In a groundbreaking partnership, the National Community Reinvestment Coalition (NCRC) joined forces with the Washington State Employees Credit Union (WSECU) to identify the optimal location for a new branch in Tacoma, Washington. This collaboration underscores NCRC’s commitment to assisting financial institutions in establishing branches that not only thrive financially but also effectively meet the needs of low- and moderate-income (LMI) communities.

NCRC’s research experts generated two innovative indices to help our institutional partners to understand the landscape they are operating in across a variety of key categories. But this quantitative work was only half of the story: NCRC organizers also convened a community meeting where WSECU staff heard from local organization leaders and residents with specific insights.

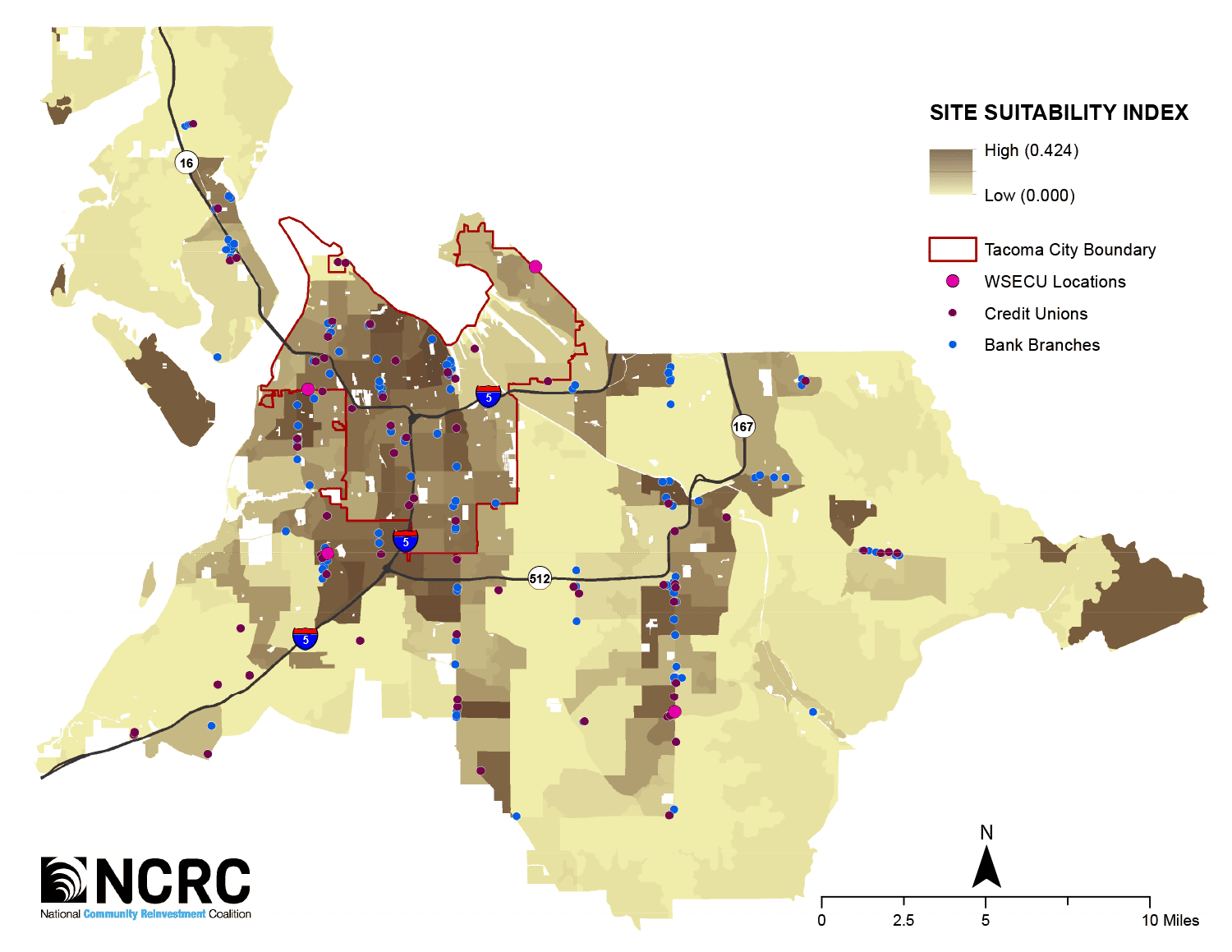

The Site Suitability Index (SSI) assesses the potential demand for financial services in locations by considering household and business density and distance from competing financial service locations. Data in the SSI includes population and business density, LMI economic categorization of the census block group and proximity to other bank and credit union branches. For further insight into our methodology, see below.

