2022 IMPACT

Jesse Van Tol

President & CEO

Dear friends,

It was a hopeful and complicated year. The economy mostly rebooted and reopened after COVID lockdowns, layoffs and shutdowns, but families were still squeezed by persistent supply chain issues and spiking consumer prices. There was pent up public demand and political posturing to get “back to normal” – even though the pre-pandemic normal was grossly unfair and built on a foundation of inequality, racism and redlining. We reconvened in person for the 2022 Just Economy Conference, but millions of vulnerable Americans still needed to take strict precautions and limit social contact to protect their health.

Past injustices explain but do not excuse the present day racial wealth divide. At NCRC, understanding history is critical context for the solutions we seek to build a better future for all.

Our north star remains both clear and elusive: make a Just Economy a national priority and a local reality.

We do this through a unique and powerful mix of research, investigations, investments, media, grant-making, capacity-building, training, advocacy, litigation, convening and facilitation to expand equitable and inclusive access to credit, capital, jobs, housing, health, financial security and personal well-being.

We are proud to share this overview of our 2022 impact on behalf of our members, the communities we serve and the values we all share.

Here are a few highlights, and you’ll find more details in the report:

- We facilitated negotiations for community benefits agreements with seven banks that committed, in aggregate, $205 billion to low- and moderate-income (LMI) communities across the nation, in collaboration with more than 150 member organizations. Since 2016 NCRC’s game-changing work to standardize and strengthen community benefits agreements has secured more than $600 billion in lending, investments and philanthropy for disinvested and underserved communities.

- GROWTH by NCRC, one of NCRC’s affiliated impact ventures, built or rehabbed 138 homes and expanded into its 20th market with new projects in Dallas.

- We directly distributed $4.7 million in grants for local capacity building and through NCRC Community Development Fund we made $4.64 million in low-interest loans for small business resilience and construction of affordable housing across dozens of member organizations and communities.

- Through live and online events and courses we trained more than 4,000 changemakers nationwide across a variety of best practices and tangible, technical skills.

- We conducted nearly 250 tests to probe for bias in financial services business practices.

- We won a federal court case that will protect housing market data from decaying at the expense of our movement’s work.

- Our published reports made waves around the country, including our continued analysis of bank branch closure trends and a first-of-its-kind investigation into appraisal bias and worrisome findings about potential redlining that prompted us to cut ties with a major bank.

- Our policy, legal and government affairs staff helped protect the Consumer Financial Protection Bureau from industry attacks.

- Our expertise and innovation shaped prominent coverage in the New York Times, the BBC, NPR, Bloomberg and Fast Company – and 4,700 mentions across all media for a potential reach of more than eight billion news consumers.

- Prompted by advocacy work by NCRC, our members and allies, federal policymakers took some long-overdue steps to expand access to credit, capital and housing, including introduction of a new draft rule to improve compliance and enforcement of the Community Reinvestment Act.

- Our coalition grew to more than 700 member organizations, a new milestone!

Our 2022 impact was dramatic and meaningful. The glaring gaps in how our economy works – and fails – were both frustrating and motivating. NCRC’s momentum going into 2023 is crucial. The historic overhaul of Community Reinvestment Act regulations will be finalized early in the year, along with key rules on small business lending, fair housing and other priorities.

We’re grateful for the tireless work of our members on the ground in their communities, and for the continued collaboration and support from our partners, donors and allies who make our impact possible. We’ve got more to do and we can’t do it alone.

