Overview:

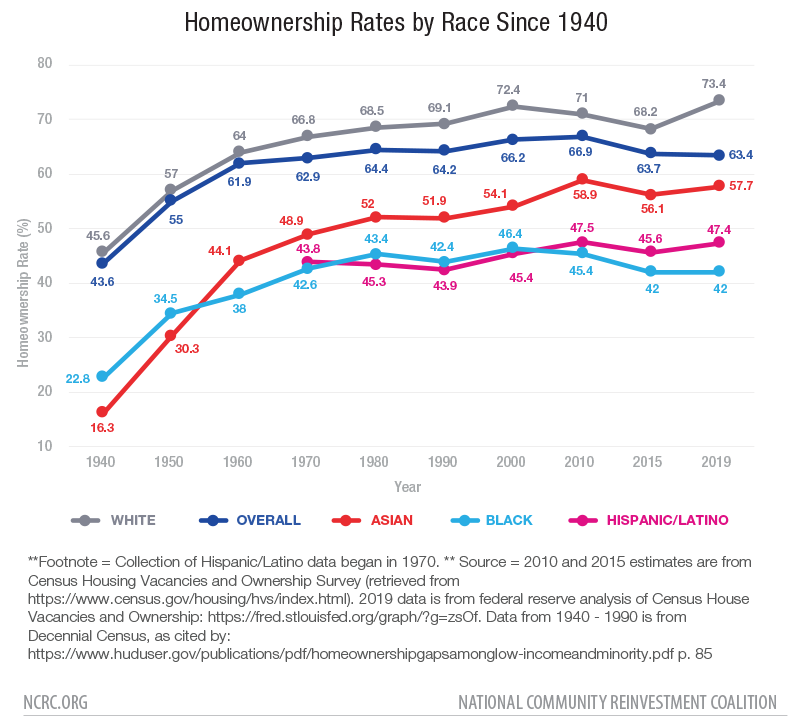

A radical increase in Black homeownership is needed to see progress in bridging Black and White homeownership and wealth inequality. One of the defining factors of economic well-being for individuals and families is household net worth or wealth, but not all families are equal. Decades of racial injustice and economic inequality have led to persistent disparities in wealth, specifically for people of color. One of the foundational steps in building wealth is homeownership. Today, the homeownership rate for African Americans[1] is approximately 42% – 45%, essentially unchanged from the rate decades ago and widening over the last a few years. This report highlights historic Black homeownership rates, and underscores the need to significantly increase homeownership rates for Black Americans. We believe reaching a 60% Black homeownership rate will address significant barriers to housing access and wealth creation for the African American community.

Takeaways:

- After declining for much of the past 20 years, the national Black homeownership rate has persisted at 42 percent between 2016 – 2018, as low as it was in 1970, while the rate of white homeownership increased to 73% percent in 2019, a record high.

- A 20% – 30% gap between Black/White homeownership rates has persisted for more than 100 years, despite Black homeownership increases in the mid-1900s.

- African Americans go into greater debt for less valuable homes and receive less of a return on homeownership than Whites.

- If holding the current rates of Black homeownership formation and loss constant, then it would require approximately 165,000 additional new Black homeowners annually over the next 20 years to get to 60% Black homeownership by 2040.

- Bold new approaches to housing finance and investment in community development is required to get to a 60% homeownership rate for African Americans.

- Even getting to a record-level Black homeownership rate of 60% will not bridge the Black and White wealth divide. Additional bold programs like baby bonds, full employment and reparations are needed to close the Black/White wealth divide in the foreseeable future.

- Black populations with moderate incomes in geographic areas with affordable housing and low Black homeownership rates offer strong opportunities to increase African American homeownership.

Introduction

For most Americans, homeownership is the largest component of their wealth. Disparate rates of wealth and homeownership are symbiotic issues that persist and continuously leave Black households behind in building generational wealth. One of the most vital ways to combat the racial wealth divide is increasing Black homeownership rates. Yet, there has been a lack of progress in increasing Black homeownership for most of the last 60 years and a similar lack of progress in bridging the Black/White homeownership divide for more than 100 years. The failure to include the majority of African Americans as homeowners is not new but requires a renewed sense of urgency.

