Key Takeaways

- Business structure played a role in accessing PPP loans.

- Entrepreneurs whose businesses were structured as LLC, S or C corporations were significantly more likely to have received a PPP loan than less sophisticated sole proprietorships and partnerships.

Key Findings

A survey of small business owners found that:

- Black men were significantly more likely to inquire about a PPP loan than White and Latino men.

- Black men had the highest percentage approval rate at 12.5% compared to Whites at 11.5% and Latinos at 4%. Latino men and women entrepreneurs were less likely to inquire about a PPP loan than White and Black entrepreneurs.

- Latino men were the least likely to be approved for and receive a PPP loan with just a 4% approval rate.

- Latino women had the lowest inquiry rate for PPP loans but had higher rates of applying for PPP loans compared to White and Black entrepreneurs.

- Entrepreneurs with businesses structured as a Limited Liability Corporation were significantly more likely to have inquired about a PPP loan than entrepreneurs with businesses structured as an S/C corporation, Sole/Joint Proprietorship or Partnership.

- Entrepreneurs whose businesses were structured as an LLC or had an S/C corporation were significantly more likely to have received a PPP loan.

Introduction

From October 23, 2020, to December 29, 2020, the National Community Reinvestment Coalition (NCRC) surveyed small business owners in nine Metropolitan Statistical Areas (MSA). The MSA’s surveyed were: Los Angeles, Atlanta, New York City, Chicago, Houston, Miami, Detroit, Seattle and Washington, DC. Survey questions asked about accessing Paycheck Protection Program (PPP) loans, an innovative program created to save small businesses and retain employees. The data collected in the survey provided insight into accessing capital for small businesses as this program had fewer entry barriers than traditional loan products.

In April 2020, Congress passed the Coronavirus Aid, Relief, and Economic Security (CARES) Act, which established the PPP, directing banks to issue loans to small businesses administered through the Small Business Administration (SBA) 7A program. These loans will potentially convert to a forgivable grant. The purpose of these loans was to keep businesses “open” and retain employees. At the same time, stay-at-home orders limited customer’s access to these businesses, thereby, employee’s access to a stable income.

It is estimated that 100,000 Black businesses closed because of the pandemic. One reason was because they were unable to access credit. Traditional barriers to credit like credit score did not apply to the PPP approval process. Eliminating the role that credit scores played in accessing credit revealed other barriers that borrowers had to overcome before they could access credit. Other factors like criminal records and student loan defaults had an impact on access. Furthermore, this highly sought-after program ran out of funding in the first round. Congress provided additional funding and extended the program two more times at different points throughout the pandemic.

Critics said that the lack of collection of demographic information from the applicants hid other barriers to access based upon race and sex. The SBA announced in May 2020 that they would collect this data on the backend through the forgiveness application. However, this remedy did not provide a comprehensive picture because applicants that were rejected, discouraged or choose not to apply for forgiveness are deleted from the data collection process.

One barrier that has not been fully analyzed is business structure. The first section of the PPP application required the applicant to check off the type of business structure. Small business applications request this information as well. Despite business structure being required for all business credit applications, there is no easily accessible research on how it is used as a proxy or can affect the outcome of an application. This paper focused on the role that business structure had on accessing PPP loans and small business credit before the pandemic.

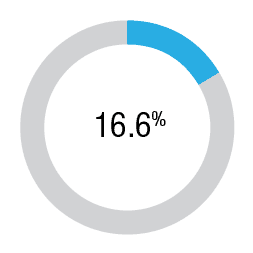

There were a total of 938 survey participants. All participants were asked questions about their business structure, loan modifications, financial literacy and accessing PPP loans. Of the 938 respondents (n=938), only 156 (16.6%) reported that they had, at a minimum, inquired about a PPP loan. The data provided by these participants provided further insight into the type of entrepreneur who inquired about this specific product and the type of entrepreneur that was ultimately successful in being approved for this product.

Methodology

From October 23, 2020 to December 29, 2020, NCRC conducted an in-depth survey administered to US entrepreneurs that employed 500 people or less and obtained a credit product with an outstanding balance before March 1, 2020, and/or had a commercial rental space. The survey focused on entrepreneurs in the following nine MSAs: Los Angeles, Atlanta, New York City, Chicago, Houston, Miami, Detroit, Seattle and Washington, DC.

We used an online survey software, Qualtrics, and recruited business owners using panel services and Chamber of Commerce groups through social media outreach. The strategy aimed to get equal representation across all races and ethnicities in the sampling frame. Our total response rate was 984 responses. To ensure no duplicate or error responses in the sample, an independent examiner scrubbed the data of incomplete responses and filtered them out. Our final sample was 938 responses with 307 responses from Black small business owners, 277 responses from White small business owners, and 354 responses from Latino small business owners. The survey instrument was available in both English and Spanish. The survey instrument was administered between rounds two and three of PPP funding thus it reflects the borrower experience during the first and second rounds of funding.

