- 2021

- NCRC IMPACT

Jesse Van Tol

President & CEO

Dear friends,

The year started with a failed coup. The COVID pandemic kept going, racial and socioeconomic inequalities remained unsolved, and political divisions deepened. So did our resolve within the National Community Reinvestment Coalition to make a Just Economy a national priority and a local reality.

The year wasn’t easy for anyone, but it was a year of major achievements for NCRC. We facilitated $187 billion in lending, investment and philanthropic commitments from banks to low- and moderate-income (LMI) families and communities of color. NCRC and our affiliated businesses issued a combined $19.8 million in direct funding, low-interest rate loans and investments to strengthen member organizations and help small businesses survive an especially difficult year. Our research, media, training, advocacy, digital tools, events and other programs reached more people than ever before. This included more than 1,500 who participated in our Just Economy Conference, a massive (6x) jump in audience engagement across our social media channels, 37% growth of media citations, and 76% growth in unique visits to the widely cited reports and tools and views on our website. Our membership grew to 625 organizations in 46 states. We also achieved dramatic policy victories, including the complete rollback and cancellation of the Trump administration’s poorly conceived Community Reinvestment Act rules.

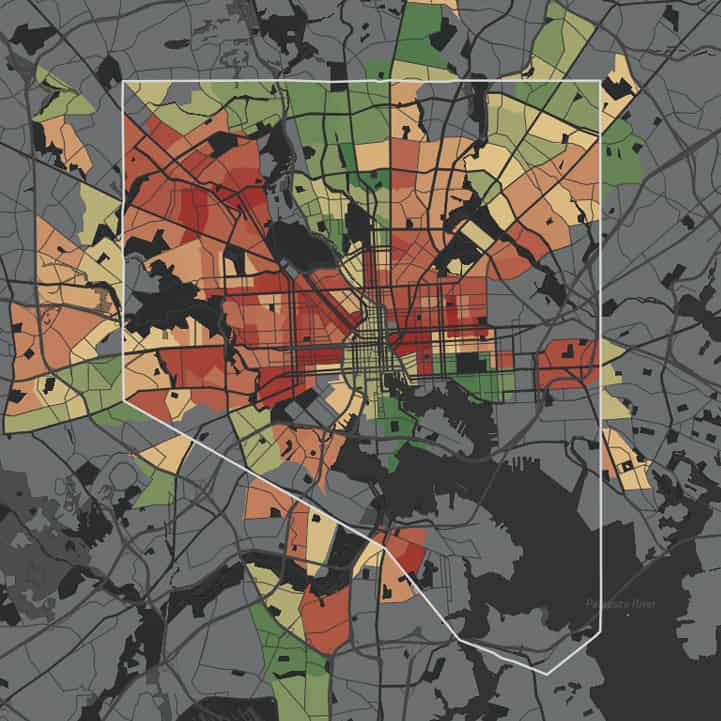

NCRC research and investigations made clear that public policies and private sector practices have failed to close racial, gender and socioeconomic gaps in personal wealth and homeownership rates. Our work also probed persistent disparities and vulnerabilities in health, education and other levers for upward mobility in neighborhoods that suffered from 20th Century redlining and decades of disinvestment.

Unfairness and inequality can seem endless, permanently baked into the American landscape and our capital markets and perpetually worsening human experience for millions of Americans. But it needn’t be. We launched the Just Economy Pledge in 2021 as a call to action for our members, allies and leaders in government and the private sector. It’s also a commitment to our children. We hope you too will sign it, share it, pursue it, and join NCRC in pushing our nation to deliver on its promise to provide all Americans the opportunity to build wealth and live well.

Our impact last year set the stage for more in 2022. We will continue to inform and activate fellow citizens to meet the growing public demand for real and permanent solutions to the persistent and dehumanizing inequities across finance, housing, health, education, business and other interconnected systems. Read on for a look at some of what we accomplished in 2021.

With gratitude to our members, staff, board, allies and to all who support us,

Jesse Van Tol

President & CEO

Katy Crosby

Chair, NCRC Board of Directors

Katy Crosby

Chair, NCRC Board of Directors

Board of Directors

Board of Directors

Catherine Hope Crosby, Chairperson

Town of Apex NC

Irvin Henderson, Vice Chairperson

National Trust for Historic Preservation

Bethany Sanchez, Vice Chairperson

Metropolitan Milwaukee Fair Housing Council

Elisabeth Risch, Secretary

Executive Director of Housing Opportunities Made Equal (HOME)

Peter Hainley, Treasurer

CASA of Oregon

Robert Dickerson, Jr. Immediate Past Chairperson

Birmingham Business Resource Center

David Adame

Chicanos Por La Causa Inc.