Today’s Black homeownership rate is one of the lowest homeownership rates for African Americans in decades. Rates have been steadily declining from a peak of 49% in 2004, before the 2008 housing crisis.[2] This decline in homeownership rates, however, began before the housing crisis. In fact, in the past 15 years, Black homeownership has seen the most dramatic drop of any racial or ethnic group, and the Black homeownership rate in 2019 had descended to nearly as low as it was when discrimination was legal.[3] Currently, the average Black homeowner likely owns more in mortgage debt than their White counterparts on a house with less value. While the average first home of a Black purchaser is valued at $127,000, they also average $90,000 in mortgage debt. In comparison, White first-time homebuyers have an average home value of $139,000 with $75,000 in mortgage debt.[4] So African Americans go into greater debt for a lower-valued asset thus weakening the returns for this fundamental investment. This is an example of how even when African Americans acquire wealth-building assets like homeownership and higher education they have less of a return on their investment thus limiting the positive effect of these assets.

Early Black Homeownership Trends

In the wake of the 1930s Great Depression, the federal government sought to strengthen homeownership through the 1933 establishment of the Home Owners’ Loan Act and accompanying creation of the Home Owners Loan Corporation (HOLC), resulting in more than $3 billion in mortgage financing. The history of HOLC’s discriminatory and disparate neighborhood desirability rating system is well documented.[5] Predominantly White neighborhoods were deemed “most desirable” and outlined in city maps with green. In contrast, “hazardous” neighborhoods populated with “undesirable” ethnic groups and run-down infrastructure — predominantly Black communities — were outlined on city maps with red. HOLC’s discriminatory practices were enabled by the Federal Housing Administration, which ensured and supported lending and subsidized housing development in greenlined, predominantly-White communities. These housing policies, coupled with the socio-economic impacts of slavery and Jim Crow laws, contributed to a vastly unequal homeownership landscape. In 1940, the Black homeownership rate (22.8%) was nearly half of the White homeownership rate (45.6%).[6]

Despite these discriminatory housing policies, Black homeownership from 1940 to 1960 increased from 22.8% to 38%,[7] albeit home and neighborhood values were unequal, contributing to unequal return on investment and wealth creation. Despite the Jim Crow era and systemic discrimination in housing laws and practices, this growth in Black homeownership was historically the greatest increase in Black homeownership rates. This Black homeownership growth followed an overall rise in homeownership rates for all demographics. Contributing to much of this increase was the healthy economic conditions and housing boom post-WWII, enabled by a housing-construction moratorium lifting and low-interest mortgages, that benefited both White and Black households alike. However, even during the most significant increase in Black homeownership, there was little bridging the Black/White homeownership divide. In 1940, the gap in Black/White homeownership rates was 22.6%; in 1960, it widened to 26%.[8] The substantial rate in Black homeownership growth experienced from 1940 – 1960 began to stagnate after 1960, even after the 1968 Fair Housing Act, which was geared to right the wrongs of past housing legislation and practices. From 1960 to 1980, the Black homeownership rate only grew six percentage points — from 38% to 43.8%.