Industries most represented in the sample include retail trade (17.4%), construction (9.6%) and information technology (9.5%). The overall PPP lending population saw the highest percentages of participation in the following industries; Accommodation and Food Services (15%), Construction (12%), Health Care and Social Assistance (10%), Professional, Scientific, and Technical Services (10%), and Other Services (10%). The ownership structure of the businesses sampled are: sole proprietorships (42.6%), limited liability corporations (LLC) (19.4%), partnerships (16.3%) and joint proprietorships (13.3%). The survey did not differentiate between employer firms and non-employer firms. The survey also did not include businesses that did not have banking relationships before the pandemic.

We performed statistical analysis to determine any statistically significant differences in behaviors and experiences between White, Black and Latino small business owners across survey responses. The chi-square test for independence is a particularly robust way for social scientists to evaluate whether there are substantial differences in outcomes between groups. The simple “yes or no” categorization of the small business owners’ financial portfolio enabled the survey results to achieve a high level of validity.

This data provided some transparency into the small business lending marketplace, especially around who could access a PPP loan product.

Survey Participant Demographics

There were 938 completed responses to the survey; all entrepreneurs are located within the targeted MSA’s. Of these respondents, 38% were Latino, 33% were Black and 29% were White.

The sex make-up of our survey respondents was 65% male and 35% female. In the sex make-up of the entrepreneurship marketplace, males comprise 79% of the marketplace and females 21%. We did not ask the respondents to disclose their gender identity/non-binary status.

The average age of respondents was 38 years old. The average entrepreneur in the NCRC survey was 12 years younger than the average entrepreneur in the US.

Length of Time in Business

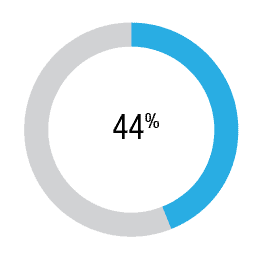

44% of entrepreneurs surveyed have been in business between 2-5 years.

Paycheck Protection Program Access:

Number of Respondents who Inquired and Received PPP

156 of 938 (16.6%) of surveyed respondents inquired about a PPP loan.

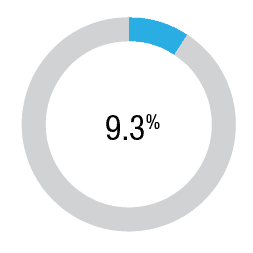

87 of 938 (9.3%) of the surveyed respondents were approved for a PPP loan.

Age of Business Owners who Inquired About PPP

The average age of surveyed entrepreneurs who inquired about a PPP loan was 36 years old.

Age of Business Owners who Received PPP

The average age of surveyed entrepreneurs who received a PPP loan was 38 years old, the same as the average age of entrepreneurs who responded to the survey.

PPP – Inquired and Received by Sex/Race

Black and Latino entrepreneurs had different outcomes inquiring, applying and receiving a PPP loan depending on sex. Overall, Latino males were the least successful of all entrepreneurs, regardless of race or sex, in receiving a PPP loan. Both Latino male and female entrepreneurs had lower rates of inquiring about a PPP loan than White and Black entrepreneurs.

The survey revealed that Black males were significantly more likely to inquire about a PPP loan than White and Latino males. There was a significant negative difference in the inquired-to-applied (inquired/applied) ratio for Black males than White or Latino males. This drop in the inquired-to-applied ratio was not significant for either White or Latino males.

The survey revealed that Black and Latino females applied for PPP loans significantly more often than White females. However, despite this increased interest, the ratio of applied-to-approved (applied/approve) for PPP was the lowest among Black and Latino females, which was the opposite for White females.

Specific Business Structures Were More Likely to be Approved for a PPP Loan

The first section on a PPP application required the applicant to check only one business type for business structure out of 11 options. An analysis of total loans approved between April 2020 and December 2020 revealed that almost 58% of all PPP loans went to small businesses with either a corporation or LLC business structure. Our survey results revealed a similar trend; businesses that either had an LLC or C-corp structure were more successful than other business structures at receiving approval for a PPP loan. The survey data provided additional information on the lending arena because it highlighted the disparities between inquiry and approval, data not captured by the SBA or any other source. Both charts below do not distinguish between employer and non-employer businesses.

In December 2020, the SBA released data on all PPP loans that originated up until this point. One of the data points released was business structure. Of total loans originated, C Corps (29.06%) and LLCs (28.22%) were the structures most likely to have received funding from the program. Entrepreneurs with businesses structured as Sole Proprietorships (15.86%), S Corps (13.60%) and Partnerships (1.29%) were trending in lower numbers. Both Sole and Joint Proprietorships are categorized under "Sole Proprietorship" in the application process.

From our definitions of business structures, it appear that sole proprietorships were less successful at getting a PPP loan than partnerships and corporations.

The survey data revealed that entrepreneurs with businesses structured as an LLC (38.5%) were significantly more likely to have inquired about a PPP loan (p < .05) compared to all other business structures. For PPP applied, there were no significant differences among the different business structures. Entrepreneurs whose businesses are structured as an LLC (14.8%) or had an S or C corporation (17.0%) were significantly more likely to have received a PPP loan (p < .05) compared to those with a sole or joint proprietorship (6.7%) and partnerships (7.8%).

