Bank staff routinely provide inferior service and less helpful information to Black small business loan applicants, according to a new Consumer Financial Protection Bureau (CFPB) study.

In the experiment, CFPB sent Black and White testers to banks to discuss small business loan options. They found bank staff nearly twice as likely to express an interest in lending to the White testers, despite the Black testers presenting stronger materials. Bank staff also steered Black testers toward credit card products and mortgages significantly more often than in conversations with White testers.

The CFPB’s findings mirror those of past investigations performed by the National Community Reinvestment Coalition (NCRC), where White testers received far more thorough assistance and Black testers were subjected to far less friendly and helpful treatment.

Since the passage of the Equal Credit Opportunity Act, lending discrimination is supposed to be a thing of the past, a relic from the dark days of Jim Crow and racial segregation. However, Black entrepreneurs are still facing barriers to obtaining small business loans. These barriers contribute to the stubbornly wide racial wealth gap.

The CFPB study revealed differential treatment for Black and White entrepreneurs in small business lending at point-of-sale as well. The agency sent Black and White participants “trained to present themselves based on a pre-developed small business profile” to meet with bank representatives to seek credit. Black testers were assigned slightly more financially favorable profiles than White testers. Despite that superior financial profile, Black participants received significantly less encouragement to apply for a loan. The lenders in the experiment expressed interest in loaning to 40% of the White participants, but only 23% of Black participants, a significant disparity. Both sets of testers sought small business loans. Bank staff nonetheless encouraged them to look into mortgages and credit cards – redirecting 59% of Black participants but just 39% of White ones.

These findings validate the experiences of NCRC’s own “mystery shoppers.” Multiple such probes have revealed that White small business owners received significantly better treatment from bank employees than non-White business owners did.

“Discouragement is discrimination, and it is rampant in small business lending,” said Lara Benson, NCRC Attorney in Fair Housing & Fair Lending. “When we send testers into banks to present the same material, even though both testers have equivalent financial profiles, the White tester often experiences better customer service and is given more information on available products, whereas the Black testers often get the bare minimum information and little, if any, follow up.”

The CFPB and other agencies have long gathered evidence that non-White small business owners end up with worse credit outcomes, using data from a variety of sources. But it can be harder to convince the world that there is personal bias at play within the underwriting process, rather than just an abstract disparity at the end of it. The CFPB study is the latest in a line of studies proving that discrimination still exists in lending.

Such discrimination is illegal. It is also both a cause and a symptom of a larger issue: the racial wealth gap.

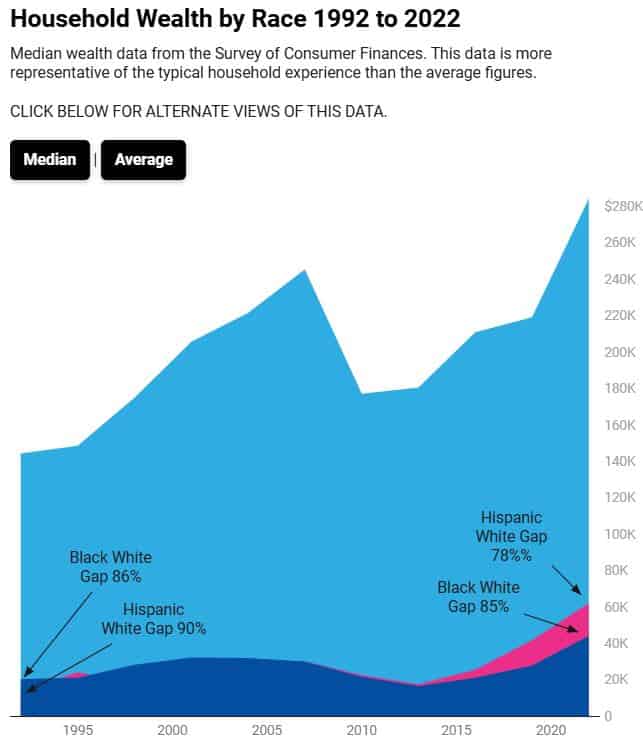

Despite the intense societal attention to racial justice sparked by the Black Lives Matter movement, the racial wealth gap remains persistent and unshrinking. A recent study by NCRC evaluated the racial wealth gap from 1992-2022 and discovered that the gap increased in recent years as White wealth has grown far more rapidly than Black wealth. In 2022, the median White household had more than six times that of the median Black household, and four times that of the median Hispanic household.

Building business equity might help close the racial wealth gap. Business equity is a vital component of wealth-building for Black families, as it represents 21% of wealth accumulation for Black households.

Business ownership can be a path for generating personal and generational wealth, but for decades Black entrepreneurs have faced barriers to obtaining the capital they need to start their businesses. This lack of funding can be attributed to discriminatory practices, racial bias and negative societal expectations.

Black people are roughly 12% of the US population, but own less than 3% of all US businesses. Black-owned businesses start with lower levels of funding and struggle to obtain loans.

Even when Black entrepreneurs have good credit scores and qualify for lending, they are three times less likely to submit a loan application than White entrepreneurs, for fear of the loan being denied.

If that fear were misguided, that would be one thing. But mystery shopper testing by both advocacy groups and the federal government indicates Black business owners are right to be suspicious, because bank staff either actively or tacitly discourage their applications.

Discouragement is discrimination, and Black entrepreneurs are suffering from it. This is why NCRC has advocated the passage and implementation of Section 1071 of the Dodd-Frank Act, holding financial institutions accountable by requiring them to collect and report data on credit applications for small businesses.

Transparency is accountability, and Section 1071 of the Dodd Frank Act is an essential tool in ensuring the enforcement of the Equal Credit Opportunity Act. Without the clarity that data will provide, it will be harder to identify which banks most need to scrutinize their training practices and employee performance to stamp out the discrimination the CFPB and NCRC studies exposed.

Lauren Wolters is a Government Affairs Associate at NCRC.

Photo by Amtec Photos via Flickr.