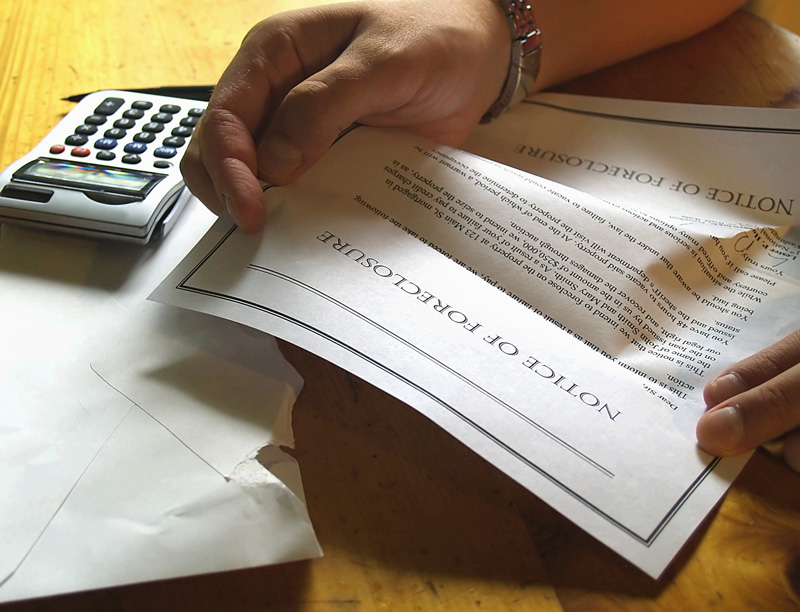

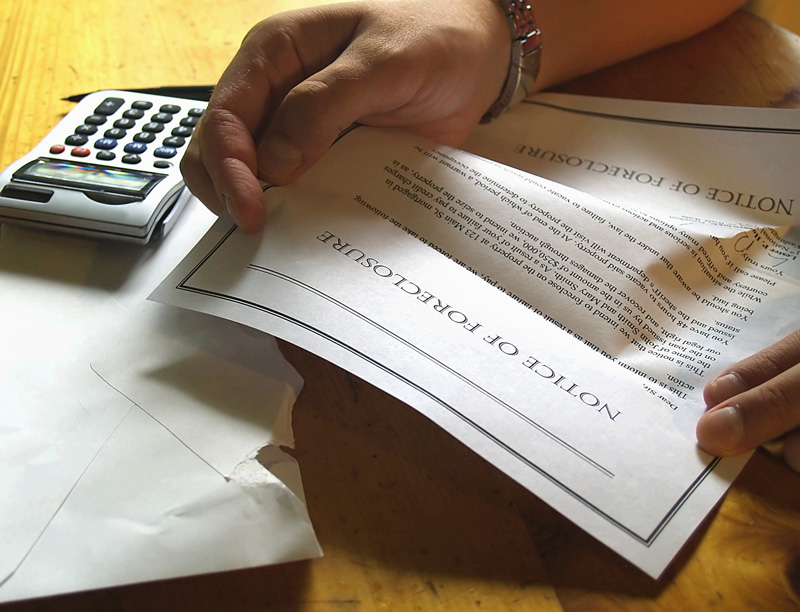

Rubber stamp foreclosures continue pattern of disrespect for consumers’ rights and legal process, creating moral hazard for financial services industry

Washington, DC – In a letter to President Obama on Friday, the National Community Reinvestment Coalition joined dozens of other consumer and civil rights groups in a call for a temporary national moratorium on foreclosures, until an investigation can be completed to determine the extent to which consumers’ rights have been violated by servicers and lenders. NCRC also called on Congress and the Administration to pursue non-voluntary measures to resolve the foreclosure crisis.

groups in a call for a temporary national moratorium on foreclosures, until an investigation can be completed to determine the extent to which consumers’ rights have been violated by servicers and lenders. NCRC also called on Congress and the Administration to pursue non-voluntary measures to resolve the foreclosure crisis.

“The rights of consumers have been treated as an afterthought by the financial industry,” said John Taylor, president & CEO of the National Community Reinvestment Coalition. “Allowing the industry to rubber stamp foreclosures, and continue with sloppy, extralegal practices promotes a ‘moral hazard’ that encourages abusive behavior. Not intervening to investigate and ensure that consumers are adequately protected in the foreclosure process sends a message that mortgage lending and servicing continues to be the Wild West, wherein the industry is free to do what they want, without consideration for the borrower.”

“We need to end the voluntary reliance on the industry to do the right thing with respect to homeowners. Three years of following this approach on the foreclosure crisis has largely failed. Congress and the Administration should take this opportunity to finally put in place something that puts an end to unnecessary foreclosures, rather than delaying them,” said Taylor.

groups in a call for a temporary national moratorium on foreclosures, until an investigation can be completed to determine the extent to which consumers’ rights have been violated by servicers and lenders. NCRC also called on Congress and the Administration to pursue non-voluntary measures to resolve the foreclosure crisis.

groups in a call for a temporary national moratorium on foreclosures, until an investigation can be completed to determine the extent to which consumers’ rights have been violated by servicers and lenders. NCRC also called on Congress and the Administration to pursue non-voluntary measures to resolve the foreclosure crisis. Washington, DC–On Friday, September 24th, NCRC will testify before Federal Reserve Board on making critical improvements to HMDA data, so that lenders can be held accountable for the types of loans they are issuing to communities.

Washington, DC–On Friday, September 24th, NCRC will testify before Federal Reserve Board on making critical improvements to HMDA data, so that lenders can be held accountable for the types of loans they are issuing to communities.