Gilbert T. Bland

Urban League of Hampton Roads Tidewater Community College

Cornell Crews

Community Reinvestment Alliance of South Florida

Phyllis Edwards

Bridging Communities

Will Gonzalez

Ceiba

Charles Harris

Housing Education & Economic Development

Ernest Hogan

Pittsburgh Community Reinvestment Group

Matt Hull

Texas Association of Community Development Corporations

Jean Ishmon

Northwest Indiana Reinvestment Alliance

Carol Johnson

City of Austin’s inaugural Civil Rights Office

Brent Kakesako

Hawaii Alliance for Community- Based Economic Development

Matthew Lee

Inner City Press

Sharon H. Lee

Low Income Housing Institute

Moises Loza

Housing Assistance Council

Aaron Miripol

Urban Land Conservancy

Andreanecia Morris

HousingNola

Ernest (Gene) E. Ortega

Rural Housing, Inc.

Arden Shank

Community Reinvestment Alliance of South Florida

Kevin Stein

California ReinvestmentCoalition

Beverly Watts

Tennessee Human Rights Commission

Marceline A. White

Maryland Consumer Rights Coalition

Some Numbers

Some Numbers

Community Benefits Agreements

$187 Billion

We facilitated four community benefits agreements with banks that committed $187 billion in loans, investments and philanthropy to underserved communities and the organizations that serve them.

Through 2021, NCRC completed community benefits plans with 17 banking groups that will put a combined $383.3 billion into underserved communities, as well as 86 additional bank branches.

Research

14 major reports

We published 14 major reports and four racial wealth snapshots.

Just Economy Conference

4,219 hours of content

The virtual Just Economy Conference reached a record 1,516 live attendees, 4,219 hours of content viewed online, and 2,714 chats exchanged among participants, plus 56 Just Economy Sessions over eight days.

44 state delegations

Advocacy Week: 110 meetings with the House, Senate and federal regulators with 44 state delegations, including Washington, DC, and Puerto Rico.

Housing

240 homes acquired

GROWTH by NCRC acquired 240 homes and sold 72, of which 85% benefited LMI neighborhoods/persons, or both.

Since 2015, GROWTH has:

- invested more than $133 million in 878 homes

- sold 395 homes, 85% of the homes were sold either to LMI buyers and/or within LMI communities

Training

147 training programs

with 4,100+

participants.

NCRC Community Development Fund

99% of

$1.12 million

in federal Paycheck Protection Program (PPP) loans went to Hispanic, Black and immigrant- or woman-owned businesses.

93% of $5 million in small business loans went to minority-owned businesses.

$1.3 million in grant funding distributed to 65 minority-, woman- and LMI-owned small businesses nationwide.

Attention

39k

Our work and people were cited or mentioned in 39,000 media reports.

607,860

unique users at ncrc.org

Housing Counseling Network

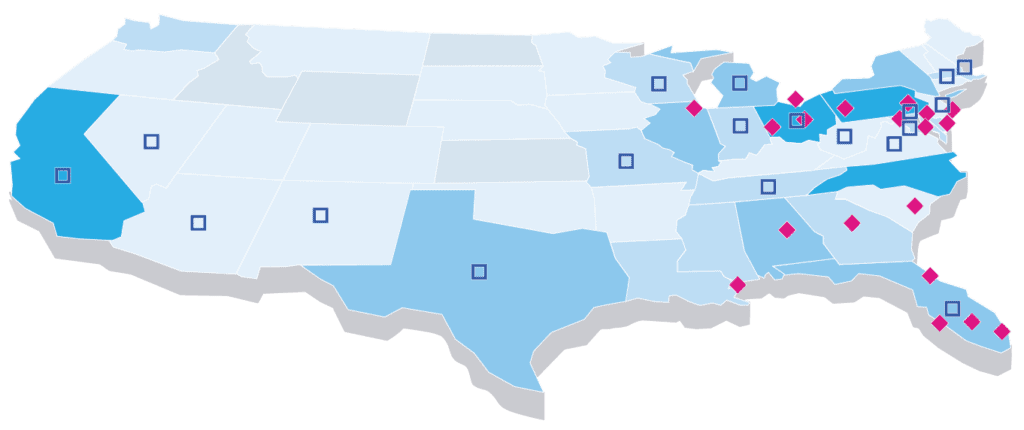

26 Member organizations in 19 states and the District of Columbia, assisting a total of 8,505 clients.

growth

19 markets in 11 states and the District of Columbia

Coalition

Grew to 625 organizations in 46 states and Puerto Rico and DC.