Jesse Van Tol

President & CEO

Katy Crosby

Chair, NCRC Board of Directors

Catherine “Katy” Crosby

Chair, NCRC Board of Directors

Board of

Directors

Board of Directors

Catherine Hope Crosby, Chair

Town of Apex NC

Irvin Henderson, Vice Chair

National Trust for Historic Preservation

Bethany Sanchez, Vice Chair

Metropolitan Milwaukee Fair Housing Council

Elisabeth Risch, Secretary

Housing Opportunities Made Equal (HOME)

Peter Hainley, Treasurer

CASA of Oregon

Robert Dickerson, Jr., Immediate Past Chair

Birmingham Business Resource Center

David Adame

Chicanos Por La Causa

Gilbert T. Bland

Urban League of Hampton Roads Tidewater Community College

Cornell Crews

Community Reinvestment Alliance of South Florida

Phyllis Edwards

Bridging Communities

Stephen Glaude

Coalition for Non-Profit Housing and Economic Development (CNHED)

Will Gonzalez

Ceiba

Charles Harris

Housing Education & Economic Development

Ernest Hogan

Pittsburgh Community Reinvestment Group

Matt Hull

Texas Association of Community Development Corporations

Jean Ishmon

Northwest Indiana Reinvestment Alliance

Carol Johnson

City of Austin’s inaugural Civil Rights Office

Brent Kakesako

Hawaii Alliance for Community- Based Economic Development

Matthew Lee

Inner City Press

Sharon H. Lee

Low Income Housing Institute

Moises Loza

Formerly, Housing Assistance Council

Aaron Miripol

Urban Land Conservancy

Andreanecia Morris

HousingNola

Arden Shank

South Bend Heritage Foundation

Kevin Stein

California Reinvestment Coalition

Beverly Watts

NAACP

Some

Numbers

Some Numbers

Community Benefits Agreements

$205 Billion

We facilitated seven community benefits agreements with banks that committed $205 billion in loans, investments and philanthropy to underserved communities and the organizations that serve them.

Through 2022, NCRC completed community benefits plans with 22 banking groups that will put a combined $590 billion into underserved communities.

NCRC Community Development Fund

$8 million

NCRC CDF raised $8 million in debt capital for affordable housing development and small business lending.

79.6% of $1.2 million in small business loans went to minority-owned businesses.

$3 million in low interest loans to finance affordable housing.

Community Impact Grants

$4.7 Million

Awarded to 65 grantees in 16 states for affordable housing, small business development, arts & culture, COVID-19 relief, housing counseling and capacity building initiatives.

Research

10 major reports

We published 10 major reports and white papers.

Just Economy Conference

864 ATTENDEES

We were able to come back together for the first in-person Just Economy Conference since 2019. 864 of our allies and partners attended, with an average of 447 people in breakouts throughout the conference.

36 state delegations

Advocacy Week: 120 meetings with the House, Senate and federal regulators with 36 state delegations, including Washington, DC.

AFFORDABLE HOUSING

138 HOMES BUILT OR REHABBED

GROWTH by NCRC built or rahabbed 138 homes, representing an investment of $40.1 million, and sold 115 homes.

Since 2015, GROWTH has:

- Acquired 1,049 lots or properties

- Sold 560, 85% of the homes were sold either to LMI buyers and/or within LMI communities

Training

105 training programs

with 5,200 participants.

Attention

4.7K

Our work and people were cited in 4,700 media reports, with a potential reach of 8.1 billion readers and viewers.

