-wealth communities that NCRC members are both a part of and serve. Through our network, we learned about the rates of unemployment, business closures and housing instability that rivaled the Great Depression. Our members suffered alongside and within their communities as they struggled to provide direct services, keep staff and apply for federal relief. NCRC was no exception to this hardship and had to become more innovative, resilient, flexible and efficient in how we conducted our work. We gained clarity and direction about the future of work and the role of NCRC as a champion for a just vision of that future. We invested heavily in technology and expanded publishing and virtual training and events. We assisted our members as they transitioned to remote services. We helped members access Payroll Protection Program funding and other recovery grants made available through the private sector. We also tested lenders and found glaring evidence that White applicants for PPP loans were treated better than Black applicants. The pandemic also made apparent the need for stakeholder partnerships. A ground-breaking NCRC report made clear the connection between historic discrimination and modern wealth and health outcomes, and we made a concerted effort to engage hospitals around community investment.

NCRC was from its beginning committed to equality and civil rights. In 2020, the Black Lives Matter movement galvanized Americans from all walks of life to protest the deaths of George Floyd, Breonna Taylor, Ahmaud Arbery and what they represented: an endless cycle of police brutality against people of color. It compelled us to dig deeper and work harder to create equitable wealth-building opportunities and to solve economic injustice. NCRC leveraged its influence to call for racial equity in the private sector, especially in banking and finance services to address the growing racial wealth divide. NCRC developed benchmarks to increase the workforce representation of race and ethnic diversity and in supplier contracts within financial institutions. We installed a banner on our headquarters two blocks from the White House in downtown D.C. to show support for BLM and for protests in the streets below. We also launched internal initiatives to address the impact of racial injustice on staff and how that too is central to our mission of a Just Economy.

Even as a non-partisan organization, NCRC felt the energy leading up to the 2020 election. Federal agencies scurried to pass regulations that were harmful to low-income communities and communities of color. This was seen in several banking and housing policies, and most notably in new rules for enforcement of the Community Reinvestment Act from the Office of the Comptroller of the Currency. NCRC’s rapid response rallied our nationwide coalition of members and stakeholders and thousands of individuals who submitted comments opposed to the new rules. We sued to cancel the new rules, the two other banking agencies that enforce the law, the FDIC and Federal Reserve, declined to go along with the new rules, and our strong response set the stage for a more thoughtful joint rule-making effort involving all the banking agencies in 2021.

NCRC’s greatest impact in 2020 was outside of Washington, in the communities served by our members across the nation. That included Community Benefits Agreements we negotiated with Morgan Stanley, First Merchants Bank and Huntington Bank which, combined, meant $36.4 billion in lending, investments and philanthropy committed to the communities served by those lenders.

It was a difficult year for everyone, but the challenges of 2020 helped NCRC grow and reinforced our commitment to advancing a Just Economy. We entered 2021 with renewed hope, more experience and a deeper commitment to the work that lies ahead.

Above all, we thank our members, allies and funders for their continued trust and support.

COVID-19 Response & Recovery

With support from the U.S. Department of Housing and Urban Development (HUD), we provided more than $2 million in funding to members of NCRC’s Housing Counseling Network, and $250,000 in pandemic relief funding supported by Wells Fargo to members across 15 states. The grants provided financial support for technology and other expenses to Housing Counseling Network members in Puerto Rico, Texas, Florida, New Mexico, Tennessee, New Jersey, Ohio, Maryland, Arizona, Connecticut, Michigan, Indiana, California, Wisconsin, Iowa and the District of Columbia. Counseling agencies used these funds to secure platforms that would assist with video conferencing and record retention. Additionally, agencies were able to provide laptops and PPE for clients and staff meeting physically in the office.

When the pandemic emerged, there was an immediate need for nonprofit organizations to receive training on the necessary knowledge, tools and resources to better serve their communities. In 2020, NCRC’s National Training Academy (NTA) increased their number of trainings by 173% compared to the previous year.

NTA produced 147 online training events on housing counseling, capacity building and other topics for more than 4,000 participants from nonprofits nationwide.