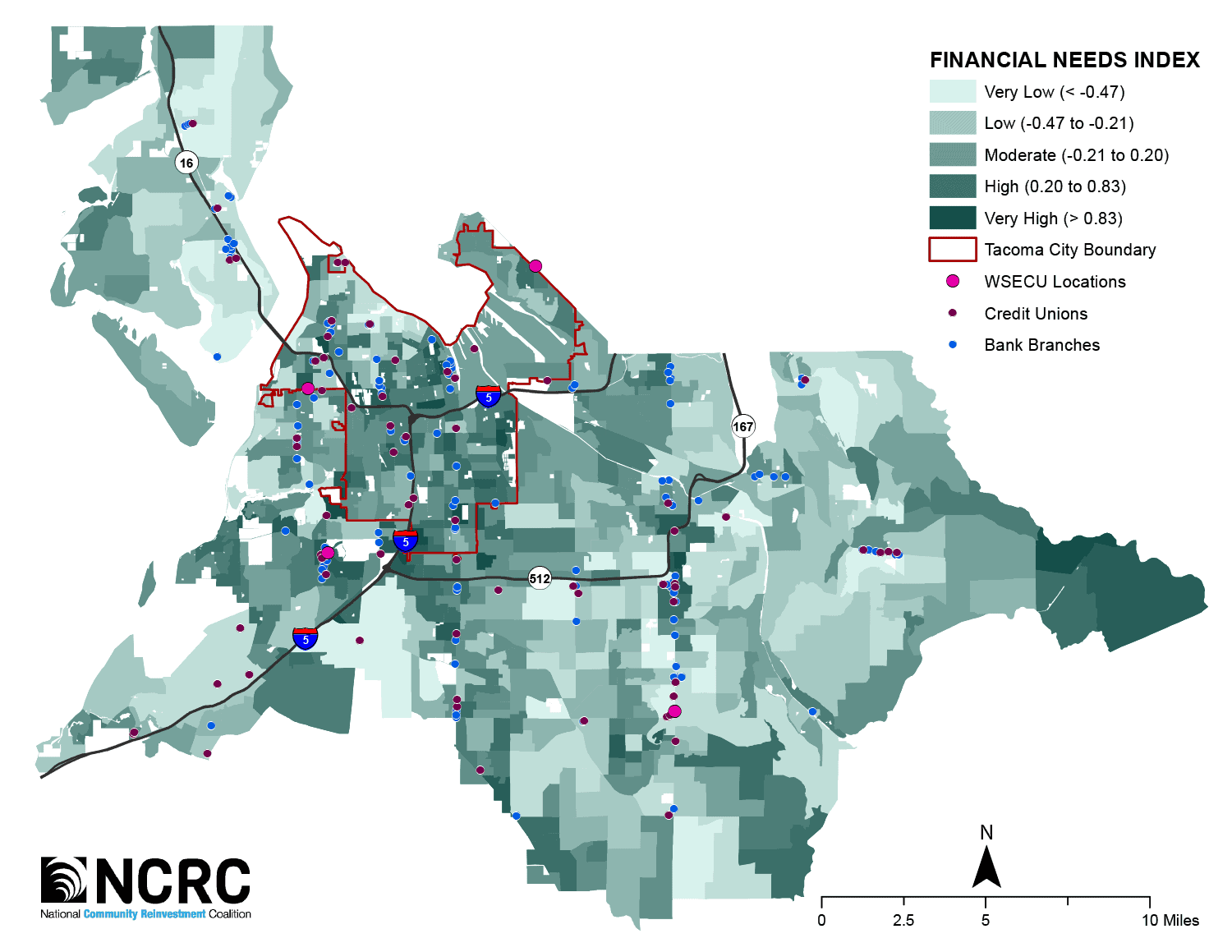

The Financial Needs Index (FNI) is designed to locate areas of high need based on population and measures of existing access to digital technologies and proximity to banking services. The data used in creating the FNI includes population density, percent of minority population, percent of households with internet subscriptions, percent of households with a smartphone and distance to the nearest bank or credit union branch.

NCRC utilized Mapbox, an advanced online mapping tool, to provide WSECU with a clear visual understanding of Tacoma and Pierce County’s financial landscape. This interactive tool played a crucial role in assessing the geographical distribution of financial needs and potential branch locations.

Tacoma’s specific physical and legal geography meant some further tinkering was necessary beyond our standard mapping processes. Urban development in Tacoma is highly influenced by state-imposed Urban Growth Boundaries and the geographical presence of Mount Rainier. After excluding protected wilderness areas to un-clutter the picture, NCRC’s analysis identified specific north-south corridors as prime locations for new financial branches, despite the presence of existing financial services.

The maps allow WSECU to see where branches are most needed. But they do not on their own convey what branch services are most vital to the people who live in those mapped corridors of town.

That’s why we also helped the credit union directly and openly communicate with local stakeholders. Direct engagement with local community groups was a key aspect of this partnership. NCRC convened a community meeting where WSECU staff and leaders actively listened to the concerns and suggestions of local residents and nonprofit leaders. This meeting was designed to foster a sense of transparency and mutual respect, in order to cultivate trust within the community. The meeting and subsequent ongoing discussions revealed critical insights, such as the need for small dollar loans in financially underserved areas and the importance of accessible financing for minority-owned businesses. The community’s voice will be instrumental in shaping the project’s direction.