Up to 9

10-19

20-39

40-70

Championing Equitable Community Investments

Championing Equitable Community Investments

“Without a strong CRA, these populations will continue to be consigned to poverty, housing instability and chronic health issues, rendering our efforts futile. We are losing ground.”

NCRC advocacy, investigations, investments and engagement with the private sector pushed financial institutions to meet the needs of all communities where they operate.

Community Reinvestment Act

In response to united opposition from NCRC and other community organizations, and from the lending industry itself, on December 14, 2021, the Office of the Comptroller of the Currency (OCC) rescinded its final 2020 Community Reinvestment Act rule. Our opposition included a federal lawsuit filed by NCRC and one of its members, the California Reinvestment Coalition, challenging the rule as arbitrary and capricious. The 2020 rule would have slowed down if not reversed the progress in reinvestment in low- and moderate-income (LMI) communities by encouraging banks to seek out large-dollar infrastructure deals that offered marginal services to LMI neighborhoods – or even posed them harm. State-level interest in CRA also progressed in 2021, when Illinois joined with Massachusetts, New York and Connecticut to pass a state-level Community Reinvestment Act. States are applying CRA regulations more broadly across the entire financial sector, not just banking – a model for federal CRA reform.

In January, we created CRA’s First Aid Kit, a resource for hospitals, health systems and medical professionals to support CRA modernization and partner with lenders on community projects to address both economic insecurities and community health issues through CRA. The toolkit helped hospitals and health systems respond to the Federal Reserve Board’s Advance Notice of Proposed Rulemaking on CRA, which NCRC and several of our member organizations responded to with written comments. Of the 615 total comments submitted, 65 comments, or 10.6%, were related to the social determinants of health and ultimate health outcomes for LMI communities.

Community Benefits Agreements

Since 2016, NCRC has pioneered a collaborative process that creates community benefits agreements (CBAs) with banks to increase their lending, services and philanthropy in LMI communities and communities of color. By the end of 2021, NCRC developed CBAs with 17 banking groups that will put a combined $383.3 billion – and 86 additional bank branches – into underserved communities.

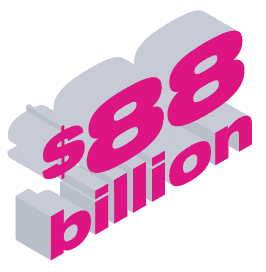

2021 was our busiest and biggest year yet for the high-impact CBA activity we have pursued for years. We inked our largest agreement to date — an $88 billion commitment from PNC Bank – and organized 20 meetings between banking leaders and a total of 320 NCRC members to create four new community benefits plans that committed $187 billion in loans, investments and philanthropy to underserved communities and the organizations that serve them.

PNC

Our $88 billion CBA with PNC Bank committed the bank to continue meeting with NCRC members to identify local community development opportunities and community needs, and discuss ways that PNC can partner with local organizations. This included a commitment to work with organizations that serve communities along the US border, which was a new service region for PNC as a result of its merger with BBVA. The agreement also included resources for community organizations to assist states in fully utilizing federal SNAP benefits for workforce development projects, the first time that PNC has supported this important work.

M&T

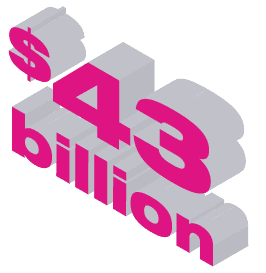

Our $43 billion plan with M&T included a unique commitment for M&T to expand their philanthropic support for community organizing in New York City, Bridgeport, Buffalo, Baltimore, and other cities. We were thrilled that M&T saw the importance of funding this critical work and committed to working with NCRC to expand it.

Huntington

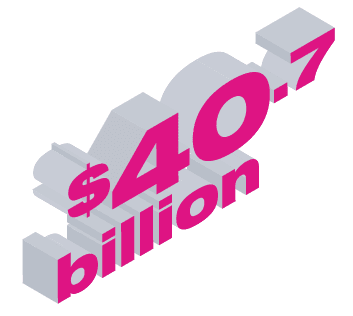

We facilitated a $40.7 billion plan related to Huntington’s merger with TCF Financial Corporation, winning a commitment for Huntington to develop 75 new funding relationships with nonprofits led by people of color.

First Citizens

Our $16 billion plan negotiated with First Citizens will ensure that it honors and expands a previous CBA in its acquisition of CIT. First Citizens’ specific commitments included doubling their community development financing in North Carolina, increasing small business lending in all states in their footprint, supporting programs where mental health workers travel and assist law enforcement when responding to mental health emergency calls, and training staff to understand the needs and experiences of older adults and recognize suspicious activity on behalf of those experiencing cognitive decline.

