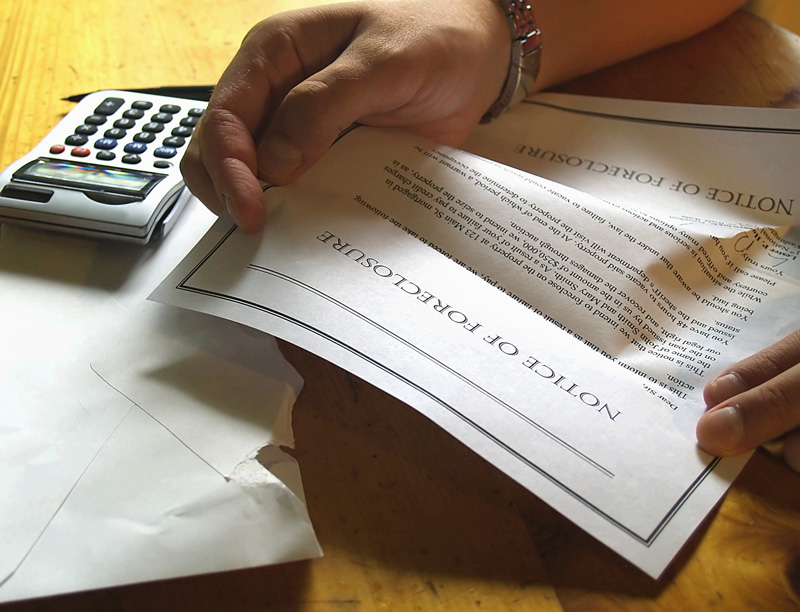

A Foreclosure Tightrope for Democrats

Luke Sharrett/The New York Times

“There are, in fact, valid foreclosures that probably should go forward,” said David Axelrod, an adviser to the president.

While senior Congressional Democrats join the calls for a national moratorium on foreclosures, the White House once again is arguing against punishing the industry, just as it did in 2009 amid the outcry over the unbreakable habit of paying large bonuses.

“Irresponsible banks need to be held accountable, but if we have not found a problem with a bank’s process we do not believe that we should impose a moratorium where that can hurt the market and hurt individual buyers,” said Shaun Donovan, secretary of Housing and Urban Development. The administration’s basic logic has not changed since it took office in the depths of the financial crisis: Hitting the financial industry, officials argue in private and in public, hurts the broader economy. A moratorium on foreclosures may provide short-term political satisfaction in an overheated election climate, but the administration fears it will only delay the inevitable and necessary process of forcing many Americans out of homes they cannot afford.

A Foreclosure Tightrope for Democrats Read More »

groups in a call for a temporary national moratorium on foreclosures, until an investigation can be completed to determine the extent to which consumers’ rights have been violated by servicers and lenders. NCRC also called on Congress and the Administration to pursue non-voluntary measures to resolve the foreclosure crisis.

groups in a call for a temporary national moratorium on foreclosures, until an investigation can be completed to determine the extent to which consumers’ rights have been violated by servicers and lenders. NCRC also called on Congress and the Administration to pursue non-voluntary measures to resolve the foreclosure crisis.