Homeownership over the last 40 years

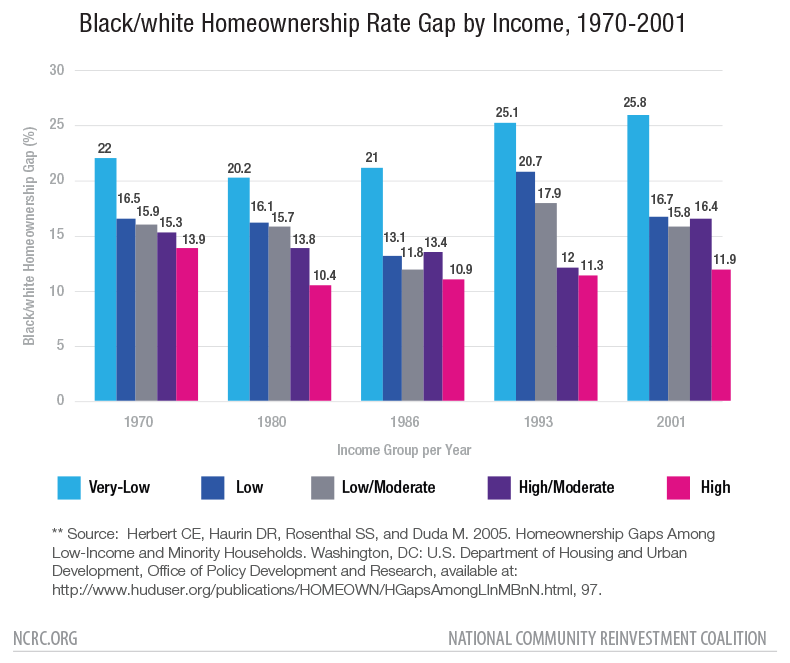

While Black homeownership has fluctuated over the past 40 years, the homeownership rate for Black Americans has still significantly lagged behind their White and Asian counterparts. Shockingly, Black homeownership rates remained relatively unchanged during the mid-’70s to early ’80s. Since 1980, the homeownership gap between high-income Black and White Americans, in particular, was marginally narrowed; however, the homeownership gap among low- and moderate-income (LMI) Black and White households remained relatively constant, and widened after the late 1980s, thus widening the gaps in wealth and asset generation between Black and White Americans.

While Black homeownership overall has remained relatively frozen since 1980, White homeownership grew to its current rate of 72.4%. While homeownership rates among Black Americans had stagnated, gains in White homeownership rates have increased, resulting in an ever-growing homeownership gap that leaves Black Americans behind and left out from wealth-building opportunities.[9]

Throughout the 1990s, Black homeownership rates experienced small increases. African Americans started the decade with a homeownership rate of 44% and ended it with a homeownership rate of 46.3%.[10] For African Americans in particular, homeownership rates reached a peak of 49% between 2004 – 2006. Once the housing bubble burst and the 2008 recession hit, more than 240,000 Black homeowners lost their homes[11] due to a myriad of reasons, such as the housing crisis’s subsequent economic recession, widespread job loss, foreclosures and overall financial instability. Disproportionate effects from the recession were seen across income brackets. High-earning Black homeowners were 80% more likely to lose their homes than their White counterparts. The consistently disparate impacts of the housing crisis on African Americans caused the preexisting racial wealth divide to dramatically worsen. In the Great Recession, the wealth of U.S. families overall was reduced by 28.5%, but for Black Americans, the decline was 47.6%.[12]

Throughout the 1990s, Black homeownership rates experienced small increases. African Americans started the decade with a homeownership rate of 44% and ended it with a homeownership rate of 46.3%.[10] For African Americans in particular, homeownership rates reached a peak of 49% between 2004 – 2006. Once the housing bubble burst and the 2008 recession hit, more than 240,000 Black homeowners lost their homes[11] due to a myriad of reasons, such as the housing crisis’s subsequent economic recession, widespread job loss, foreclosures and overall financial instability. Disproportionate effects from the recession were seen across income brackets. High-earning Black homeowners were 80% more likely to lose their homes than their White counterparts. The consistently disparate impacts of the housing crisis on African Americans caused the preexisting racial wealth divide to dramatically worsen. In the Great Recession, the wealth of U.S. families overall was reduced by 28.5%, but for Black Americans, the decline was 47.6%.[12]

Getting to 60% Homeownership

The United States must make strides to reverse the decline of Black homeownership that has been the trend for most of the last 20 years, and ensure home loss protections for its most vulnerable populations during and post COVID-19 economic disruption. Doing so not only ensures the economic stability of families but continues to also carve a path of wealth protection for low-wealth families. Since the turn of the century, homeownership rates for Black Americans have steadied and slowed more significantly than other racial group. Therefore, a focus on advancing Black homeownership is paramount to achieving a more equitable economy. A focus on African American households over the age of 40 with credit scores between 600 and 700 and a median annual household income of $40,000 to $100,000 is a group that is vital to strengthening Black homeownership rates. This age demographic is important to focus on, as younger Black homeowners have a higher likelihood of transitioning back to renting: 59% of Black homeowners younger than age 35 did so. This household income group is also important to focus on, as building wealth for LMI families via homeownership could significantly improve their economic standings overall. Homeownership efforts should also focus on southern and midwestern states with a largely middle-income African American population. These areas — such as Minnesota, Georgia and Michigan — have a large potential to increase Black homeownership rates nationwide.

How many new Black homeowners a year are needed to reach a 60% Black homeownership rate by 2040?