Wealth Building for People and Places

Wealth Building for People and Places

There cannot be a Just Economy until there is no more racial wealth divide.

Advancing Business Formation, Resilience and Growth

NCRC continued to expand the ways we advance entrepreneurship, from creating impact ventures to providing assistance, training and grants directly to small businesses. We also provided groundbreaking research on the pandemic’s impacts on small businesses and in support of increased small business data collection.

The DC Women’s Business Center (DCWBC), operated by NCRC and supported by the US Small Business Administration, provided women entrepreneurs in the Washington, DC, metro region with information and assistance to continue navigating the pandemic and its ever-changing dynamics. DCWBC also produced a study and report on pandemic-related challenges faced by women-owned small businesses in the DC metro region; launched VetBizLadyStart, a 14 week training program on federal contracting for women veteran startup entrepreneurs involved and opened ShopHer, a 4,000-square-foot pop-up retail space at DC’s Union Station.

An NCRC report examined the impact of the pandemic on culturally significant Black-owned businesses in Baltimore and DC. It demonstrates how the pandemic exacerbated the displacement of culturally-significant small businesses as well as the local art and culture they steward.

In ”Black Entrepreneurship’s Lethal Pre-Conditions,” NCRC’s Racial Economic Equity team partnered with Dr. Jared Ball from Morgan State University to show that Black America was in an economic crisis before COVID and that growth of Black entrepreneurship has lagged overall economic growth. In Addressing the Needs of Black-Owned Businesses and Entrepreneurs, NCRC partnered with ResiliNC to show how the economic consequences of the global pandemic amplified disparities in financing to Black-owned businesses, causing greater rates of closure and slower recovery than White-owned businesses.

Impact Ventures & Investments

NCRC manages a growing network of subsidiaries, affiliated investment funds and impact ventures to expand access to affordable homeownership, small business capital and living-wage jobs.

The NCRC Community Development Fund (NCRC CDF) is a mission-based lender, focused on ensuring Black, Latino and other underserved borrowers and LMI individuals have the tools, knowledge and expertise to move toward economic mobility. In 2021, NCRC CDF facilitated $1.12 million in federal Paycheck Protection Program (PPP) loans to small business owners hoping to keep their dreams afloat. With a median loan size of just over $18,000, nearly a third of these loans went to independent contractors – many of whom are considered “gig economy” workers who would have traditionally been excluded from this type of safety net – and 99% of these PPP loans were administered to Hispanic, Black and immigrant- or woman-owned businesses.

NCRC CDF also provided pandemic relief to minority-, woman- and LMI-owned businesses by distributing grant funding through the Stavros Niarchos Foundation Small Business Growth & Recovery Fund. NCRC CDF worked with its partners in the NCRC Capital Markets program to identify 65 small business recipients nationwide and distributed $1.3 million in grant funding to these underserved entrepreneurs.

MILLION

$

0

in federal Paycheck Protection Program (PPP) loans to small business owners

0

%

of the PPP loans were administered to Hispanic, Black and immigrant- or woman-owned businesses.

$

0

median PPP loan size

NCRC CDF facilitated an additional $5 million in small business lending via the Wells Fargo Open for Business Fund, Small Business Pandemic Relief, Recovery and Resiliency Program. NCRC CDF won a grant to create a loan program (at or below 3% interest) serving small businesses averaging less than $3 million in annual revenue across the country. Of the $5 million distributed, 50% of loans went to women-owned businesses and nearly 93% went to minority-owned businesses.

Lastly, NCRC CDF invested $9 million in the New York Forward Loan Fund (NYFLF), which has made low-interest loans to more than 1,700 small businesses, non-profits and small landlords across New York State totaling more than $100 million in capital to help these businesses recover from the devastating impacts of the pandemic.

Women- and minority-owned small businesses, nonprofits and multi-family housing companies that did not receive federal COVID-19 assistance are now on the road to recovery, thanks to this partnership between New York State, CDFIs and other organizations. In total, NYFLF funds have originated 1,716 loans, with an average loan size of $56,120. Of the businesses that have received loans: 46% are minority-owned businesses, 41% are women-owned businesses, and 22% are minority- and women-owned businesses – with a diverse array of businesses across all industry types.

Increasing Homeownership

Homeownership can help bridge racial and economic inequity by building generational wealth and promoting financial security. Homeownership stimulates economic vitality and neighborhood stability, improves community health and increases civic engagement. Affordable homeownership options attract and keep essential workers and businesses in our neighborhoods. Affordable homeownership is a basis for positive social, educational, health and family development.