398,019

unique users at ncrc.org

Housing Counseling Network

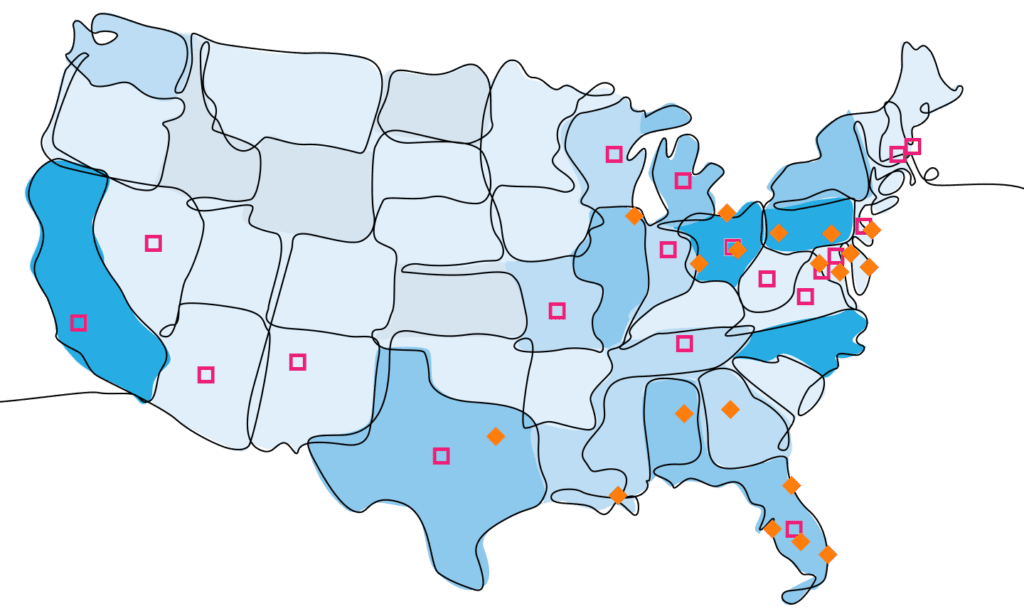

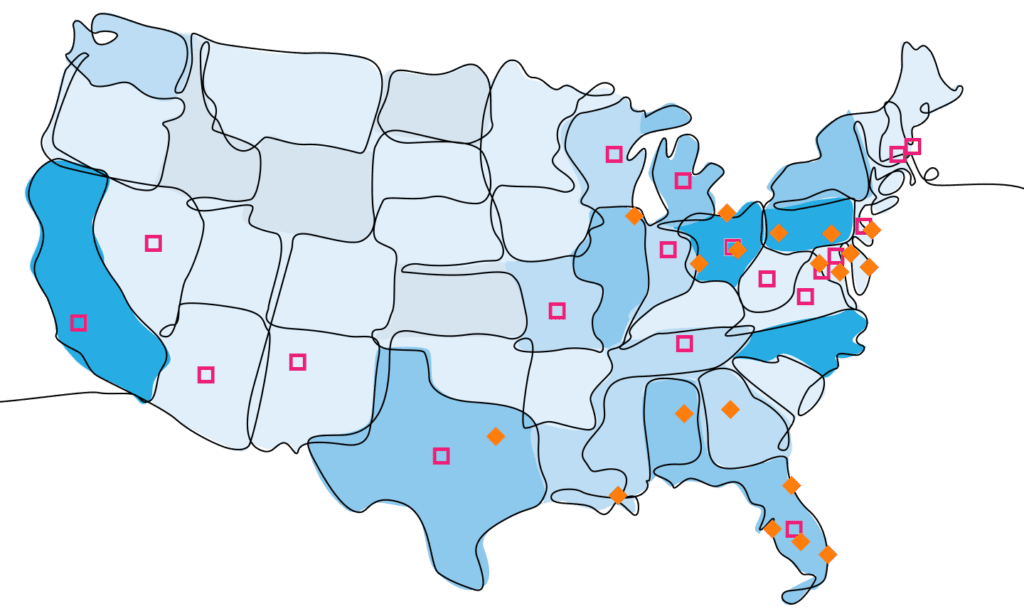

27 Member organizations in 16 states and the District of Columbia, assisting a total of 12,130 clients.

growth

Coalition

Grew to 757 organizations in 46 states and Puerto Rico and DC.

Up to 9

10-19

20-39

40-70

Housing Counseling Network

27 Member organizations in 16 states and the District of Columbia, assisting a total of 12,130 clients.

Growth

Coalition

Grew to 757 organizations in 46 states and Puerto Rico and DC.