Survey Business Structure:

Business structure impacts liability and how the business is taxed. It may also have impacts on accessing credit. The type of structure business owners choose to use is not equal across sex and race/ethnicity.

There are five main structures, but those are not the only structure forms. The level of sophistication of a structure refers to the time and energy to create, maintain and properly manage the legal aspects of the business structure. The business structures are: Sole/Joint Proprietorship, Partnership, C corporation, S corporation and LLC. Each of these structures provides benefits and drawbacks to the owners.

- Sole/Joint Proprietorship - Sole proprietorships are the most common business structure for small businesses. Under this structure, there legally exists no difference between the owner and the business entity.

- Partnership - A partnership is the simplest business structure consisting of two or more people who share the ownership of a business, and each contributes money, property, labor or skill. All parties share in both the profits and losses.

- C Corporation - A C corporation is a more complex business structure in which the owners and any stakeholders are taxed separately from the business as an entity itself.

- S Corporation - A S corporation is a business structure similar to a C corporation, except that it is taxed as a corporation altogether and can elect to pass income (along with other credits, deductions and losses) directly to shareholders.

- Limited Liability Corporation (LLC) - is a structure and a legal liability mechanism that can be applied to all of the above business structures. Business owners structure their business as an LLC to protect themselves from personal liability for business debts.

Race and Sex by Business Structure of All Survey Respondents

Overall, the survey revealed significant differences in each type of business structure depending on the race or national origin among the male entrepreneurs who responded to the survey. There was only a significant difference in the sole/joint proprietorship and partnership structures for the female respondents.

Business Structure for Males

- LLC: Black-owned businesses (41.2%) were significantly more likely than White-owned businesses (21.9%) and Latino-owned businesses (5.4%) to have their business structured as a Limited Liability Company (LLC) (p < .05). Hispanic-owned businesses (5.4%) were significantly less likely than White-owned businesses (21.9%) to be an LLC (p < .05).

- S or C Corporations: Black-owned businesses (2.0%) and Latino-owned businesses (2.9%) were significantly less likely than White-owned businesses (13.9%) to have their business structured as an S or C corporation (p < .05).

- Partnerships: Latino-owned businesses (28.1%) were significantly more likely than White-owned businesses (15.2%) and Black-owned businesses (8.5%) to be a partnership (p < .05).

- Sole or Joint Proprietorships: Latino-owned businesses (63.6%) were significantly more likely than White-owned businesses (49.0%) and Black-owned businesses (48.2%) to be a sole or joint proprietorship (p < .05).

Business Structure for Females

- Sole or Joint Proprietorships: For female respondents, White-owned businesses (73.1%) were significantly more likely than Black-owned businesses (54.4%) and Latino-owned businesses (58.6%) to be a sole or joint proprietorship (p < .05).

- Partnerships: Black-owned businesses (18.4%) and Latino-owned businesses (19.1%) were more likely than White-owned businesses (5.9%) (p < .05) to structure their business as a partnership.

Age of All Survey Respondents with Type of Structure

Entrepreneurs in the survey who had either an S or C corporation were significantly older, with an average age of 47.8 and p = 0.001, compared to the entrepreneurs of other types of business structures.

Products Utilized by Business Structure Pre-Pandemic

The survey also measured products that small businesses utilized before the pandemic. The more sophisticated business structures, S & C Corporations (90.7%) and LLCs (91.0%), were significantly more likely to utilize business credit cards than Partnerships (74.8%) and Sole/Joint Proprietorships (76.0%). LLC’s (76.3%) and Sole/Joint Proprietorships (72.1%) were significantly more likely to use an SBA loan product compared to S & C Corporations (46.5%) and Partnerships (45.3%). S & C Corporations (65.1%) and Sole/Joint Proprietorships (60%) were significantly more likely to utilize a business line of credit prior to the pandemic compared to Partnerships (43.9%) and LLC’s (39.7%).

Conclusion and Recommendations

Entrepreneurs said low credit scores and insufficient credit history were two reasons why they did not expect to receive credit before the pandemic. These were not reasons that should have barred entrepreneurs from accessing the PPP program, as neither credit scores nor credit history were used in any part of the approval process. The statistical difference between the number of businesses that inquired about a PPP loan and the number of approved businesses revealed that other barriers continued to prevent entrepreneurs from accessing credit. When examining the financial products originated by business structure before the pandemic to the business structures that were more successful at receiving PPP loans, we observed that business structure was likely a barrier to credit.

There is not enough research on the correlation between business structure and accessing credit. However, to fully determine the extent of this correlation, the definitions of each business structure must be defined by industry and government agencies so that these definitions do not overlap. Additional research on business structure will identify its impact on business recovery from this recession. The Federal Reserve found that 30% of Black-owned firms viewed credit availability as their biggest challenge arising from the pandemic. This challenge is expressed disproportionately more by Black entrepreneurs. Implementing and disseminating the required small business data collection will help small businesses recover as Special Credit Lending Products can be implemented to fulfill the lending voids that this data reveals. However, right now, mystery shopping at the inquiry stage is the only tool that reveals discouragement. This information is essential from both a fair lending and business practice standpoint.

Featured image: ©golibtolibov