NCRC tackled the homeownership gap and affordable housing crisis through a variety of channels in 2021. We produced widely cited research on the homeownership gap and how to close it. Our research team’s analysis of 2020 Home Mortgage Disclosure Act (HMDA) data found that Black and Hispanic home buyers saw modest increases in their market share of home purchase loans, but were still far short of their population share or the increased lending needed to approach parity with the White homeownership rate.

This analysis backed up earlier findings reported by NCRC’s Racial Economic Equity team in their report, ”60% Black Homeownership: A Radical Goal For Black Wealth Development.” They found a 20-30% gap between Black/White homeownership rates has persisted for more than 100 years, despite universal homeownership increases in the mid-1900s.

We pushed for a radical increase in Black homeownership and other progress on affordable housing as part of our policy efforts.

But not all of our news from 2021 regarding homeownership was bad.

“The City of Birmingham is proud to partner with GROWTH by NCRC on Oak Hill, in order to make our vision of community reinvestment a reality. Oak Hill offers high-quality homeownership opportunities to a well-deserving community that has weathered through economic challenges. My hope is that by adding affordable new homes, we will generate opportunities for wealth-building, community engagement and neighborhood revitalization in Ensley.”

Mayor Randall L. Woodfin, Birmingham

We constructed and sold affordable homes through the NCRC Housing Rehab Fund, known as GROWTH by NCRC, which operates in 19 markets across 11 states and the District of Columbia. GROWTH acquired 240 homes and sold 72 last year; 85% of those deals benefitted LMI neighborhoods, individuals or both. Workforce development programs spurred by GROWTH trained 6,607 people and placed 5,049 local residents in living-wage jobs.

A $200,000 partnership with the TD Bank Foundation allowed NCRC to expand its Housing Counseling Relief Fund Program, which provided housing counseling and training resources to members helping individuals and families impacted by COVID-19 in LMI areas in Delaware, Florida, Maryland, New Jersey, New York, Pennsylvania, Vermont, Virginia, and Washington DC.

NCRC’s Housing Counseling Network (HCN) partnered with NeighborWorks America to distribute $1.5 million to housing counseling service providers nationwide throughout the NCRC network.

NCRC’s National Training Academy (NTA) provided US Department of Housing and Urban Development (HUD) certification training to housing counselors. We provided trainings in housing counseling and instruction to other nonprofit organizations on topics such as: Nonprofit Sustainability, Leadership Development, Disaster Preparedness & Recovery, Program Management, Navigating Eviction, Foreclosure Prevention, Preparation for the HUD Certification and Financial Triage.

In total, and with funding support from HUD, TD Bank and JPMorgan Chase & Co., NTA produced 147 online training programs for more than 4,100 attendees

Ensuring Equitable Access

Ensuring Equitable Access

A result of our individual and coalition work to reverse the OCC’s True Lender rule, the Senate reversed the rule in a bi-partisan vote to apply the Congressional Review Act to the rule.

It’s hard to do much in life without access.

You need access to a grocery store to buy necessities. You can’t stay informed, communicate and do business online without access to the internet. But when access to financial and home buying services aren’t available, it is often against the law.

NCRC worked hard in 2021 to help enforce those legal protections.

Fair Lending

NCRC conducted a multi-city survey of small business owners across the nation about accessing Paycheck Protection Program (PPP) loans and other options such as lease and loan modifications to save their businesses. We found that Black and Latino small business owners did not have equal access to business loan modifications.

On the policy side of ensuring access to safe and sound financial services, we opposed charter applications by Rakuten and GM Financial and opposed KMD’s proposed acquisition of Liberty Bank. We also filed comments on regulatory matters concerning faster payments, third-party relationships, use of AI, Big Tech Payments Platforms and SNAP-related strategic determinants of health.

We also provided a statement on the disparate impacts of artificial intelligence in finance, stablecoins, duty-to-serve goals for Fannie Mae and Freddie Mac’s manufactured housing lending and proposals to speed up payments to the Federal Reserve.

And in April, as a result of our individual and coalition work to reverse the OCC’s True Lender rule, the Senate reversed the rule in a bi-partisan vote to apply the Congressional Review Act to the rule.

The LBTBQ+ community faces many barriers in access to financial services. In May, the House Financial Services Committee cited NCRC’s same-sex couples and mortgages study during the markup for H.R. 166, including a shout out commending the report from Rep. Ritchie Torres (D-NY).

NCRC became a member of the National LGBTQ Anti-Poverty Action Network and signed onto the network’s letter urging funding and solutions to ensure the Build Back Better reconciliation legislation would adequately address the needs of low-income LGBTQ+ people, families and communities.