DRIVING INVESTMENT

ON THE GROUND

DRIVING INVESTMENT ON THE GROUND

Community Benefits Agreements, Promoting Homeownership & Small Business Resilience

$205 BILLION IN PRIVATE SECTOR COMMITMENTS

Our organizing team led in helping 150 NCRC member organizations negotiate new and extended community benefits agreements (CBAs) with seven banks that committed $205 billion for loans, investments and philanthropy to underserved communities – making 2022 our most productive year ever in this crucial work, topping 2021’s organizing work that delivered four CBAs totalling $187 billion.

Since 2016, NCRC has completed more than two-dozen agreements with 22 bank groups delivering more than $600 billion in bank commitments to disinvested and underserved communities and families.

Highlights of the deals inked in 2022 included:

U.S. Bank

Our $100 billion CBA with U.S. Bank committed the bank to launch three special purpose credit programs (SPCPs), including one that will issue $100 million in mortgage loans, and to spend tens of millions more in grants and other supports for local community organizations – including, for the first time ever in an NCRC-facilitated CBA, a specific commitment to local news media outlets owned by people of color.

BMO Harris Bank

Our $40 billion CBA with BMO Harris Bank committed the bank to invest in economic equity efforts targeted to Native Americans, including millions in down payment assistance, 125 new mortgage originations on tribal lands and the creation of a new Native Land Advisory Group half of whose members will be picked by NCRC. BMO Harris Bank further committed to expanding its SPCP targeted to minority-owned small businesses by adding $100 million to the program.

Cadence Bank

Our $20.7 billion CBA with Cadence Bank committed the bank to $11.8 billion in mortgage lending to Black, Hispanic and low- to moderate income (“LMI”) borrowers in its service footprint, and $6.5 billion more in small-business lending in LMI census tracts. The bank will further invest $2.4 billion in new funds to support non-profit developers, technical assistance organizations and other small community organizations.

Old National Bancorp

Our $8.3 billion CBA with Old National Bancorp committed the bank to make more than $1 billion in home purchase and improvement lending to underserved communities, $2 billion more in small business lending and more than $3 billion in community development lending to support local high-impact work with patient capital.

New York Community Bancorp

Our $28 billion CBA with New York Community Bancorp committed NYCB to originate $5.7 billion in home loans to LMI borrowers in majority-minority communities and $21.7 billion in lending and grantmaking to community development organizations, with a special emphasis on minority-led organizations in Detroit.

Umpqua Bank

Our $8.1 billion CBA with Umpqua Bank committed the bank to spending $3 billion promoting homeownership, $3.5 billion underwriting community development programs and $1.6 billion in small business capital, all targeted to underserved LMI and minority communities.

ADVANCING AFFORDABLE HOMEOWNERSHIP

Homeownership is a key driver of generational wealth and long-term financial security for families – which is why NCRC works every day to close the huge and persistent divide in homeownership rates between White, more well-off people and the communities that have historically been targeted for disinvestment and deprivation.

NCRC’s 2022 policy, research and advocacy work zeroed in on key drivers of these broader trends. We produced widely-cited research on the evaporation of physical bank branch networks and the effect branch closures have on local lending accessibility. We identified new insights and troubling blindspots in federal Home Mortgage Disclosure Act (HMDA) data. We pushed lawmakers and regulators to both modernize the rules governing fair and equitable lending and to improve their enforcement of existing rules.

IMPACT VENTURES & FUNDS

We Build Communities – Literally

We don’t just work to move minds – we build homes and communities that are dignified, affordable and accessible to all.

GROWTH by NCRC, one of NCRC’s affiliated impact ventures, built or rehabbed 138 homes in 2022 and expanded into its 20th market with new projects in Dallas. GROWTH also forged new local partnerships, including a record-breaking commitment to build 1,000 new homes in Atlanta over the next five years and an expansion of its ongoing work in Birmingham, Alabama, to build hundreds more there.

Since 2015, GROWTH has:

- invested more than $173 million in 1,049 homes

- sold 560 homes, 85% of which were either to LMI buyers and/or within LMI communities

“I am grateful for NCRC’s program for the opportunity to buy this house. I am a veteran and I missed out on two other bids before GROWTH. Thank you for your great assistance and helping me successfully buy this amazing house.