The Urban Institute recently calculated the impact of adding 3 million new Black homeowners by 2030. Using 2019 American Community Survey estimates, the Black population was approximately 41.98 million; 6,457 million were homeowners, resulting in a 42% homeownership rate. Assuming that: 1). Population increase remains constant, 2). the average rate of Black homeownership increase remains the same, 3). household formation rate remains the same, and 4). Black homeownership loss rate remains the same, then it can be estimated that if 3 million new Black homeowners were added by 2030, this would result in a 57.5% Black homeownership rate.

Utilizing this goal and assumptions, getting to a 60% homeownership rate by 2030 equates to 3.3 million new Black homeowners needed. This additional 3.3 million new Black homeowners would create a total of almost 10 million (9.9 million) or 330,000 a year.[13] Adding a decade to Urban Institute’s goal to accommodate the pace of progress set by historic precedent, creating 3.3 million new additional Black homeowners by 2040 would mean 165,000 additional new Black homeowners would be needed per year. This radical increase required for new Black homeowners speaks to the bold new policies and practices needed to substantially increase Black homeownership in the foreseeable future.

Where across the United States will these additional new Black homeowners come from?

To increase Black homeownership, metropolitan areas with low Black homeownership rates, but a high concentration of Black populations with moderate incomes should be the focus. Specifically, large Black populations in economically stable regions where median housing prices are comparable to median rent prices. It is also important to target geographic areas that have relatively affordable housing prices and overall cost of living. Black populations with moderate incomes in geographic areas with low Black homeownership rates offer a great opportunity to increase the national state of Black homeownership. In focusing on affordable areas to increase Black homeownership, more low-cost houses could be built; particularly, multi-family structures can allow for low housing costs and more density closer to employment opportunities and schools. Furthermore, focusing on areas with low Black homeownership can create more wealth equity in local areas by increasing immediate homeownership rates, and consequently improving intergenerational wealth for the descendants of new homeowners.

For example, Georgia is a state that fits this model, with a median Black household income of $44,600 and a Black renter rate of 53%.[14] Even in cities where the Black population is large — such as Atlanta, Baltimore and Washington, D.C. — Black home mortgage borrowers are still underrepresented in the mortgage market in comparison to White applicants, even when controlling for income. For example, although Baltimore has a 29% Black population, only 15% of mortgages have originated with Black borrowers since the Great Recession. In comparison, 60% of total mortgages have gone to White borrowers — a 45% gap.[15] Minneapolis has the largest gap between Black and White homeownership at 50%, with Albany, New York, following with a 48.8% gap in homeownership and Buffalo, NY with a 44.5% homeownership gap.[16] This indicates a sizable Black population who could afford to become future homebuyers, and just need some assistance and affordable housing.

How does financial instability impact low-wealth Black homebuyers?

Low-wealth Black homebuyers have a different set of needs that are often unaddressed by mainstream mortgages and homebuying programs, such as lower savings available for a down payment and lower credit scores. Also, 33% of Black households have thin credit files, meaning that their credit-use levels are insufficient for generating a credit score.[17] In comparison, only 18% of White households have a thin file. This further contributes to the Black-White homeownership gap as households with poor credit or thin credit files struggle to obtain mortgages.

Financial stability and mortgage products that accommodate income and wealth levels are not only advantageous for purchasing a home, but also in keeping and maintaining a home. Low-income Black households don’t often have the financial means for housing maintenance and improvement, falling victim to ill quality and substandard housing over time. Nationally, 35.8% of occupied housing units need at least one repair. Among these households, low-income, older homeowners had the highest average repair costs across all groups ($4,187) and households in these groups were disproportionately likely to identify as Black.[18] Depreciating homes generate little value and equity when it’s needed the most and additional programs can be established to mitigate such risk.

A Call to Action

Achieving 60% Black homeownership is no easy feat. It requires a more concerted effort to financially invest in programs and opportunity neighborhoods. Programs that assist with down payments and credit repair are also much needed to assist those who don’t currently qualify for a home loan but can be mortgage-ready in the future. Even in recent years, with greater attention focused around America’s racial wealth divide and gaps in homeownership specifically, many large banks have promised billions of dollars to create thousands of new Black homeowners. There is more that can be done. To further private corporations, large banks and government agencies’ commitment to increasing Black homeownership and wealth, each should employ bold and transformative goals to increase Black homeownership rates to record 60% in 10 to 20 years. Transformative investment and creative homeownership in cities with Black residents with moderate income and credit scores, but have minimal Black homeownership, have the greatest room for improvement and possibility to increase Black homeownership rates in large numbers.