NCRC became a member of the National LGBTQ Anti-Poverty Action Network and signed onto the network’s letter urging funding and solutions to ensure the Build Back Better reconciliation legislation would adequately address the needs of low-income LGBTQ+ people, families and communities.

Fair Housing

NCRC conducted 344 matched-pair tests in nine cities which revealed racial, gender and socioeconomic differences in treatment in mortgage and small business lending, and real estate sales, appraisals and rentals.

NCRC filed eight housing discrimination cases with HUD, which included complaints based on email testing demonstrating discrimination on the basis of national origin against Asians, discrimination in mortgage lending against Blacks and Hispanics.

Matched-pair Tests

0

Cities

0

Revealed racial, gender and socioeconomic differences in treatment in mortgage and small business lending, and real estate sales, appraisals and rentals.

NCRC’s policy team also fought to ensure access to housing in 2021. In the fall, the Federal Housing Finance Agency (FHFA) requested comments on proposed affordable housing goals and equitable housing finance plans. For the first time, FHFA proposed a goal specific for predominantly minority tracts, which NCRC strongly supported. NCRC asked for more aggressive goal setting in some cases and also for an evaluation of local performance at the metropolitan level and in rural counties.

After the Biden Administration began promoting affirmatively furthering fair housing requirements across the executive agencies, NCRC urged FHFA to evaluate local performance and to focus on metropolitan areas and rural counties with wide racial and ethnic disparities in lending.

As pandemic-related moratoria on housing evictions expired, NCRC research used historical eviction data to help members in Philadelphia visualize specific areas where they would expect an increase in eviction filings.

The LBTBQ+ community faces many barriers in access to housing services. In 2021 NCRC launched the LGBTQ+ Economic Equity newsletter to share news, analysis and updates on LGBTQ+ issues in housing, financial services and other topics related to a #JustEconomy.

NCRC discussed updated protections for LGBTQ+ people under the Fair Housing Act on American Public Media’s Marketplace radio program:

“This is a very big deal,” said Jake Lilien, an attorney and compliance program manager with the National Community Reinvestment Coalition. “We’ve been waiting a long time for the day when someone could contact HUD and say, ‘I’ve been the victim of housing discrimination because I’m gay or because I’m trans.”

Jake Lilien, NCRC

Audience & Influence

Audience & Influence

It is often those who make the most noise that see the most action.

Our focus on original content and publishing as a core product to reach and inform our audiences boosted the visibility and strengthened the reputation and influence of NCRC. External media citations to our publications and views increased 37% and unique visits to the NCRC web site grew more than 70%.

Membership

0

member organizations

0

number of states, DC and Puerto Rico

0

new members added in 2021

We finished the year with 625 member organizations in 46 states, DC and Puerto Rico. In 2021, we added 174 new members – a roughly 40% increase in the size of our coalition.

Policy & Advocacy

The needs of our members drive our policy and advocacy work. We are their voice on Capitol Hill, with federal regulators and other national organizations. In 2021, our policy agenda urged ambitious goals for the Biden Administration, the 117th Congress, and the nation’s business community, touching on every sphere of American society, including housing and access to credit. Our members pushed this agenda during our first-ever, all virtual Advocacy Week.

This advocacy brought us several big wins in 2021, including advancement of an effort by the OCC, FDIC and Federal Reserve Board to issue a new joint Community Reinvestment Act rule in 2022. We continue to urge the federal banking regulators to include a robust consideration of race and expanded assessment areas in the new rule.

We urged the CFPB to issue a strong Section 1071 small business lending data rule and fought back on industry efforts to weaken it. We pushed FHFA to set ambitious affordable housing goals and helped them identify neighborhoods and metro areas that should be the focus of their new housing equity work. We pressed the Federal Reserve Board to ensure that financial institutions benefiting from the payments system serve the public interest, and we applauded HUD for releasing its interim final rulemaking on AFFH.

We empowered a new congressional caucus on social determinants of health with robust data and conceptual analysis, advised the White House transition team on a broad slate of priorities they should pursue to meet President Biden’s economic and equity goals, and we expanded our regulatory and policy work to take leadership on cryptocurrency issues, the dangers of algorithmic lending and other technology issues to help regulators keep pace with innovation.

Media Mentions

Our work and views earned 39,900 mentions across all media for a total potential reach of one trillion news consumers. Total mentions were up 37% from 2020 and potential reach was up 68%.

Audience Growth

NCRC Website Sessions

0

+70.42% from 2020

Unique Users

0

+76.67% from 2020

Email Subscribers

0

+4.84% from 2020

Social Impressions

0

+159.2% from 2020

Social Engagement

0

+648.2% from 2020

Just Economy Conference

Just Economy Conference

The conference drew 1,516 live participants.