With funding support from HUD and JPMorgan Chase & Co., NTA provided training on disaster recovery, financial capability, preparation for the HUD certification exam, CRA, foreclosure intervention, nonprofit sustainability, advocacy and many other topics.

Community Reinvestment Act

OCC issued new rules, NCRC sued

In June, NCRC took an unprecedented action for the organization by filing a lawsuit against the Office of the Comptroller of the Currency (OCC) to stop a final rule it had issued that would vastly diminish the effectiveness of the Community Reinvestment Act (CRA) in promoting lending and reinvestment in low- and moderate-income (LMI) communities. NCRC and the California Reinvestment Coalition (CRC) led the lawsuit against the OCC that also involved a number of NCRC members and co-plaintiffs.

...the OCC issued a Final Rule that guts the act and eviscerates the backing it provides to the LMI communities and communities of color...

The lawsuit, which remained pending in federal court at the end of the year, stated, “acting alone and without the support of the other federal regulatory agencies that implement the CRA, the OCC issued a Final Rule that guts the act and eviscerates the backing it provides to the LMI communities and communities of color that have long suffered from discrimination by financial institutions. It will allow banks to receive credit for activities that do little or nothing to help those communities and that may in fact harm and displace the residents of these communities. By applying a one-size-fits-all formula, the Final Rule ignored local needs and allows banks to disregard a large number of communities in favor of ones where it may be more financially advantageous to concentrate their investments.”

Of the 1,922 unique comments submitted, 1,594 or 83% disagreed with the OCC’s rule

Training, Expertise and Capital for Small Businesses

The D.C. Women’s Business Center (DCWBC), operated by NCRC and supported by the U.S. Small Business Administration, provides women entrepreneurs in the DC metro region with information and assistance to create and maintain thriving small businesses. In 2020, DCWBC counseled 190 clients, created 26 jobs, trained 369 people, provided $381,000 in capital infusion loans and helped business owners secure over $150,000 in contracts. In addition to these successes, the DCWBC provided critical business coaching and helped numerous business owners expand their businesses and obtain loans.

In 2020 DCWBC...

• counseled 190 clients

• created 26 jobs, trained 369 people

• provided $381,000 in capital infusion loans

• helped business owners secure over $150,000 in contracts

DCWBC provided 9 virtual trainings and webinars to over 450 people. Topics included: Strategic Realignment Business in a “New Normal”, Navigating the CARES Act: Understanding the PPP & EIDL Loan, Small Business Brief Advice Legal Clinic and Expanding Global Opportunities for Women-Owned Businesses During COVID-19.

An NCRC report co-authored with the Piedmont Business Council, “Impact of COVID-19: African American Entrepreneurship in Piedmont, North Carolina,” found that while all self-employed entrepreneurs in North Carolina experienced great fluctuations in active employment rates from March to August, White entrepreneurs enjoyed a complete return to pre-COVID active entrepreneurship rates by August. On the other hand, rates of Black self-employed entrepreneurs that are actively working experienced a 62% decrease by August from pre-COVID rates of active employment.

EQUIVICO By NCRC

In 2020, NCRC’s Capital Markets division, led by Eleni Delimpaltadaki Janis, expanded NCRC’s reach and service to small businesses in lower-income communities, especially those owned by people of color, women and veterans. We developed and launched Equivico by NCRC, an impact investment manager, that facilitates inclusive and responsible small business lending nationally and provides transformative training and mentorship to borrowers.

When COVID-19 crushed the economy in early 2020, Equivico acted quickly to help small businesses find their footing through three key initiatives.

- We trained nearly 400 businesses on the fundamentals of the Payroll Protection Program loan application process before the program opened.

- We created a robust COVID-19 online guide of federal, state, city, and private sector aid for small businesses, which was accessed more than 2,000 times.

- We designed the Stavros Niarchos Foundation (SNF) Small Business Growth & Recovery Fund, a grant program to provide small businesses with non-repayable grants of up to $20,000 each, along with training and mentorship. The program launched in February 2021.