— Charles G., Pittsburgh, PA

MENTORING & FUNDING THE NEXT GENERATION OF SMALL BUSINESS LEADERS

Another NCRC impact venture, The NCRC Community Development Fund (NCRC CDF), is a mission-based lender, focused on ensuring Black, Latino and other underserved borrowers and LMI individuals have the tools, knowledge and expertise to move toward economic mobility.

In 2022, NCRC CDF made $4.64 million in low-interest loans for local capacity-building, small business resilience and construction of affordable housing across dozens of member organizations and communities. The fund also laid the groundwork to provide more grants and lending capital than ever before in the year ahead. NCRC CDF raised an additional $8 million in debt capital for affordable housing development and small business lending. At the same time, it focused on strategic engagement in State Small Business Credit Initiative (SSBCI) programs. NCRC CDF also stood up two innovative projects to support communities of need, including the new Launch Academy, a business accelerator for start-ups, and the Growth Academy, which provides technical assistance, education and networking opportunities for more established business owners.

in low-interest loans for local capacity-building, small business resilience and construction of affordable housing.

in debt capital for affordable housing development and small business lending.

The DC Women’s Business Center (DCWBC), managed by NCRC, supported a retail pop-up incubator called ShopHER at Union Station for 13 women-owned small businesses in the DC metro region, selling clothing, jewelry, popcorn, candles, home goods and art from all around the world. The incubator provided a brick and mortar location for the businesses, classes and additional resources for the entrepreneurs, as well as a sense of community during the pandemic.

ShopHER is another stepping stone for me because it gave me the experience of having my own retail space. It provides me with a home store. Pop-ups are fun, but having a store has been such a great experience. Being a part of ShopHER has also provided me with business classes and opportunities to build my business as a whole.

— Ebony McMillian, owner of Bermuda Triangle Vintage Clothes

SHAPING THE

FUTURE

SHAPING THE FUTURE

Regulatory & Legislative Advocacy

catalyzing change in government policy

Our policy, government affairs and legal experts helped catalyze changes in government policy across numerous issues of major concern to the public – none more significant than the pending major overhaul of Community Reinvestment Act (CRA) rules, proposed by regulators in 2022.

It was the first time in 25 years that regulators proposed meaningful updates to that vital law. About 20% of all comments made public by the regulators at the end of the rulemaking comment period in August 2022 used NCRC sample letters or research, and 64% aligned with NCRC’s recommendations. Our team further supported more than 130 NCRC members who visited lawmakers for NCRC’s National Advocacy Week last spring, bringing ground-level community concerns directly to Congress in 120 separate meetings.

NCRC’s policy and legal teams continued to play a key role in public conversations around how to harness technology’s potential for good while ensuring consumers are protected from its risks. We framed key debates through a mix of formal comment letters and public positioning with coalitions, including on digital currencies, fintech efforts to infiltrate the traditional banking space without accepting commensurate oversight and innovators’ responsibility to ensure AI tools enhance lending equity. We lobbied regulators and lawmakers to invest properly at the intersection of housing policy and environmental policy by targeting communities on the front lines of the climate crisis.

Investigations, Enforcement Actions & Litigation

NCRC conducted 248 matched-pair tests in seven cities to investigate potentially discriminatory practices in mortgage lending, small business lending and other financial industry transactions relevant to family wealth-building. As news stories about racial bias in home appraisals percolated throughout the year, NCRC released findings from a “mystery shopper” investigation into appraisal bias in the Baltimore area – the first report of its kind to be published.

Investigating potential discriminatory practices in mortgage lending, small business lending and other financial industry transactions relevant to family wealth-building.