The COVID-19 pandemic hit just weeks before our in-person 2020 Just Economy Conference, forcing us to cancel the national event for community, policy, government, business and foundation leaders working toward an inclusive economy that not only promises but delivers to all Americans opportunities to build wealth and live well.

In 2021, we returned with a fully virtual Just Economy Conference that featured 56 Just Economy Sessions over 8 days.

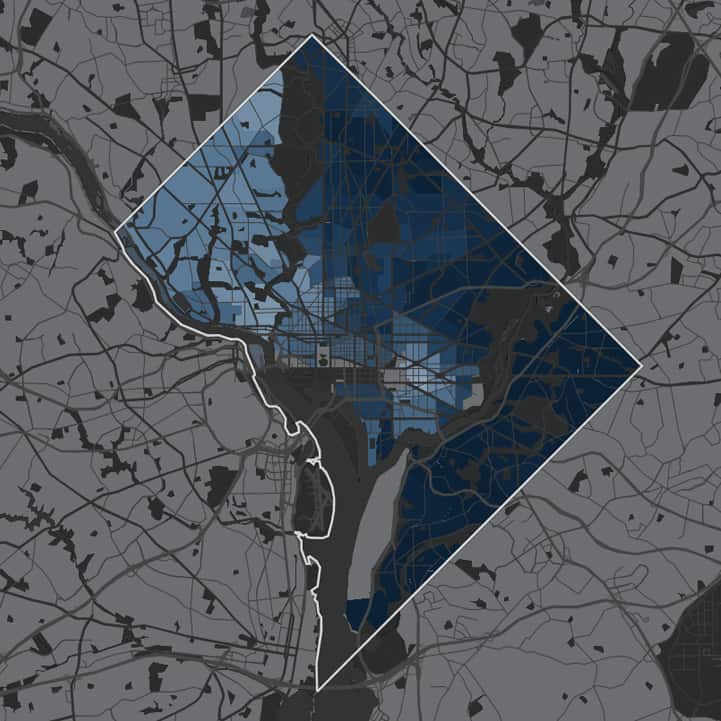

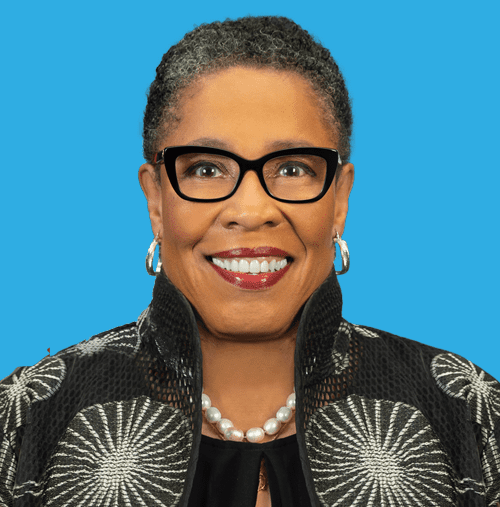

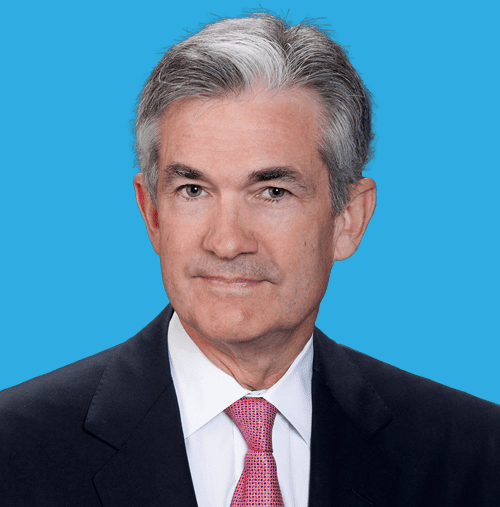

The conference drew 1,516 live participants. Keynote Speakers included journalist Nikole Hannah-Jones, Federal Reserve Board chair Jerome Powell, HUD Secretary Marcia Fudge, US Senators Sherrod Brown, Elizabeth Warren and Charles Schumer; and PNC Financial Services CEO William Demchak. In total, 4,219 hours of content was viewed on the conference platform and 638 recording views occurred on YouTube during the month of May 2021. There was also great engagement and networking with 2,714 chats sent.

2021 Keynote Speakers

“The just economy conference is a great opportunity to learn from experts, and other communities and organizations similar to yours, facing similar issues. There are valuable opportunities for connection to research, data, and resources to help you get started. And an opportunity for sharing your successes and challenges.”