Widespread reform is needed to change the state of Black homeownership and with it the racial wealth divide that keeps African Americans in a cycle of asset poverty. A bold federal program, such as the proposed 21st Century Homestead Act, that focuses on revitalizing large clusters of abandoned properties in cities with hyper-vacancies, paired with federal jobs programs that combine infusing greater income and homeownership opportunities targeted at African Americans, is the type of plan that needs to be explored to bridge these historic inequalities.[19] Housing reforms must encourage marshalling federal resources to boldly address the devaluation of Black neighborhoods and enable communities to develop new and preserve existing affordable housing stock.

In addition to meeting the fundamental needs of housing access for Black Americans, there must be a renewed focus on wealth creation and an overall narrowing of the racial wealth divide between Blacks and their White counterparts. Much like trends in homeownership, little has changed in the wealth of low-income households as the wealth gap between low- and middle-income households continues to grow, with pronounced differences across racial lines.[20] Proposals need to address the wealth divide directly, such as baby bonds and some form of reparations for descendants of African slavery. Originally conceptualized by Darrick Hamilton and William Darity Jr., baby bonds would be federally managed and endowed savings accounts set up for all children at birth. Baby bonds would be endowed in a race- and income-conscious progressive scale, with lower-income families receiving larger deposits. Funds would be accessible upon the child turning 18, and could be used for postsecondary education, homeownership or retirement.[21] Funding for a baby bonds program would come from robust tax reform. This would ensure that the wealthiest in America play an integral role in wealth redistribution to the most economically disenfranchised.

The idea of reparations is not new. The Civil Liberties Act of 1988 provided more than 80,000 survivors of Japanese internment camps with $20,000 checks as a formal apology for imprisoning Japanese Americans. Similarly, Germany paid about $40 billion to Jewish victims of the holocaust and their descendants.[22] African Americans, many of whom can trace their heritage back to enslaved ancestors, are also due for financial restitution. The legacy of slavery, Jim Crow and institutional discrimination has resulted in severe economic disenfranchisement of African Americans, particularly when compared to other racial groups. A national reparations program could substantially improve the economic standings of African Americans, both immediately and intergenerationally. Many cities have already taken steps toward a housing-related reparations program and intervention, advocating for the redirection of industry revenue to support housing programs, for example.

Of all the assets that lead to wealth, homeownership is often the first step (and, in some cases, more obtainable asset) for many Americans. It can also be a launching pad to true asset diversity and wealth. If having a diverse and balanced portfolio of assets ensures wealth and economic stability for White households, then strengthening the pathway to homeownership is only one of many ways to achieve true, meaningful wealth for Black households. It is therefore imperative that homeownership is not only increased among African Americans but home values – and the ability to leverage this value – is also on par with White households’ return and increase on wealth.

Dedrick Asante-Muhammad is Chief of Race, Wealth and Community at NCRC

Jamie Buell is Racial Economic Equity Coordinator at NCRC

Joshua Devine is Director of Racial Economic Equity at NCRC

[1] Authors use the terms “Black” and “African American” interchangeably throughout the paper.

[2] U.S. Census Bureau, Homeownership Rate for the United States [USHOWN], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/USHOWN, Retrieved on February 22, 2021.

[3] FSC Majority Staff (2019, May 8). A Review of the State of and Barriers to Minority Homeownership. [ Memorandum] p. 3. United States House of Representatives Committee on Financial Services. Retrieved from https://financialservices.house.gov/uploadedfiles/hhrg-116-ba04-20190508-sd002_-_memo.pdf

[4]Choi, J., McCargo, A., & Goodman, L. (February 28, 2019). “Three differences between black and white homeownership that add to the housing wealth gap”. Urban Institute. Retrieved from https://www.urban.org/urban-wire/three-differences-between-black-and-white-homeownership-add-housing-wealth-gap

[5]NCRC (March 20, 2018). “HOLC ‘Redlining’ Maps: The Persistent Structure of Segregation and Economic Inequality”. Retrieved from https://ncrc.org/holc/ For more information, see The Color of Law: A Forgotten History of How Our Government Segregated America by Richard Rothstein (2017).