Community Benefits Agreements

Since 2016, NCRC has pioneered a collaborative process that leads to written commitments from banks to increase their lending, services and philanthropy in LMI communities and communities of color. Despite new challenges caused by the pandemic, NCRC had another big year in 2020 negotiating community benefits agreements (CBAs) between large financial institutions and our members. NCRC finalized two new plans, with a combined value of $36.4 billion, one with Morgan Stanley ($15 billion) and one with First Merchants Bank ($1.4 billion), as well as our first renewal of a community benefits plan with Huntington Bank ($20 billion). Our community benefits work in 2020 also reflected lessons learned about how we can tailor these plans to better address racial inequality and expand opportunity.

It’s becoming increasingly clear that nonprofits led by African Americans, Hispanics, Asians and other people of color face greater difficulty in securing funding for their critical services and programs. Nonprofits led by people of color were more likely to report a lack of access and challenges with fundraising from individual donors (63% vs. 49%) and from foundations (51% vs. 41%) compared to White-led nonprofits.

2016 - 2020

billion

in community benefits agreements with

14 banks

NCRC’s 2020 agreements put several strategies in place to address this issue in 2021. In addition, Huntington and First Merchants agreed to expand the overall number of organizations they partner with, which will also expand opportunities for nonprofits offering crucial services.

First Merchants also committed to specific goals and significant increases in lending for African Americans, Hispanics and Asians, in addition to borrowers with low- and moderate-incomes. On average, each of the above groups will see an increase in lending of 33% over the course of the First Merchants agreement.

NCRC also worked with Morgan Stanley to secure $5 million for a new Field Empowerment Fund to provide grants to our CDFI, affordable housing, small business and housing counseling members. These funds will also be largely targeted to organizations led by people of color. This fund is part of the $15 billion plan negotiated with Morgan Stanley as a result of their merger with E*TRADE.

The 2020 plan with Huntington was our first community benefits plan renewal. Huntington committed to $20 billion in loans, investments and philanthropy over five years, a $4 billion increase from our first Huntington agreement. The 2020 Huntington agreement reflected new items that will expand opportunities by including commitments to meet or maintain leadership levels of supplier and executive diversity.

Our 2020 commitments involved 112 of our member organizations. Between 2016 and 2020, NCRC confirmed 14 commitments from banks to direct $210 billion into underserved communities, and to open 59 new bank branches.

Affordable Homes By GROWTH

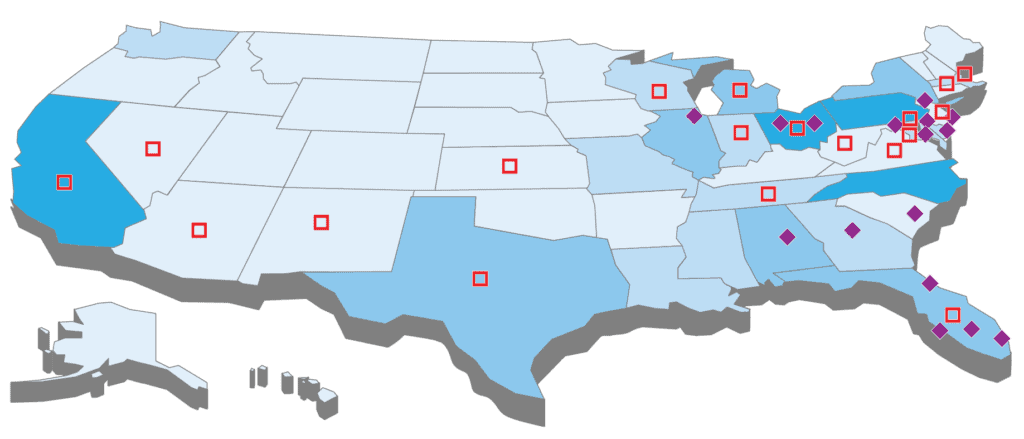

GROWTH is an initiative of NCRC designed to create pathways to homeownership for low- and moderate-income (LMI) individuals and families while improving property values in LMI communities. GROWTH operated in 17 markets in ten states and the District of Columbia in 2020.