Irma Yépez Klassen -- Program Officer -- Zilber Family Foundation

Advocacy Week

The pivot to an all-virtual conference also offered us the opportunity to transform our annual Hill Day into a full Advocacy Week.

Nearly 200 members from 44 state delegations, including DC and Puerto Rico, took our Just Economy message to Capitol Hill for more than 110 meetings with Members of Congress and federal regulators. Leading up to Advocacy Week, we held dozens of meetings with state leads and their delegations and two Advocacy Week prep calls with participants. During those prep meetings, NCRC trained participants on how to conduct themselves in Capitol Hill meetings and answered questions about NCRC’s 2021 Policy Agenda.

Financials

Financials

These major funders provided $100,000

or more to NCRC in 2021:

- Bank of America Corporation

- BBVA Compass (Now PNC Bank)

- Citibank

- Fifth Third Bank

- First Horizon Bank

- Goldman Sachs

- Huntington National Bank

- JPMorgan Chase & Co.

- KeyBank

- Kresge Foundation

- Morgan Stanley

- NeighborWorks America

- Ocwen Financial Corporation

- PNC Bank (Acquired BBVA in 2022)

- Quicken Loans, LLC. (Now Rocket Mortgage)

- Robert Wood Johnson Foundation

- Santander Bank, N.A.

- Stavros Niarchos Foundation

- Sterling Bank & Trust (Now Webster Financial Corporation)

- TD Bank

- The Kresge Foundation

- The Winston-Salem Foundation

- Truist Financial Corporation

- U.S. Department of the Treasury

- U.S. Small Business Administration

- U.S.Department of Housing and Urban Development

- W.K. Kellogg Foundation

- Wells Fargo

- Woodforest National Bank

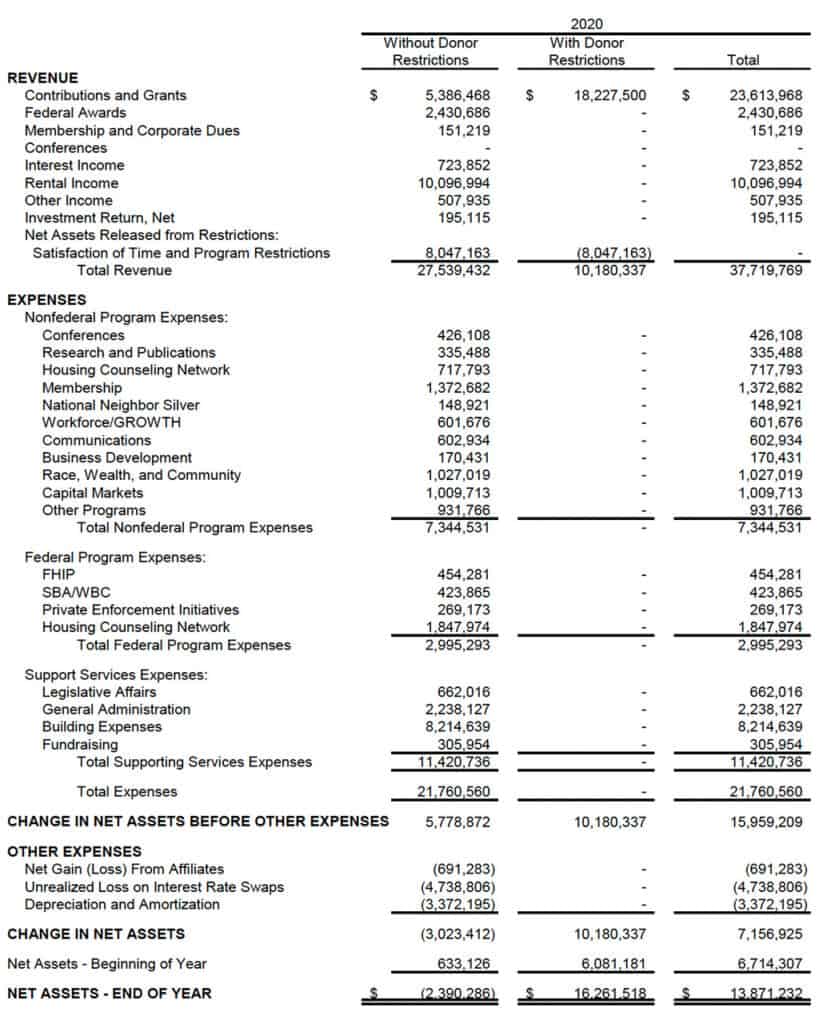

2020 audited financials

Copyright © NCRC. Some Rights Reserved. Terms / Privacy / Code of Conduct / DMCA

NCRC 740 15th Street, Suite 400, Washington DC 20005 | 202 628-8866