[6] Herbert CE, Haurin DR, Rosenthal SS, and Duda M. (2005). “Homeownership Gaps Among Low-Income and Minority Households.” p. 85. Washington, DC: U.S. Department of Housing and Urban Development, Office of Policy Development and Research. Retrieved from https://www.huduser.gov/publications/pdf/homeownershipgapsamonglow-incomeandminority.pdf.

[7]Ibid.

[8] U.S. Census Bureau Decennial Survey.

[9] Herbert CE, Haurin DR, Rosenthal SS, and Duda M. (2005). “Homeownership Gaps Among Low-Income and Minority Households.” p. 88. Washington, DC: U.S. Department of Housing and Urban Development, Office of Policy Development and Research. Retrieved from https://www.huduser.gov/publications/pdf/homeownershipgapsamonglow-incomeandminority.pdf.

[10] U.S. Census Bureau, Homeownership Rate for the United States [USHOWN], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/USHOWN, Retrieved on February 22, 2021.

[11] Merle, R. (June 19, 2010). “Minorities hit harder by foreclosure crisis”. Washington Post. Retrieved from https://www.washingtonpost.com/wp-dyn/content/article/2010/06/18/AR2010061802885.html

[12] McKernan S., Ratcliffe C., Steuerle C., Zhang, S. (April 21, 2014). “Impact of the Great Recession and Beyond: Disparities in Wealth Building by Generation and Race”. Urban Institute. Retrieved from https://www.urban.org/research/publication/impact-great-recession-and-beyond/view/full_report

[13] Original calculations by Choi, J. of Urban Institute’s Housing Finance Policy Center (2021). For further information, see McCargo, A. & Choi, J. “Closing the Gaps: Building Black Wealth Through Homeownership” December 2020. https://www.urban.org/sites/default/files/publication/103267/closing-the-gaps-building-black-wealth-through-homeownership_1.pdf

[14] U.S. Census Bureau (2019). American Community Survey, 5-year estimates.

[15]Zonta, M (July 15, 2019). “Racial Disparities in Home Appreciation”. Center for American Progress. Retrieved from

https://www.americanprogress.org/issues/economy/reports/2019/07/15/469838/racial-disparities-home-appreciation/

[16] Choi J., McCargo A., Neal M., Goodman L., Young C. (October 2019). “Explaining the Black-White Homeownership Gap: A Closer Look at Disparities across Local Markets”. Urban Institute. Retrieved from https://www.urban.org/sites/default/files/publication/101160/explaining_the_black-white_homeownership_gap_a_closer_look_at_disparities_across_local_markets.pdf

[17] Choi, J. (February 21 2020). “Breaking Down the Black-White Homeownership Gap”. Urban Institute. Retrieved from https://www.urban.org/urban-wire/breaking-down-black-white-homeownership-gap

[18] Divringi E., Wallace E., Wardrip K., Nash, E. (2019). “The Cost to Repair America’s Housing Stock — and Which Homes Need It The Most”. Federal Reserve Bank of Philadelphia and PolicyMap. Retrieved from https://housingmatters.urban.org/research-summary/cost-repair-americas-housing-stock-and-which-homes-need-it-most

[19]Baradaran, M. (May 2019). “A Homestead Act for the 21st Century”. The Great Democracy Initiative. Retrieved from https://greatdemocracyinitiative.org/wp-content/uploads/2019/05/Homestead-Act-050719.pdf

[20]Horowitz J., Igielnik R., Kochhar R. “Trends in income and wealth inequality”. Pew Research Center. Retrieved from https://www.pewresearch.org/social-trends/2020/01/09/trends-in-income-and-wealth-inequality/

[21] Collins C., Hamilton D., Asante-Muhammad D., Hoxie J. “Ten Solutions to Bridge the Racial Wealth Divide”. Institute of Policy Studies. Retrieved from https://ips-dc.org/wp-content/uploads/2019/04/Ten-Solutions-to-Bridge-the-Racial-Wealth-Divide-FINAL-.pdf

[22] Neiman, S. (July 21, 2019). “Op_Ed: Germany paid Holocaust reparations. Will the U.S. do the same for slavery?” Los Angeles Times. Retrieved from https://www.latimes.com/opinion/story/2019-07-19/reparations-germany-hr40-holocaust-slavery

two para below has changed.

What an excellent read and a call to action.