GROWTH’s impact investment fund, the NCRC Housing Rehab Fund, builds new homes, purchases and renovates older homes, and sells existing homes. Despite significant obstacles created by COVID-19, GROWTH nevertheless achieved its highest volume of sales in its history and completed 202 homes in 2020.

Since 2015, GROWTH has...

• invested more than $100 million in 650 homes

• sold 395 homes

• 83% of the homes were sold either to LMI buyers or within LMI communities

Career and Technical Education

Starting with a workforce training program developed by NCRC’s GROWTH team in East Wilmington, Delaware, NCRC’s Workforce Development initiative has grown into a program that provided career and technical education for more than 1,000 LMI individuals in 13 cities in eight states in 2020. Workforce training has become a major focal point of NCRC’s support for organizations serving individuals and families on food stamps (SNAP), a focus that was particularly timely given the dramatic expansion of SNAP recipients nationwide during the pandemic. To date, NCRC’s workforce training program has served more than 7,000 people and placed more than 5,000 in living wage jobs.

Some Numbers

Agreements

We facilitated two community benefits agreements with banks that committed $36.4 billion for lending, investments and philanthropy in their communities. From 2016 through 2020, NCRC confirmed commitments from 14 banks to direct $210 billion into underserved communities, and to open 59 new bank branches.

Research

We produced ground-breaking and widely cited research creating 22 research briefs and producing a new interactive Fair Lending Report.

Virtual Events

13 Just Economy Sessions

2,054 Attendees

Training

We provided 147 online trainings to 4,000 participants on fair housing laws, fair lending and the Community Reinvestment Act (CRA).

Housing

We completed 202 homes, 83% of which supported homeownership in LMI neighborhoods or for LMI families.

To Date:

• 650 homes invested in

• 395 homes sold

• $107 million invested

Housing Counseling Network

3,116 clients served:

• 972 Foreclosure Prevention Counseling

• 1,010 Pre-Purchase Counseling

• 386 Rental Counseling

• 42 Reverse Mortgage Counseling

• 43 Homeless Counseling

• 685 Financial Management/Budget Counseling

• 411 Post-Purchase Counseling

• 571 Total number of clients seeking a forbearance

Housing Counseling Network

Member organizations in 18 states the District of Columbia and Puerto Rico assisting a total of 8,868 clients.

Growth

18 markets in

10 states and the District of Columbia

Coalition

Our coalition grew to 620 organizations in 44 states

Up to 9

10-19

20-39

40-70

Research

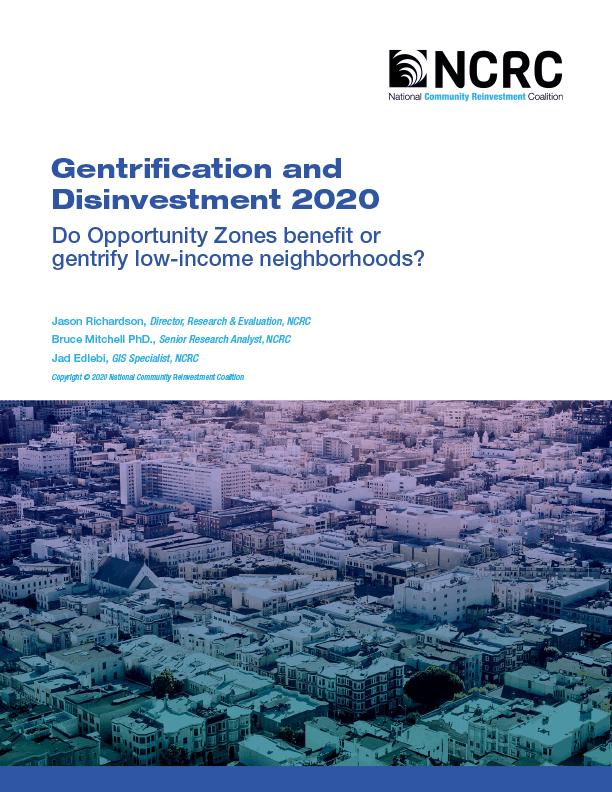

NCRC research offers national reports on critical topics like redlining and bank branch closures. In 2020, NCRC published a major report on Gentrification and Opportunity Zones, building upon previous work on gentrification and displacement. Both of these reports garnered national press coverage and are still continuously cited.

