This is one in a series of articles about the pandemic and America’s First Female Recession. See more here.

A year after the coronavirus became a pandemic, nearly 3 million women have left the workplace because of child care and other responsibilities, resulting in what is being labeled the nation’s first she-recession. How many of these women will return to the workforce, and in what capacity is a big unknown. A portion will likely turn to entrepreneurship with its potential to be more flexible with child care to pay their bills, and, if they are successful, as a wealth-building tool.

Since 2014, there has been a steady increase in women entrepreneurs, with almost 13 million women-owned small businesses in 2019. Black women own 21% of all women-owned businesses.

But entrepreneurship is not a successful venture without the right tools. One of these tools is access to credit – the money needed to start a business, expand or deal with ebbs and flows in revenue.

Access to credit needs to be available to all as required under the Equal Credit Opportunity Act (ECOA). ECOA makes it illegal for a creditor to discriminate against someone based on gender, race or another protected class. Over the past year, this has not been true for women entrepreneurs, especially for Black female entrepreneurs.

In April 2020, in response to the pandemic’s economic effects, Congress created a new forgivable lending program called the Paycheck Protection Program (PPP). NCRC conducted mystery shopping of the small business pre-application experience from April 27 – May 29 in Washington, D.C., and July 27- August 7 in Los Angeles.

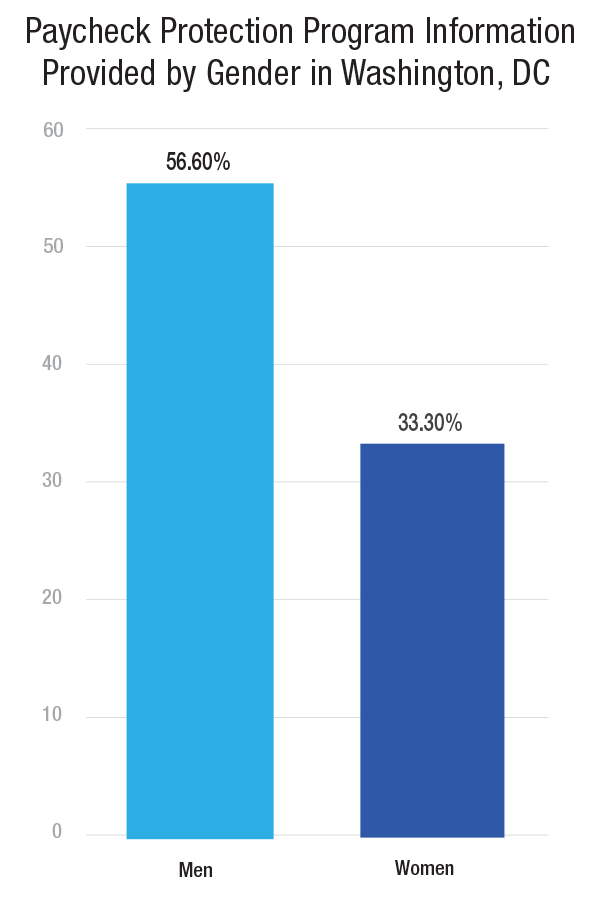

In Washington, D.C., we found that men were informed significantly more often about a PPP loan product than women at the beginning of the second round of PPP funding.[1] This information asymmetry in D.C. put women business owners at a disadvantage.

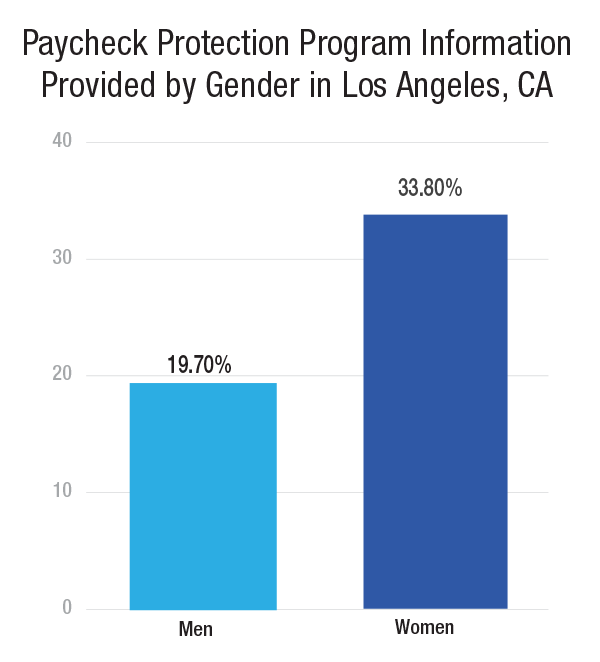

Examining the data in Los Angeles just based on gender, the reverse occurred. Women received significantly more information about a PPP loan product than men during the last two weeks that the second round of PPP program funding was available. A deeper dive into the data revealed that Black women received statistically significantly less PPP information compared to White and Latino women. There was no statistical difference in PPP information provided to White and Latino women. This results in Los Angeles may have occurred because there was still a significant amount of PPP funding available at the end of the two weeks, and financial institutions were trying to originate additional loans, deciding then to focus on women but not on all women.

The percentage of women who received information about a PPP loan in the tests was the same in both cities. This means that about 68% of the women testers were not told about a PPP product. This female percentage of non-information about a PPP product aligns with the low number of women-owned businesses that received PPP loans. Of the 1.1 million PPP loan applications that contained demographic information, 25% of these loans went to women-owned businesses. This low number of originations to women-owned businesses is not an equal distribution compared to the number of women-owned small businesses eligible for this product. Being shut out from programs like PPP harmed women entrepreneurs.

The statistically significant lower rates of access to PPP product information to women testers is a potential fair lending violation. Financial institutions and regulators need to conduct file reviews to ensure that financial institution practices did not result in disparate treatment between equally qualified borrowers. Women entrepreneurs cannot be successful, and entrepreneurship won’t be a successful pathway to bring women back to the workforce, if barriers to credit continue.

**We know a few conference sessions and blog posts are not enough to talk about all the ways the pandemic has impacted women, and the possible solutions. Share your thoughts, concerns, hopes and ideas in the Just Economy Forum or on our Jamboard. While discussion in the Just Economy Forum is limited to NCRC and Just Club members, Jamboard is open to the public.**

[1] We found no statistical difference in information between White and Black women.

Anneliese Lederer is NCRC’s Director of Fair Lending.