NCRC filed multiple formal HUD complaints based on the findings of our matched-pair and mystery shopper testing. And as we awaited the outcomes of those legal efforts to protect people’s civil rights, similar past efforts bore fruit. Three housing providers agreed to deliver about $100,000 in relief to NCRC members stemming from HUD conciliation processes we initiated. An NCRC complaint against a fourth firm, filed in 2017, was also upheld and settled.

NCRC also scored a major win in federal court in the fall, in a decision that will restore some vital banking rules and provide greater transparency into patterns of mortgage lending discrimination which were wrongfully undermined under the previous presidential administration.

NCRC’s highest-profile legal victory in 2022 will have more sweeping positive implications for economic justice nationwide: We won a lawsuit against the CFPB, forcing the agency to restore data collection standards that it had illegitimately undermined under President Trump.

NCRC can also take some credit for a historic federal fine for redlining levied in July against a Philadelphia-area lender owned by Warren Buffett. The news report that sparked government action against the firm relied heavily on NCRC staff expertise and analysis.

CHANGING THE NARRATIVE,

LEADING THE CONVERSATION

CHANGING THE NARRATIVE, LEADING THE CONVERSATION

Research & Publishing To Shape Public Discourse

We published 10 reports and research briefs, including groundbreaking new work on the intersection of redlining and public health outcomes and an unprecedented exposé on a major bank’s poor performance in promoting Black homeownership.

We published 80 blog posts and three white papers. Our publications, advocacy and staff expertise earned hundreds of major media mentions including deep, rich feature pieces in the New York Times, Bloomberg BusinessWeek and the BBC. In April, the NCRC CDF was named one Fast Company’s most innovative companies in the world for 2022, listed in the “Small and Mighty” category for organizations with fewer than 10 employees.

NCRC’s policy, legal and government affairs staff filed 21 separate comment letters with regulators across major issues from predatory lending to loopholes in banking law to financial technology and cryptocurrency. We helped lead critical scrutiny of “Buy Now Pay Later” businesses, promoted congressional efforts to close the Industrial Loan Corporation loophole and defended the Consumer Financial Protection Bureau from ongoing attacks – among many other activities to uphold consumer rights and ensure the safety and soundness of our financial system.

NCRC’s research team also delivered groundbreaking work in 2022 that will fundamentally change how we understand the legacy of redlining. The new methodology developed by NCRC’s research team in partnership with the University of Michigan enables direct analysis of public health outcomes in the present day in specific neighborhoods, factored for the intensity of redlining that was once imposed by public policy in those same physical spaces.

GROWING THE

NCRC NETWORK

GROWING THE NCRC NETWORK

Membership

member organizations

number of states, DC and Puerto Rico

new members added in 2021

Media

Audience

Just Economy

Conference

Just Economy Conference

The conference drew 864 in-person participants

For the first time since 2019, NCRC members were able to gather in person for our annual Just Economy Conference in May. 864 of our closest allies and partners came together in Washington to network, share ideas and celebrate the hard work we all do every day.

A few of the 2022 Featured Speakers

Anand Giridharadas

Lael Brainard

Vice President of the Federal Reserve Board

Randall L. Woodfin

Saule Omarova

Michael Hsu

Acting Comptroller of the Currency

Marcia L. Fudge

Secretary of the U.S. Department of Housing and Urban Development

Martin J. Gruenberg

Chairman (Acting), Federal Deposit Insurance Corporation

Janis Bowdler

Great opportunity to hear from organizers and practitioners all over the country; very good representation from BIPOC folks and organizations working at the intersections of economic justice and many other issues; plenty of experts to learn from on many topic areas; fun programming as part of the conference.

— Vivian Satterfield, Chief Sustainability Officer at Portland’s Bureau of Planning and Sustainability

Virtual Advocacy Week

More than 130 members from 36 state delegations, including DC, took our Just Economy message to Capitol Hill for more than 120 virtual meetings with members of Congress and federal regulators. Leading up to Advocacy Week, we held dozens of meetings with state leads and their delegations and two Advocacy Week prep calls with participants. During those prep meetings, NCRC trained participants on how to conduct themselves in Capitol Hill meetings and answered questions about NCRC’s 2022 Policy Agenda.