The engagement sessions highlighted diverse needs, including Islamic finance and ITIN lending (loans for borrowers lacking a Social Security Number), specific support mechanisms for first-time homebuyers and general financial education services. The discussions underscored the necessity of building trust in financial institutions and extending services beyond conventional banking.

The collaboration led to innovative ideas like leveraging church properties for community development, establishing Individual Development Accounts (IDAs), and creating specialized loan programs for non-White business owners. These initiatives are aimed at providing targeted financial support to underserved communities.

WSECU staff told NCRC they found the process engaging, informing and rewarding.

“We very much appreciate NCRC’s partnership and their approach that delivered not only incredibly useful data, but more importantly, the chance to sit in conversation with community leaders, to listen to their needs and their hopes,” said Paul Kirkbride, Chief Operating Officer at WSECU. “It was a powerful learning experience for our team. If we want to address these complex problems, and eliminate financial deserts altogether, we need to find new and innovative ways to address these issues, build new partnerships, and completely rethink branching models.”

This successful partnership between NCRC and WSECU is a model for future collaborations. NCRC is eager to extend its expertise and services to other financial institutions interested in opening new branches that align with community needs and financial viability. Institutions looking to embark on similar ventures are encouraged to reach out to Jason Richardson for more information and guidance.

Partnering banks and community groups – like NCRC and WSECU did in Tacoma – can help establish financial branches that are not only economically successful but also deeply embedded in serving community interests. This partnership is one of many NCRC projects that delivers on a key part of our Just Economy Pledge: to make a Just Economy a national priority and a local reality. NCRC is dedicated to fostering equitable and accessible financial environments, and stands ready to partner with other institutions to replicate this success in communities throughout the US.

Jason Richardson is NCRC’s Senior Director of Research.

Catherine Petrusz is NCRC’s CRA Coordinator.

Photo by NCRC.