In addition, the coronavirus pandemic provided a new opportunity for NCRC to explore new ideas about how community investment relates to other important issues such as public health. This led to our first report on the relationship between redlining, public health and COVID-19 risk in partnership with the University of Richmond and the University of Wisconsin – Milwaukee.

NCRC also continued to support members and stakeholders including Congress and other national partners with custom research to help further their work on a variety of issues. In 2020, the research team greatly expanded the access that members have to their services. A new, interactive Fair Lending Report can be customized easily for members based on their needs. We also increased our work advising members on their own research and analysis, becoming a leader in the research space on a number of issues.

A new area for NCRC was the publication of numerous research briefs, shorter reports about specific topics of interest. Placing NCRC as the authority on topics that our members care about, these research briefs covered a broad swath of topics. In 2020 alone, we wrote about the Small Business Administration Paycheck Protection Program, 2019 mortgage lending, Asian American mortgage lending (in partnership with National CAPACD), same-sex mortgage lending, bank branch closures, the CFPB consumer complaint database, and more. We published 22 research briefs in 2020.

Finally, NCRC invested in tools and skills to continually improve the services we offered to members. Since 2016, the federal government has pulled back from their efforts to make data broadly available to the public. In their place, we have expanded our capacity to host and process data, and we have amassed cloud databases that include almost 200 million mortgage loan records, 20 years of bank branch location and closure data, and 20 years of business lending data. Using various data software tools, we can work with almost any file format, from any source, and at any scale. This data matters. Members that fully understand the data of their communities can walk into a meeting with confidence and address the concerns of their constituencies on an even footing with banks, elected officials and other groups in part thanks to these efforts.

Our work results in greater impact for NCRC both nationally and in our member communities. NCRC research team members were sought after as speakers and interview subjects, appearing in dozens of panels as well as print, radio and video interviews, documentaries and webinars. They also were asked to review new reports both for peer reviewed journals and for national and local partner organizations, and were frequently called upon by federal agencies for informal consultations on how we use the data they produce and for feedback on how to improve that data.

Ensuring Equitable Access

NCRC’s Fair Housing and Fair Lending teams investigate claims of discrimination, and conduct tests to reveal evidence of discrmination in lending and housing.

Fair Housing

real estate sales tests

Two tests that showed differential treatment on the basis of race led to a settlement with a Virginia housing provider. As part of the settlement, NCRC will provide training to the company over the next three years to help them better follow fair housing laws. The team also conducted 100 affordable rental housing tests for an Indiana state agency. The agency picked four tests in 2020 to file enforcement complaints against the housing providers, while still reviewing others and filing additional complaints in 2021.

Fair Lending

matched-pair tests

NCRC completed more than 120 matched-pair tests focused on the protected classes of race, national origin and gender in the Washington, D.C., and Los Angeles metropolitan statistical areas. Tests in April and again in July found that White applicants for PPP loans were treated better than Black applicants, a pattern that was well documented in small business lending before COVID-19. NCRC’s PPP testing was cited widely by media and became a benchmark for discussions about flaws in the PPP program as well as in fair lending standards and training gaps at banks.

Age-Friendly Banking

NCRC Supported Older Americans through education, research, outreach

Older Americans were astutely impacted by the pandemic. NCRC advanced its Age-Friendly Banking program to reach more older adults with important and changing information about COVID-19 scams and resources to help maintain their financial security through the crisis. We created education and outreach content for members and the general public with webinars, a home mortgage report, a literature review and continued engagement with national and local leaders in the aging and banking space.

COVID-19 prompted innovation among scammers. Both strategies for reducing elder fraud and enhancing financial management in the midst of the pandemic quickly became immediate needs for older adults and their caregivers. Our webinars, Federal Agency Strategies For Reducing Elder Fraud and Older Adults and Banking And Financial Management During COVID-19, garnered nearly three times as many attendees as Age-Friendly Banking webinars and in-person events in 2019, indicating a need for urgent content in banking, financial management and aging.