TRAINING &

MENTORING

TRAINING & MENTORING

105 webinars and online training courses and 3 in-person events

The online events covered important just economy topics like Community Reinvestment Act reform, bank branch closures, criminal history and access to credit, and more. Together, these events served more than 5,200 participants and allowed us to grow our audience, equip our members, and hear from key leaders in the fight for economic justice.

The DCWBC co-organized two virtual multi-week “Get Certified” cohorts comprised of 11 sessions designed to help women business owners obtain government certifications. These workshops were hosted virtually with over 100 registrants per cohort and attended by an average of 61 participants per session. Overall, the DCWBC provided over 589 counseling sessions to 323 female entrepreneurs and organized 37 webinars attended by 1,409 female registered attendees.

NCRC’s National Training Academy trained 1,820 practitioners, managers and executives through 36 webinars, 16 virtual learnings, 3 in-person events and 2 eLearning courses. Courses offered included prepping housing counselors for the HUD Exam, the power of partnership and collaboration, developing high impact strategic plans, and much more.

In spring 2022, NCRC CDF launched dual-path business accelerator programs as a scaled effort in providing technical assistance to its entrepreneurial community while cultivating its lending pipeline. The Launch Academy is geared toward start-ups and provides small business owners with practical context on the foundational steps of launching a successful business. Growth Academy is intended for seasoned business owners who want to learn how to scale their business and position it for various types of capital. Led by industry experts, the courses consist of nine-week cohort-style sessions that provide new tools and resources, one-on-one mentoring, and the opportunity to connect with fellow participants to cultivate relationships with like-minded business owners. After successful spring, summer, and fall cohorts, both programs are set to continue in 2023.

We launched the Fellowship for Equitable Development to cultivate the next generation of community development leaders – and so they can support and learn from community development corporations and community development financial institutions. We selected four fellows from Howard University, American University, University of the District of Columbia and Georgetown University.

GRANT MAKING

AND LENDING

GRANT MAKING AND LENDING

Empowering Local Leaders

We directly distributed $4.7 million in grants to 65 grantees in 16 states to support affordable housing, small business, arts & culture, COVID-19 relief, housing counseling and capacity building initiatives. The NCRC CDF made $4.64 million in low-interest loans for local capacity-building, small business resilience and construction of affordable housing across dozens of member organizations and communities.

in grants to 65 grantees in 16 states

in low-interest loans for local capacity-building

families served by the NCRC Housing Counseling Network

provided in grants to 30 NCRC member community organizations

The NCRC Housing Counseling Network served 12,130 families in fiscal year 2022, a record high for the intermediary program. With support from Morgan Stanley, the first round of NCRC’s $2.7 million Field Empowerment Fund (FEF) provided unrestricted grants to 30 NCRC member community organizations to help them respond to economic challenges created by the COVID-19 pandemic. Targeting historically underserved communities, the grants were designed to implement and scale innovative investments that promote COVID-19 economic recovery. Grantee projects ranged from helping clients qualify for micro mortgages to assisting entrepreneurs with procurement practices and COVID-19 relief.