In NCRC’s research brief on mortgages and older adults, we found that older borrowers were Whiter than younger borrowers, and that there are racial disparities in interest rates charged between minority and White older borrowers.

We continued to be a voice for consumers, namely older adults with reverse mortgages indexed to LIBOR by joining the National Consumer Law Center in their comment letter regarding the issuance of guidance on cessation of LIBOR, selecting an appropriate rate replacement and preparation of servicers. NCRC also joined the National Consumer Law Center, Student Borrower Protection Center, National Fair Housing Alliance, NAACP, Americans for Financial Reform Education Fund and National Consumer Law Center to comment on the Facilitating the LIBOR Transition.

NCRC’s continued communication and engagement with its established audience on older adult issues allows it to maintain a presence in all issues related to Age-Friendly Banking, Aging in Community and Healthy Aging. The National Neighbors Silver monthly newsletter has a readership of 2,060 and includes original content from NCRC, as well as other related sources.

Healthy Communities

Building wealth isn’t just about saving money or improving access to lending. Economic well being is intrinsically tied to social, physical and mental health, and financial instability has a direct ramification on a person’s health. The connection between health and community development is clear. Low- and moderate-income communities tend to suffer much more from health issues than wealthier neighborhoods. And health inequality prohibits many families and individuals from generating wealth. By improving health, we can make strides toward a more just economy. Given the life changing nature of a global pandemic and the insufficient national response, NCRC made a critical pivot to meet urgent capacity needs of our member organizations.

NCRC launched a COVID-19 Resources page that was updated throughout the year. We also participated in the Health and Wealth Summit: Stabilizing Underserved Communities While Fighting a Pandemic and presented a session about what COVID-19 revealed about the social determinants of health.

NCRC also engaged its strong network of community reinvestment advocates to communicate directly with regulators, and strengthen relationships with local and state elected officials who depend on the Community Reinvestment Act for critical community development investments reach out to untraditional local allies, such as public health advocates, hospitals, health care systems and civil right organizations to emphasize the intersectionality of this campaign, as safe, healthy, affordable housing is a social determinant of health.

We also launched a bi-weekly Health & Wealth newsletter in 2020 to update doctors, medical professionals, hospitals and health systems and national organizations focused on public health and upstream investments. There were nearly 2,000 recipients of the newsletter by the end of the year.

NCRC elevated the connection between police brutality, criminal justice and public health by highlighting emerging practices across the country aimed at eliminating racial inequity in health.

LGTBQ+

Promoting Diversity and Inclusion in the Financial Services Industry

A 2020 report from NCRC and Beneficial State Foundation introduced a Racial and Ethnic Representation and Investment (RERI) framework for banks to set goals, measure progress and evaluate performance of managers and executives. It emphasizes accountability through transparent reporting and goal-setting that banks must do on behalf of their public depositors.

Banks are past due to make good on their racial and gender equity and inclusion commitments.

NCRC’s RERI framework included a four-tiered grading system for banks to analyze their internal diversity progress. The framework also includes a review of hiring, recruitment, retention, sponsorship programs and other best practices to improve racial and ethnic representation across all job levels, while also strengthening the bank’s commitment to diversity, equity and inclusion.

The report, which analyzed 2018 data from the Equal Employment Opportunity Commission (EEOC) on racial and ethnic diversity across different job levels, found that at the executive/senior level, compared to the overall population:

3%

were Black

(13.4% overall)

homes Sold

4%

(18.3% overall)

homes Sold

6%

were Asian

(6% overall)

homes Sold

30%

were women

(50.8% overall)

homes Sold

Audience, Influence

COVID-19 changed everyone’s story in 2020. Like other organizations, NCRC shifted to a fully remote approach to work, and to digital channels for publishing, advocacy, member communications and programs. For the year, our brand influence and reputation became stronger and our visibility grew significantly through both external media attention and through the original content we published and distributed ourselves. We doubled the volume of original content published and more than tripled the number of sent emails, mostly through newsletters. The growth of our external media citations hints at another critical element of our approach: continuous improvement to the quality of our content. NCRC research and points of view on lending, housing, redlining, gentrification, bank regulations, COVID relief and other topics were cited throughout the year by The New York Times, Walls Street Journal, NBC, ABC News, Washington Post, NPR, American Banker and many others, including regional and local media outlets nationwide.