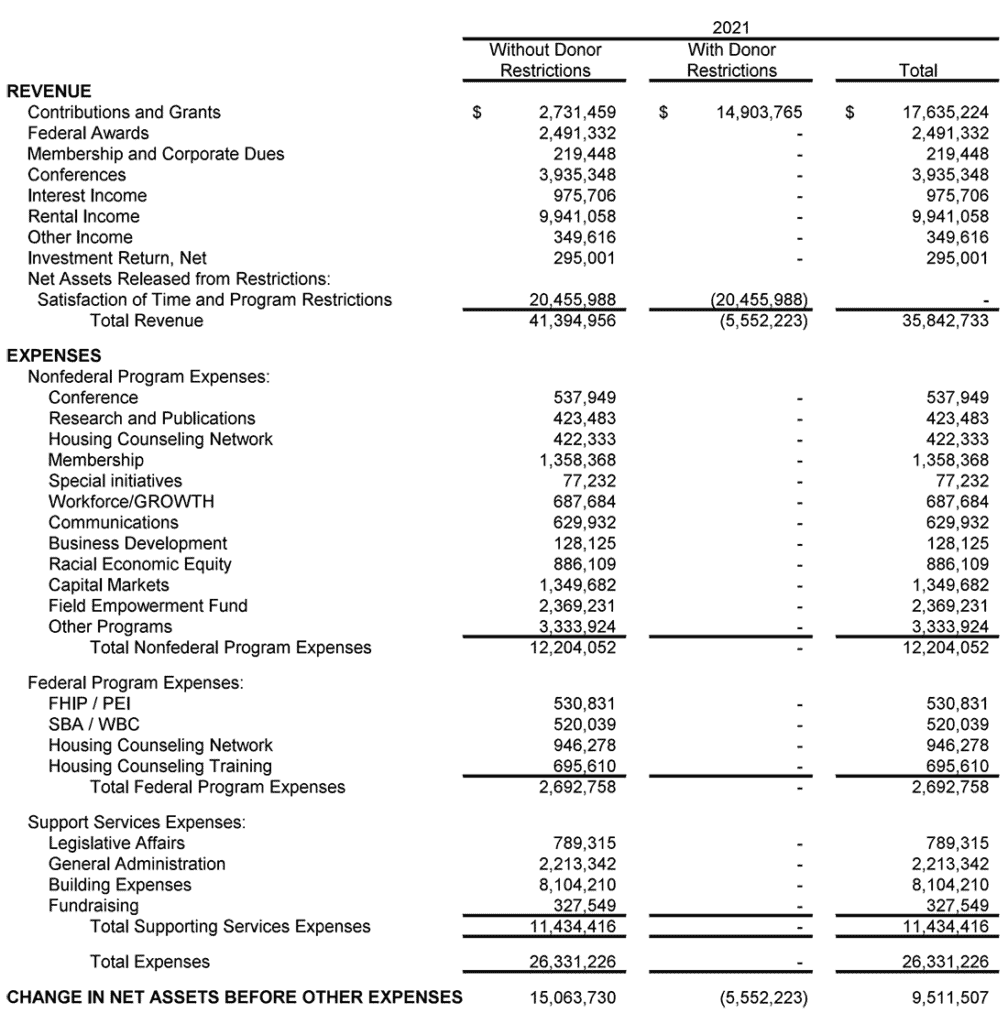

Financials

Financials

These major funders provided $100,000

or more to NCRC in 2022:

- Bank of America

- Bank of the West

- BBVA Compass

- CIT / First Citizens

- Citi Bank

- Ewing Marion Kauffman Foundation

- Fifth Third Bank

- First Horizon Bank

- Goldman Sachs

- Huntington National Bank

- JPMorgan Chase

- Kauffman Foundation

- M&T Bank

- Morgan Stanley

- NeighborWorks America

- New York Community Bancorp, Inc.

- Ocwen Financial

- PayPal

- PNC Bank

- Regions Bank

- Robert Wood Johnson Foundation

- Rocket Mortgage

- San Francisco Foundation

- Santander Bank

- Share our Strength

- TD Bank

- Truist Financial

- U.S. Bank

- U.S. Department of Housing & Urban Development

- U.S. Small Business Administration

- U.S. Department of the Treasury

- W.K. Kellogg Foundation

- Webster Bank

- Wells Fargo Bank

2021 audited financials

Copyright © NCRC. Some Rights Reserved. Terms / Privacy / Code of Conduct / DMCA

NCRC 740 15th Street, Suite 400, Washington DC 20005 | 202 628-8866