Web

Unique posts

Sessions

+63%

(437,000)

Unique Users

+78.5%

(344,058)

Press Releases

Press/In the News

Citations

Potential Reach

6.5b

(+97%)

Just Economy Sessions

After the COVID-19 pandemic forced us to cancel our largest annual event, the 2020 Just Economy Conference, we launched the virtual Just Economy Sessions.

This year shined a growing spotlight on systemic racism, and brought economic devastation to our communities. Envisioning an Anti-Racist Economy: Reparations and Beyond was a conversation between creator of “The 1619 Project” Nikole Hannah-Jones and NCRC CEO Jesse Van Tol to discuss the renewed push for reparations and other strategies to repair the harm caused by white supremacy. In Lessons from the 2008 crisis: COVID-19 response and recovery, experienced housing counselors shared what they learned from the Great Recession recovery and how it applies today.

We gathered legends of the community development world to share their wisdom with young leaders running social justice organizations across the country today in Through the Storm: Wisdom from Community Development Leaders. We examined Opportunity Zones and Gentrification, how they relate, and most importantly how Opportunity Zones can be properly leveraged to help low-income communities.

The Just Economy Sessions helped equip more than 2,000 attendees with the tools needed to confront this grueling year and advance the fight for economic justice.

13

Sessions

homes Sold

homes Sold

2054

Attendees

homes Sold

Board of Directors

Robert Dickerson, Jr., Chairperson

Birmingham Business Resource Center

Ernest Hogan, Vice Chairperson

Pittsburgh Community Reinvestment Group

Jean Ishmon, Vice Chairperson

Northwest Indiana Reinvestment Alliance

Catherine Hope Crosby, Secretary

City of Toledo, Ohio

Ernest (Gene) E. Ortega, Treasurer

Rural Housing, Inc.

Bethany Sanchez,

Immediate Past Chairperson

Metropolitan Milwaukee Fair Housing Council

David Adame

Chicanos Por La Causa Inc.

Gilbert T. Bland

Urban League of Hampton Roads Tidewater Community College

Will Gonzalez

Ceiba

Peter Hainley

CASA of Oregon

Charles Harris

Housing Education & Economic Development

Irvin Henderson

National Trust for Historic Preservation

Matt Hull

Texas Association of Community Development Corporations

Carol Johnson

City of Austin’s inaugural Civil Rights Office

Brent Kakesako

Hawaii Alliance for Community-Based Economic Development

Matthew Lee

Inner City Press

Sharon H. Lee

Low Income Housing Institute

Moises Loza

Housing Assistance Council

Aaron Miripol

Urban Land Conservancy

Andreanecia Morris

HousingNola

Elisabeth Risch

Metropolitan St. Louis Equal Housing & Opportunity Council

Arden Shank

Community Reinvestment Alliance of South Florida

Kevin Stein

California Reinvestment Coalition

Beverly Watts

Tennessee Human Rights Commission

Marceline A. White

Maryland Consumer Rights Coalition

2019 Financials

These major funders provided $150,000 or more to NCRC in 2020:

- Bank of America

- Citi Bank

- U.S. Department of Housing and Urban Development

- Discover Bank

- Fifth Third Bank

- First Horizon Bank

- Ford Foundation

- Goldman Sachs

- Huntington National Bank

- JP Morgan Chase

- Morgan Stanley

- Ocwen Financial

- Paypal

- PNC Bank

- Quicken Loans

- Robert Wood Johnson

Foundation - Santander Bank

- U.S. Small Business Administration

- TD Bank

- Truist Financial

- W.K. Kellogg Foundation

- Wells Fargo Bank